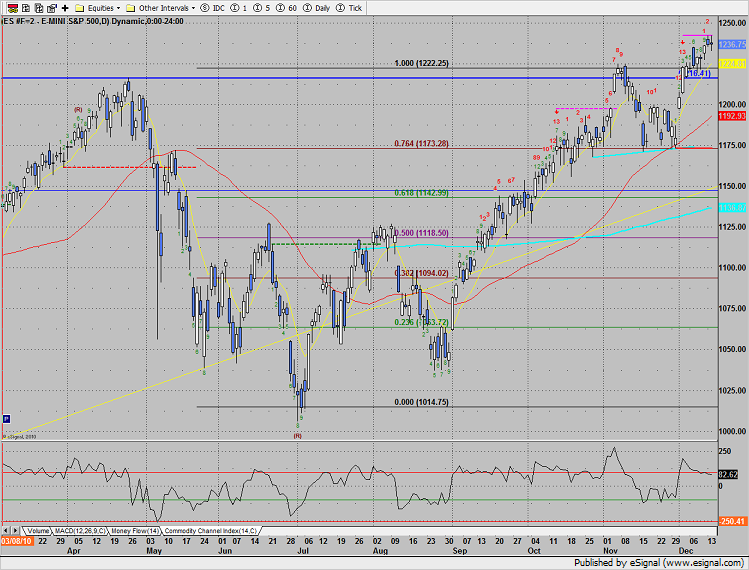

The SP posted a measuring day even after the FOMC announcement that failed to impact the futures. Tuesday was an outside day but the nominal price change negates the impact of a directional move. Price exceeded the prior high by one tick but never threatened the risk level from the active SEEKER exhaustion signal. Wednesday is 2 days until the final option expiration of 2010 and also the CPI number for December. There could be some decent movement and don’t for get to respect a bias that develops after 10am.

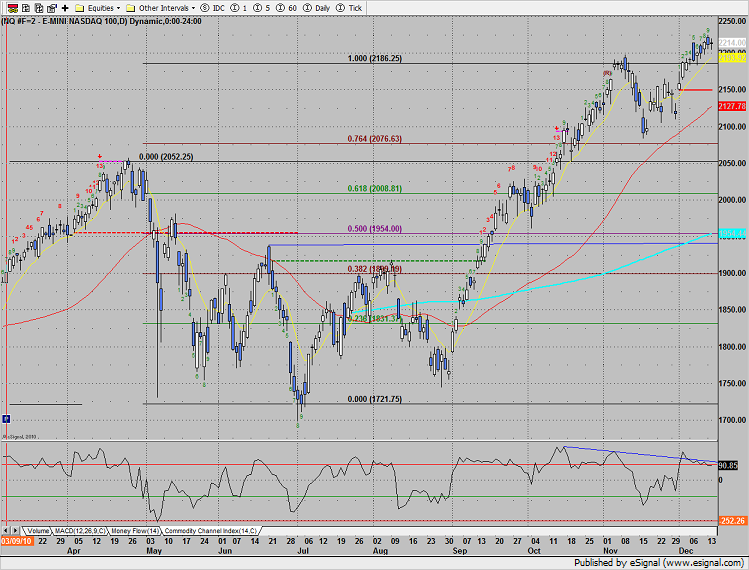

Naz failed feel the effect of the completed 9 bar run and closed about even. Many of the high flying index members were considerably weak but some of the low beta heavy weights like ORCL buffered the other losses.

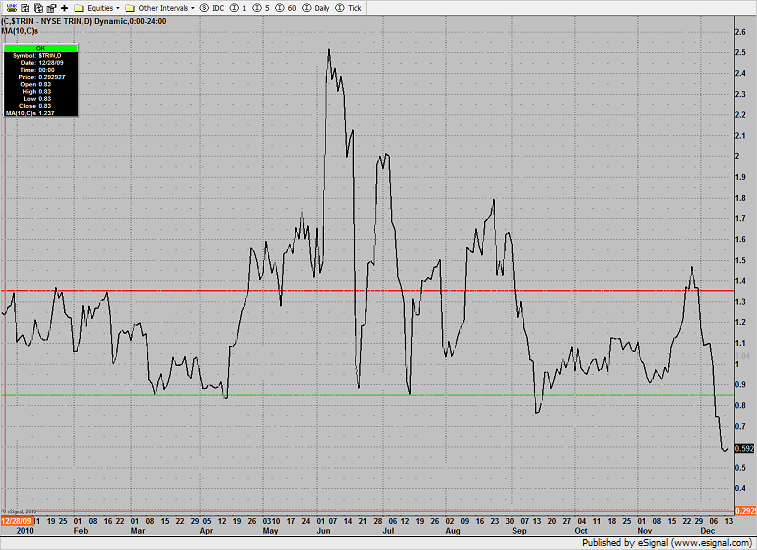

The 10-day Trin continues to show that stocks are very overbought.

We haven’t recently looked at the Dow industrials. Price is grinding against a very key level at 11,500. In the two prior trips into this area, the index took more than 24 months before exiting the range. At this time we have only been in this price range about half as long. There might be some more work to do before a legitimate resolution.

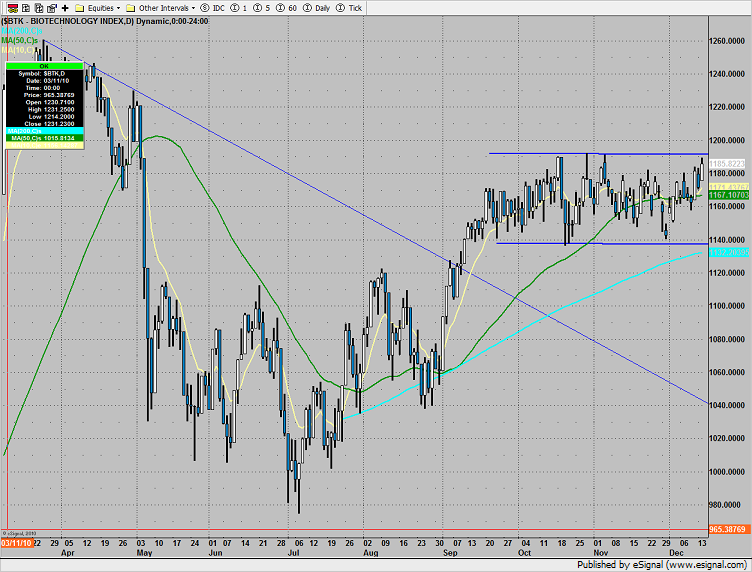

BTK was top gun rallying near the high of the range.

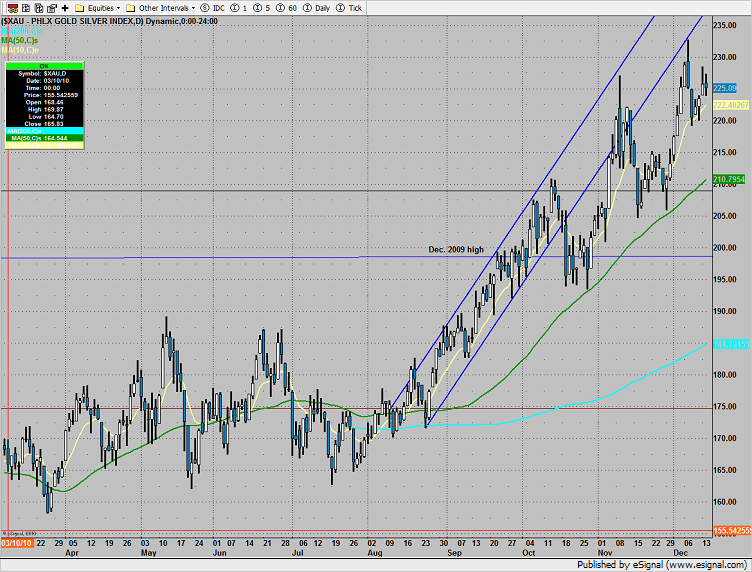

The XAU posted an inside day:

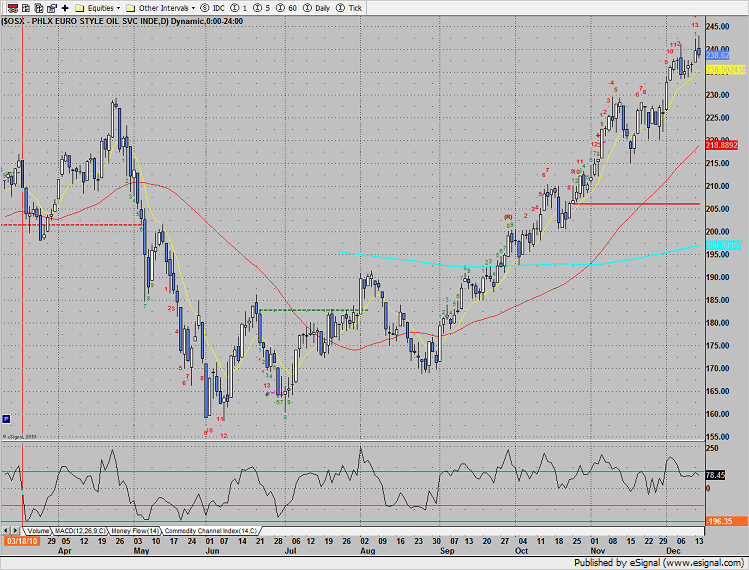

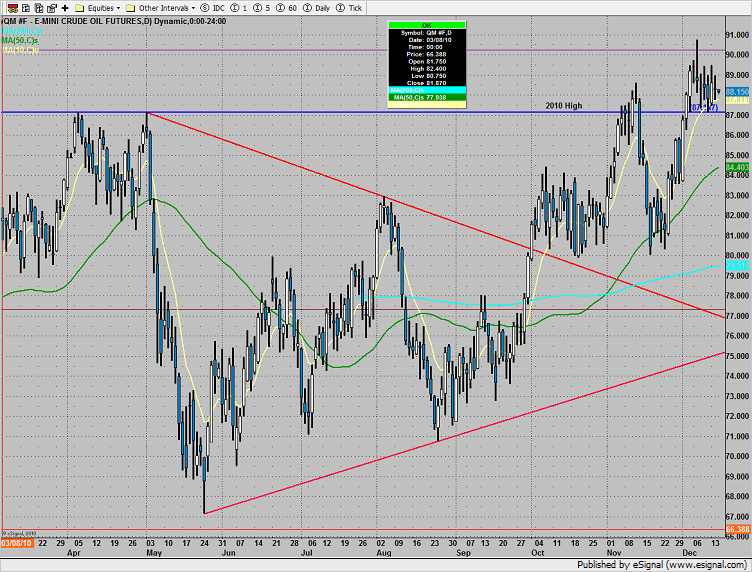

The OSX tried a new high but was rejected. The 13 exhaustion is still active. If the group rolls the market is in trouble.

O

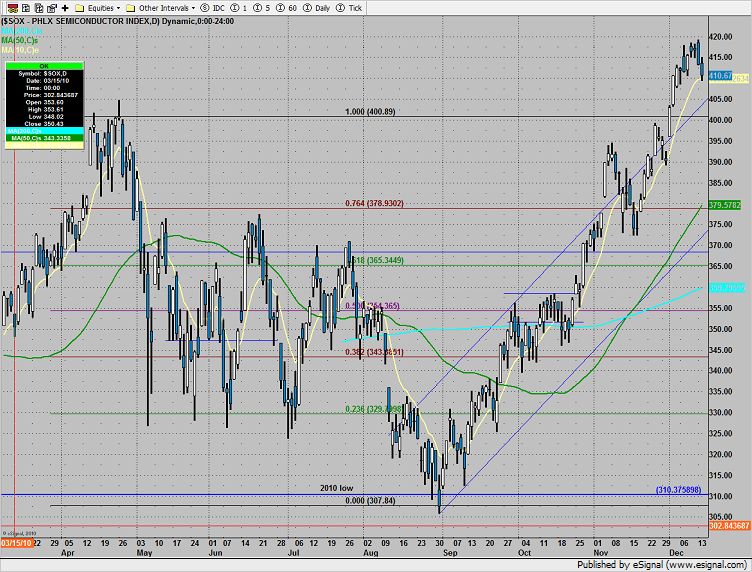

The SOX was notably weak. A settlement under the 10ema will turn the chart short-term negative.

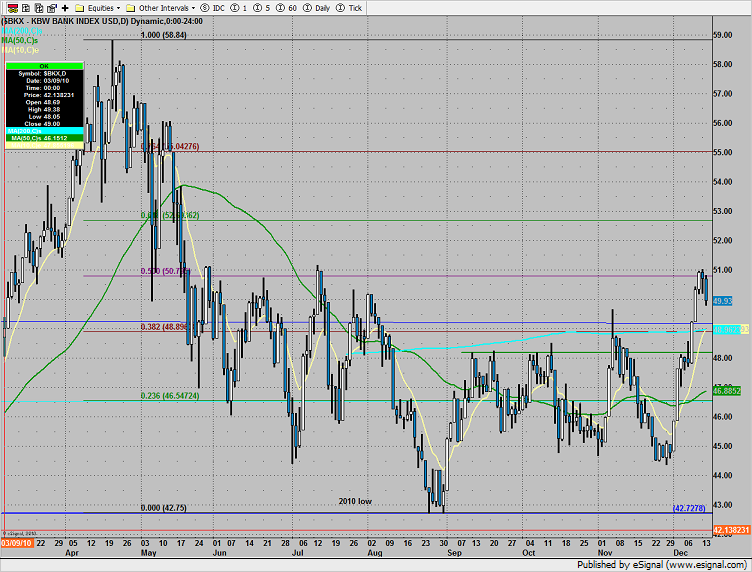

The BKX was the last laggard down 1.5%:

Oil:

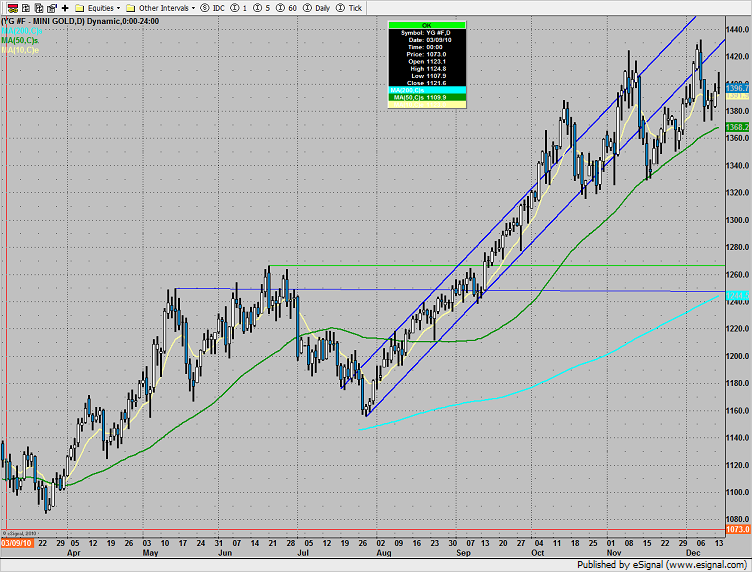

Gold: