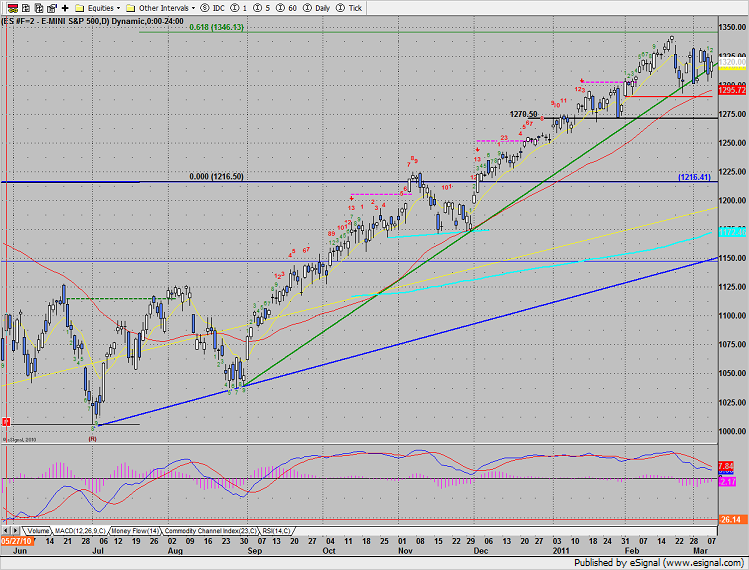

The SP lost 11 handles on the day, settling below the key DTL. The trend will not turn negative until there is a day of follow through and even better a break under the recent range.

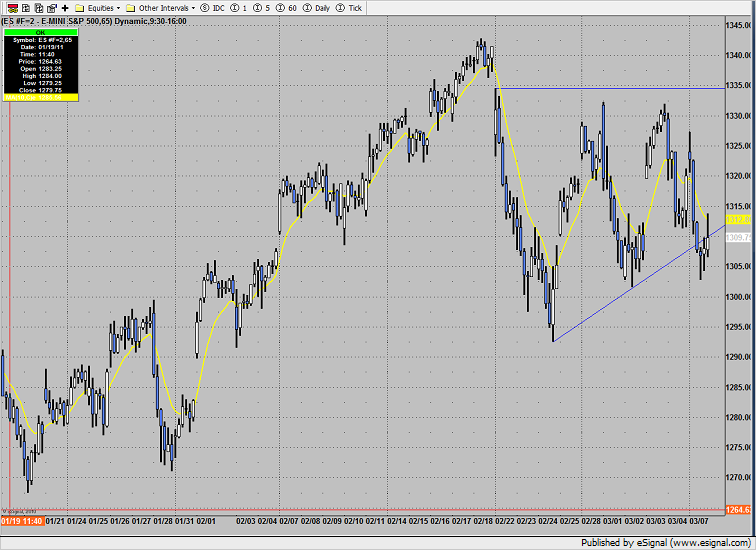

The hourly chart of the SP futures has price just barely hanging onto the falling wedge lower boundary. The upper window at the top of the pattern is key resistance going forward.

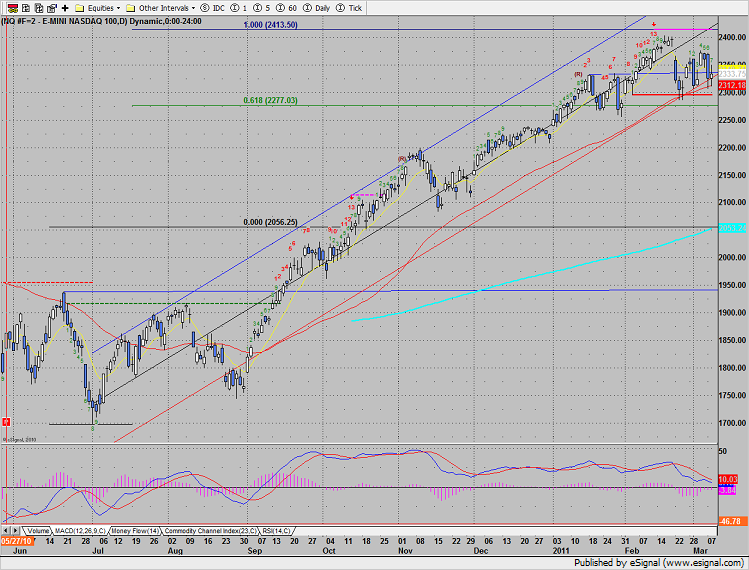

Naz lost 35 on the day, touching, but not breaking below the 50dma. A close below the rising regression channel would be the first confirmation of a trend change. Note that so far the bulls have been able to keep the MACD above the zero line. This is another key indicator to watch for confirmation of a CIT.

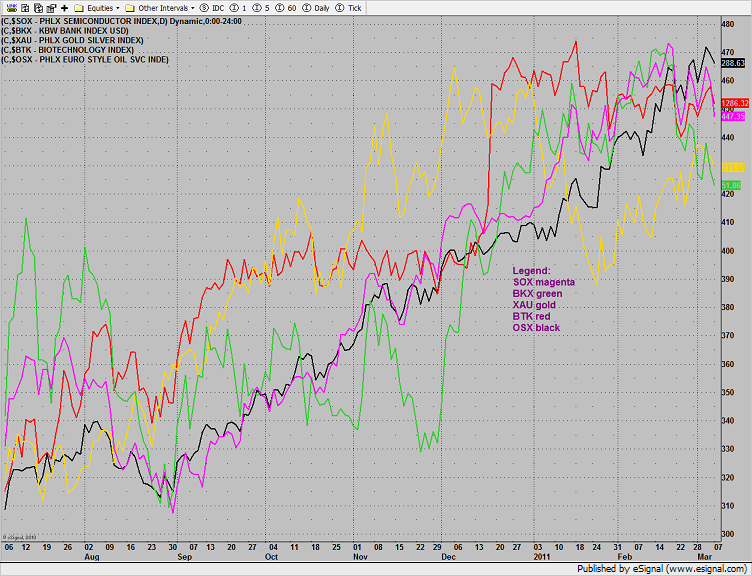

Multi sector daily chart:

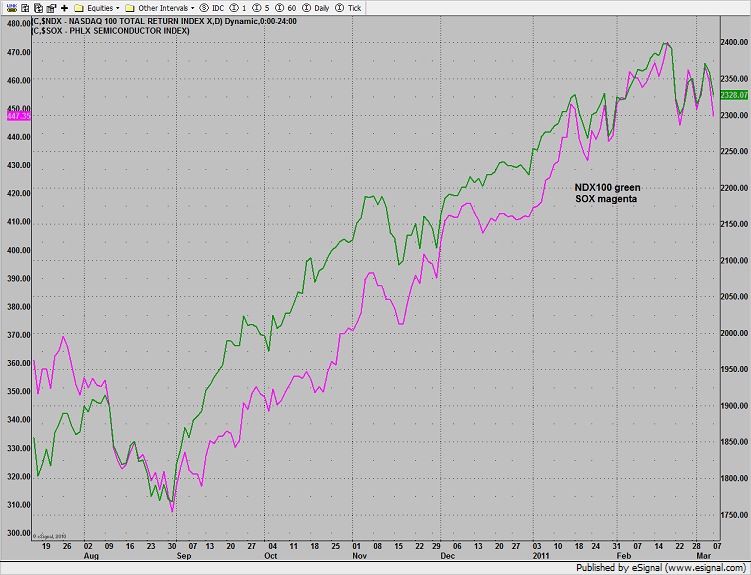

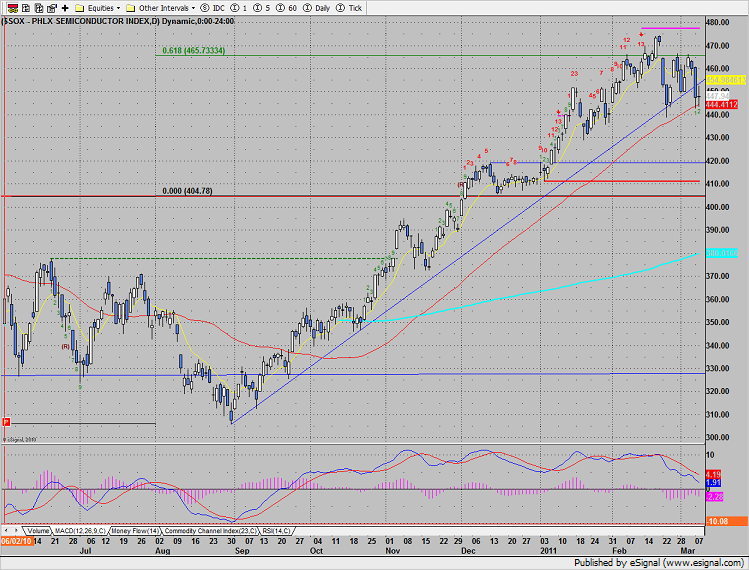

The SOX may be developing a bearish divergence from the NDX 100. Since the SOX is often a leading index, continued downside in the SOX will likely take the NDX lower with it.

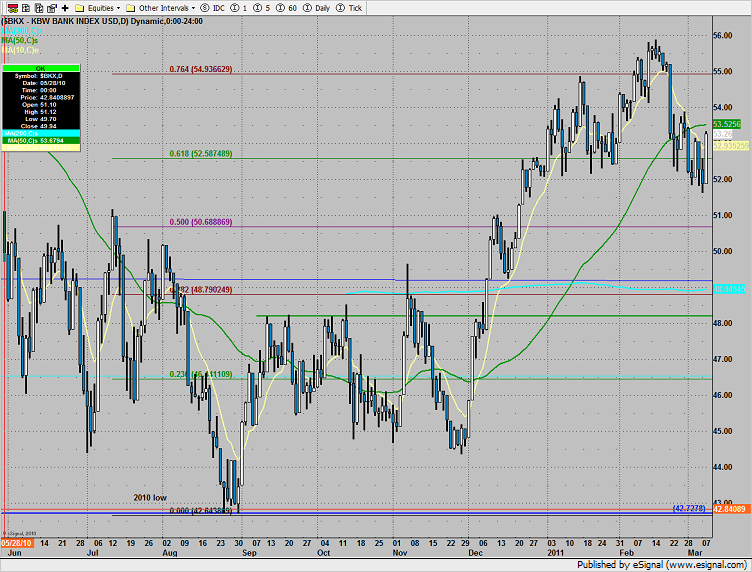

The BKX was the best performing major index on the day, only down ¾%. Target the 50% fib to cover shorts or reversal opportunity.

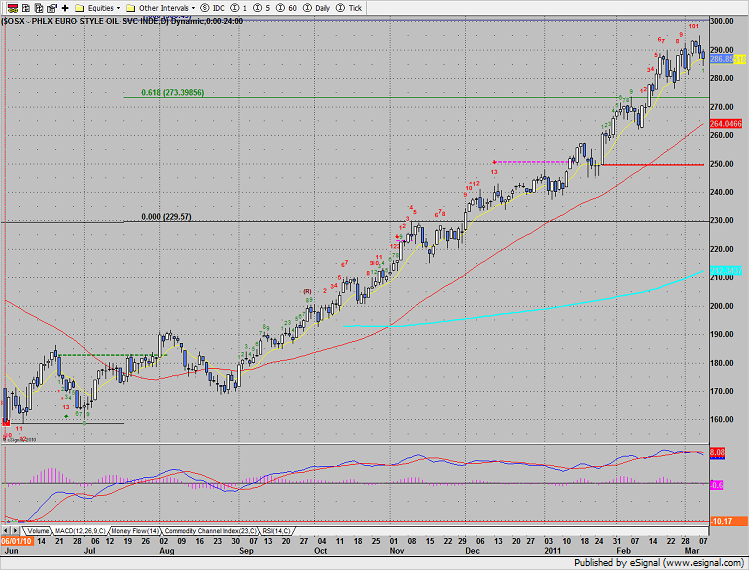

Leader, OSX posted an outside day down. A close under the 10ema would be a very negative development.

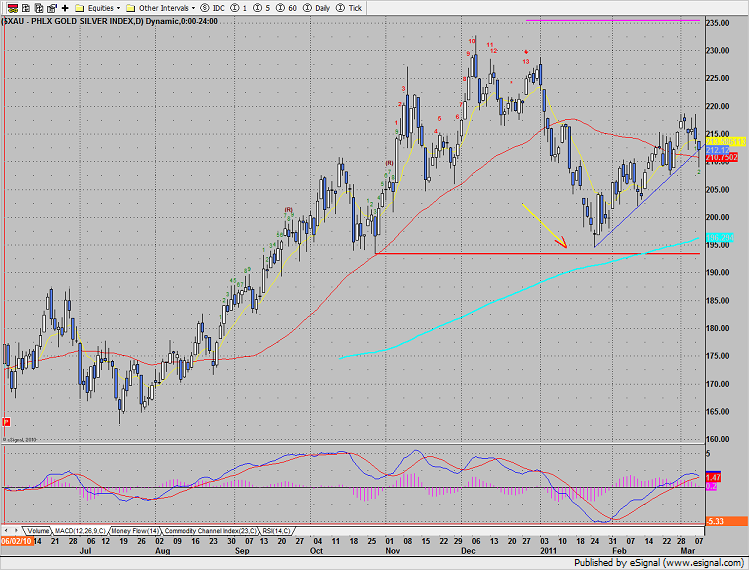

The XAU closed right at the 10ema. Even though gold futures were high on the day, the underperformance of the gold stocks is screaming that the high price of gold futures is suspect.

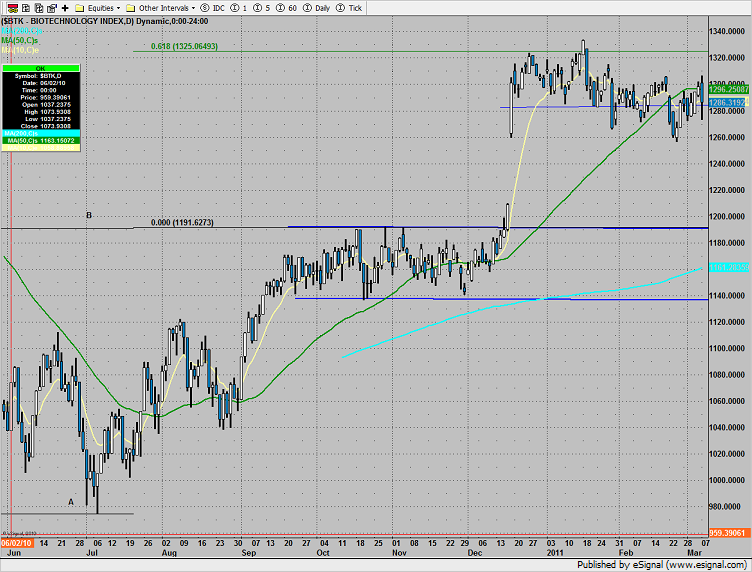

BTK remains range bound:

The SOX was the weakest major sector, lagging the SP and Naz very badly. Price has settled below the DTL for the first time in the move. Watch for a break under the zero line in the MACD for confirmation of a CIT.

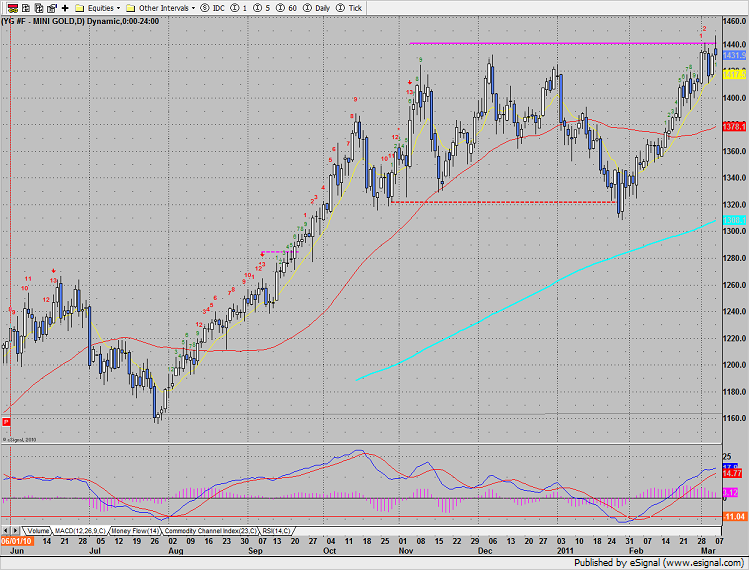

Gold:

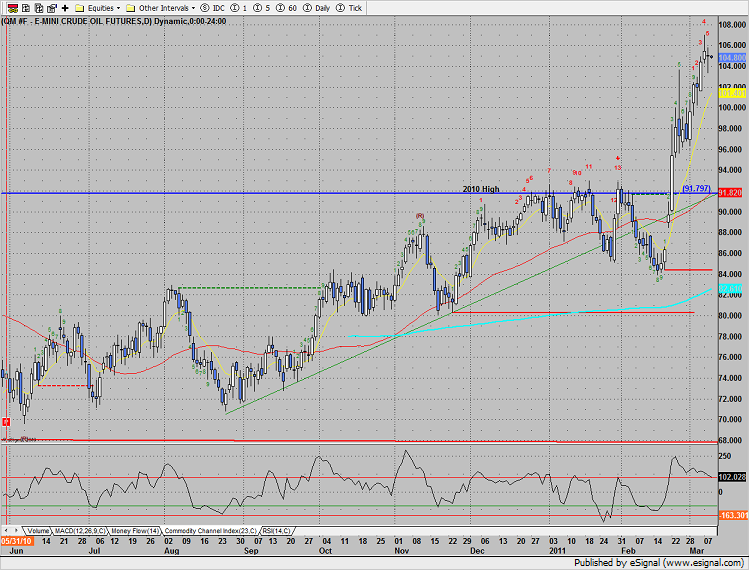

Oil: