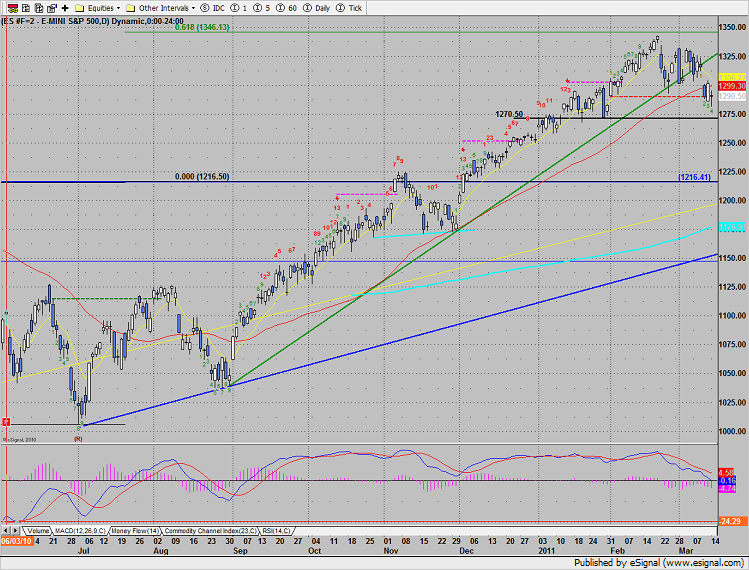

The SP expanded the range to the downside Monday, losing 10 on the day. Price has closed below the 10ema and 50dma’s. The last confirmation for the bears will be a loss of the zero line of the MACD. Note that while the action was negative, price settled above the open which qualifies as a camouflage buy signal. These short term signals were seen in the SP, NQ and YM futures. This implies that price will exceed the prior days high before the low is taken out. This is something help guide through the volatility and expiration week.

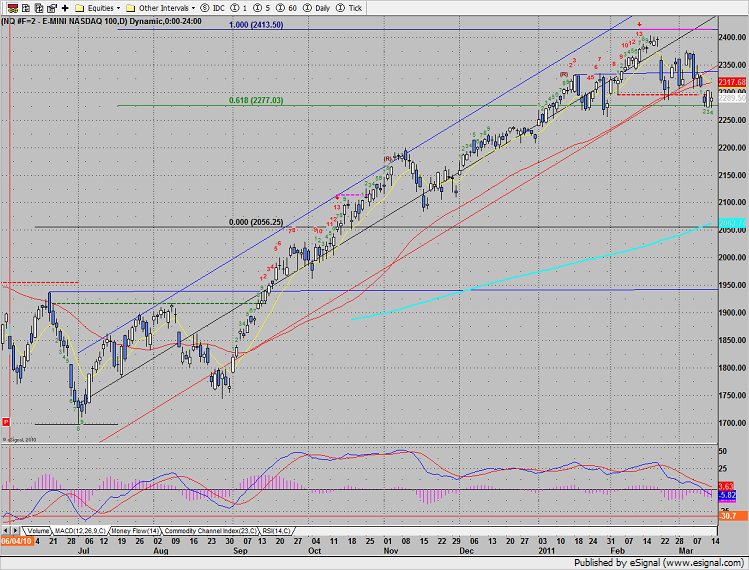

Naz remains boxed up within the recent three day range, so nothing new technically until this range is resolved on a closing basis.

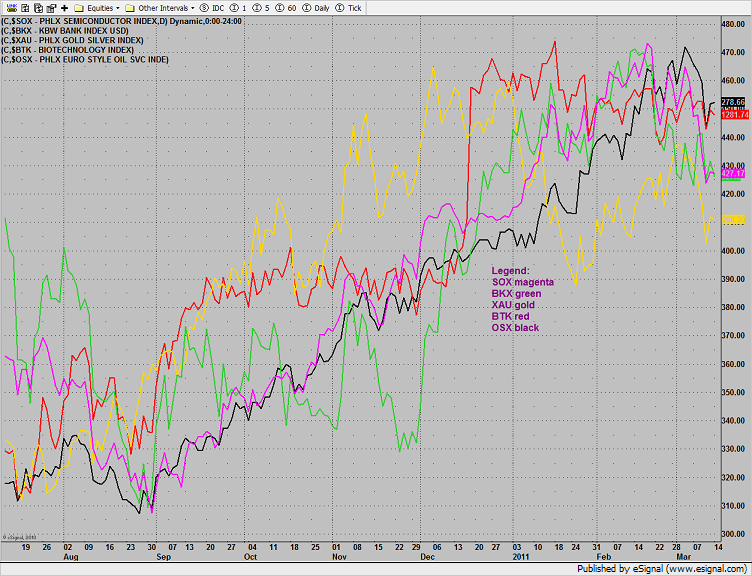

Multi sector daily chart:

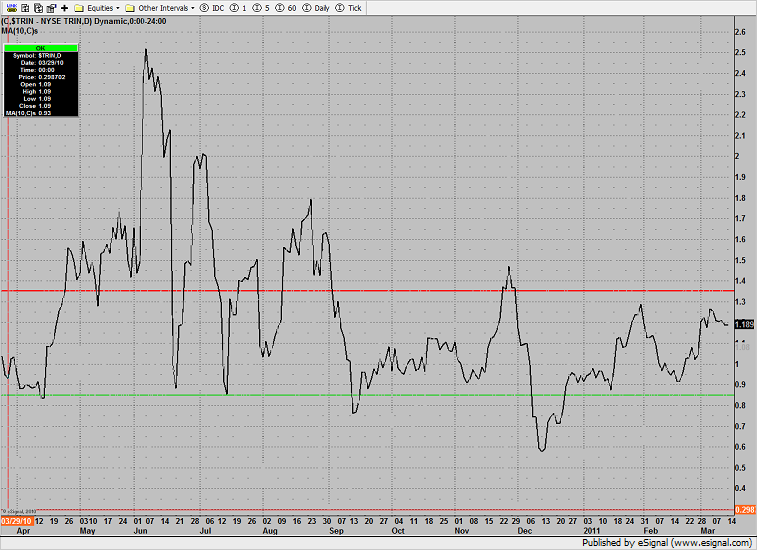

The 10-day Trin remains below the 1.35 oversold threshold which means that there is more downside potential until this level is crossed.

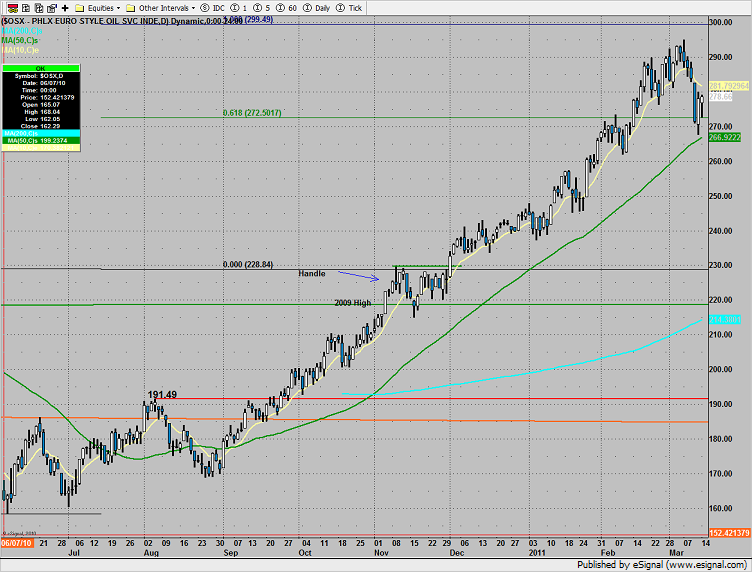

The OSX was top gun on the day, posted an inside day. The rising 50dma remains critical support.

The SOX was little changed after an attempt to fill the overhead gap. The bias remains down until the 10ema is reclaimed. Note the key support at the 420 level.

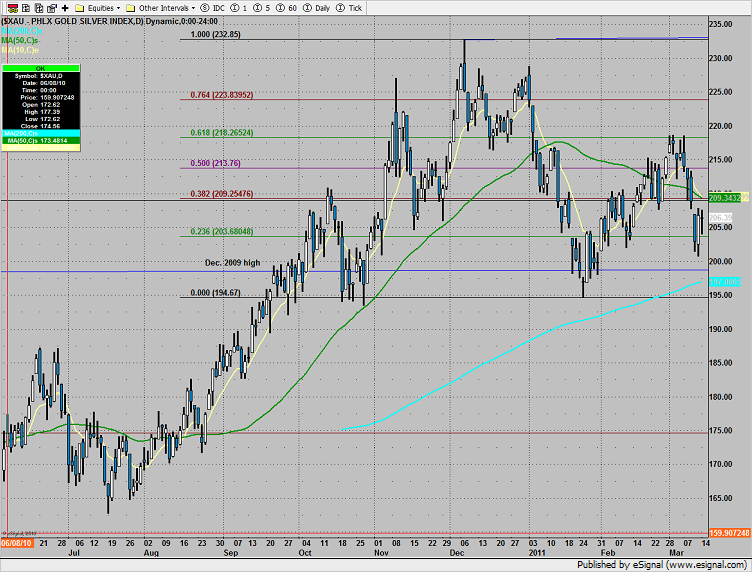

The XAU was down less than the broad market. There will likely be some volatile price action as the pattern pinches between the 50 and 200dmas.

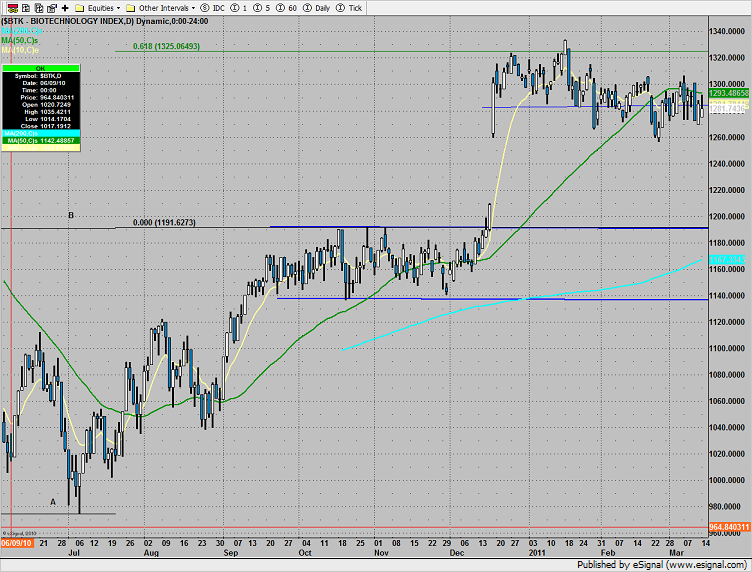

The BTK remains boxed up and often is a place for long money to hide late in market move.

The BKX was lower by 1% and has a downward bias.

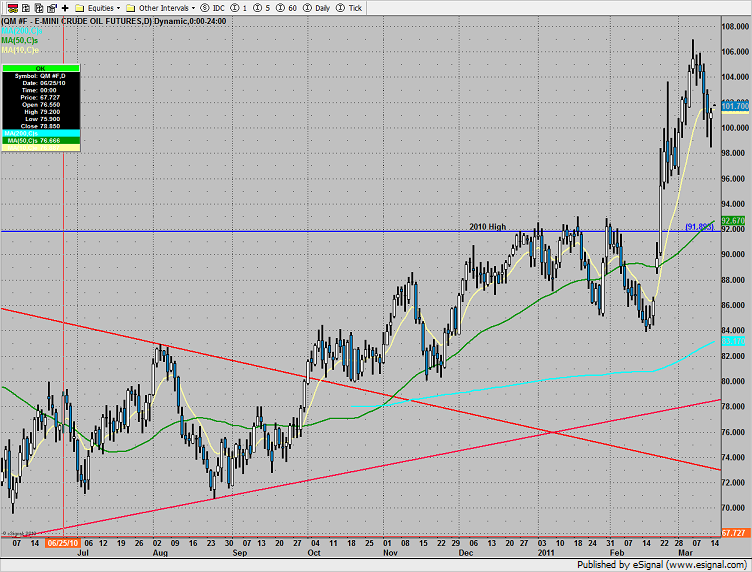

Oil spent a good deal of time below the $100 level early in the day, but ultimately settled above it leaving two very long tails (read buying) below the century mark.

Gold settled just below the 1431 breakout level.