Futures Calls Recap for 10/22/14

Two losses for the first time in a while. Both would have worked if you put them back in, but I wasn't around over lunch to re-enter the first one, and the second one re-triggered in the last 15 minutes of the day. The markets were pretty choppy early and then sold off in the afternoon. See the ES and NQ sections below. NASDAQ volume closed at 1.8 billion shares.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

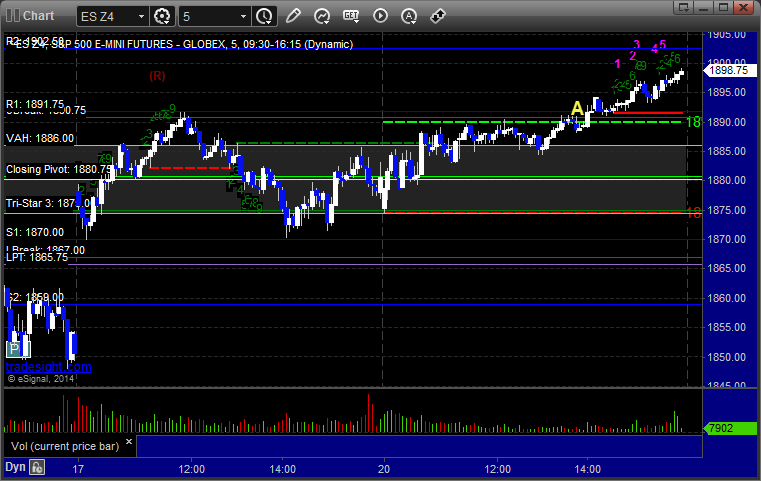

ES:

Triggered short at A at 1923.75 and stopped. Did not re-enter, though it worked later:

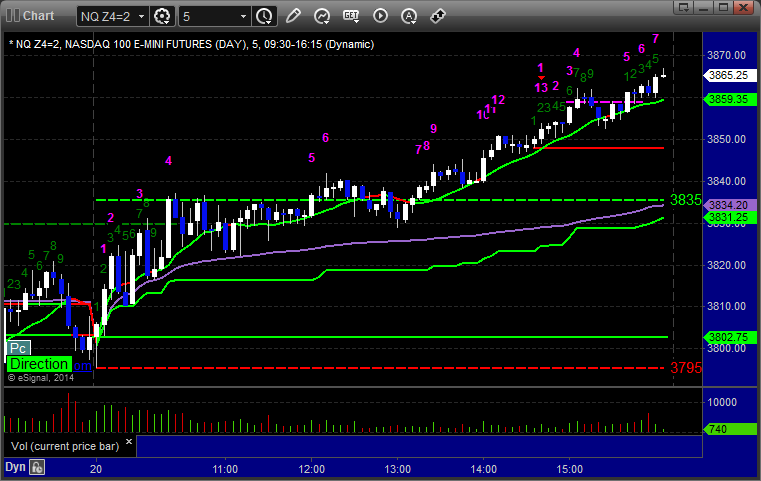

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3953.50 and stopped. Did not re-enter:

Forex Calls Recap for 10/22/14

One winner for the session, on the EURUSD, which again didn't get to the firs target by the end of the day, so we closed for 30 pips. See that section below.

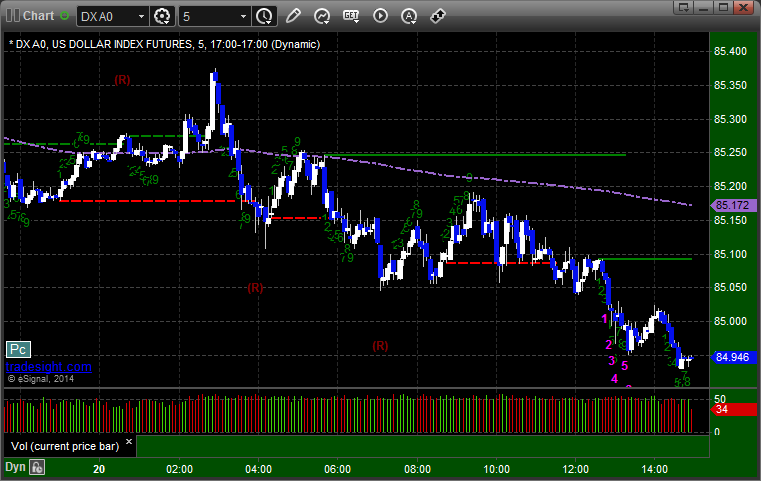

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, closed at B for 30 pips for end of session:

Stock Picks Recap for 10/21/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHRW triggered long (with market support) and worked:

MLNX triggered long (with market support) and didn't work initially, worked later in the day:

AKRX and DLTR gapped over, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered short (ETF, so no market support needed) and didn't work:

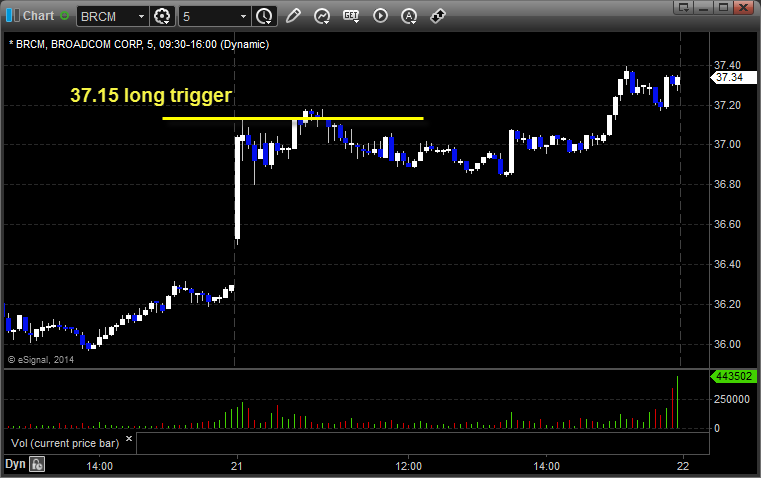

Mark's BRCM triggered long (with market support and a 13 Comber sell signal at the time) and didn't work, worked later:

FSLR triggered long (with market support) and worked:

Rich's EOG triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 10/21/14

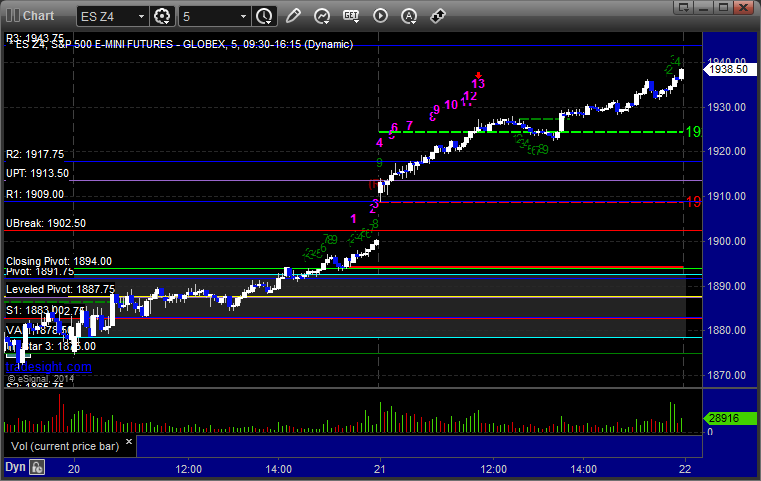

A gap and go session that was mostly a drift higher and showed very little excitement throughout. The NASDAQ was dead flat early after the gap, while the ES drifted higher, but then things flattened out over lunch and resumed the climb in the afternoon. NASDAQ volume closed at 1.7 billion shares. Felt exactly like one of the Core Eight Days of Earnings with another gap. None of our futures calls triggered.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 10/21/14

No triggers until the US session, and then a winner on the GBPUSD that I closed out completely because it hadn't even reached the first target. See that section below.

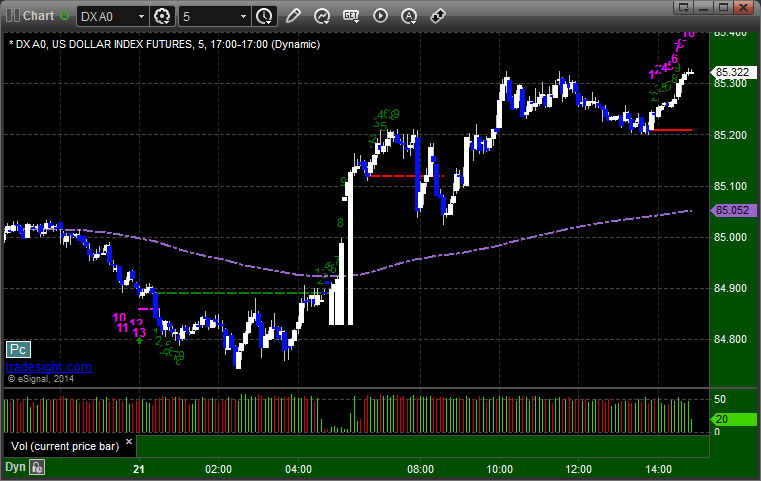

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and closed at B 20 pips in the money:

Stock Picks Recap for 10/20/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked:

GILD triggered long (with market support) and worked:

TWTR triggered long (with market support) and worked enough:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 10/20/14

A much slower session than we've been seeing lately, as volume dried up quite a bit to start the new options month and right in the middle of core earnings. The markets basically opened flat and headed higher on a drift. NASDAQ volume closed at only 1.5 billion shares, a third of which was in the last hour. We had one small winner on the ES, see that section below.

Net ticks: +2.5 ticks.

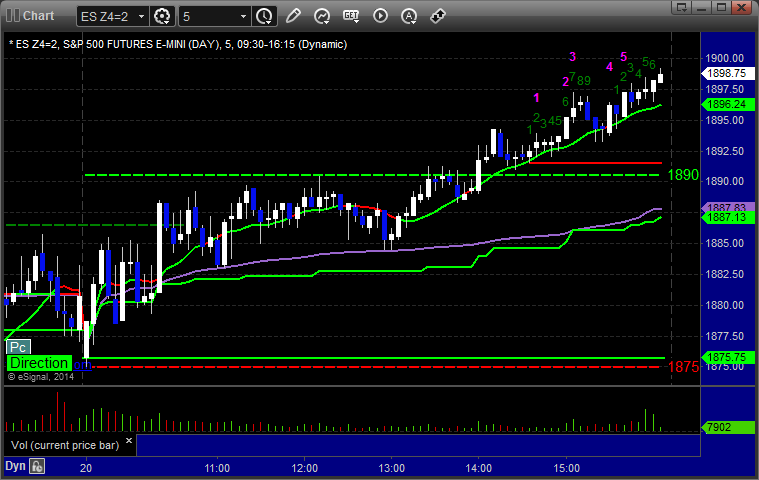

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1892.00, hit first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 10/20/14

A loser and a bigger winner for the session, which I closed because it wasn't quite to the first target by the end of the main session. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered long at B and closed at C for end of session:

Stock Picks Recap for 10/17/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

Rich's SNDK triggered short (without market support) and didn't work (worked later in the day):

GS triggered short (without market support) and didn't work, triggered later and did a little better:

AMZN triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 10/17/14

A big gap up for options expiration. We had a winner on the ES that didn't go far, and that was it. A call in the afternoon didn't trigger. NASDAQ volume closed at 1.9 billion shares, strangely the lightest of the week for expiration.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1884.00, hit first target for 6 ticks, stopped second half under the entry: