Futures Calls Recap for 7/25/14

A clean winner for another limited session of trading during summer earnings. See the NQ section below. NASDAQ volume closed at an improved 1.7 billion shares.

Net ticks: +11 ticks.

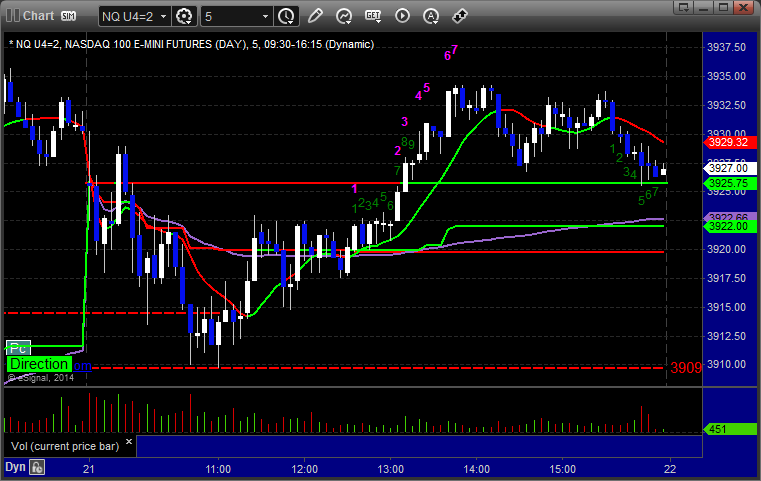

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3981.50, hit first target for 6 ticks, lowered stop a couple of times and stopped final piece at 3973.50 (note we spent the rest of the day in the Value Area):

Forex Calls Recap for 7/24/14

Finally, a little movement and a winner that is still going in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

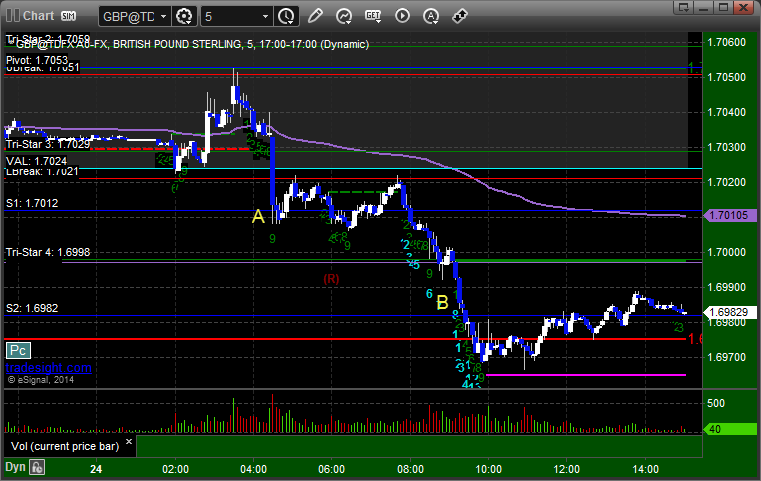

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with stop over 1.7000:

Stock Picks Recap for 7/23/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM gapped over, no play.

HTLD triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and worked:

Rich's CIEN triggered short (without market support) and didn't do much either way:

AMZN triggered short (without market support) and worked enough for a partial:

Rich's SUNE triggered short (without market support) and didn't do much either way:

In total, despite a lot of calls, that's just 1 trade triggering with market support, and it worked.

Futures Calls Recap for 7/23/14

Another narrow session as expected in earnings season. Mark pulled a small winner on the ES and that was it. Volume was improved, but just due to a couple of stocks that reported. NASDAQ volume closed at 1.7 billion. One day left of earnings!

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

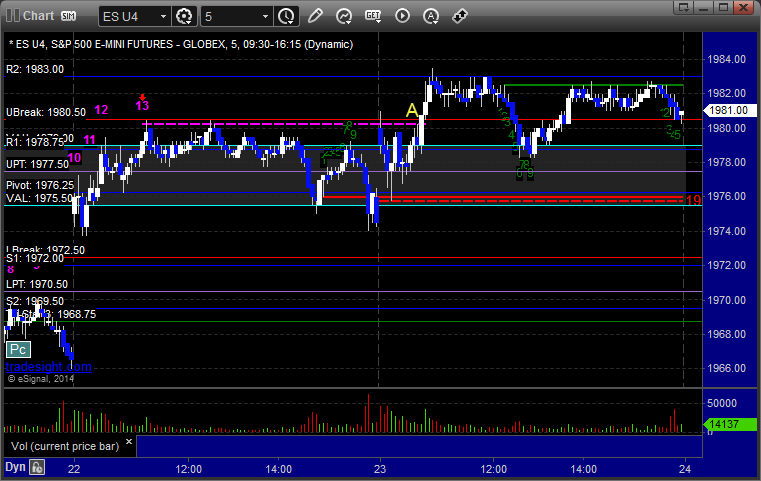

ES:

Mark's call triggered long at A at 1981.25, hit first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 7/23/14

Could be a new record low as the EURUSD traded only 20 pips from high to low for the session. Our trade triggered but obviously never got anywhere in that. Have a look at that section below.

REMINDER FOR EVERYONE: Through the end of the month, you can buy the combined Tradesight Forex Course and Tradesight Advanced Forex (Daytrading) Course for $2397, that's $700 off.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, 20 pips of range TOTAL for the session (wow), closed at B:

Stock Picks Recap for 7/22/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INTU triggered long (with market support) and worked:

NTES triggered long (with market support) and worked:

KNDI triggered long (without market support due to opening 5 minutes) and didn't work:

TSRA triggered long (without market support) and didn't work, although it went later with market support if you were interested:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked for several points:

In total, that's 3 trades triggering with market support, all 3 of them worked.

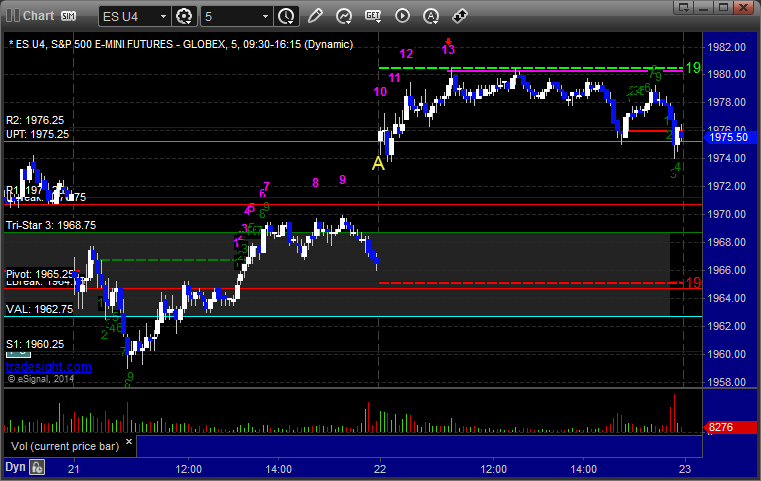

Futures Calls Recap for 7/22/14

7 points of range on the ES and barely touched a level. Took a play for the gap fill after the opening minutes and it didn't go anywhere as we spent the whole day in a 7 point range. Note the Comber 13 sell signals on the ES and NQ were the highs:

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1974.00 for the gap fill and stopped, did not re-enter:

Forex Calls Recap for 7/22/14

Another slow session. Stopped out on GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered again at B and didn't hit stop over first target, closed at C for 10 pips:

Stock Picks Recap for 7/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, KLAC triggered long (with market support, just barely) and didn't work:

Rich's EBAY triggered long (with market support) and didn't work:

His AAPL triggered short (with market support) and worked enough for a partial, but just barely:

His VMW triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Futures Calls Recap for 7/24/14

A small winner for a very light session. The markets gapped down small and never quite filled the gaps on the ES. NASDAQ volume was only 1.4 billion shares. We await the last three days of core earnings.

Net ticks: +2.5 ticks.

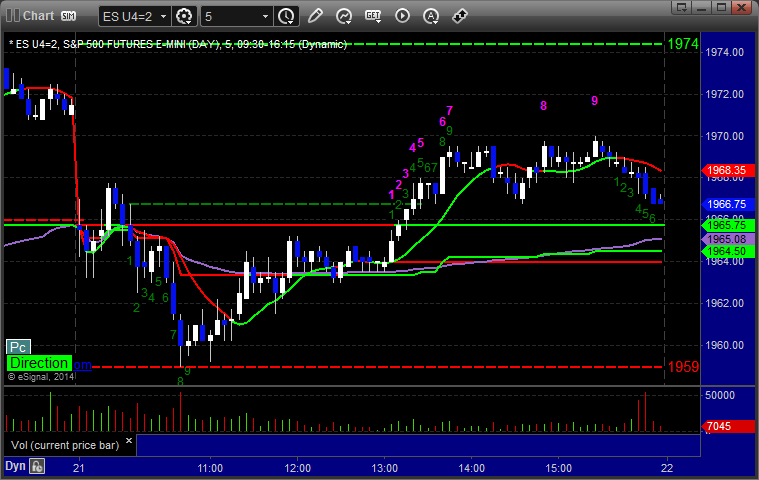

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long over the Pivot at 1968.00 at A, hit first target for 6 ticks, stopped second half under the entry: