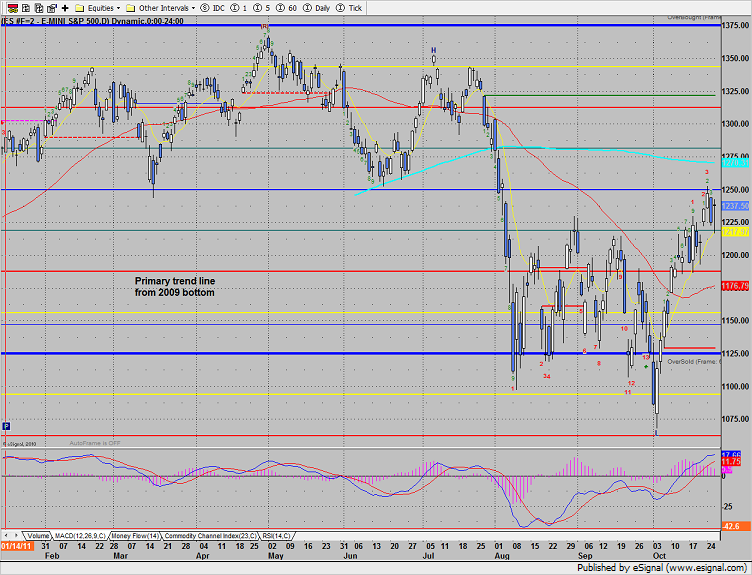

The ES bounced back 13 handles to settle higher on the day but below the key 1250 level. As expected the market is “working” the 1250 area. Expect more of this in the days to come.

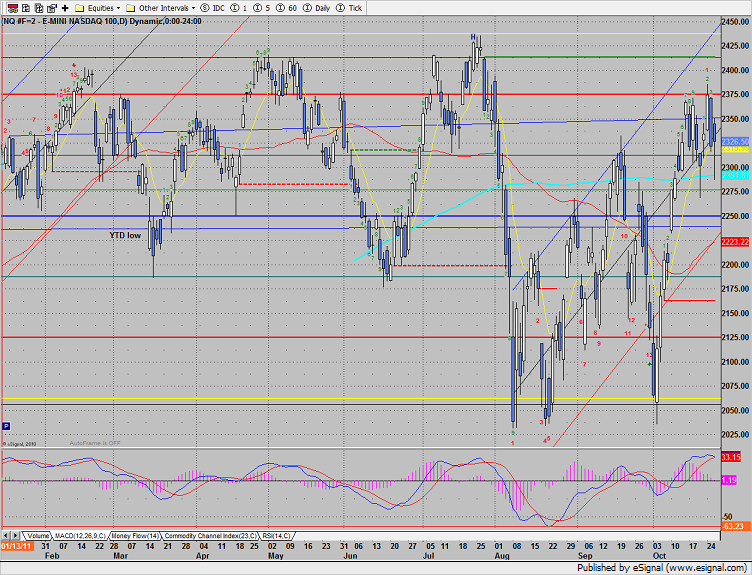

The NQ futures ended little changed with a small gain on the day. Price tested but held the 200dma. Keep a close eye on the MACD which is just beginning to look vulnerable. It takes time for the momentum indicators in the daily time frame to change character so let the chart develop and be open minded to both sides of the tape in the next few candles.

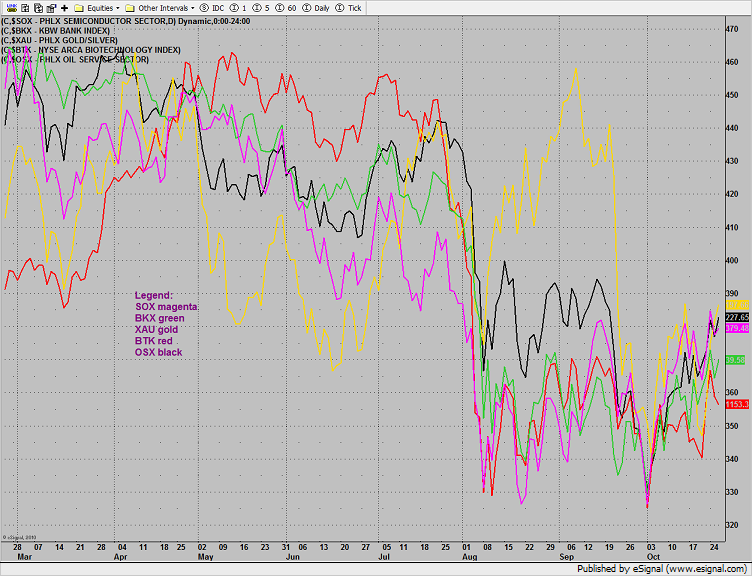

The multi sector daily chart shows relative strength developing in the XAU again.

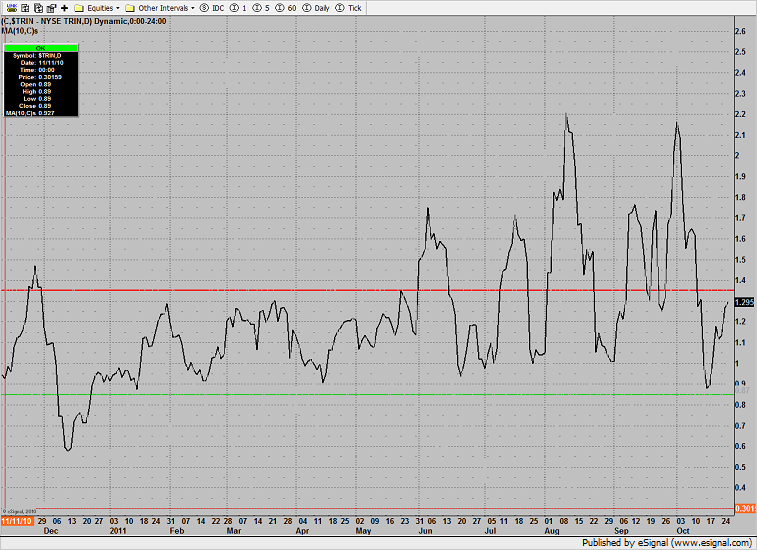

The 10-day NYSE Trin is getting closer to the 1.35 oversold threshold again.

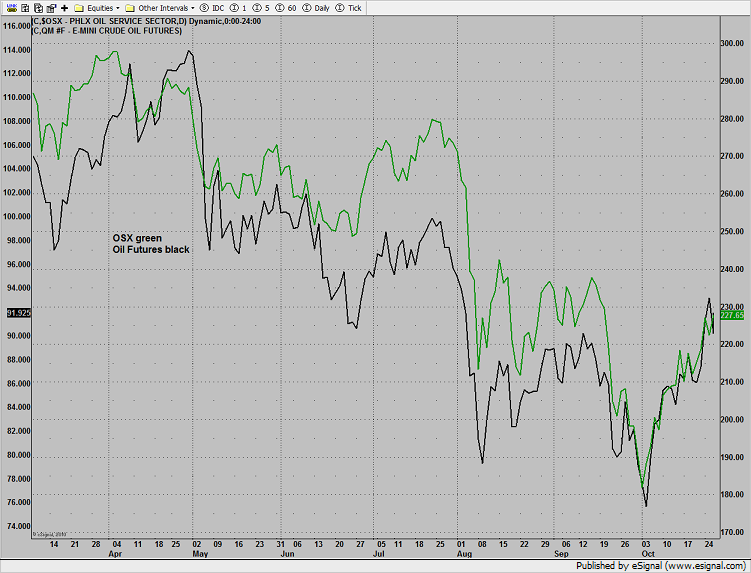

The OSX may be developing strength vs. the underlying oil futures which would be bullish for the sector. This is still a very immature divergence but one very worth monitoring.

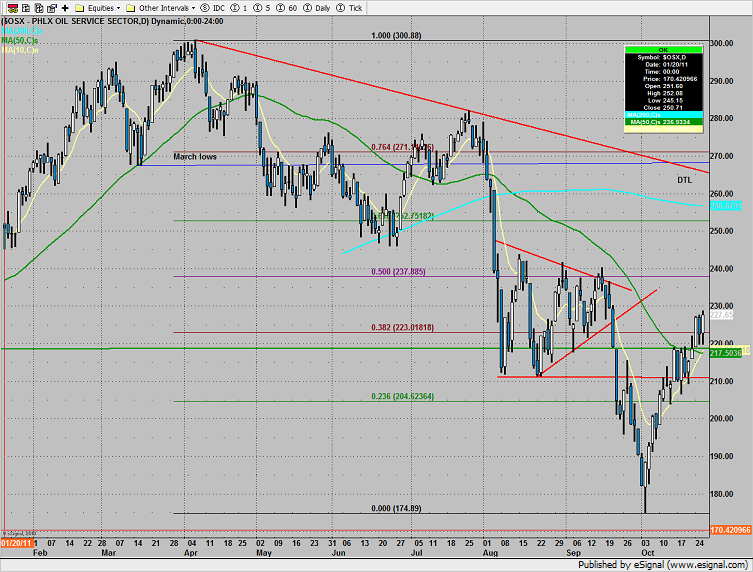

The OSX was the top gun on the day, closing at a new high on the move and setting up for a move towards the 50% fib retracement.

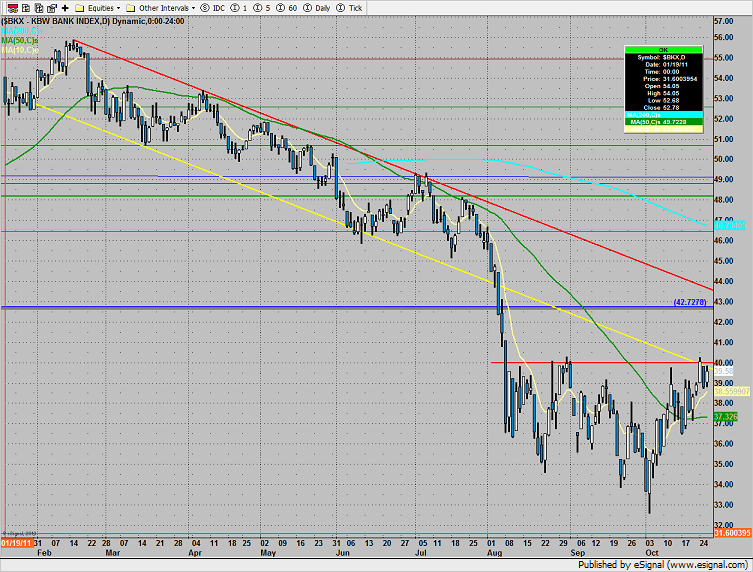

The BKX posted an inside day, still below the key 40 level.

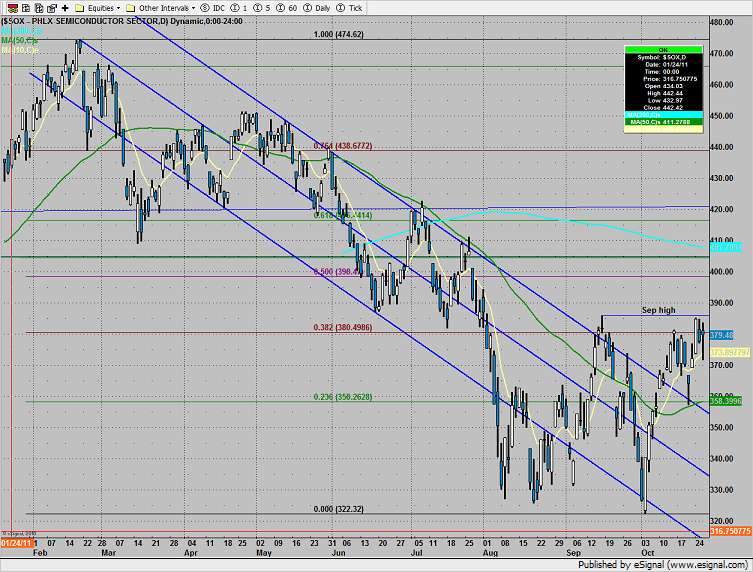

The SOX was little changed and remains below the September highs.

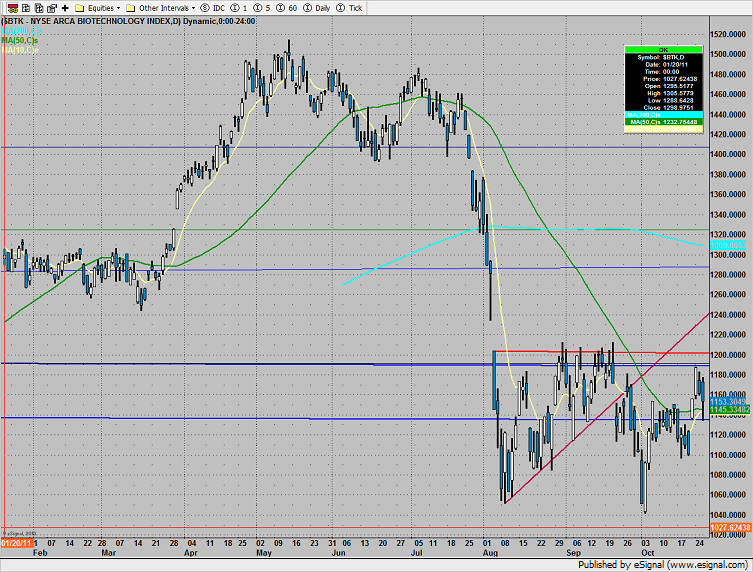

The BTK was the last laggard on the day. Price settled above both the 10 and 50 period moving averages and is still in the same range.

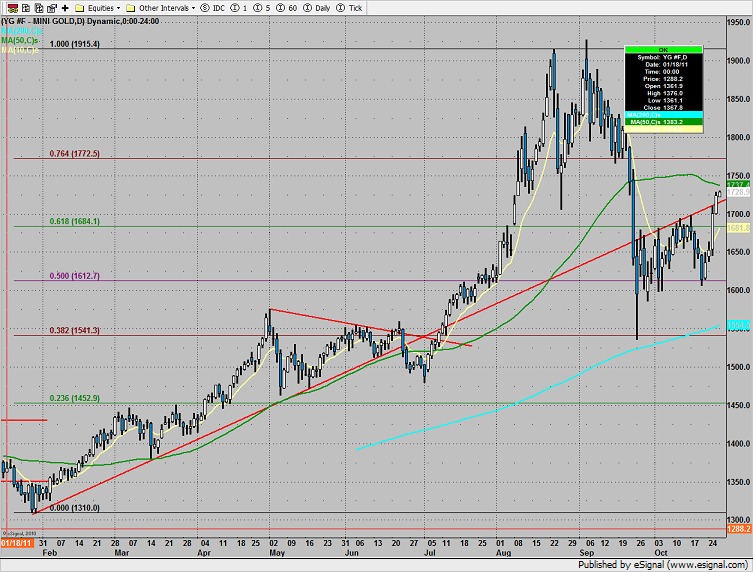

Gold broke bullishly broke back above the defining trend line. Keep a close eye on how price interacts with the 50dma just overhead.

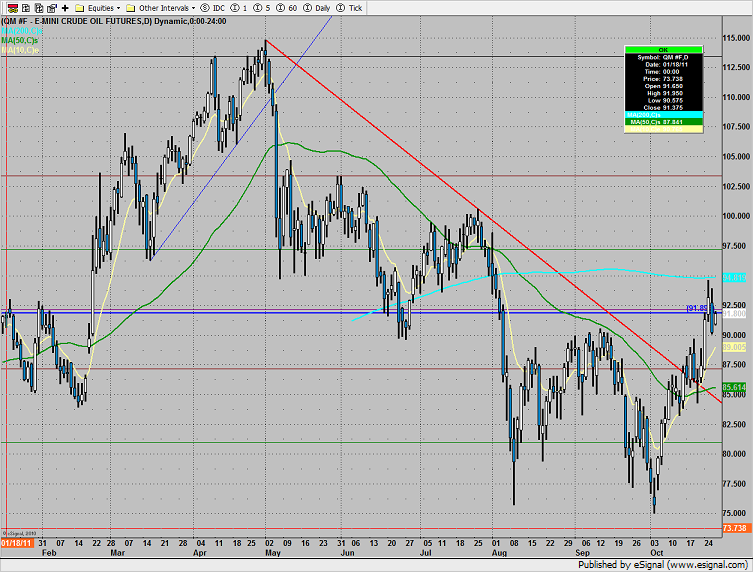

Oil was lower on the day but held above the 90 near term support level.