The SP posted a classic measuring day. These are often seen following a hard move where the bulls and bears “measure” or test each other. By the settlement, price was little changed from the opening and was higher by 4 handles. A break under Tuesday’s low will put the static trend line in play. Note that price never penetrated the upper half of yesterday’s candle which is a sign of weakness.

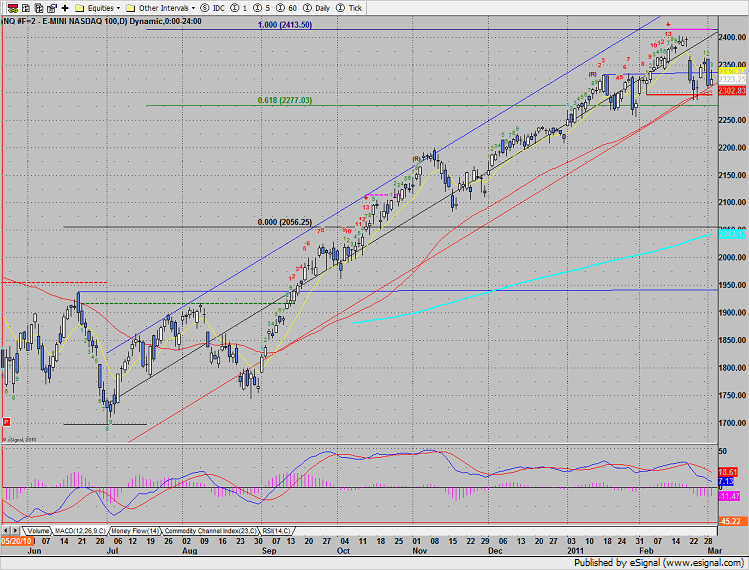

The Naz mirrored the trade in the SP. Keep a close eye on the lower regression channel (red). A loss of this area would be very bearish and imply further downside is in the cards.

Below is an analysis of the important intermarket pairs:

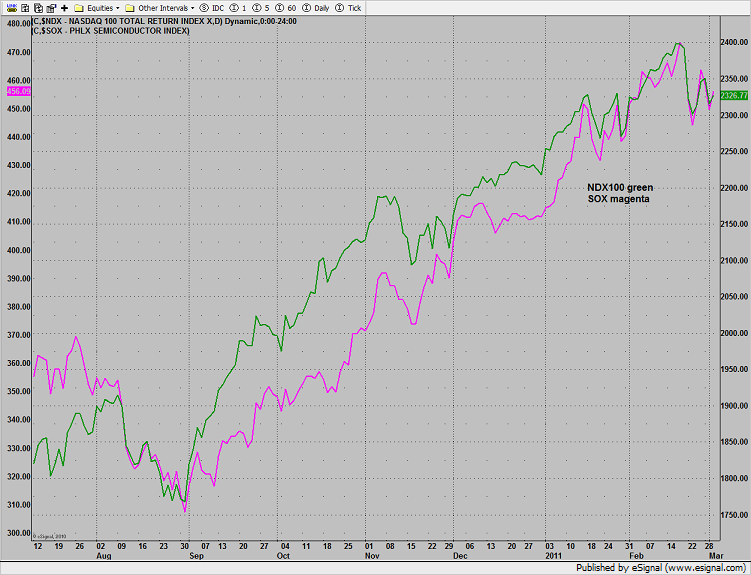

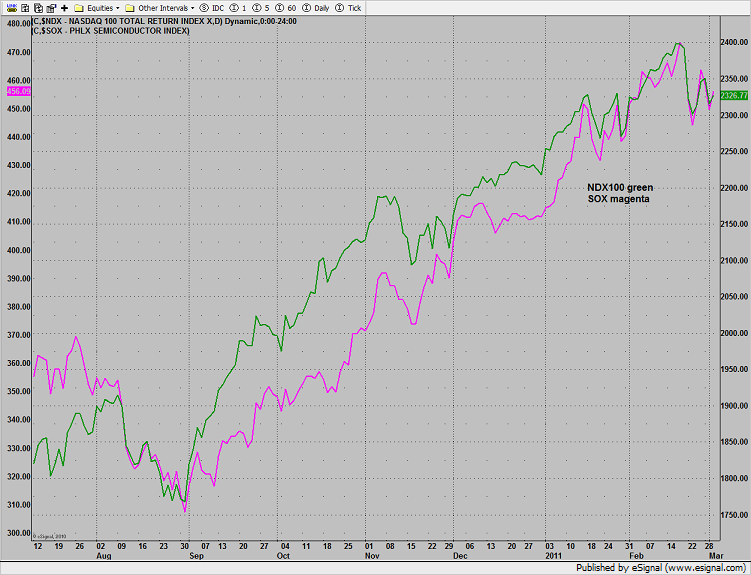

The NDX might be subtly underperforming the broader SPX which is always negative. The divergence is very small but should be monitored closely to see if the divergence widens out.

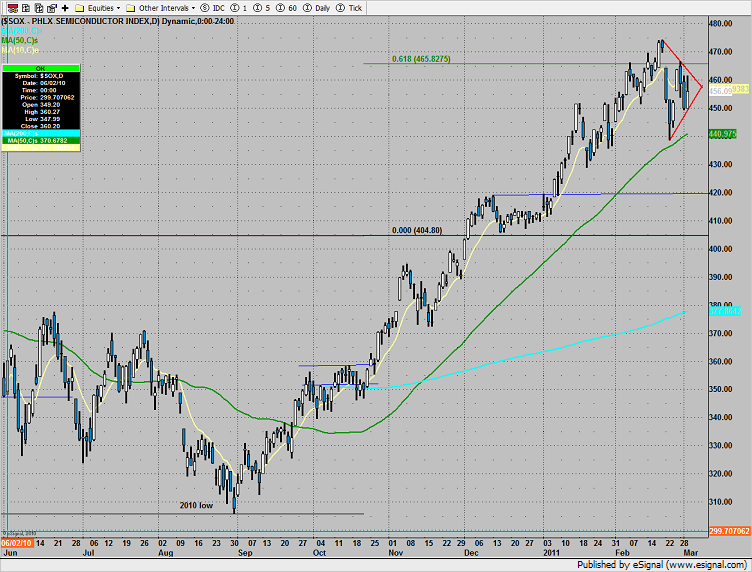

The SOX and the NDX are trading lockstep so there are no technical features at this moment.

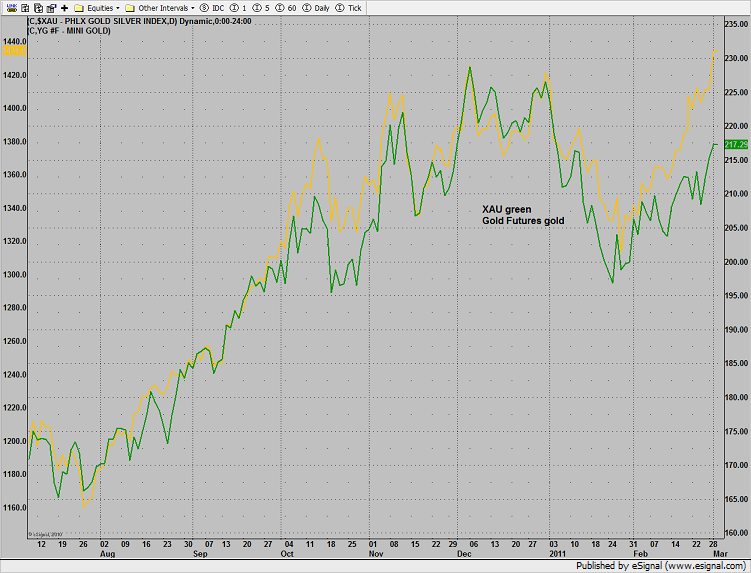

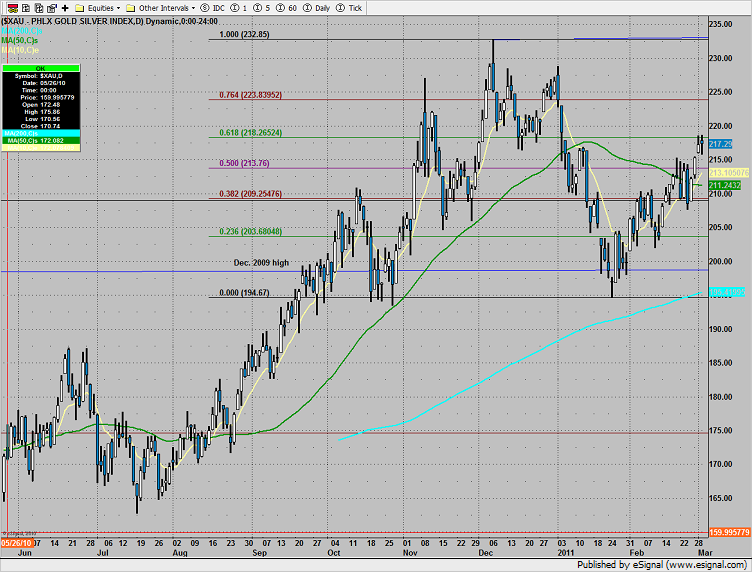

Gold mining stocks represented by the XAU continue to underperform gold futures. This is typically bearish for the gold futures. Almost all climatic runs in commodities end with this condition.

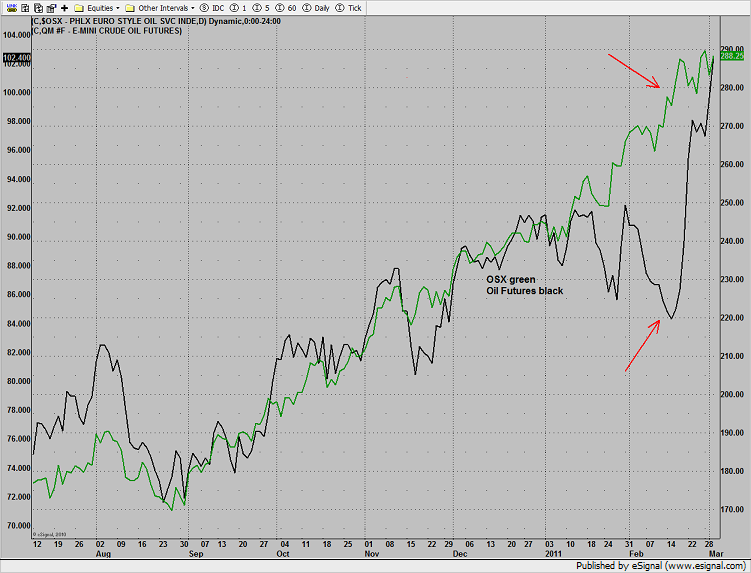

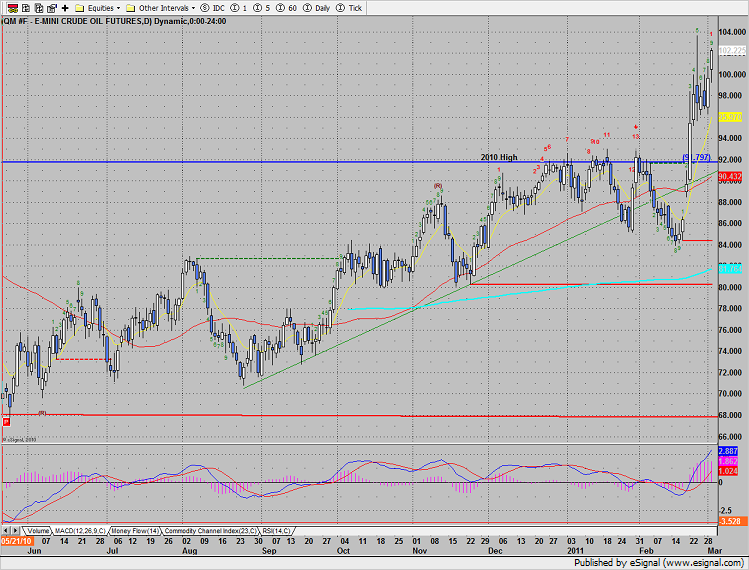

The huge spread between the OSX and oil futures has finally reconciled. As discussed in previous reports, when the underlying commodity is lagging the producing stocks (OSX in this case) expect a move in the futures to square the divergence. This was a tremendous opportunity for players who were ready to act. ETF subscribers are long the oil surrogate USO and profiting from the move.

The OSX was the top sector on the day. Note that the pattern is stretched and 9 days up in the Seeker setup phase.

The SOX was stronger than the broad market and also Naz. Price is trading out a triangle.

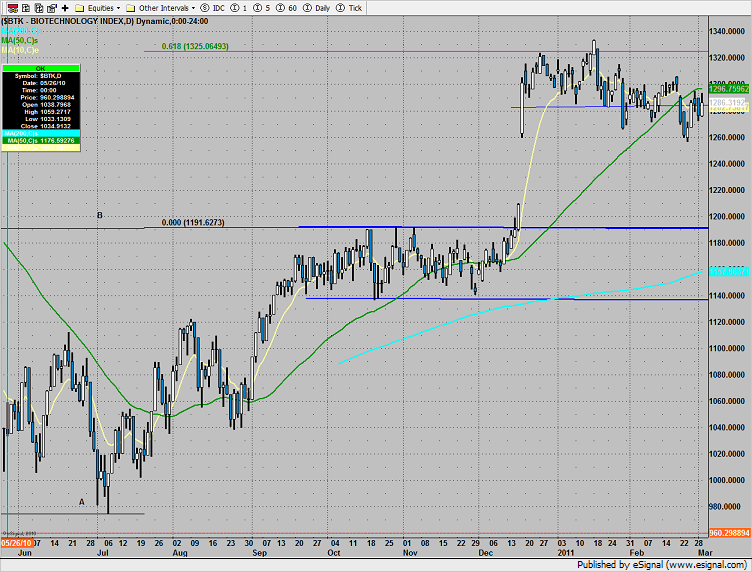

The BTK remains range bound:

The XAU is having trouble with the 62% fib. A close over this level puts the old high in play. Set an alarm for a break under 215 to imitate shorts which is very possible.

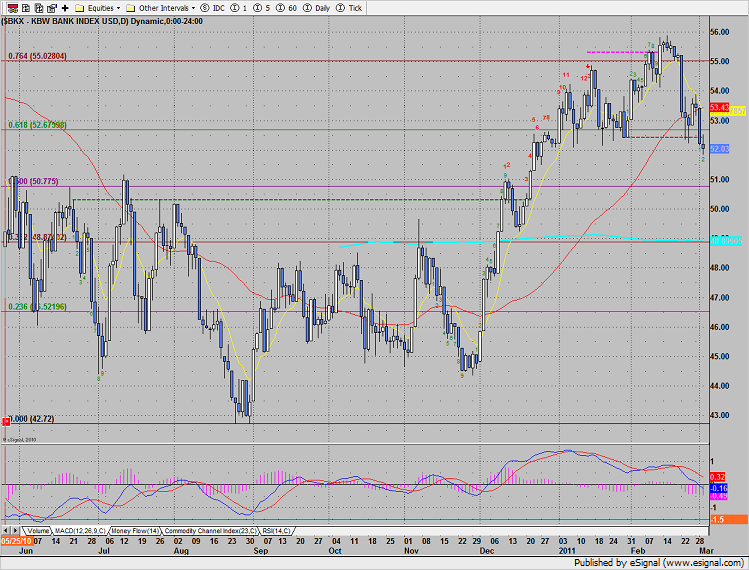

The BKX was weaker than the broad market and in so doing lost key support at the static trend line. Price is now below the 10ema and 50sma. To further burden the bulls, the MACD has crossed the zero line. The next downside target is the prior breakout at 51.

Oil made a new closing high for the move but is now 9 days up.

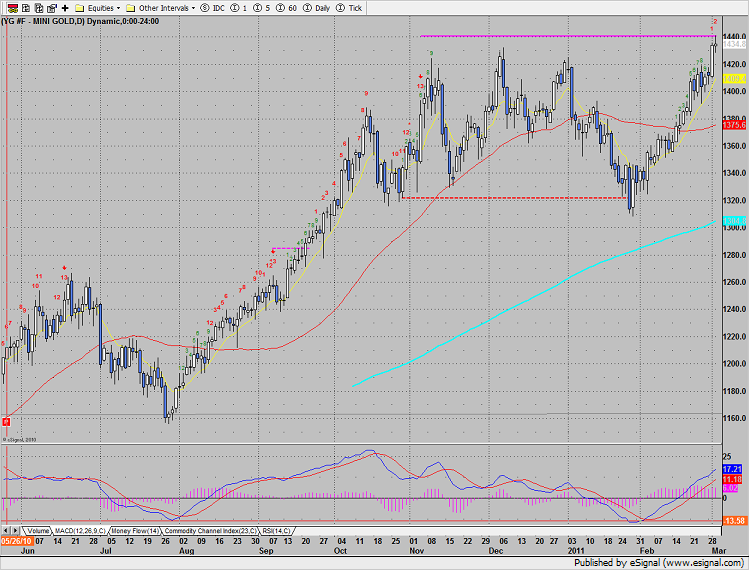

Gold tested the risk level (magenta) of the Seeker exhaustion and closed modestly higher on the day.