A nice winner in the EURUSD and we still have a bigger winner going from the prior session. See that section below.

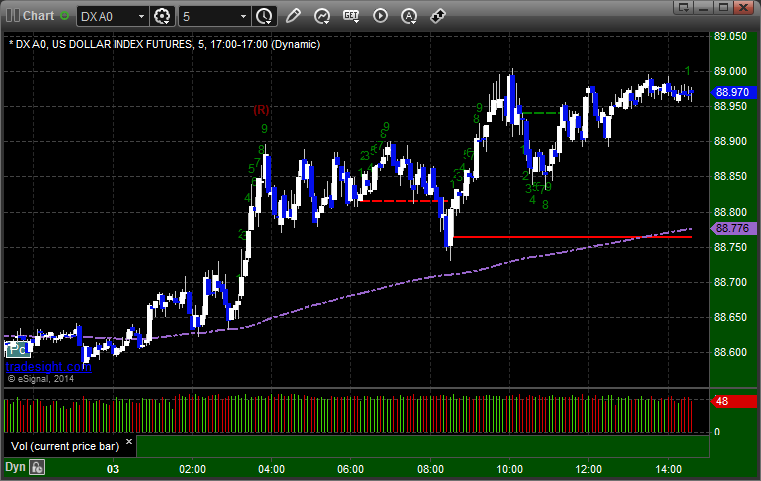

Here’s a look at the US Dollar Index intraday with our market directional lines:

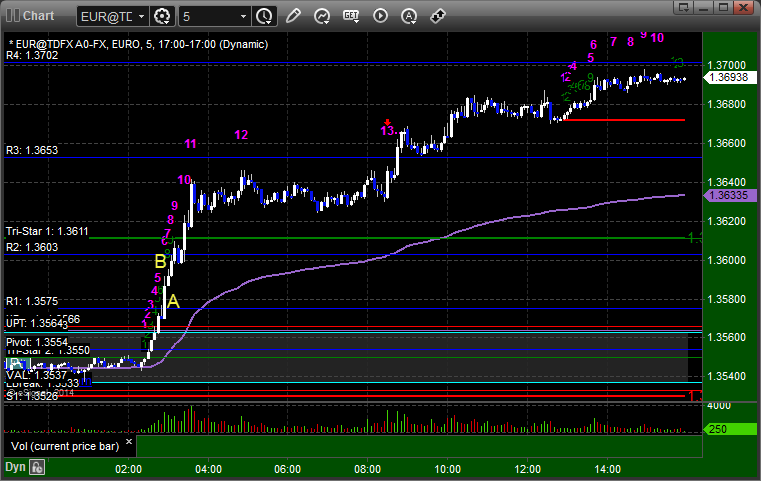

EURUSD:

We came into the session short the second half of the prior day’s trade from the 1.2420 area. Our new trade triggered short at A, hit first target at B, and we lowered the stop on both pieces (today’s and yesterday’s) twice, currently holding with a stop over C: