The markets gapped down big but you could tell the major players didn’t participate, which is what we expect for quarterly contract roll. Nothing was very technical in behavior, and we drifted lower over lunch before coming back up to the VWAP. NASDAQ volume closed at 1.9 billion shares. I wasn’t going to make any calls, but I ended up doing one anyway, and it stopped once and worked the second time. Opening ranges weren’t really useful either. Back to it on Monday.

Net ticks: -4.5 ticks.

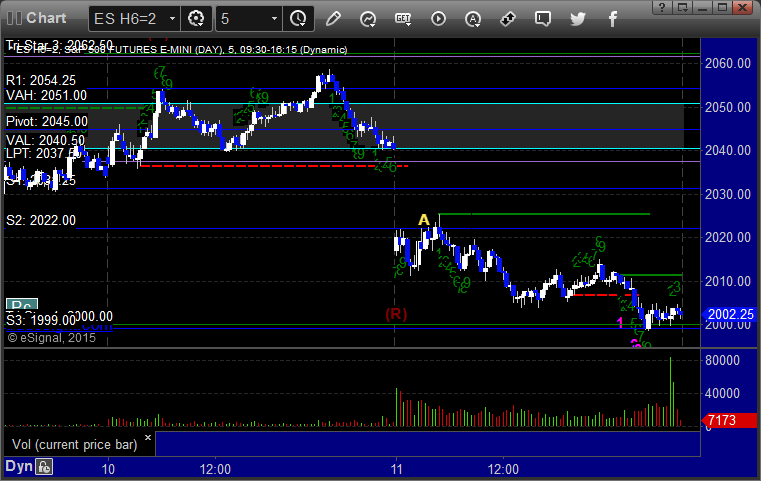

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn’t work, triggered short at B and did:

NQ Opening Range Play triggered long at A and didn’t work, triggered short at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2022.50 and stopped on a sweep. Triggered again right after, hit first target, second half stopped under entry: