Futures Calls Recap for 10/1/20

The markets gapped up, sold off, never quite filled, but went flat for everything but the first hour of the session on 3.9 billion NASDAQ shares.

Net ticks: +14.5 ticks.

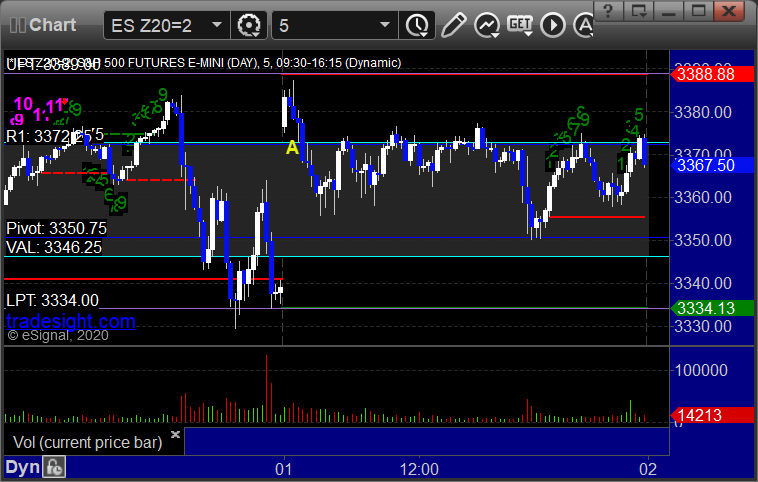

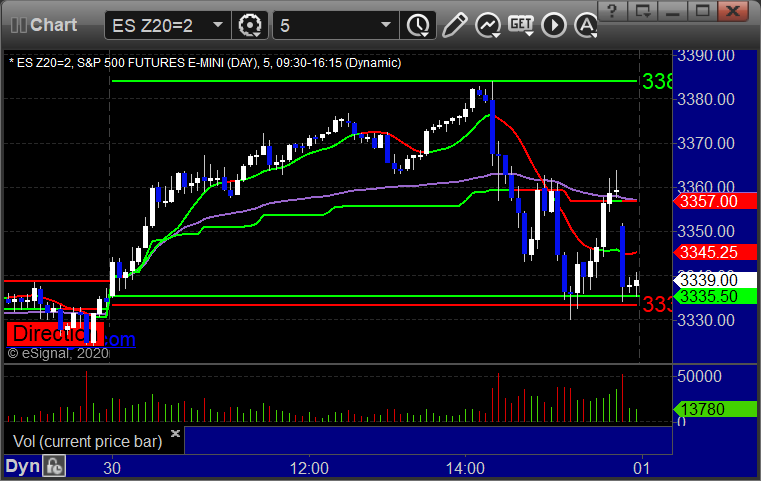

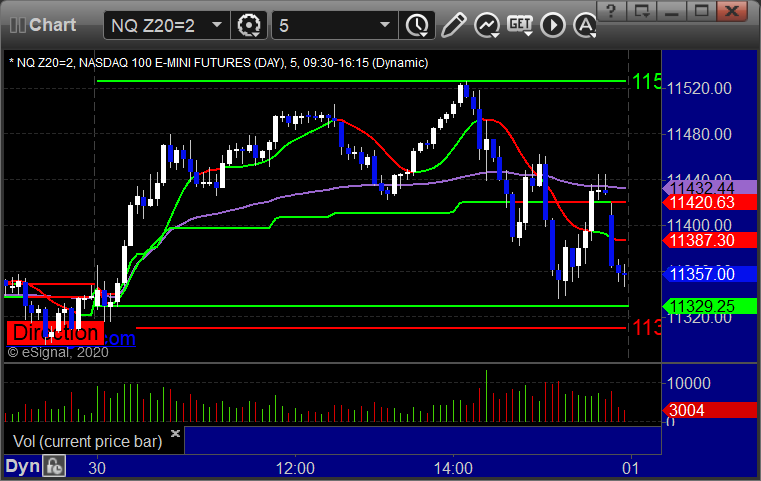

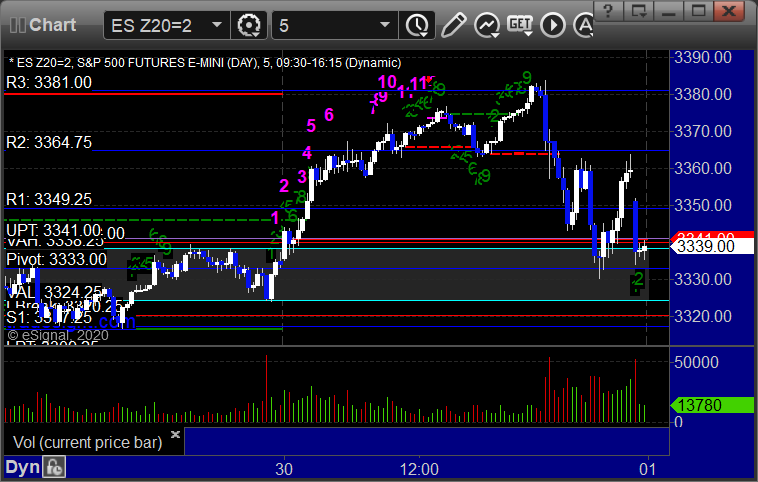

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take, same with the short:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered short at A under 3372.25, hit first target for 8 ticks, went lower but came back up and stopped over the entry instead of hitting Pivot first:

Forex Calls Recap for 10/1/20

A loser and a winner for the session. See GBPUSD section below.

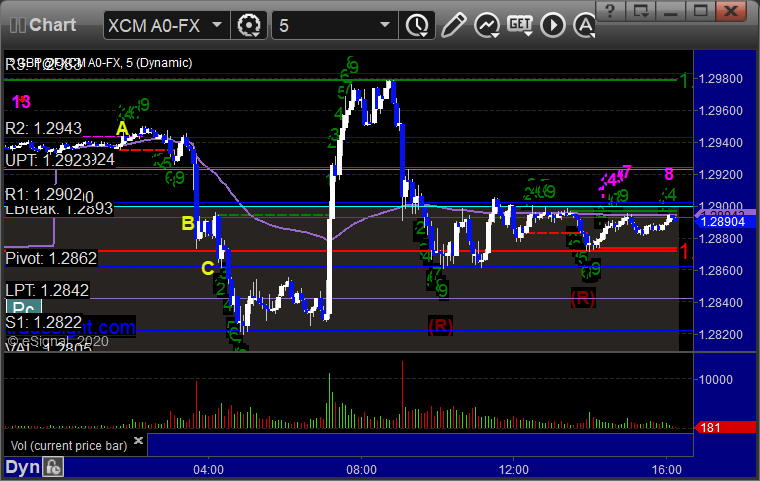

Here's a look at the US Dollar Index intraday with our market directional lines:

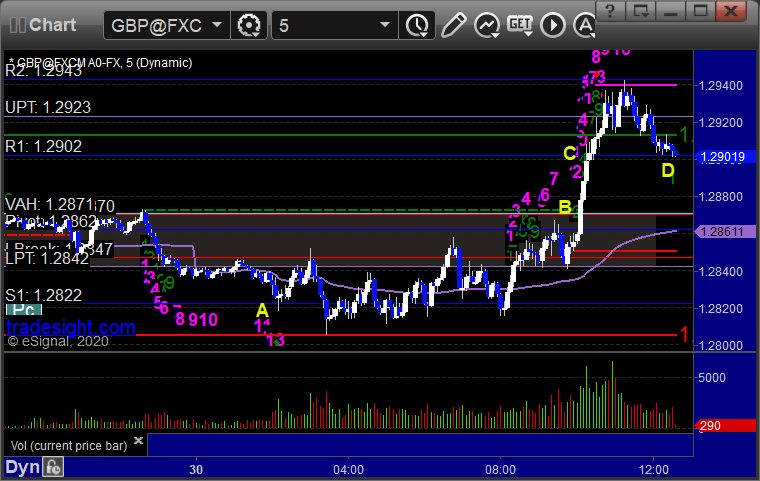

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, second half stopped over the entry:

Stock Picks Recap for 9/30/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and worked:

His NVDA triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 9/30/20

The markets opened flat, drifted higher, and then sold off sharply on 4.2 billion shares. They still closed positive for the day.

Net ticks: +0 ticks.

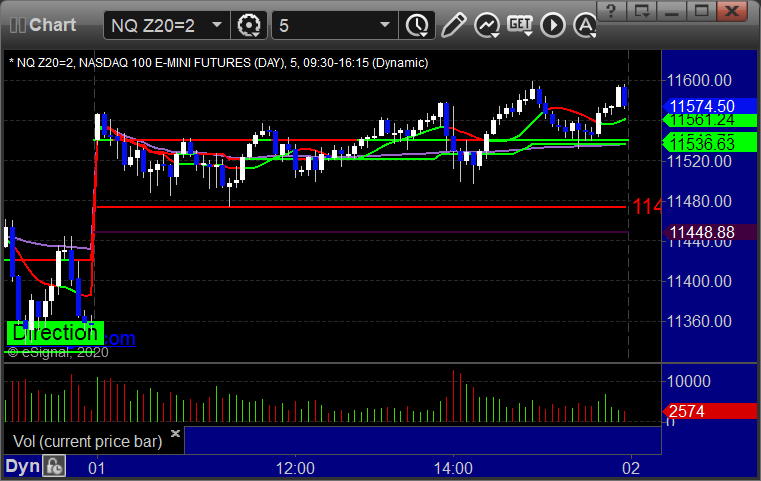

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A but too far out of range to take:

NQ Opening Range Play triggered long at A but too far out of range to take:

ES Tradesight Institutional Range Play:

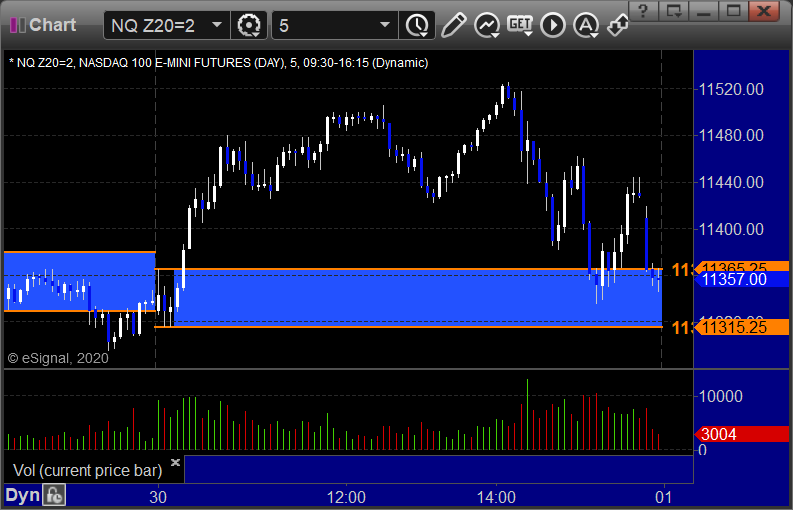

NQ Tradesight Institutional Range Play:

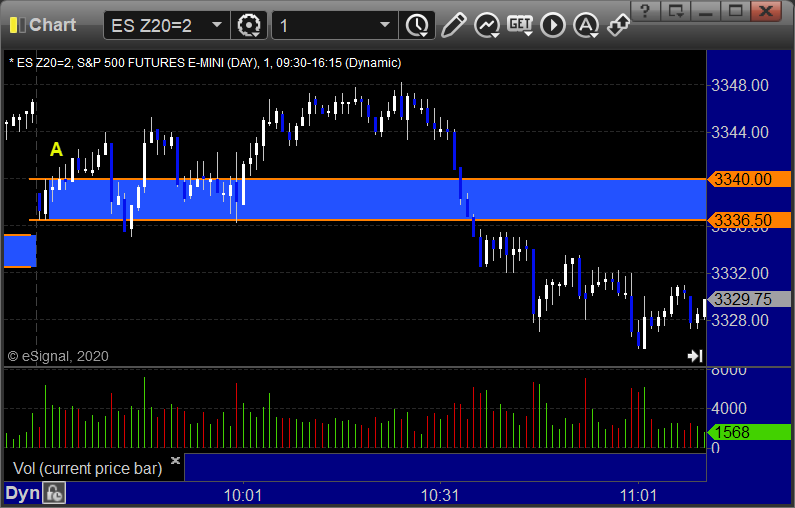

ES:

Today's easy trade was the long over R1 discussed in the Lab:

Forex Calls Recap for 9/30/20

A loser and a winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, second half was about to stop under R1 at D as I posted this:

Stock Picks Recap for 9/29/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, BYND triggered long (with market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 9/29/20

The markets opened fairly flat and stayed mostly flat for the session on 3.3 billion NASDAQ shares.

Net ticks: +4 ticks.

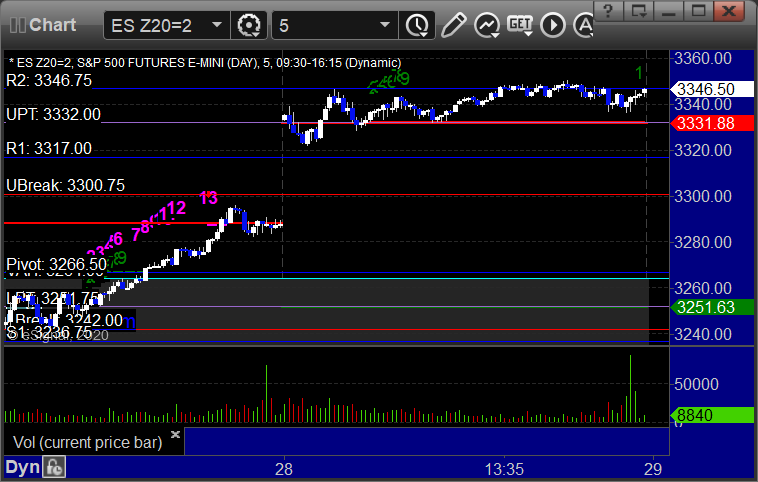

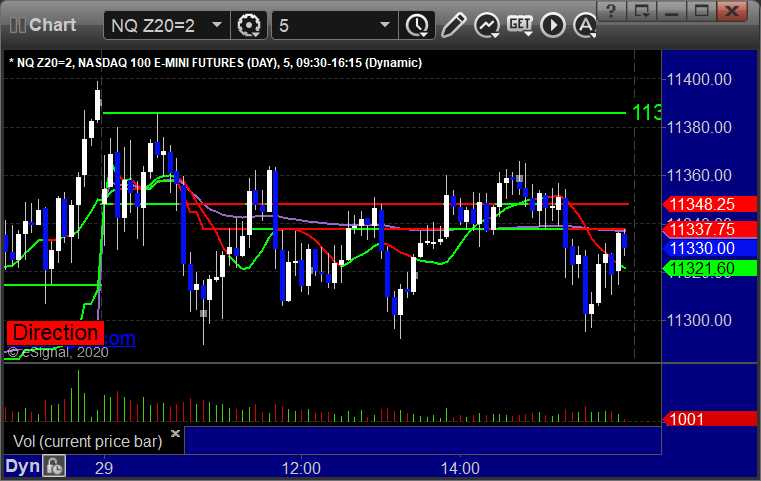

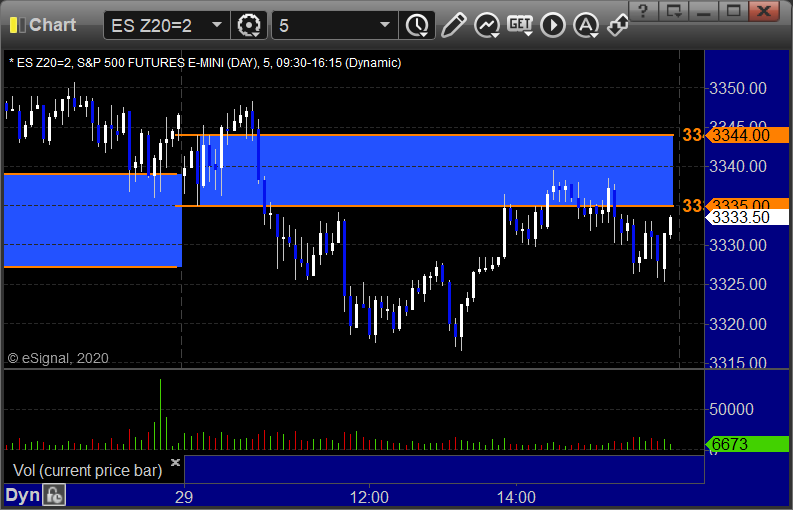

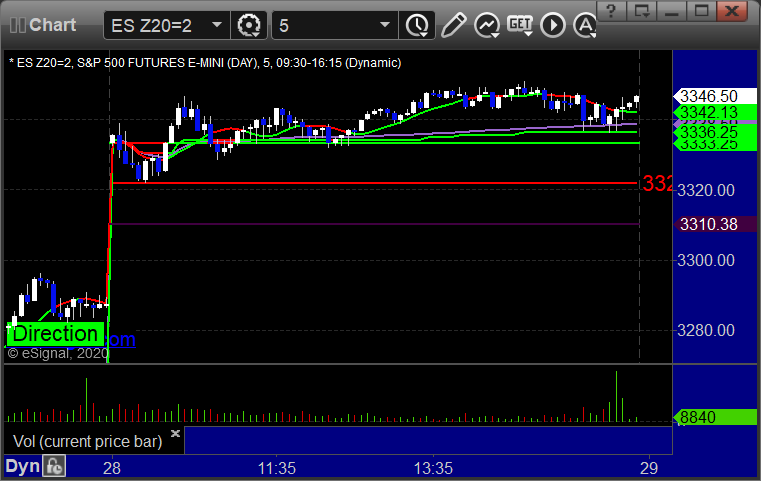

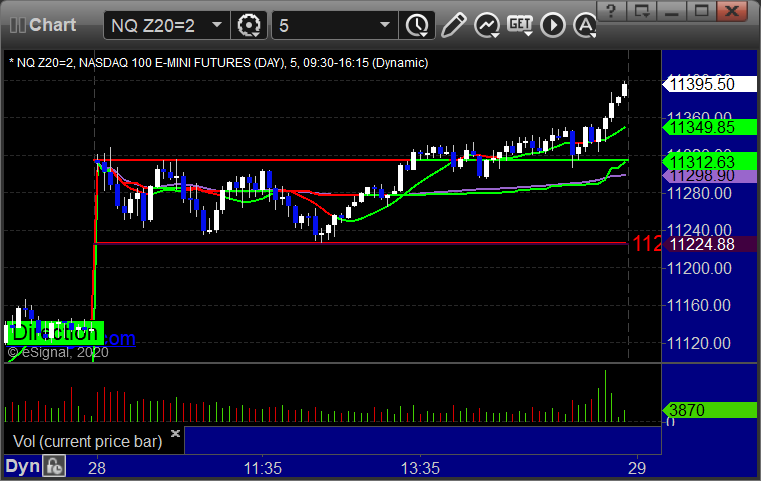

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

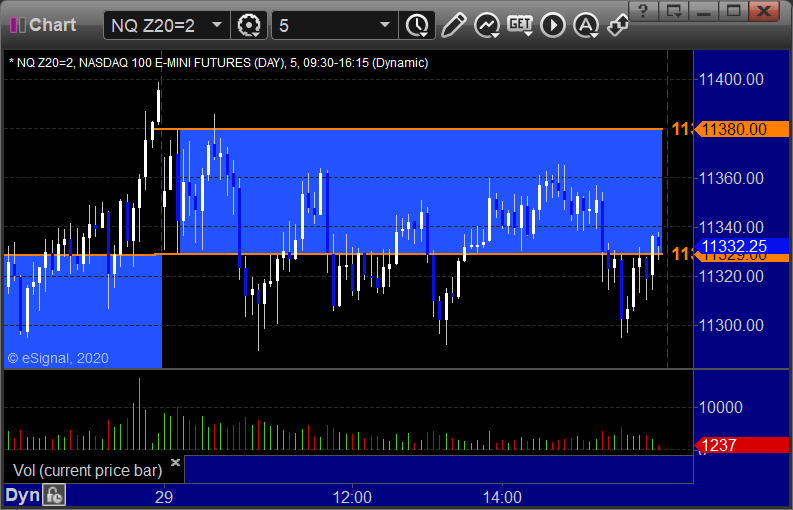

ES:

Two things to note here. The breakdown under VAL about an hour in was the short entry and the low of the day was exactly the Lower Pressure Threshold:

Forex Calls Recap for 9/29/20

A complete waste of a session. See GBPUSD section below.

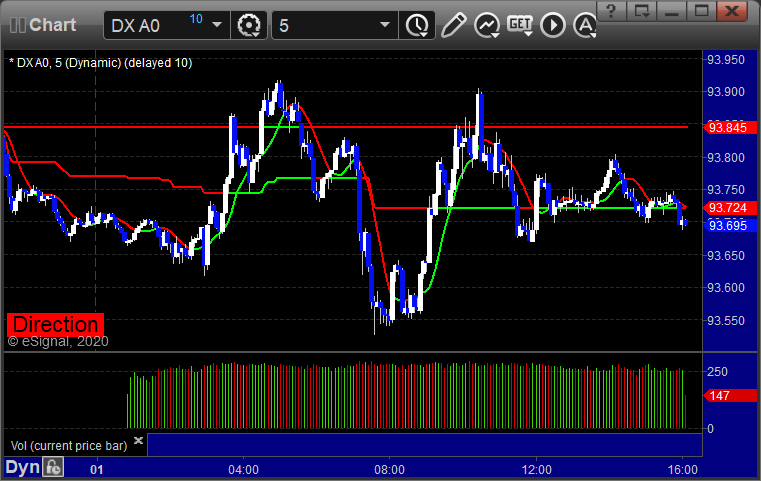

Here's a look at the US Dollar Index intraday with our market directional lines:

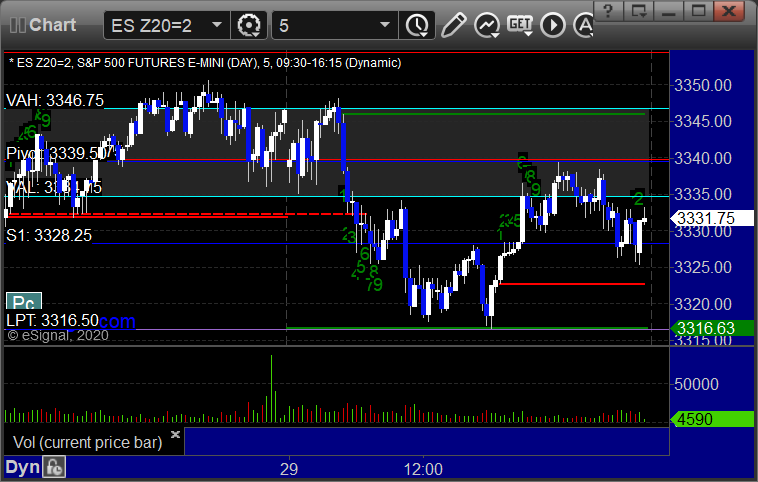

GBPUSD:

Triggered long at A and closed at B for a small gain after a dead session:

Stock Picks Recap for 9/28/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, BABA triggered short (without market support) and didn't work:

PYPL triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and eventually worked a little:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 9/28/20

The markets gapped up and put in a flat day on 3.5 billion NASDAQ shares.

Net ticks: +8 ticks.

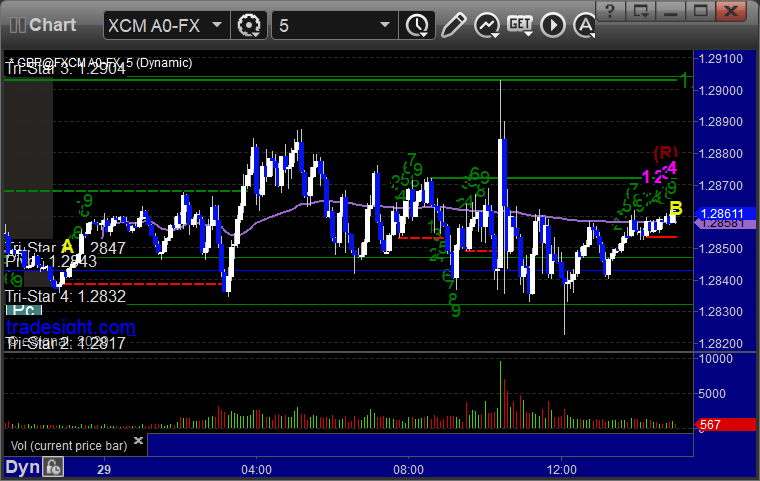

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked enough for a partial:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: