Futures Calls Recap for 7/10/14

The markets gapped down big and eventually started heading up. The NQ had a great Value Area play, and the ES gave us another winner as well. We barely got stopped out of the second half of that by a tick before it went much further. See ES and NQ below.

Net ticks: +6 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1953.25, hit first target for 6 ticks, raised stop twice and it stopped at 1954.75 at B by a tick before moving higher:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

A great Value Area setup triggered at A and crossed the Value Area to the gap fill at B:

Forex Calls Recap for 7/10/14

A trigger finally (and a winner) on the GBPUSD. See that section below. As usual, no follow through, so just a first target winner.

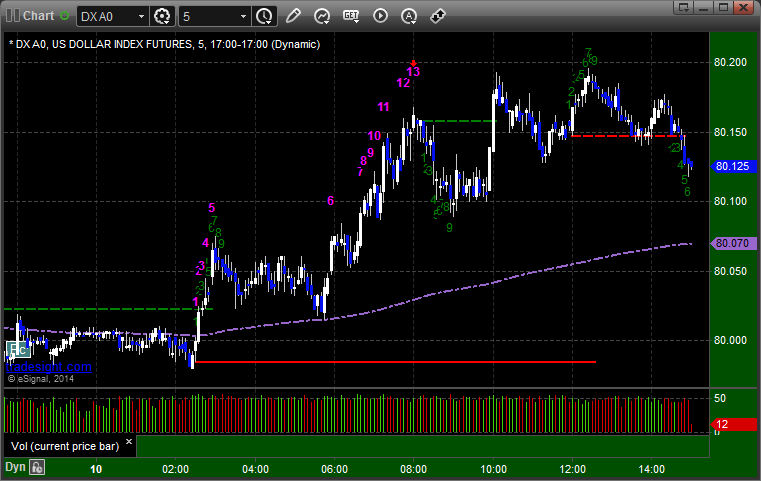

Here's a look at the US Dollar Index intraday with our market directional lines:

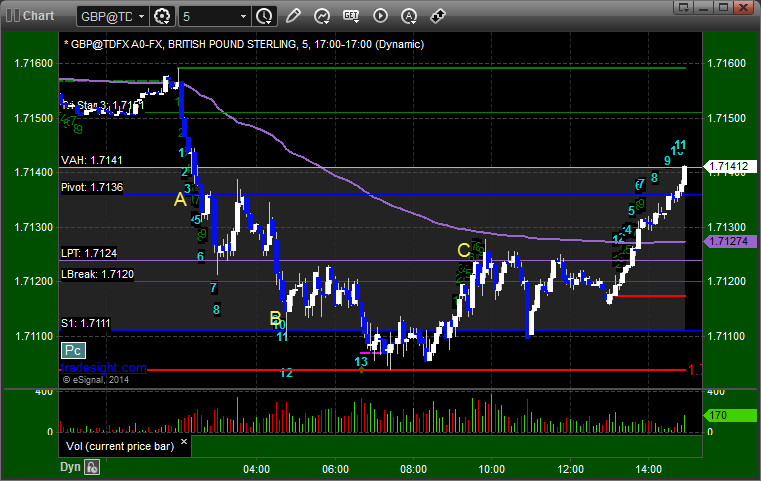

GBPUSD:

Triggered short at A, hit first target at B, lowered stop in the morning and stopped the second half over the LPT at C:

Stock Picks Recap for 7/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered, which is good when the market doesn't do much.

From the Messenger/Tradesight_st Twitter Feed, Rich's TBT triggered long (ETF, so no market support needed) and didn't work:

His AMZN triggered long (with market support) and worked:

GILD triggered long (with market support) and didn't work:

Rich's LNKD triggered short (with market support) and worked:

His BA triggered short (with market support) and didn't work:

His GOOG triggered long (with market support) and didn't work:

SINA triggered short (with market support) and worked enough for a partial:

Mark's AVGO triggered long (with market support) and worked a little:

COST triggered long (with market support) and worked a little, I closed in the money in the Messenger/Twitter feed:

In total, that's 9 trades triggering with market support, 5 of them worked, 4 did not. Not very exciting compared to the last two days.

Futures Calls Recap for 7/9/14

We gapped up and filled the gap, setting up some nice Value Area plays, but they never came to fruition as the markets took a breather after the last couple of days. NASDAQ volume, which was so strong yesterday at 2 billion shares, closed at less than 1.5 billion shares.

Net ticks: -11.5 ticks.

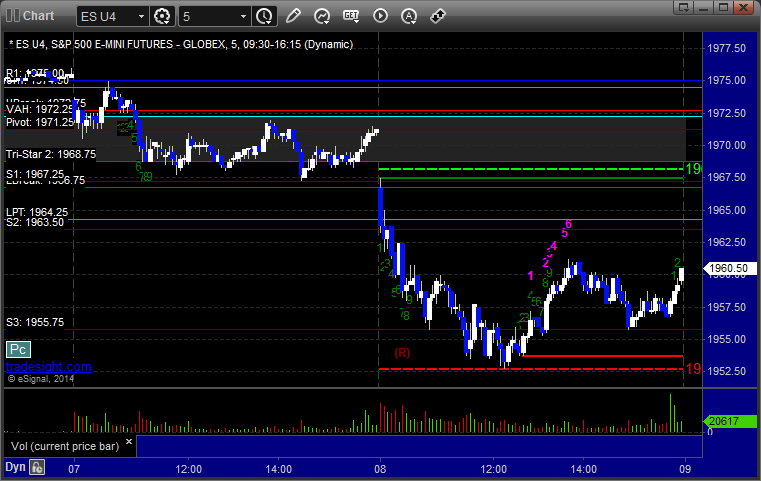

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

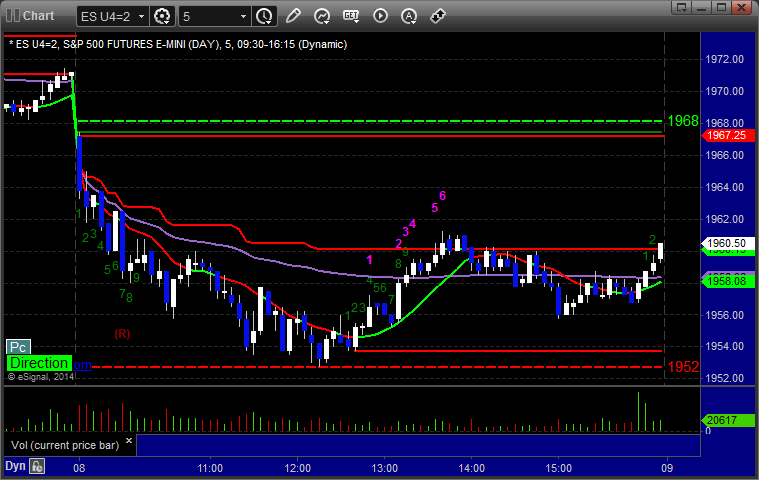

ES:

Triggered short at A at 1960.00 breaking under the Pivot into the Value Area, but stopped for 7 ticks. Put it back in and it triggered soon after and missed the first target by a tick. We did not re-enter:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3864.50, hit first target for 6 ticks, and stopped second half above the entry:

Forex Calls Recap for 7/9/14

Guess we had the right triggers on the GBPUSD, as the low of the session was our short entry that didn't trigger, and the high of the session was the long entry, although that did trigger late in the session and we closed it around the entry. See GBPUSD section below.

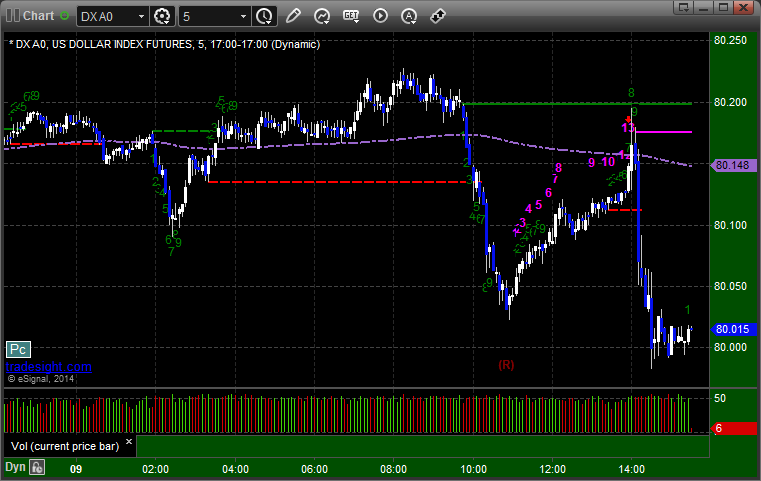

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Exactly set the trigger at A but didn't trigger. Triggered long at B late, but closed it:

Stock Picks Recap for 7/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AEGR triggered short (with market support) and worked but I posted to close it even as it triggered after the broad market indices were extended and showing reversal signals:

TASR triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

NTAP triggered short (with market support) and worked:

Rich's SCTY triggered short (with market support) and worked:

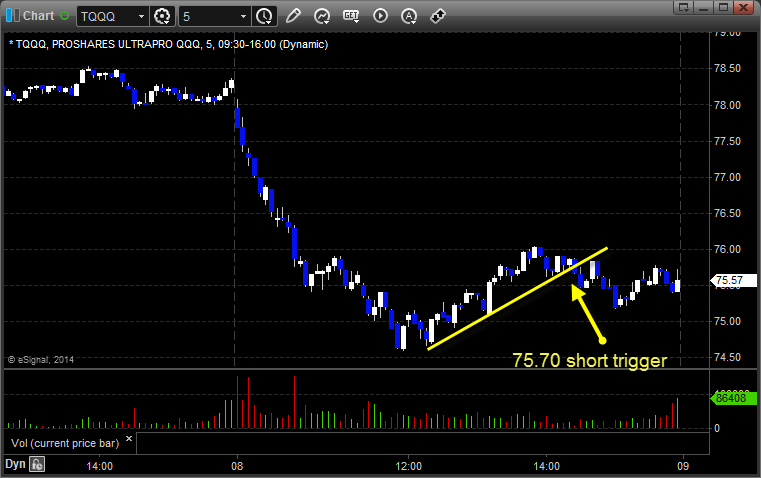

Rich's TQQQ triggered short (ETF, so no market support needed) and worked:

Several other calls were posted but nothing else triggered.

In total, that's 4 trades triggering with market support, all 4 of them worked, and AEGR is not counted.

Futures Calls Recap for 7/8/14

Kind of a wasted session for futures as the markets gapped down and pushed lower quickly and never really set a level. Calls in the afternoon didn't trigger as the markets settled onto the VWAP. NASDAQ volume was much better, closing at 2 billion shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 7/8/14

No triggers. I don't think anything would have worked either way, but the GBPUSD went the opposite direction of our idea, as did the EURUSD.

Here's a look at the US Dollar Index intraday with our market directional lines:

Stock Picks Recap for 7/7/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BBRY triggered long (just barely without market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's PCAR triggered short (with market support) and worked:

SINA triggered short (with market support) and worked:

GS triggered short (with market support) and worked:

Rich's SLB triggered short (with market support) and didn't work:

His first TSLA call triggered short (with market support) and worked:

His second TSLA call triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not, plus BBRY worked.

Futures Calls Recap for 7/7/14

A loser on the ES and a winner on the NQ. The markets gapped down small, did very little early, volume was light, and then we finally rolled to the downside a bit. NASDAQ volume closed at 1.5 billion shares.

Net ticks: +2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1974.00, didn't quite hit the first target, and stopped for 7 ticks:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3906.50, hit first target for 6 ticks, lowered stop several times and finally stopped 12 ticks in the money: