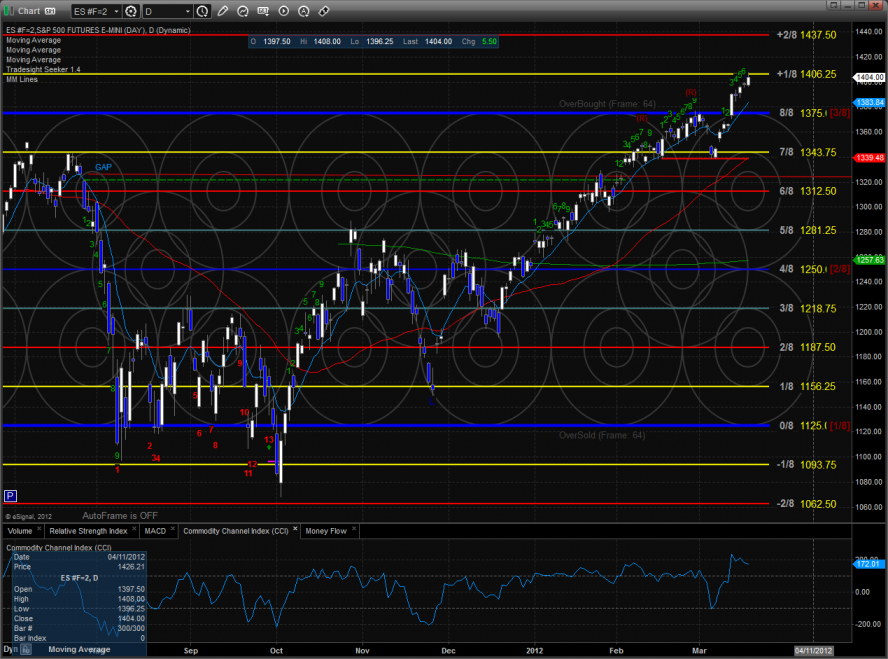

The ES broke to new high ground on the move closing deeper into the overbought Murrey math territory. Gaining 5 handles on the day the ES closed just below the 1406 level.

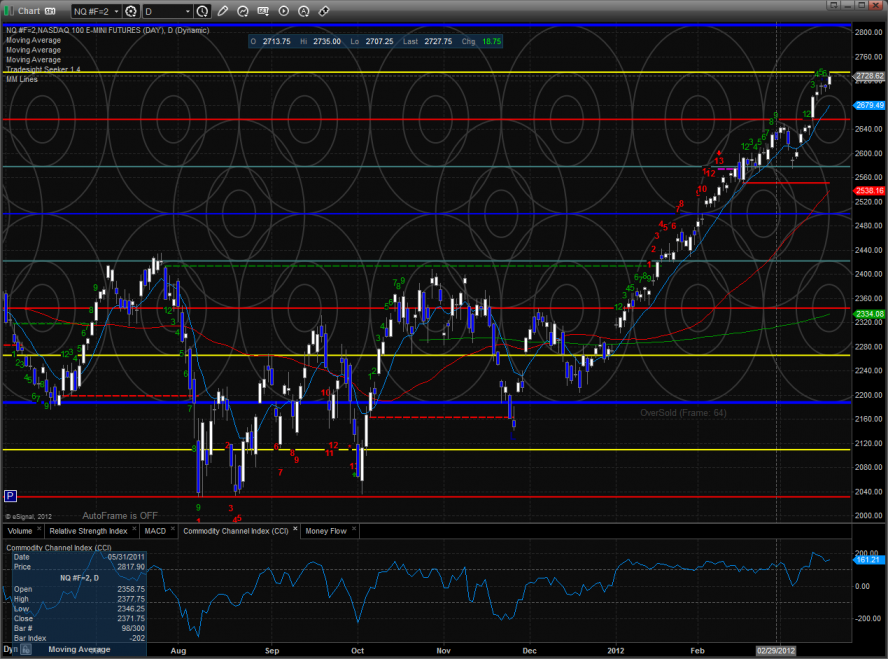

The NQ futures also made a new high adding 18 to the move. Since the Murrey math box has already frame shifted, it is not in overbought territory but very extended without any real corrective move to date.

The daily Trin closed at 1.39 which was very helpful to the bulls and kept the 10-day average from recording an overbought reading below 0.85.

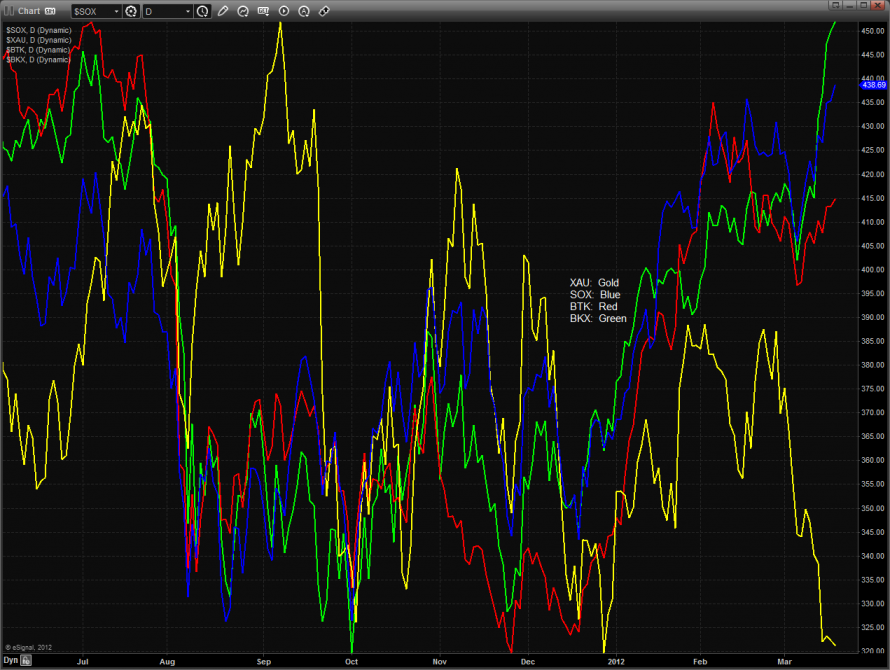

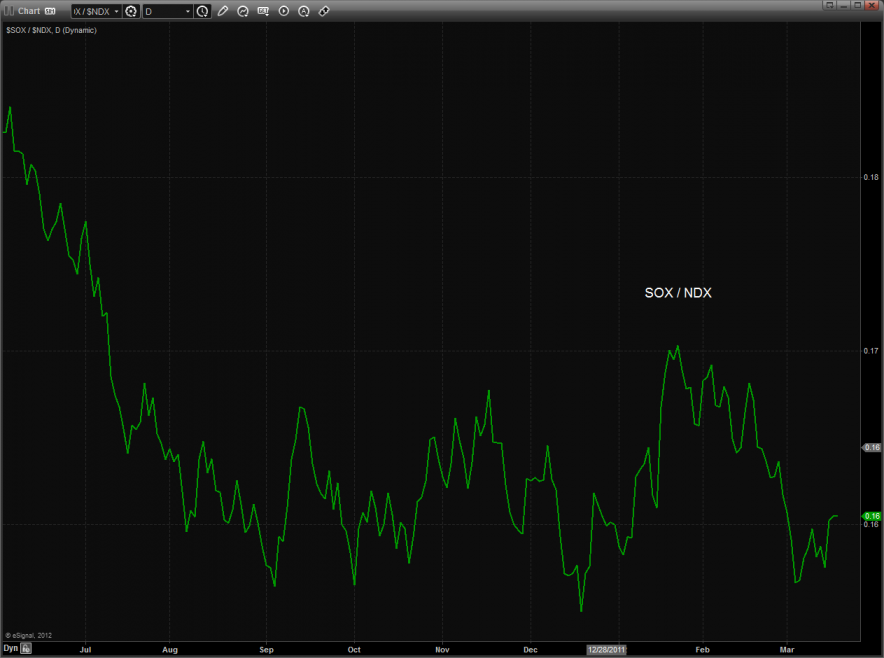

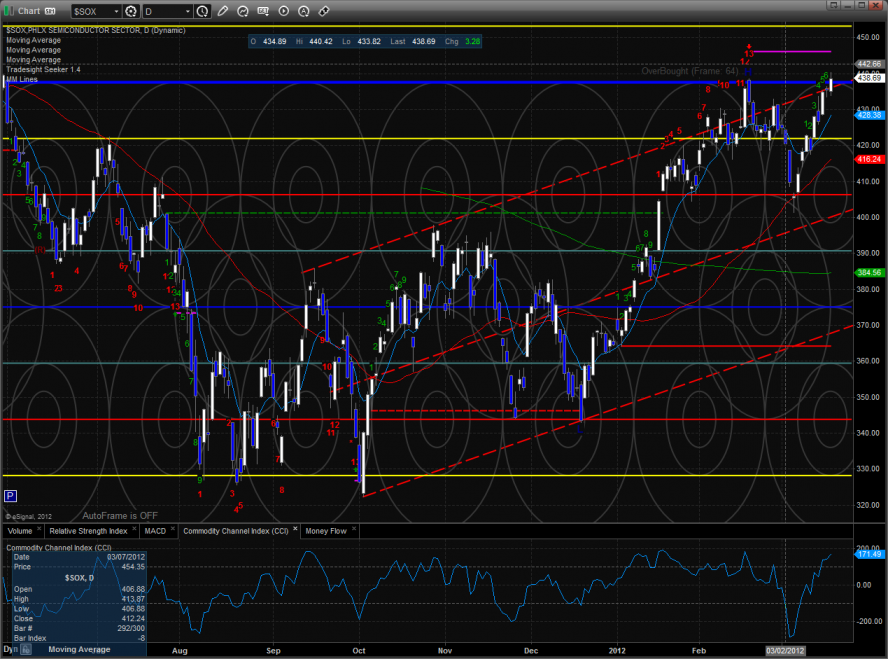

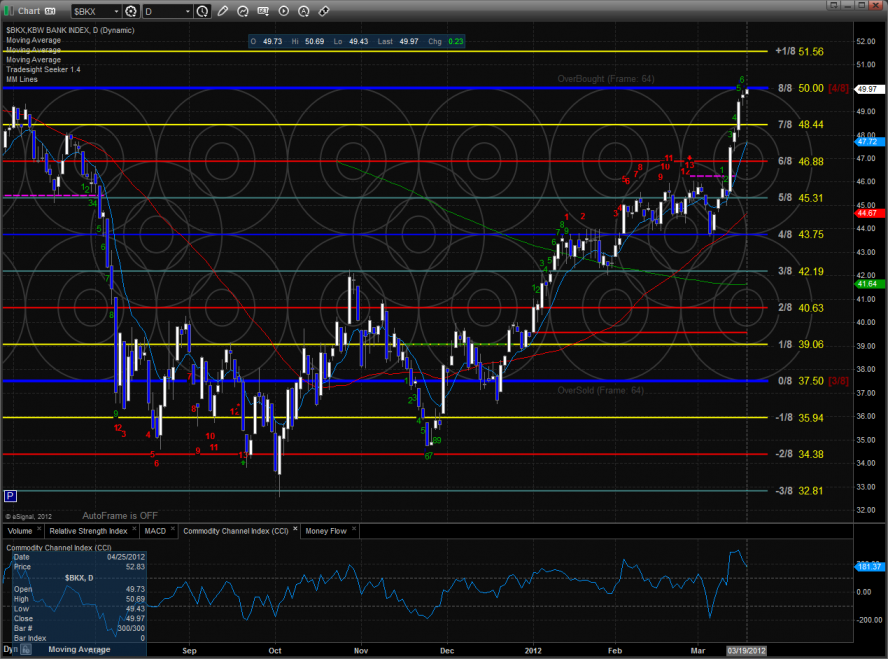

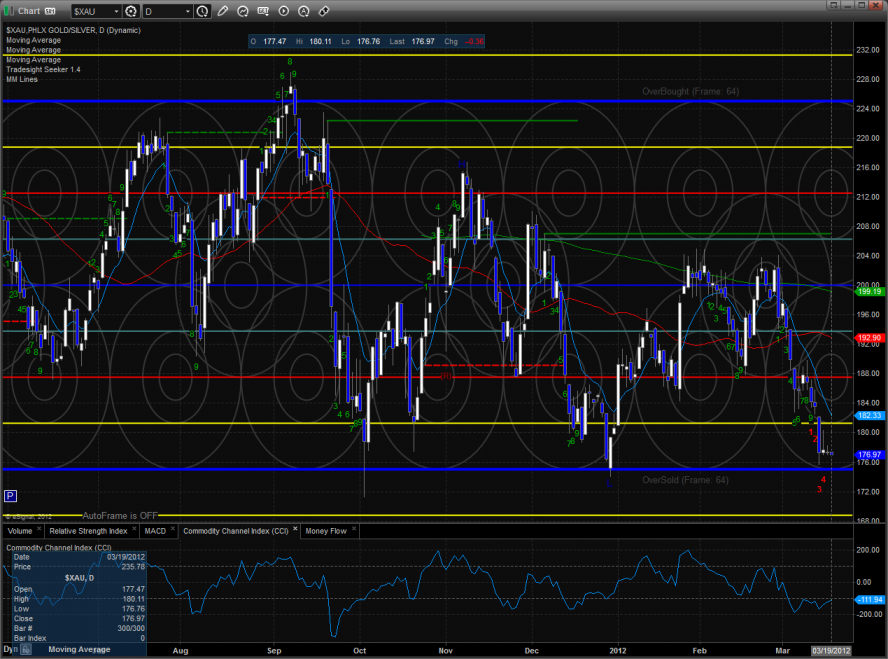

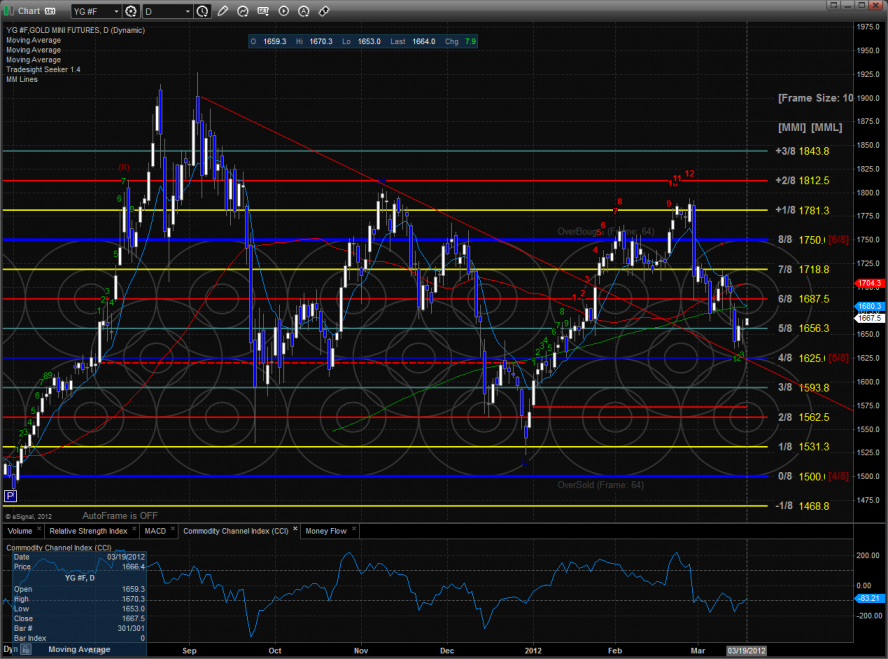

The multi sector daily chart is screaming, “Rotation”. The exit from last year’s safety play of gold stocks is clearly rotating into other more economically sensitive sectors like the BKX and SOX.

The SOX/NDX cross is bullishly bouncing off critical support:

The BKX is showing good leadership over the broad market and is beginning to get a bit extended.

The NDX/SOX is very close to a key breakout:

Possibly the chart to watch for long-term investors right now is the Dow/Gold ratio. The ratio in the weekly time frame is above the midpoint and a break and follow through above the upper channel would be very bullish for equities.

The XBD finally broke above the active static trend line Price is now 7 day up and a 9-13-9 completed Seeker run will likely be a real profit taking catalyst.

The SOX is back into the 8/8 level and still has an active Seeker sell signal.

The BKX made a new high and settled right at the 8/8 level. Note the topping tail that was left on the chart.

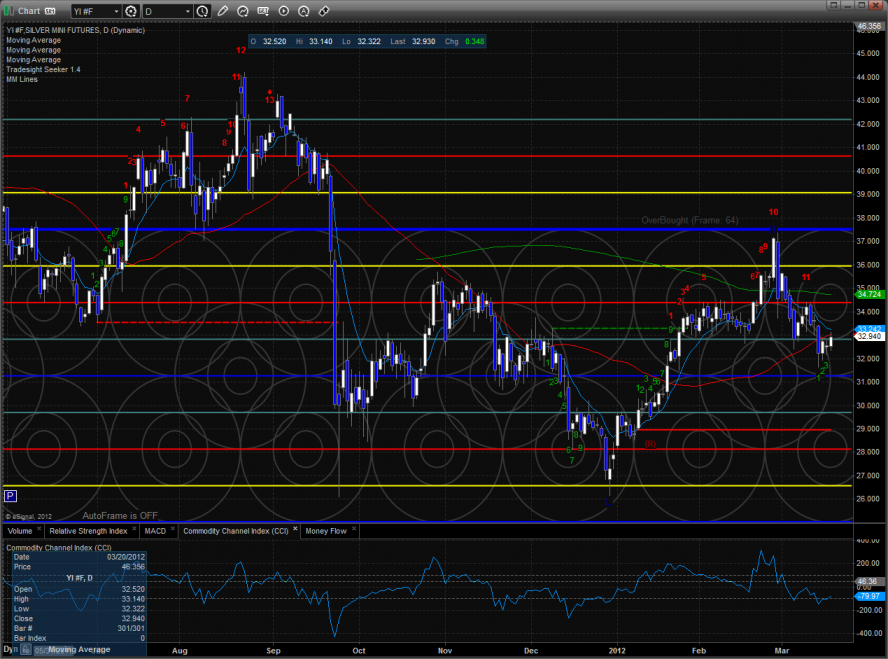

The XAU was a source of funds but is still holding above the 0/8 level.

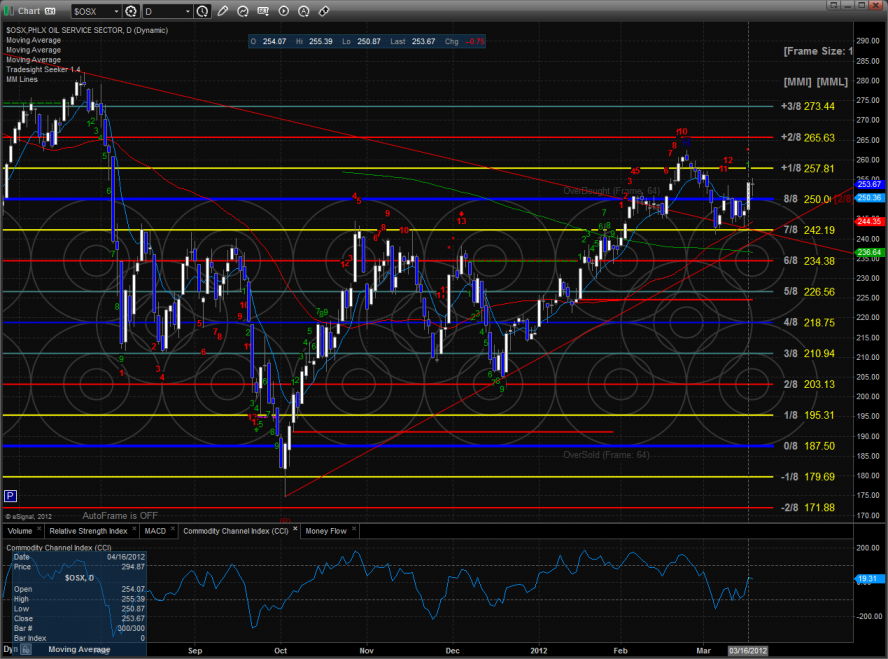

The OSX was the last laggard on the day trading inside Friday’s candle. Note that on the chart the Seeker is hunting for an exhaustion signal with will print when price closes above the candle labeled with the red 8.

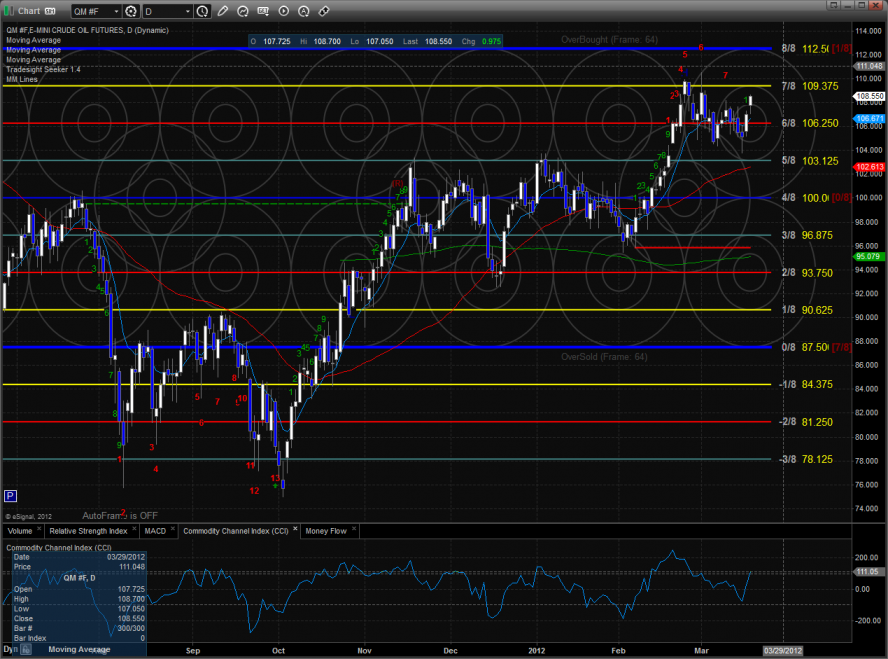

Oil:

Gold:

Silver: