Tradesight Recap Report for 9/14/22

Today in the Markets:

The markets opened flat and stayed totally dead all day on 4.4 billion NASDAQ shares..

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play both the short and the long triggered too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

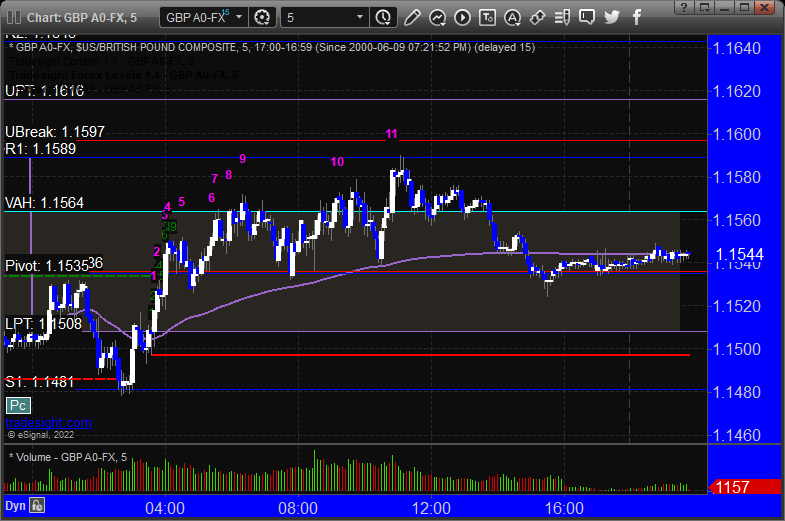

GBPUSD:

Results: +0 pips

Nothing worth doing.

No triggers.

Tradesight Recap Report for 9/13/22

Today in the Markets:

Well unfortunately, the markets gapped down big and ruined my plan, and continued to sell off sharply on 4.6 billion NASDAQ shares after the inflation number.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped under the midpoint, triggered short at B but too far out of range to take:

Additional Futures Calls:

None

Results: -20 ticks

GBPUSD:

Triggered long at A and stopped. Triggered short at B and worked. Still holding the second half with a stop above S4 (1.1557)

Results: -25 pips and the other trade is still going.

Again, not much of a day with the big gap.

These are the Tradesight calls that triggered:

Rich's ORCL triggered long (without market support) and worked.

Tradesight Recap Report for 9/12/22

Today in the Markets:

The markets gapped up and went a little higher, and that was it for the day on 4.2 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

Additional Futures Calls:

None

Results: -33 ticks

GBPUSD:

Results: +0 pips

Not a very interesting day.

These are the Tradesight calls that triggered:

Rich's FSLR triggered short (without market support) and didn't work.

Tradesight Recap Report for 9/2/22

Today in the Markets:

The markets gapped up a little, pulled back, went higher and then dead flat on light volume, then sold off to fill the gap and officially end summer on 4.2 billion NASDAQ shares.

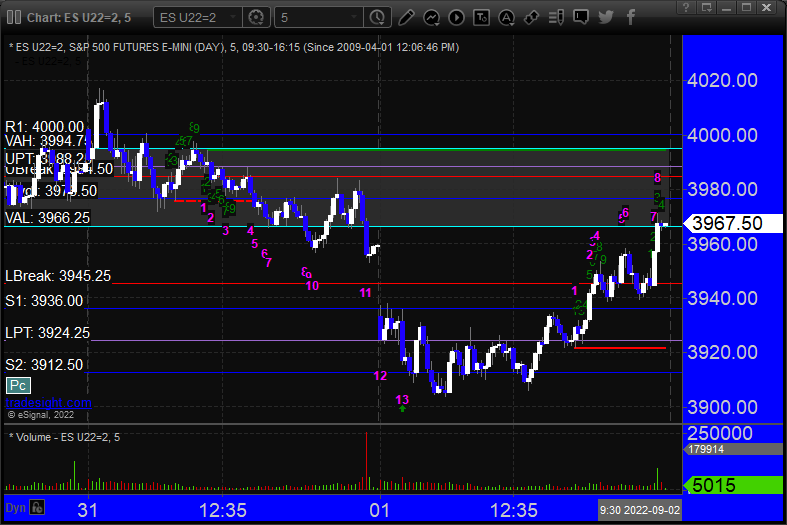

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Additional Futures Calls:

None.

Results: +0 ticks

GBPUSD triggered short at A and long at B, both stopped, not unexpected for end of summer.:

Results: -50 pips

No triggers on a low volume Friday heading into the long Labor Day weekend.

Tradesight Recap Report for 9/1/22

Today in the Markets:

The markets gapped down, went a little lower but mostly were flat all day until late and then filled the small gap on 4.8 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and stopped under the midpoint:

Additional Futures Calls:

None

Results: -19 ticks

No calls given the Levels situation.

GBPUSD:

Results: +0 pips

A decent day in the markets for us because of the NVDA call as we wind down summer finally.

These are the Tradesight calls that triggered, Rich’s NVDA triggered short (with market support) and worked big:

His UBER call triggered short (with market support) and didn't work:

COST triggered long (with market support) and worked:

Rich’s ZM triggered short (with market support) and didn't go enough to count:

Tradesight Recap Report for 8/31/22

Today in the Markets:

Mostly a waste of time. The markets gapped up a little and filled quickly and sat dead all day with a slightly negative bias to close out August on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and long at B and both were too far out of range to take:

Additional Futures Calls:

None

Results: +0 ticks

GBPUSD triggered short at A and stopped, triggered again later and worked:

Results: -25 pips

These are the Tradesight calls that triggered, Rich's UBER triggered long (with market support) and didn't work:

COIN triggered short (with market support) and worked:

PTON triggered long (without market support) and didn't matter either way:

Tradesight Recap Report for 8/30/22

Today in the Markets:

The markets opened flat and sold off for an hour and that was it on 4.5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

Additional Futures Calls:

None

Results: ticks

GBPUSD triggered long at A and stopped, triggered short at B and closed for end of session:

Results: -25 pips

Couple of winner for the session.

These are the Tradesight calls that triggered, Rich's SNOW triggered short (with market support) and worked enough for a partial:

His CAT triggered short (with market support) and worked:

His MCHP triggered short (with market support) and worked:

Tradesight Recap Report for 8/29/22

Today in the Markets:

The markets opened flat, and stayed flat. What a waste of time on the volume.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

ES opening range play triggered long at A and worked.

Additional Futures Calls:

Results: +11.5 ticks

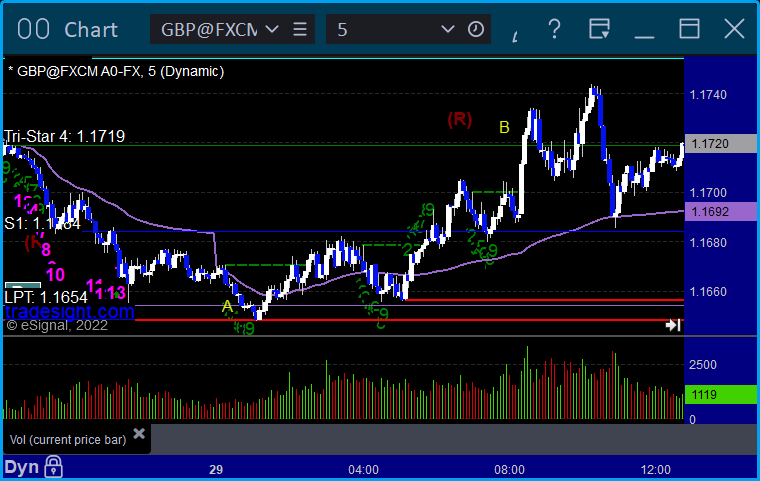

GBPUSD:

GBP/USD triggered short at A and stopped. Triggered long at B and stopped

Results: -50 pips

Not a big day. We call it a measuring day.

These are the Tradesight calls that triggered

Rich's JBHT triggered short (with market support) and worked.

Rich's AMZN triggered short (with market support) and didn't work: