Overview

The markets gapped up, filled, went flat through lunch, then sold off a little in the afternoon, but not much was expected for options expiration in July in the summer. NASDAQ volume was 4 billion shares, which is light for the new normal but worse for what was options expiration (usually extra volume for no reason). Made money on futures, forex never triggered, no stock triggers, so a small green day as expected for options expiration in July.

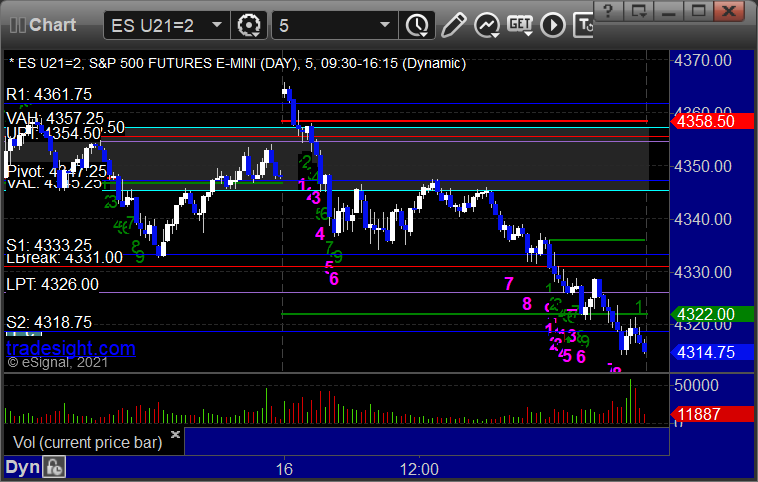

ES with Levels:

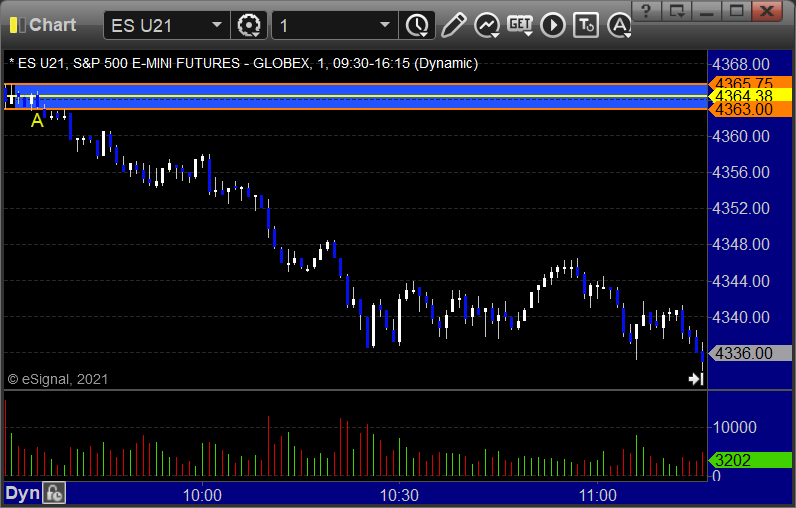

ES with Market Directional:

Futures:

ES Opening Range Play:

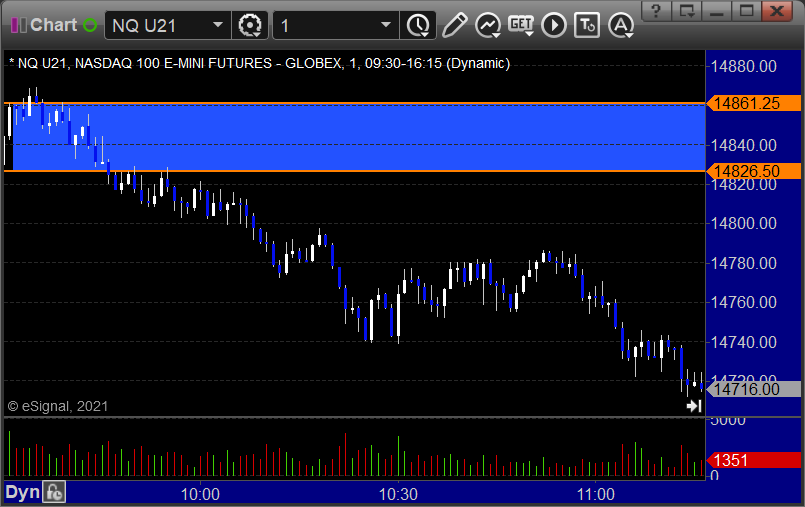

NQ Opening Range Play:

Results: +7.5 ticks

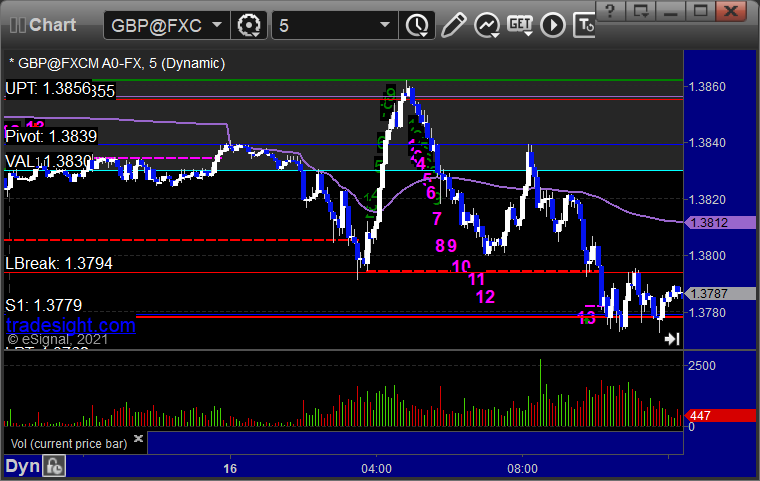

Forex:

GBPUSD:

Results: +0 pips

Stocks:

From the report, nothing triggered.

From the Twitter feed, nothing triggered.

That’s 0 triggers with market support, which is sort of normal for options expiration per Module 10. Great week though.