Stock Picks Recap for 10/27/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DYAX triggered long (with market support) and didn't go enough in either direction to count:

CHKP triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered short (with market support) and worked enough for a partial:

PCLN triggered long (with market support) and worked enough for a partial:

NTAP triggered long (with market support) and didn't work:

AMGN triggered long (with market support) and didn't work:

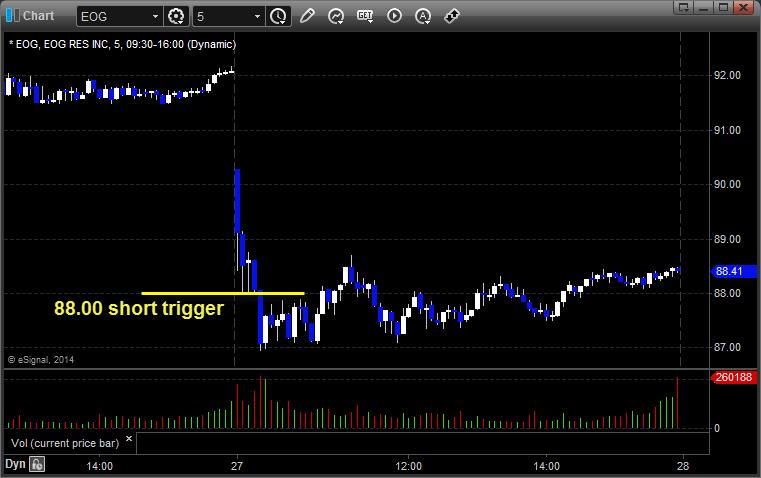

Rich's EOG triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

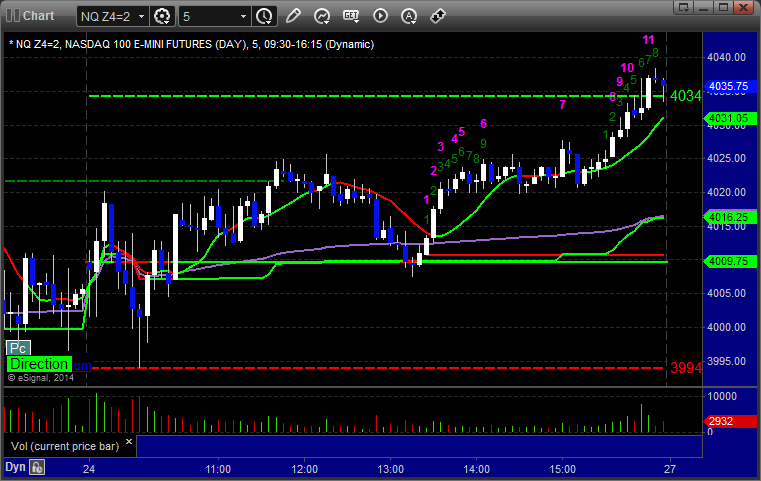

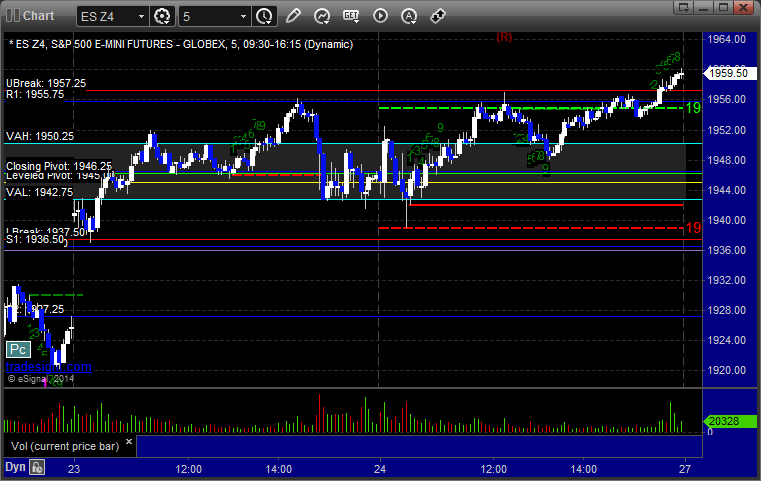

Futures Calls Recap for 10/27/14

Three triggers (could have done a fourth) from the calls, with two stopping out (before it worked the third time) and a long that worked. See the ES section below. This ended up being a really dull trading session with horrible volume of only 1.4 billion NASDAQ shares that went nowhere.

Net ticks: -8.5 ticks.

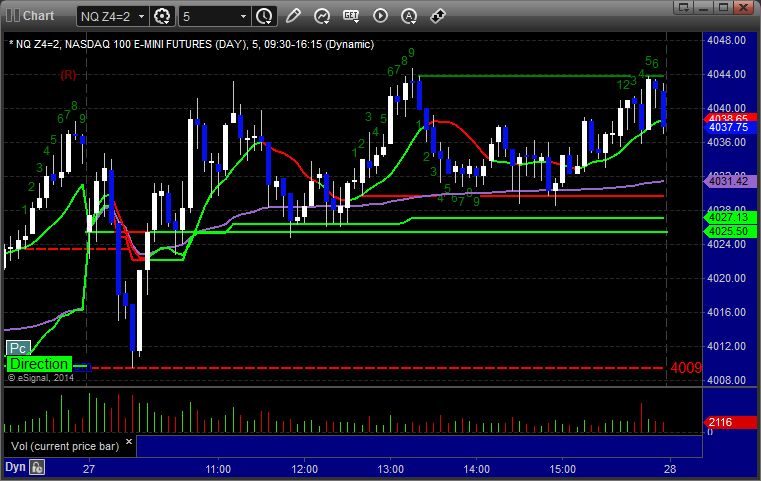

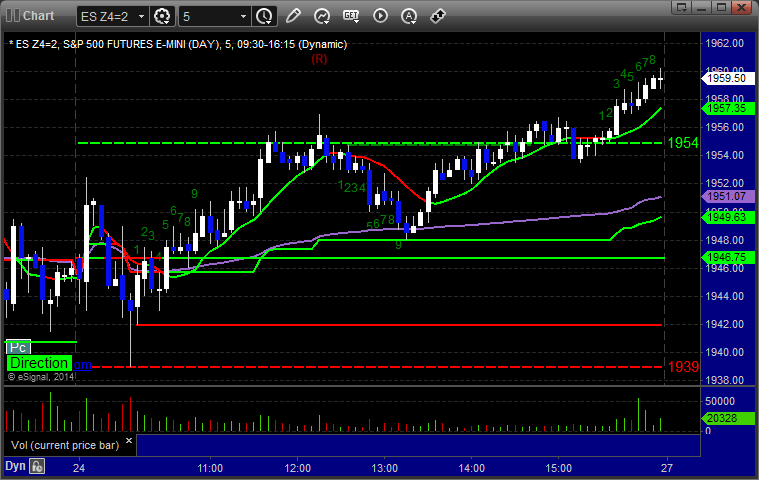

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1949.25 and stopped. Went again 10 minutes later and stopped. Also went a third time that would have worked. Later, the long triggered at B and hit the first target for 6 ticks, raised the stop twice and stopped in the money:

Forex Calls Recap for 10/27/14

A loser and a winner that is still going to start the week. See the GBPUSD section below for the recap. Remember that the pairs have a little adjustment to do because some of the world did the time change last weekend and some did not (and then it will happen again next weekend), so it throws off the technicals when the markets aren't in sync.

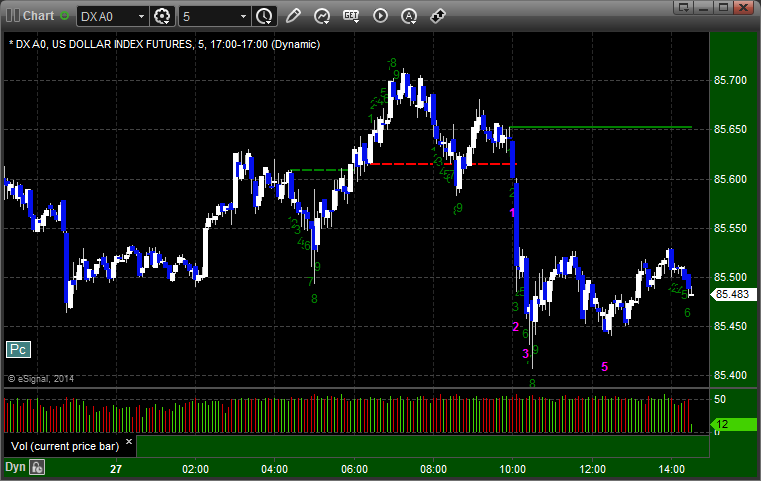

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Put it back in in the morning, triggered long at B, hit first target at C, still holding the second half with a stop under the entry:

Stock Picks Recap for 10/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERN triggered long (with market support) out of the gate and didn't work:

ISIS triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, BIIB triggered long (with market support) and didn't work:

Mark's YHOO triggered long (with market support) and worked:

SNDK triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

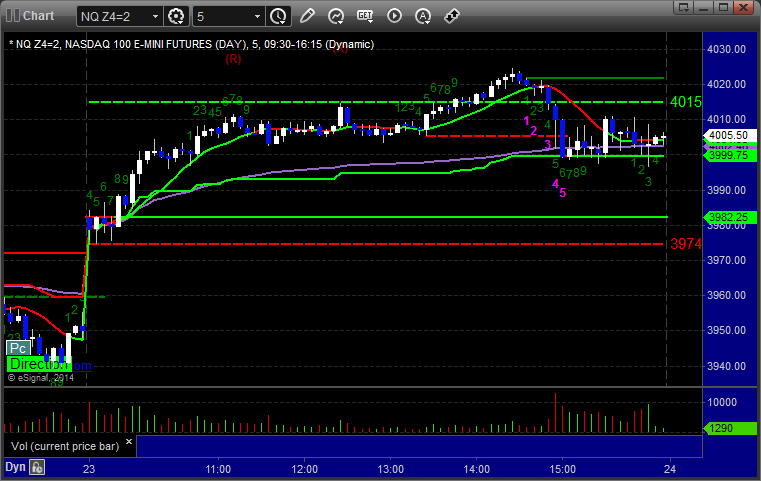

Futures Calls Recap for 10/24/14

Nothing triggered for the session on a Friday with a flat open and light volume. The first hour was dead flat and I took off. Things moved around after a bit, and there were opportunities for those that took the course.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 10/24/14

An uneventful end to a week that wasn't that interesting. One trigger lost a couple of pips and that was it from the official calls. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A, finally closed at B as it never hit stop or first target:

Stock Picks Recap for 10/23/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RGEN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's ALXN triggered long (with market support) and worked:

Rich's FAS triggered long (ETF, so no market support needed, but inside the opening 5 minutes) and didn't work:

GILD triggered long (with market support) and worked:

BIIB triggered long (with market support) and worked:

NTAP triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

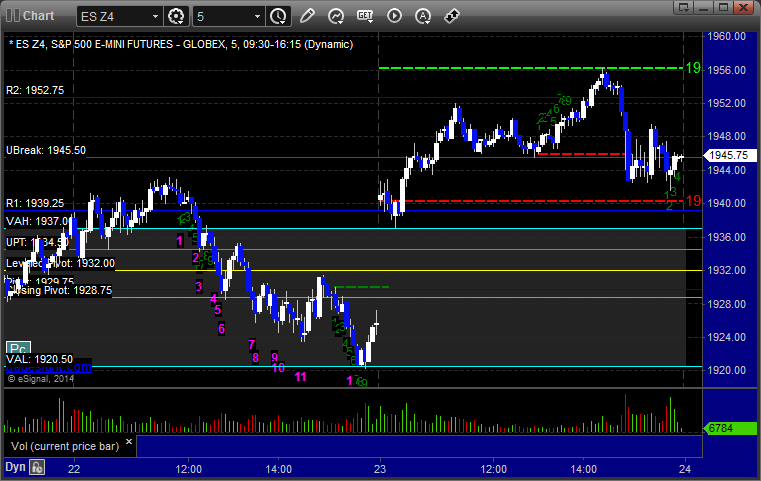

Futures Calls Recap for 10/23/14

A gap up in the markets that set up a couple of nice shorts, but none of them triggered. Instead, the market curled up on a volume warning and drifted higher, then sold off in the afternoon and closed on 1.8 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 10/23/14

An unfortunate session that went nowhere and was the first narrow-ranged day in a while. See the EURUSD for our triggers.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

One full trigger and two partial triggers under our order staggering rules.

We triggered short at A, didn't hit first target, and stopped. Triggered part of our long at B (though not all three if you staggered) and stopped. Triggered short again for part of the trade (low bid was 1.26301 on MB) and stopped:

Stock Picks Recap for 10/22/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

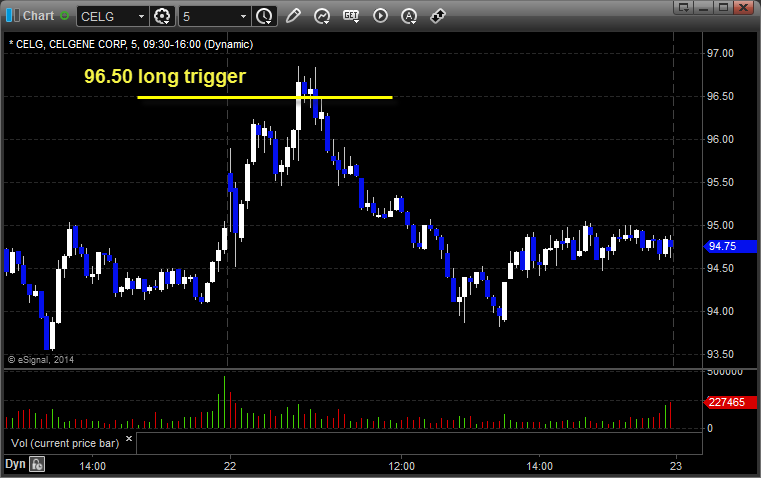

From the report, CELG triggered long (with market support) and went $0.35, which might have been enough for a partial, but we won't count it because it was so fast:

HLSS gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered short (with market support) and worked enough for a partial:

FEYE triggered long (with market support) and worked enough for an easy partial:

CELG triggered long (with market support) and worked. We used this as an early entry for partial size ahead of the main report breakout trigger:

Rich's GPRO triggered short (without market support) and didn't work:

Mark's YOKU triggered long (with market support) and didn't work:

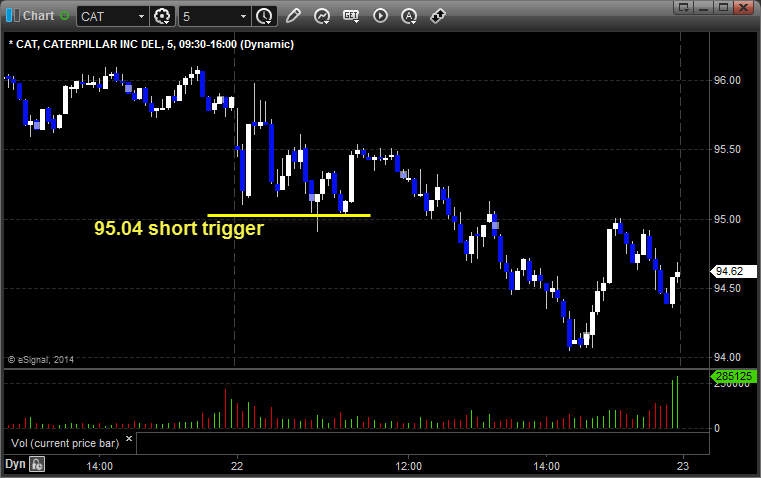

Rich's CAT triggered short (with market support) and didn't work, worked later:

His GS triggered short (without market support) and didn't work, worked later:

His BIIB triggered long (without market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.