The ES closed at a new high on the move adding 13 on the day. Price exceeded the +2/8 level and forced a bullish frame shift. The subtle level to keep in mind is the static trend line just above the 6/8 level.

The NQ futures broke to a new high and high close on the move taking on 31 handles. One interesting technical feature is that today’s price filled the open gap from late July. The next bull target will be the 7/8 level at 2437.50.

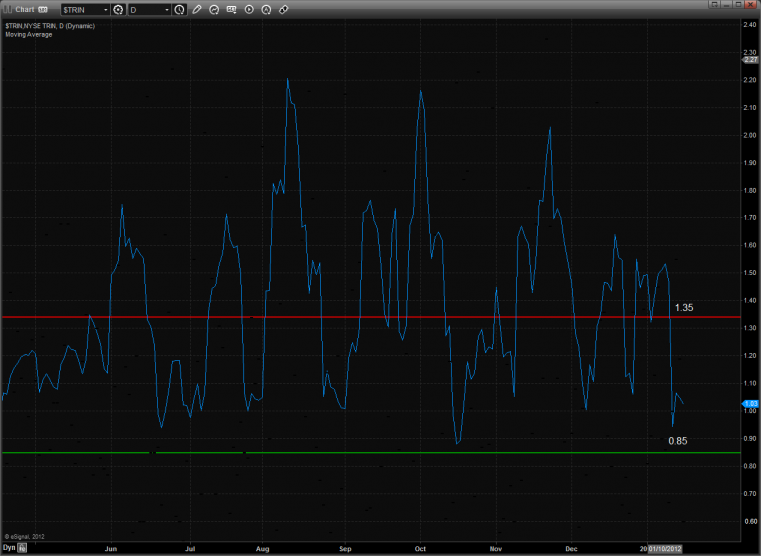

The 10-day Trin has yet to tag the overbought threshold so there still could be more gas in the tank for higher price.

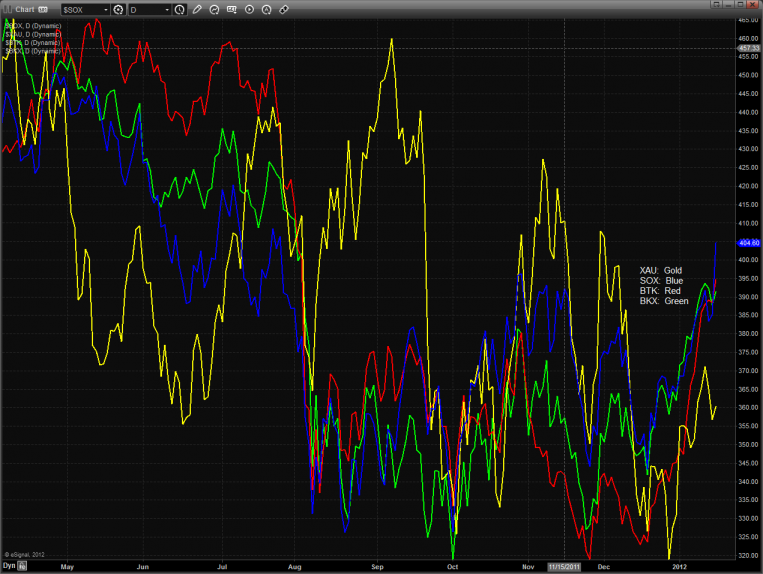

Multi sector daily chart:

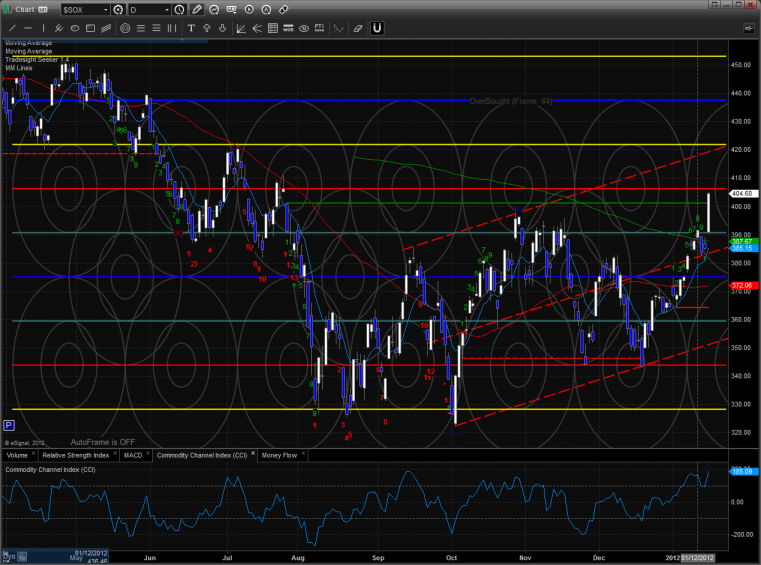

The SOX was by far the strongest sector on the day up a full 5%. Piece topped the 200dma and active static trend line. A bullish trend channel has been added to the chart.

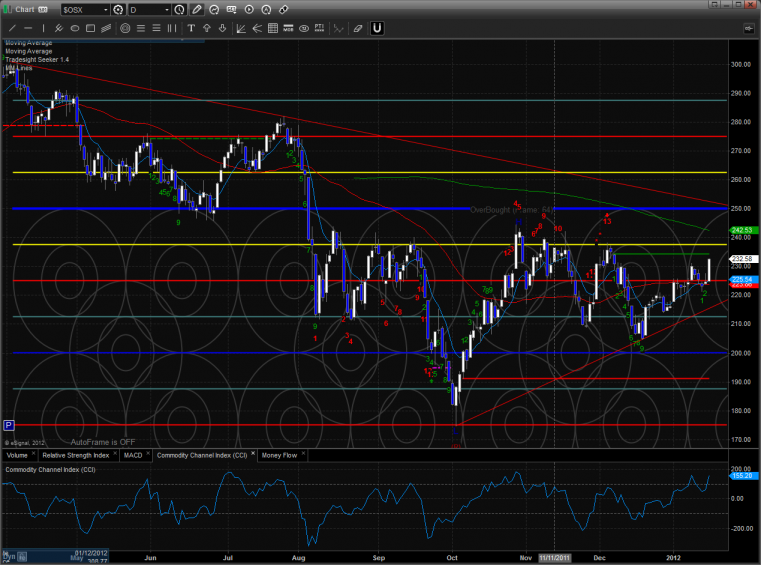

The OSX was also much stronger than the broad market. Keep a close eye on the static trend line just overhead.

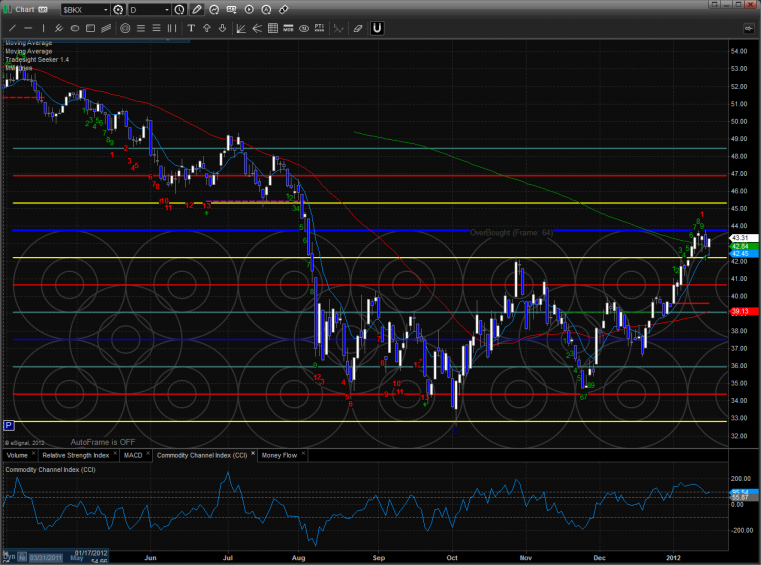

The BTK just crossed above the 8/8 level and might need a recharge. Also note that the chart now has a mid-range trend termination candle in place.

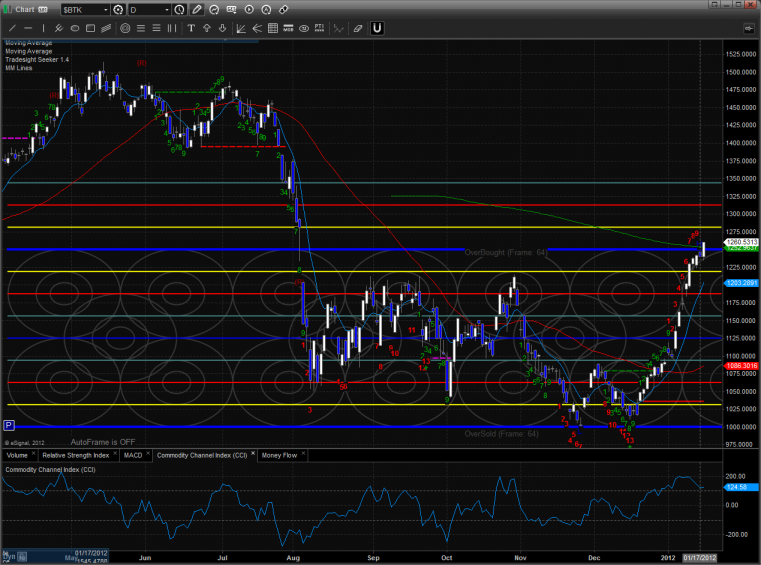

The BKX posted a less than stellar inside day. The 8/8 level is still weighing on the advance of the pattern. Price is now wedged between the 200dma and the Murrey level which should produce a powerful move once it’s resolved.

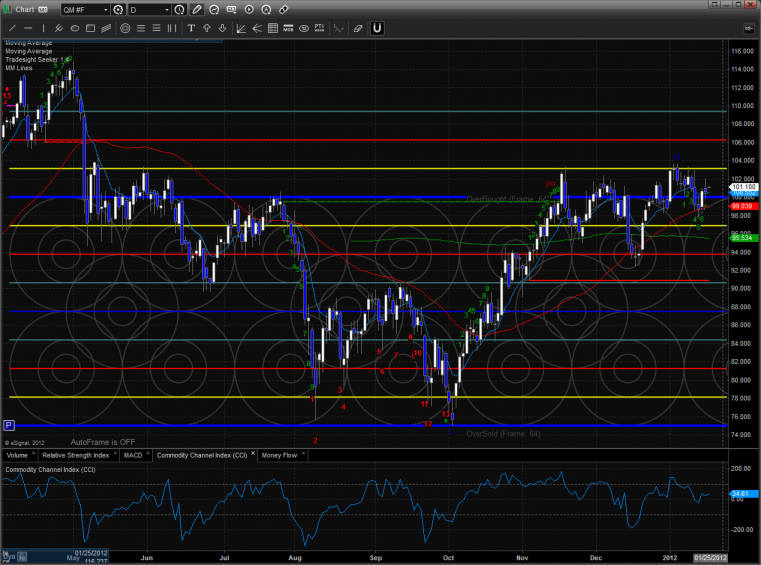

Oil:

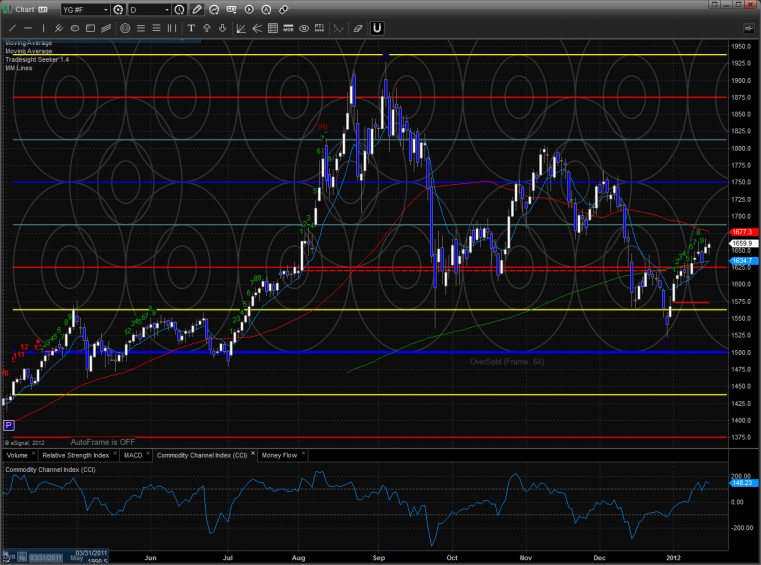

Gold: