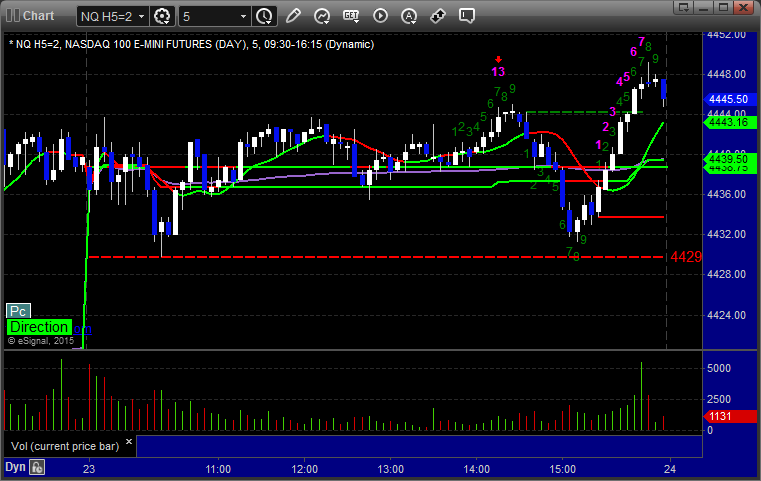

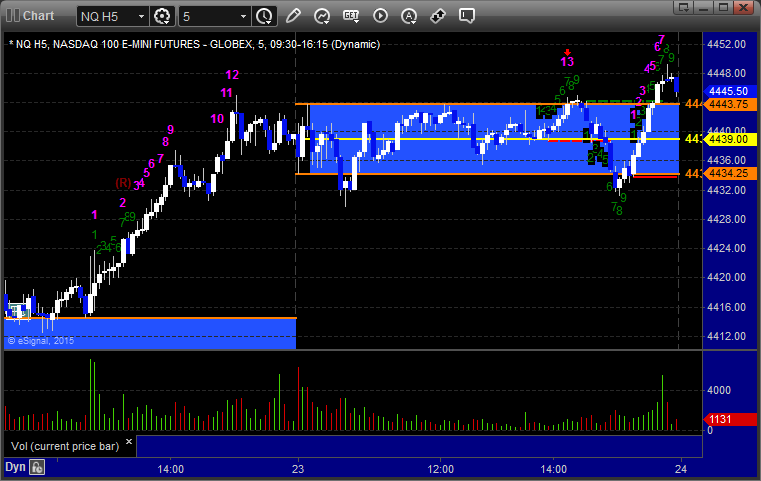

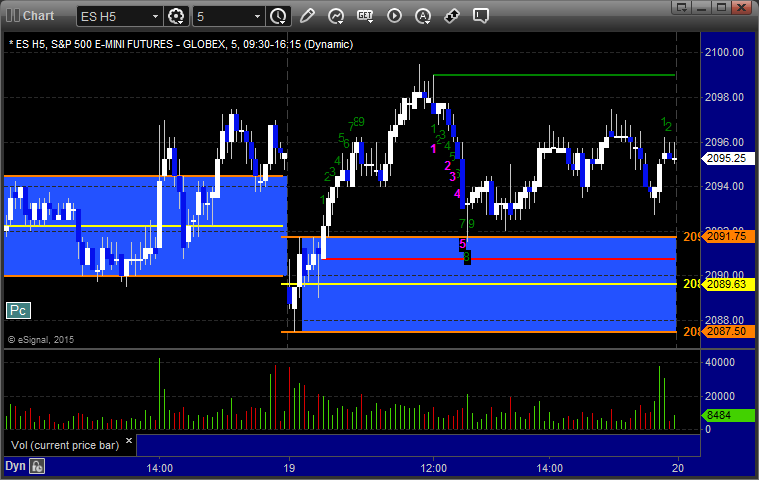

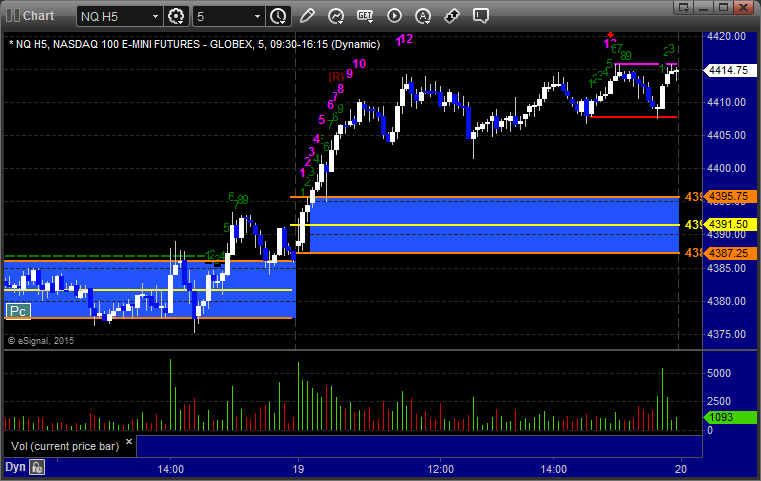

Futures Calls Recap for 2/24/15

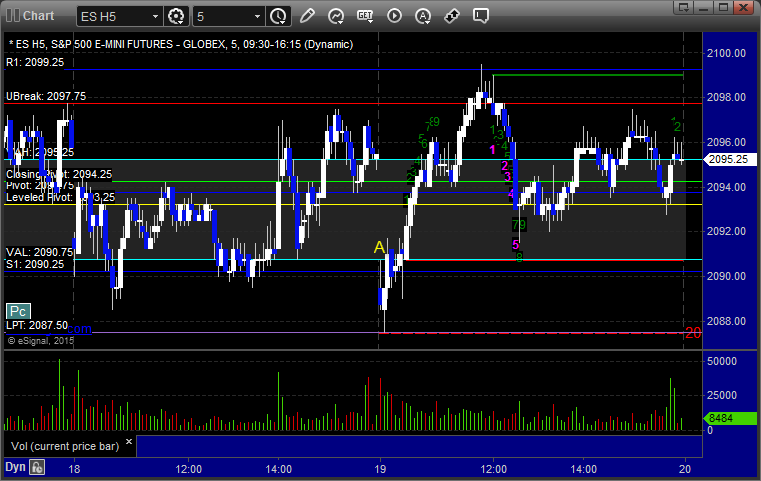

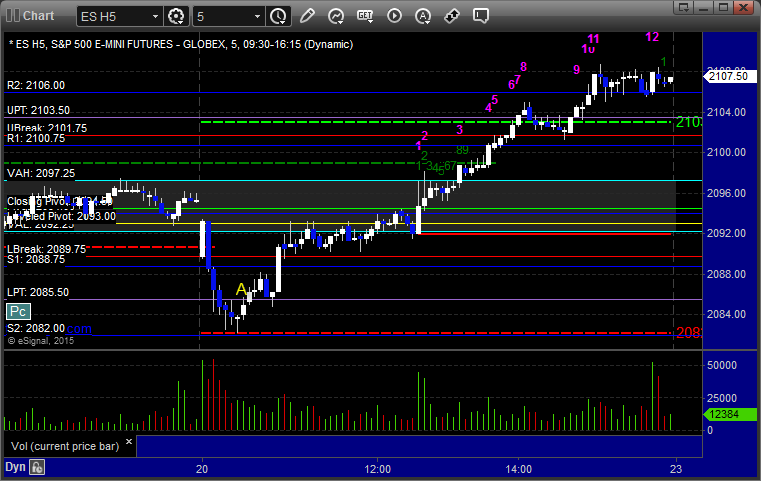

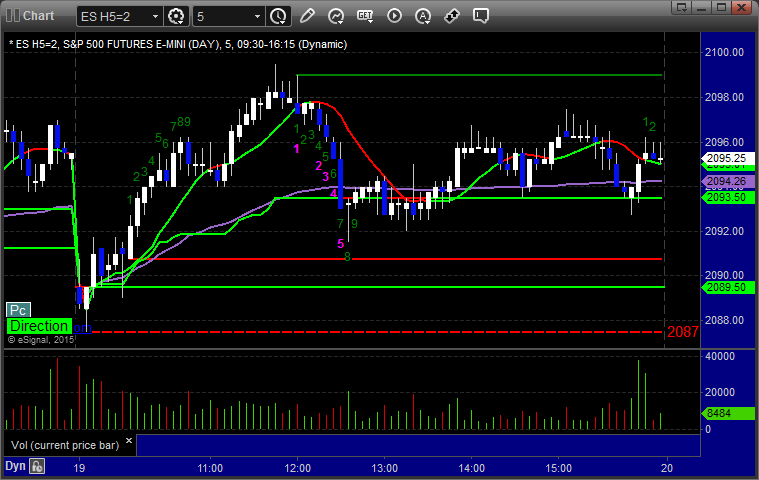

Two small winners to the first targets and that's it. The session was a little wider finally and volume improved. There was also a perfect 13 sell signal on the ES, which you can see below. NASDAQ volume closed at 1.7 billion shares.

Net ticks: +5 ticks.

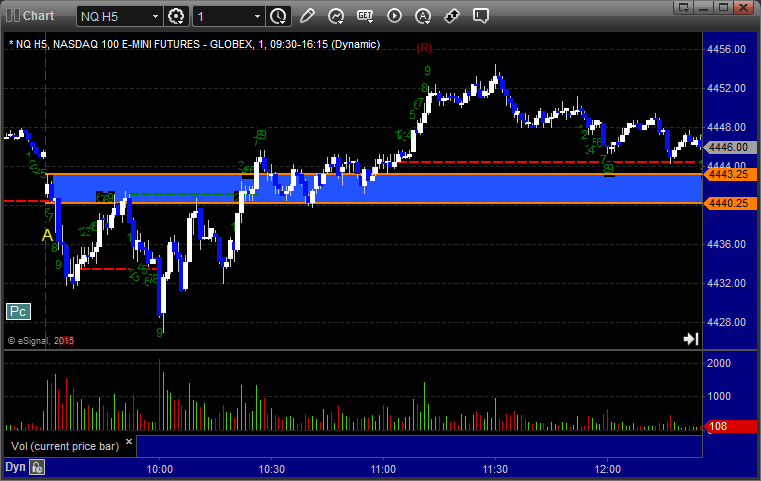

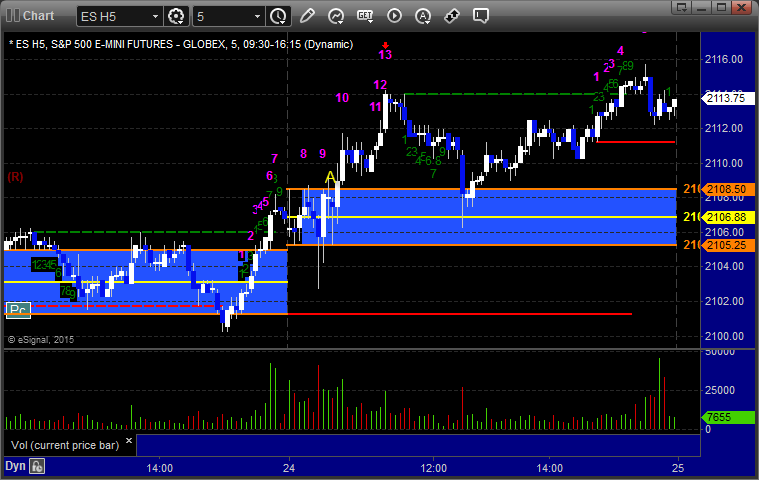

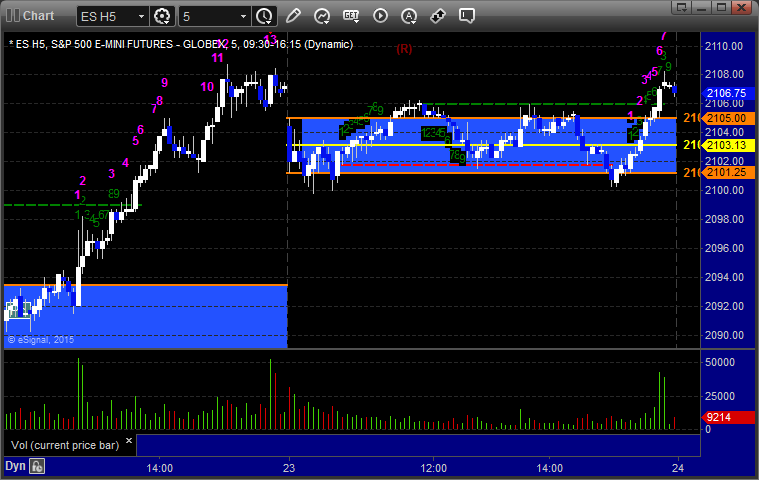

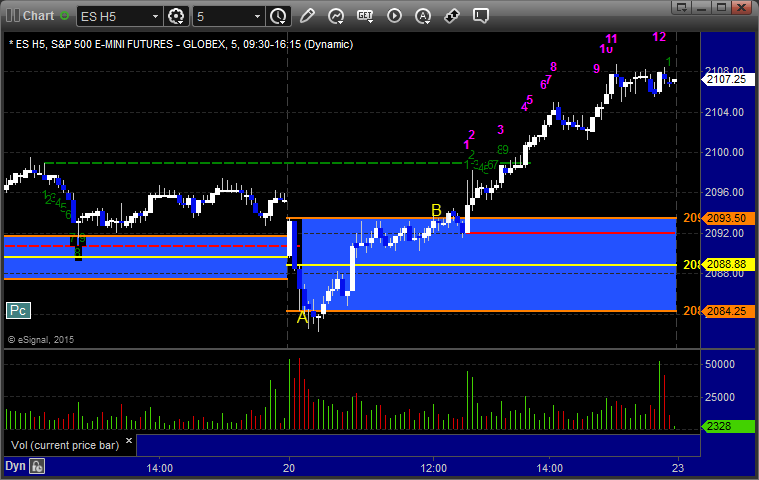

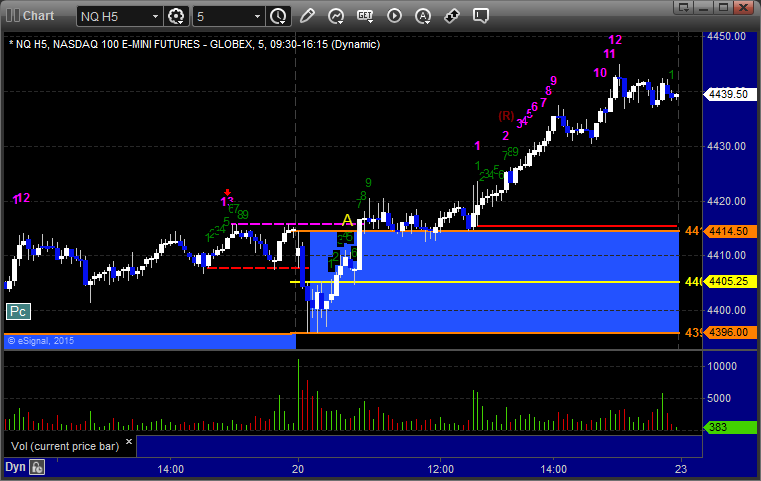

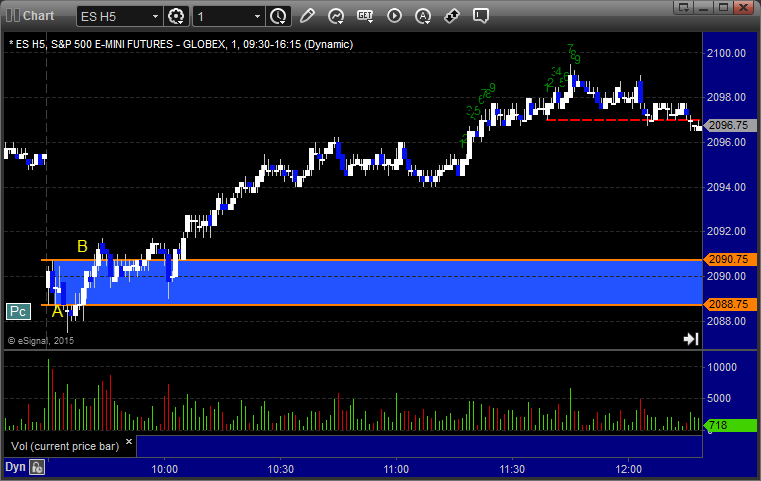

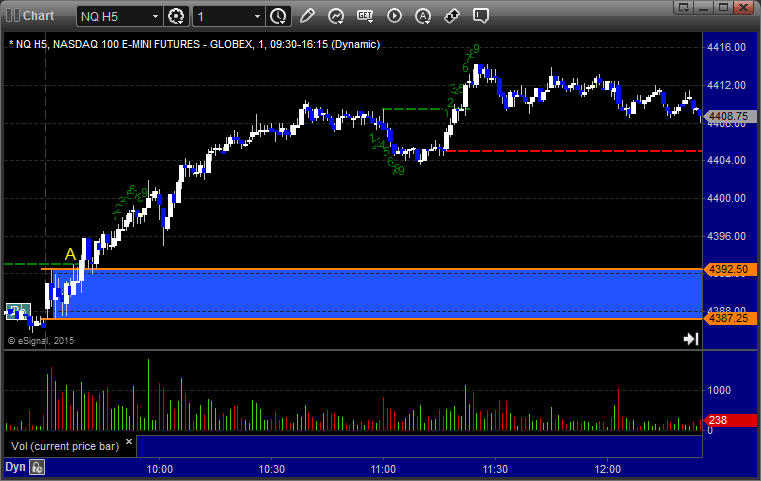

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

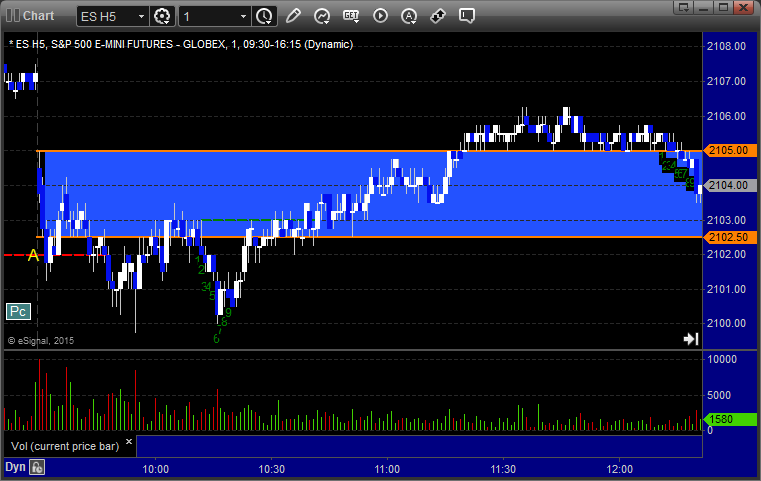

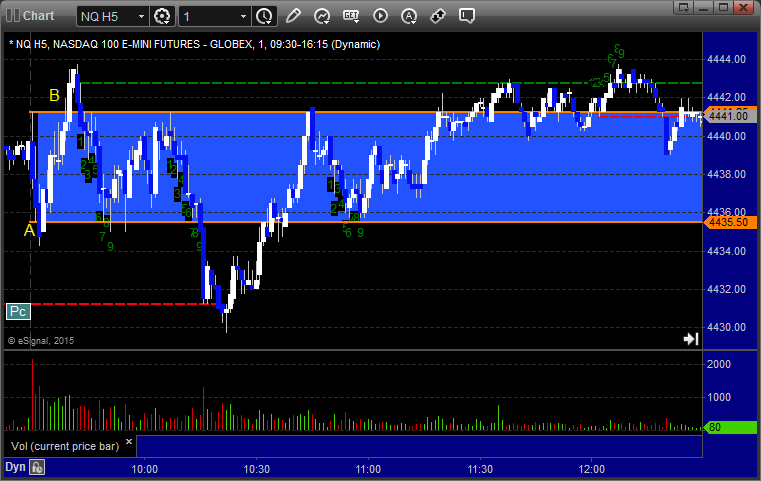

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work. Shouldn't have taken the short trigger on news as it was too far under the OR, and it was also 30 minutes into the day:

NQ Opening Range Play triggered short at A and worked, unless you passed on it because it did close the candle a decent distance under the OR Low:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and worked:

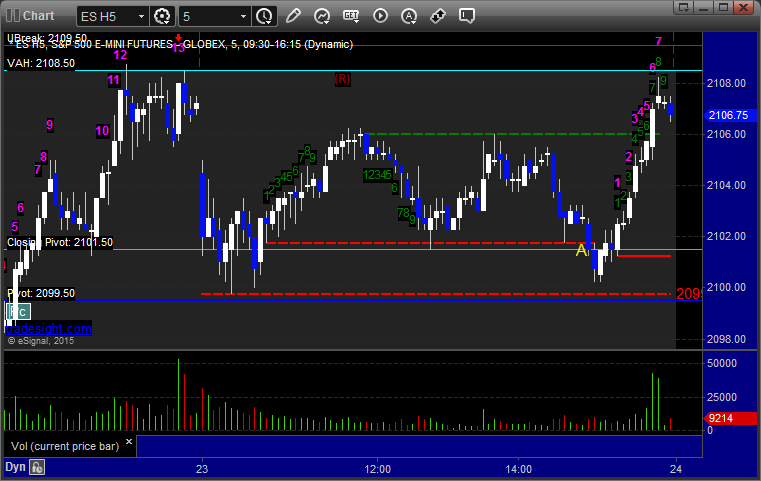

ES:

Mark's call triggered short at A at 2104.50, hit first target for 6 ticks, and stopped second half over the entry. My call triggered long at B at 2110.25, hit first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 2/24/15

A loser on a news spike. See the GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Part of the trade triggered at A, but the rest at B on the news spike and then stopped on the reversal:

Stock Picks Recap for 2/23/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered long (without market support due to opening 5 minutes) and worked:

CELG triggered long (without market support due to opening 5 minutes) and worked:

JBHT triggered long (with market support) and eventually worked:

ACRX triggered long (with market support) and worked enough for a partial:

GRMN triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, I added an additional CELG call due to the early trigger from the report, and it triggered long (with market support) and worked:

WYNN triggered short (with market support) and I eventually gave up on it and closed it slightly in the money:

In total, that's 4 trades triggering with market support, all 4 of them worked, but nothing special in the light environment.

Futures Calls Recap for 2/23/15

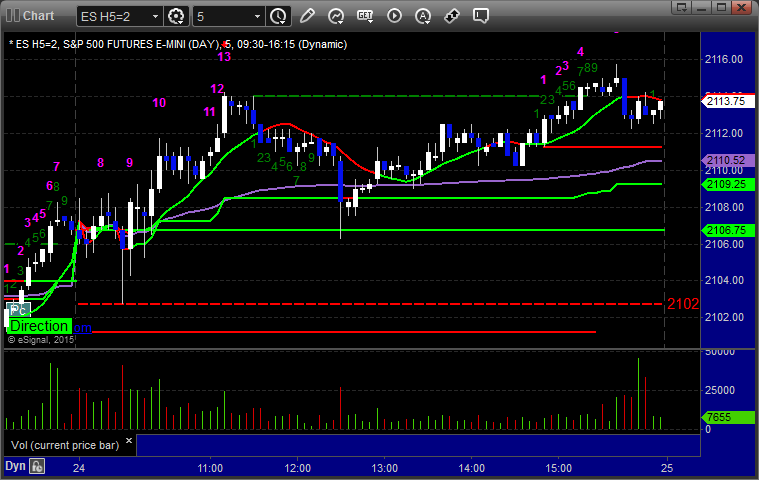

Wow, what a dull session to start the week. If you don't count the extra Closing Pivot line, the ES never touched a level all session and stuck in a 5 point range without even filling the small gap. NASDAQ volume closed at 1.6 billion shares.

Net ticks: -2 ticks.

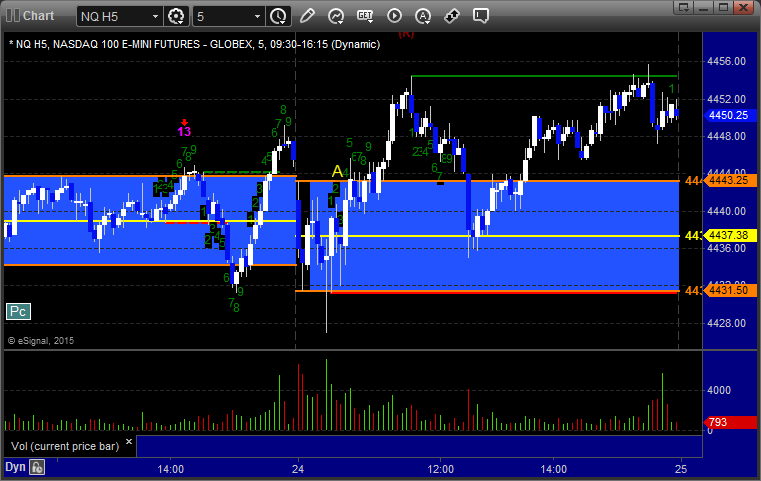

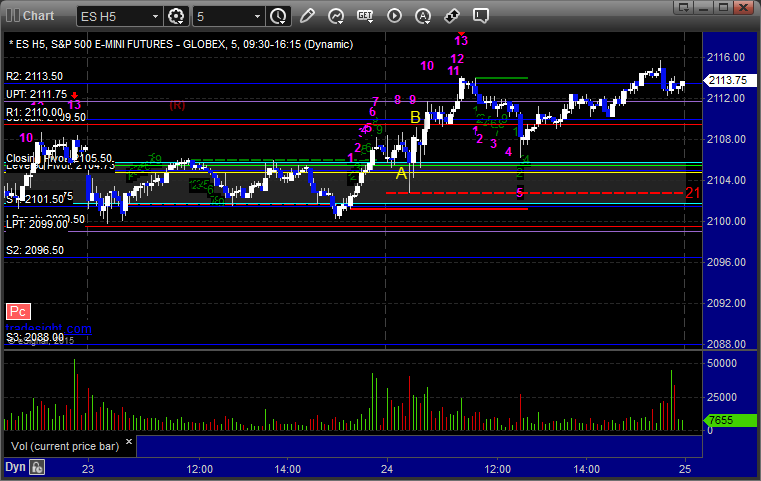

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A under Closing Pivot at 2101.25 and closed it out 20 minutes later for a 2 tick loss:

Forex Calls Recap for 2/23/15

A clean winner to start the week. See the EURUSD section below.

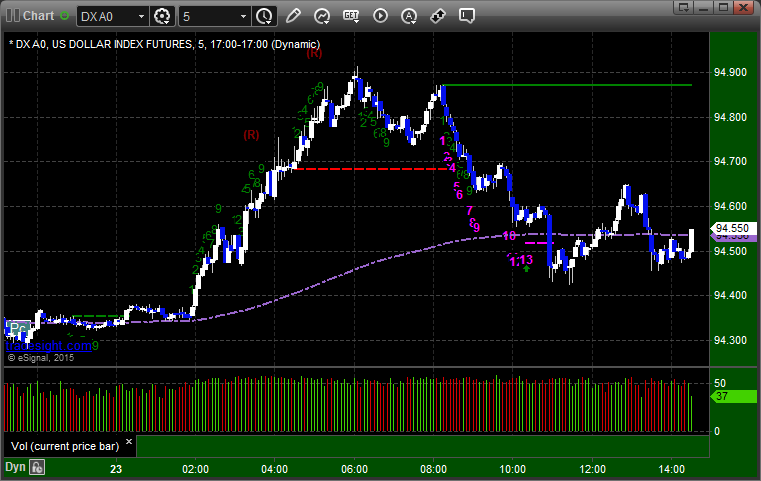

Here's a look at the US Dollar Index intraday with our market directional lines:

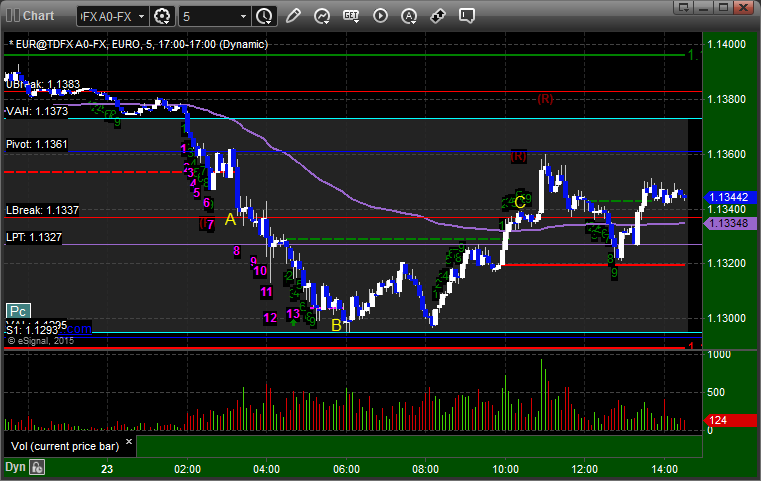

EURUSD:

Triggered short at A, hit first target at B, stopped second half over the entry at C:

Stock Picks Recap for 2/20/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered long (with market support) late in the day and worked a little:

FORM triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, FEYE triggered long (without market support) and worked:

GS triggrered short (with market support, right at the low of the day in the market) and didn't work:

Mark's BIDU triggered long (without market support) and worked:

His MCHP triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 2/20/15

Triggered short at A, one leg of the 3 under our order staggering rules could have stopped at B, first target hit for the rest at C, and then we lowered the stop over the entry and stopped at D. Then the long triggered over the Pivot at E on rumors that the Greece situation might be resolved, hit first target at F, and stopped second half at G:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B and worked great:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked great:

ES Tradesight Institutional Range Play triggered short at A and didn't work and then long at B and worked great:

NQ Tradesight Institutional Range Play triggered long at A and worked great:

ES:

Triggered long at 2085.75, hit first target for 6 ticks, closed second half for 8 ticks:

Forex Calls Recap for 2/20/15

Might as well wrap up a strange couple of weeks with a strange night. Two triggers, both hit their first targets, neither was normal. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

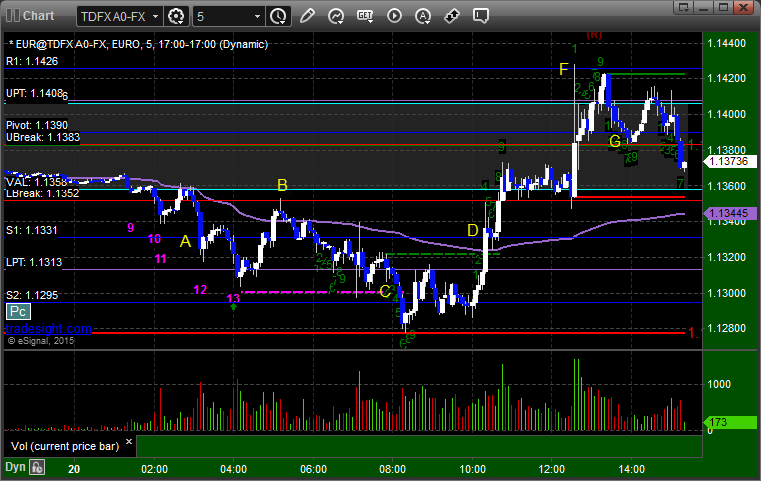

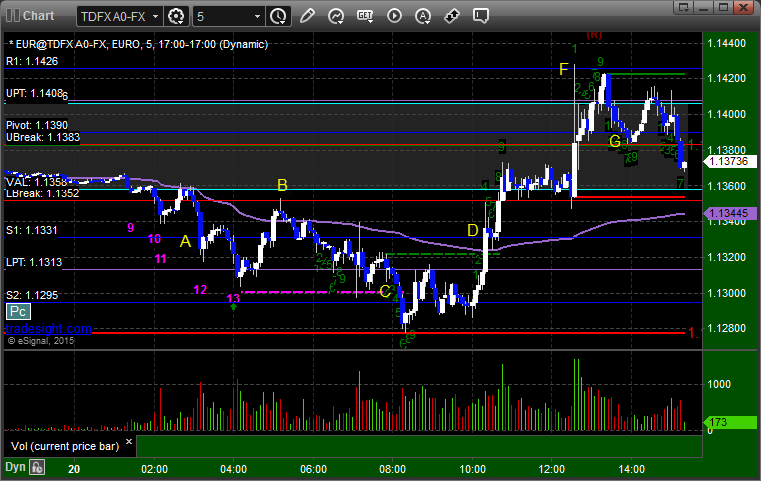

EURUSD:

Triggered short at A, one leg of the 3 under our order staggering rules could have stopped at B, first target hit for the rest at C, and then we lowered the stop over the entry and stopped at D. Then the long triggered over the Pivot at E on rumors that the Greece situation might be resolved, hit first target at F, and stopped second half at G:

Stock Picks Recap for 2/19/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SGMO triggered long (with market support) and we closed it slightly in the money after nothing happened:

BLMN triggered long (with market support, by a penny) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's CELG triggered long (with market support) and worked:

EBAY triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support (not counting SGMO since we closed it barely in the money), 2 of them worked, 1 did not.

Futures Calls Recap for 2/19/15

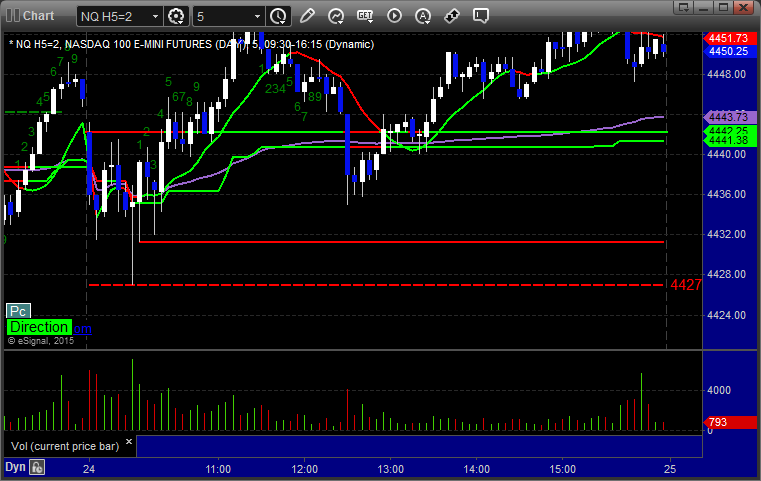

Another painfully dull session as the markets once again closed flat. Volume was only 1.45 billion NASDAQ shares. The Opening Range plays worked great, and we stopped out of one other play.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

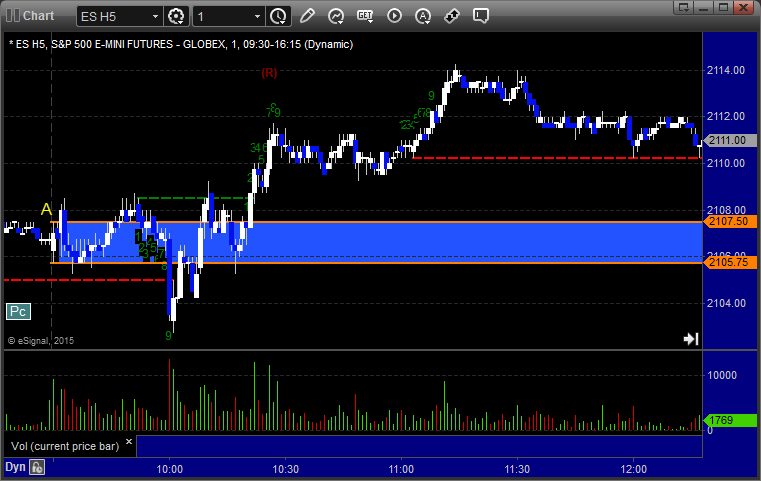

ES:

Triggered long at A at 2091.00 heading into the Value Area and stopped on the news spike 30 minutes into the market before making the move all the way across: