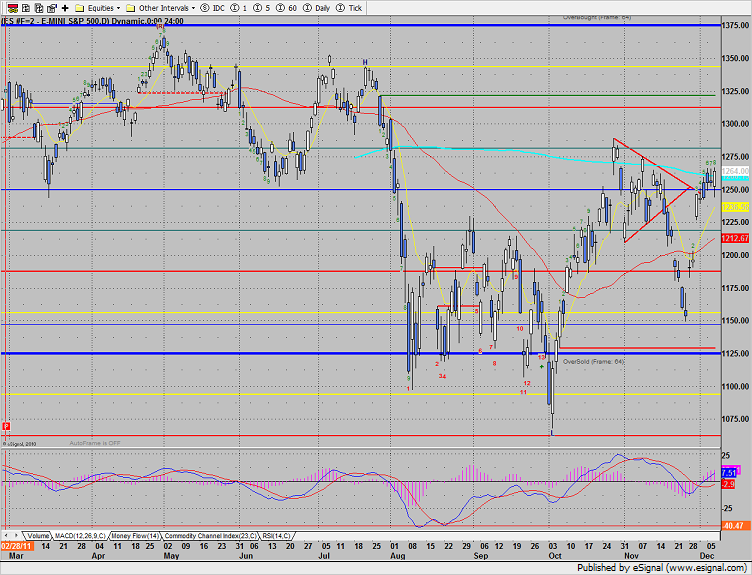

The ES settled up 9 handles on the day, close to the high of the recent range. Note that the pattern is now 8 days up. This is the first settlement above the 200dma on this impulse.

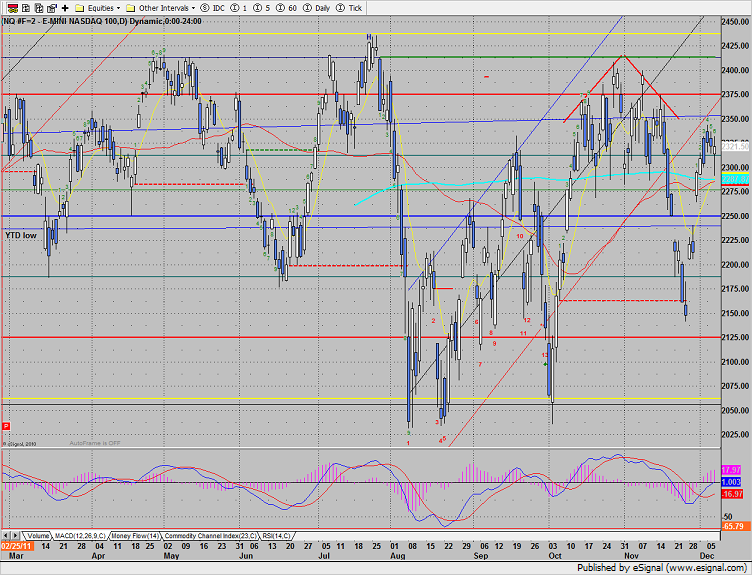

The NQ futures were not as strong as the financially influenced ES. Price was unchanged on the day and the close was below the intraday high of the move.

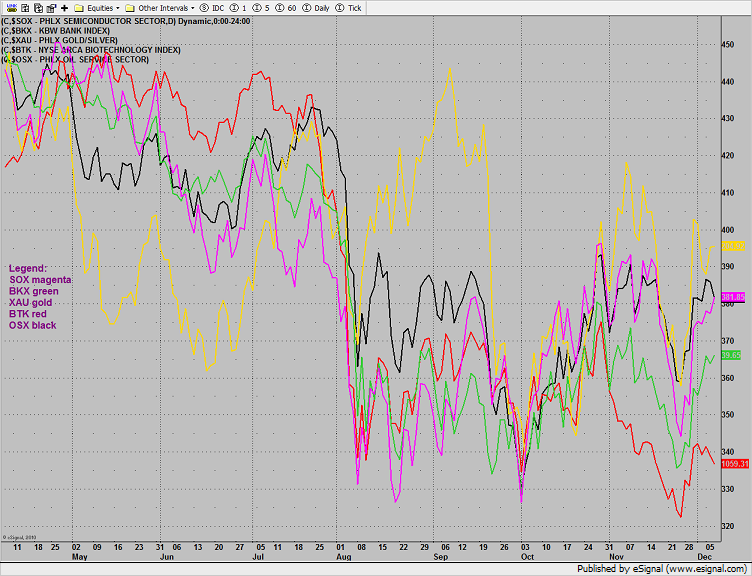

Multi sector daily chart:

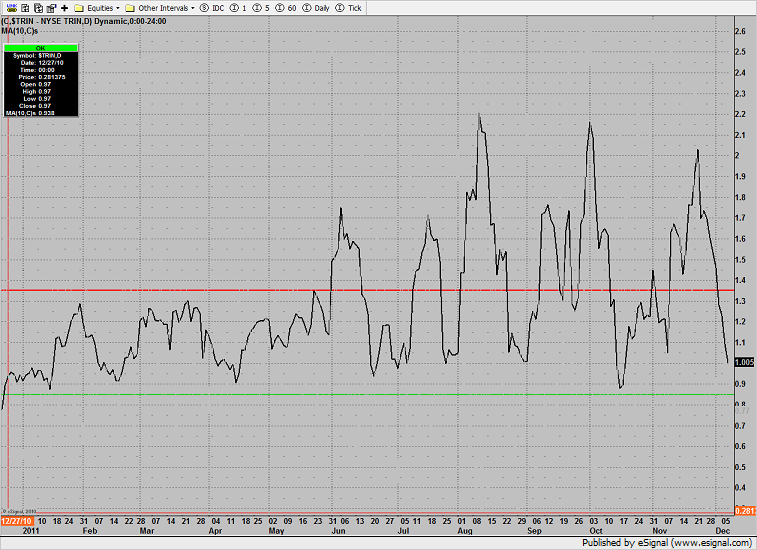

The 10-day Trin remains neutral:

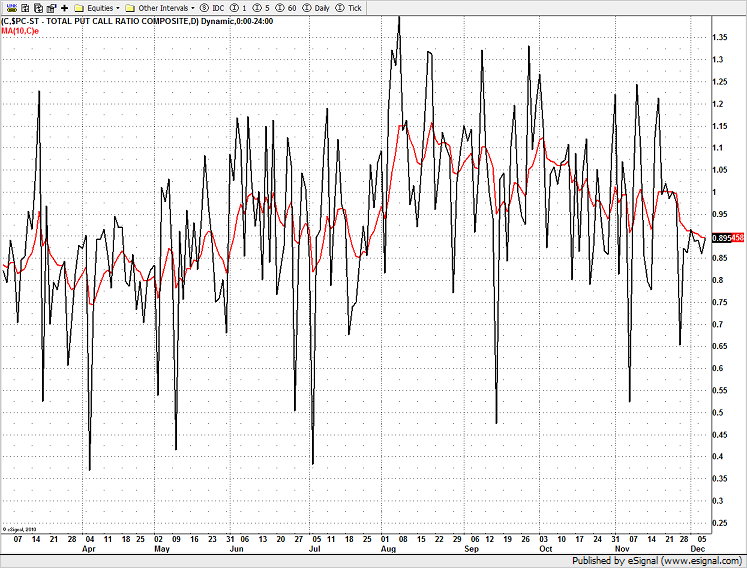

The put/call ratio has yet to record a climatic spike to the downside:

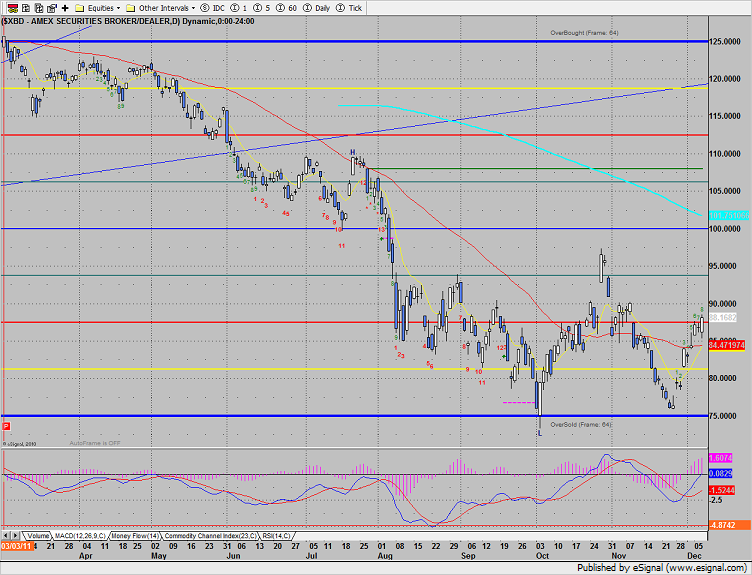

The broker-dealer index was the top gun on the day and is now 8 days up.

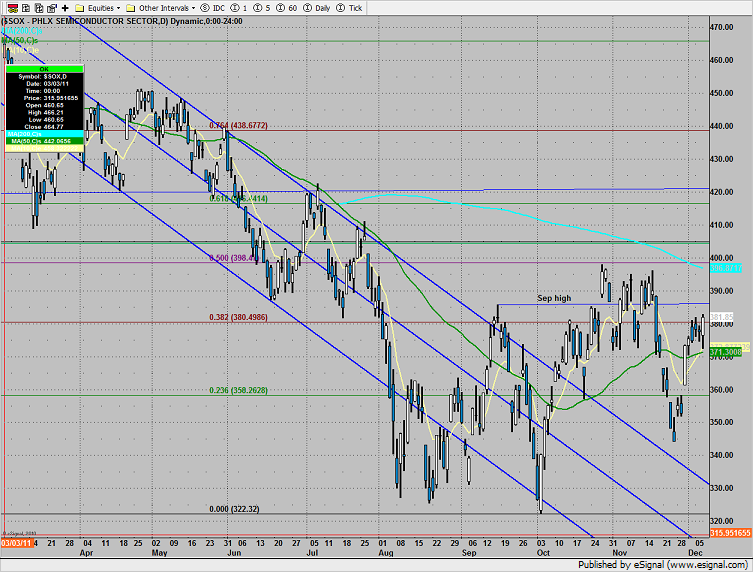

The SOX outperformed the Naz and closed at a new high on the move. The next challenge is the September high.

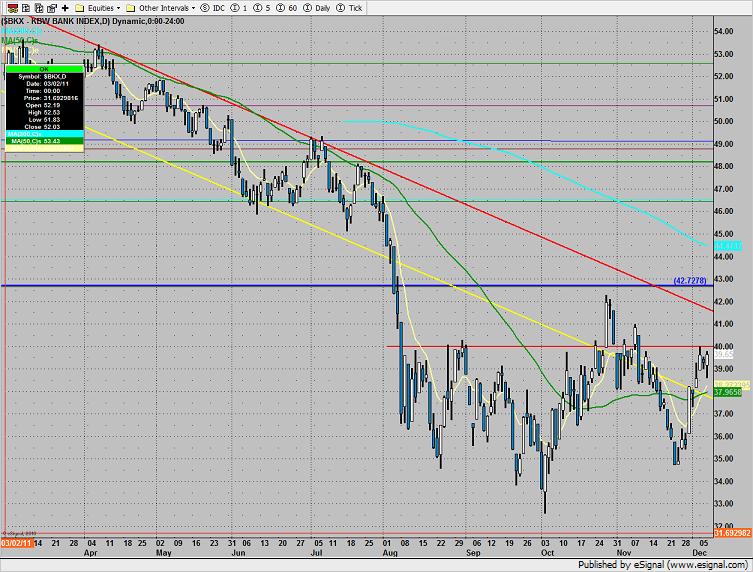

The BKX was up 1% and is just below prior resistance at the 40 level.

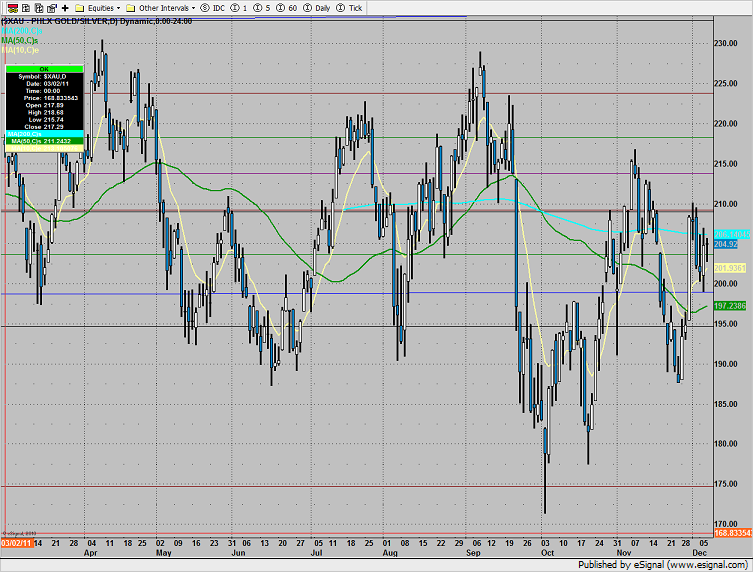

The XAU did nothing and posted a narrow range inside day.

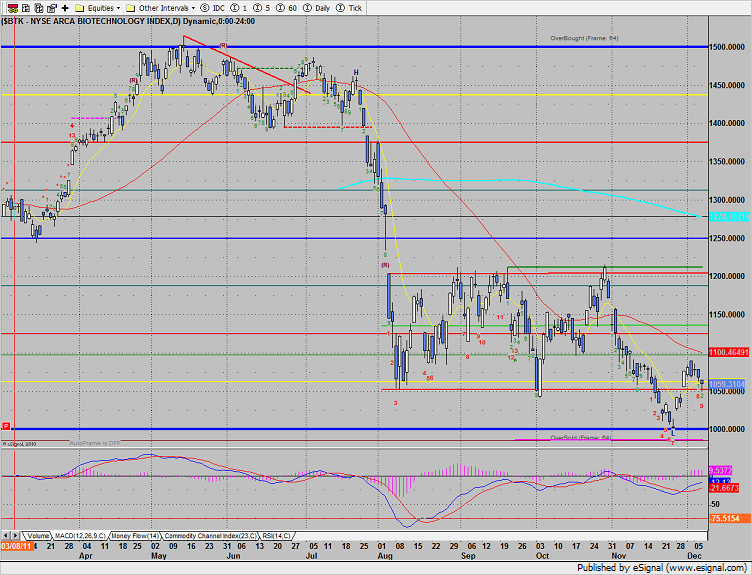

The BTK continues to hang on by a thread.

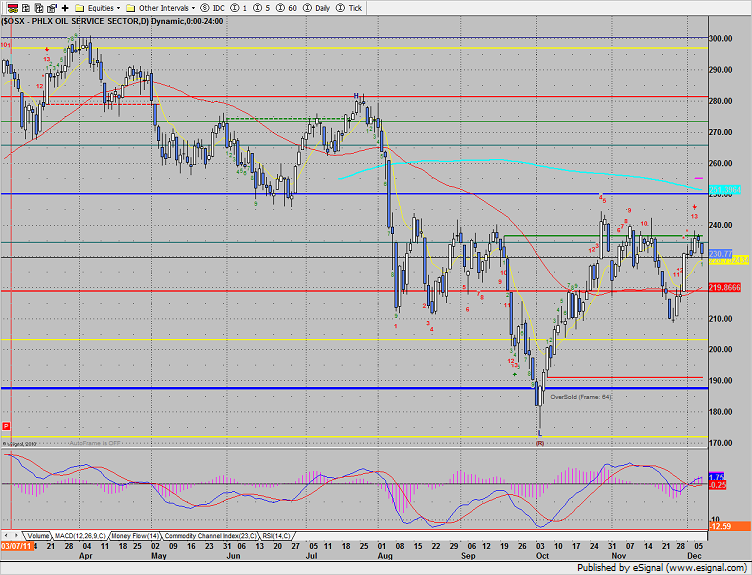

The OSX was the last laggard on the day, using the 10ema for intraday support. Note that the Seeker has an active 13 sell signal in place.

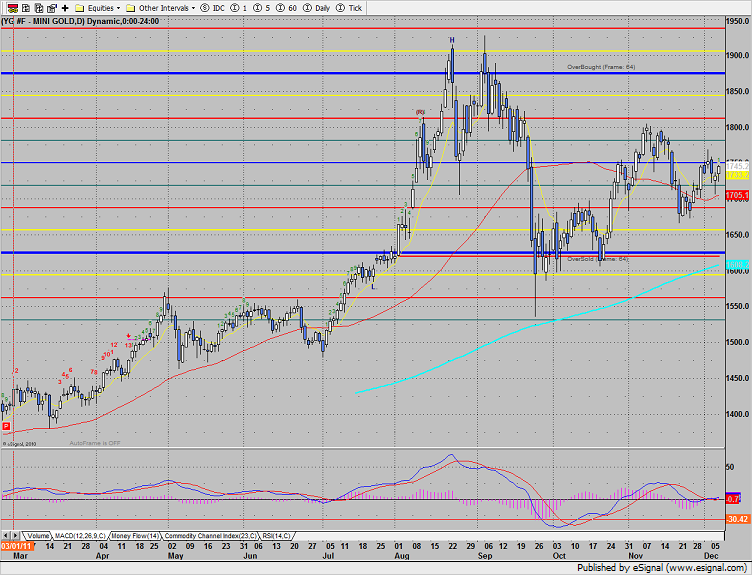

Gold was higher by 14 on the day.

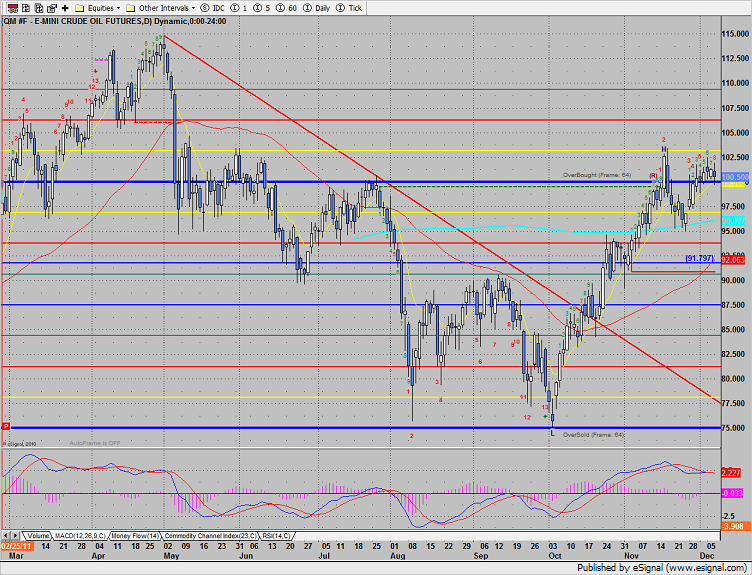

Oil was weaker than the market, just holding above 100.