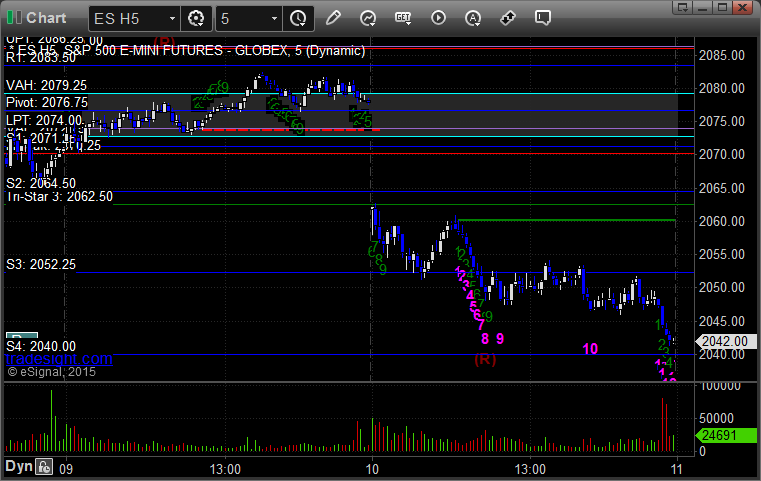

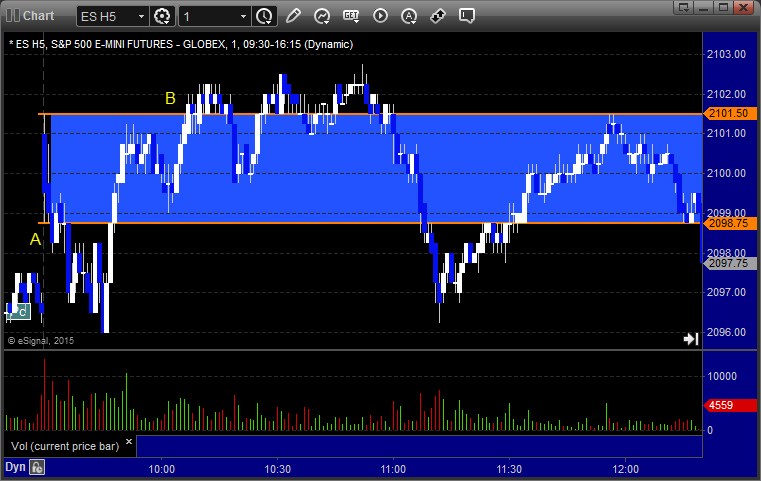

Futures Calls Recap for 3/10/15

One trade call that was set up nice but didn't work. The markets gapped down and kept going on a volume warning. NASDAQ volume closed at 1.7 billion.

Net ticks: -7 ticks.

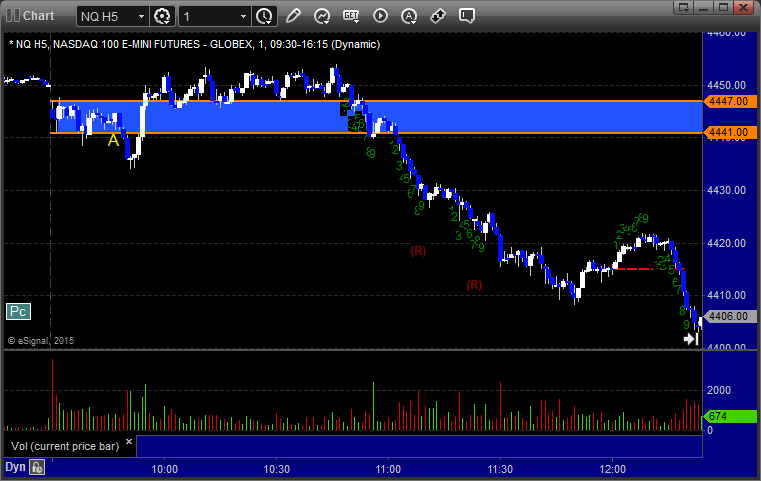

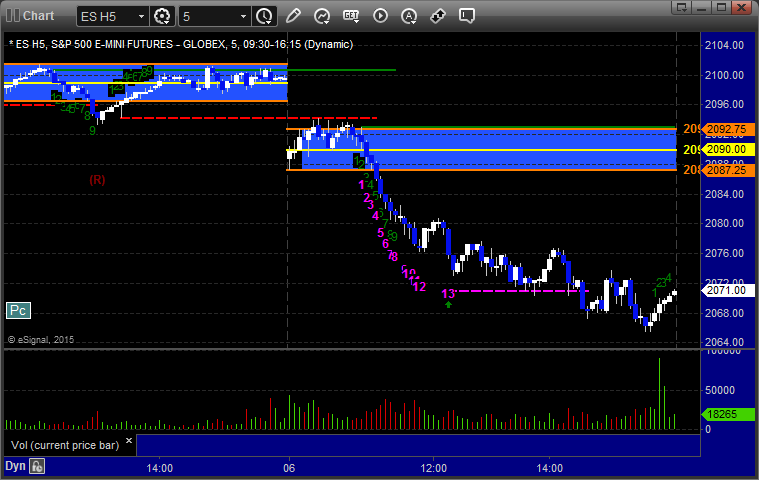

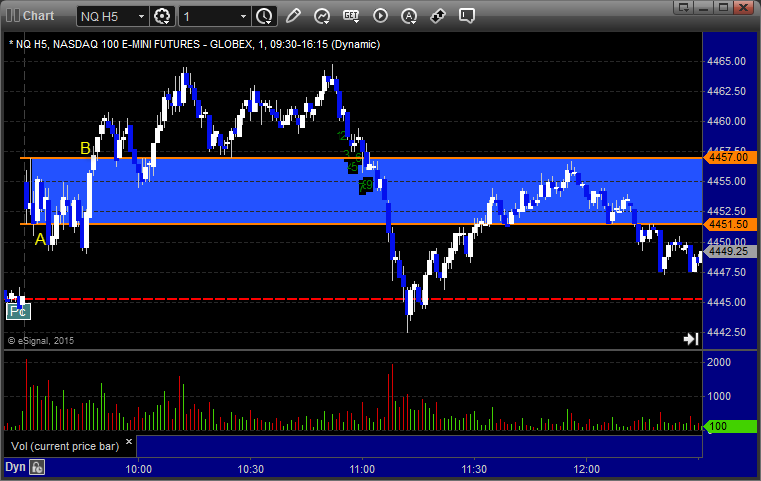

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play triggered short at A and worked:

NQ Tradesight Institutional Range Play triggered short at A and worked:

ES:

Mark's call triggered short at 2052.00 and stopped. He did not re-enter:

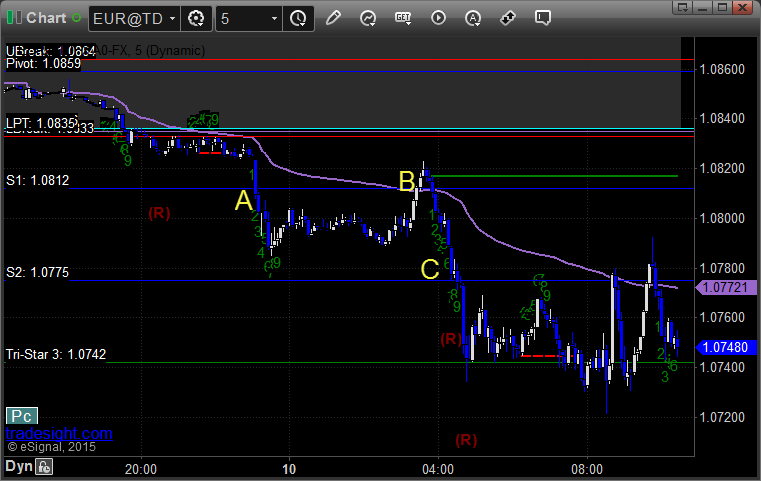

Forex Calls Recap for 3/10/15

The short triggered very early and I gave it several hours and ended up adjusting it before I went to bed, which is unusual. This ended up stopping it out over the entry before it went on to work. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A early, spent a lot of time under the trigger so I adjusted the stop over the trigger and stopped at B. Otherwise, would have worked to first target at C:

Stock Picks Recap for 3/9/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TWTR triggered long (with market support) and worked:

His AMGN triggered short (with market support) and didn't work:

His WYNN triggered short (with market support) and worked great:

Mark's VRTX triggered long (with market support) and didn't work:

His BABA triggered short (without market support) and didn't work:

Rich's AAPL triggered short (without market support but post-Apple Watch announcement) and worked great:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not, but the big trade that Rich set up all day was AAPL.

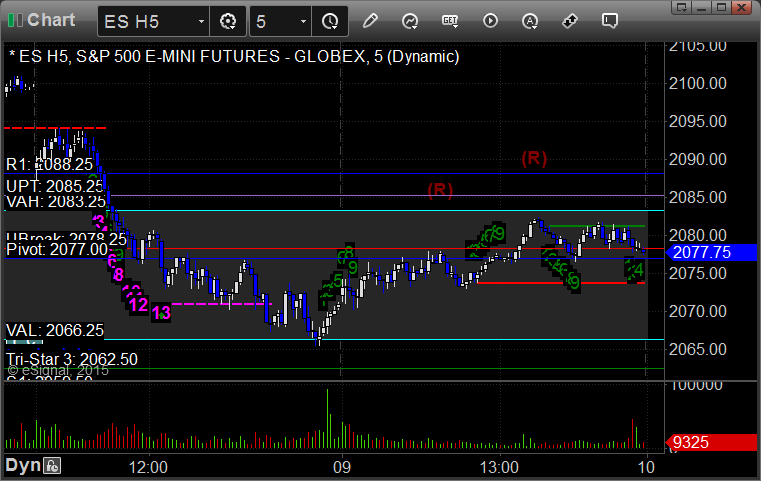

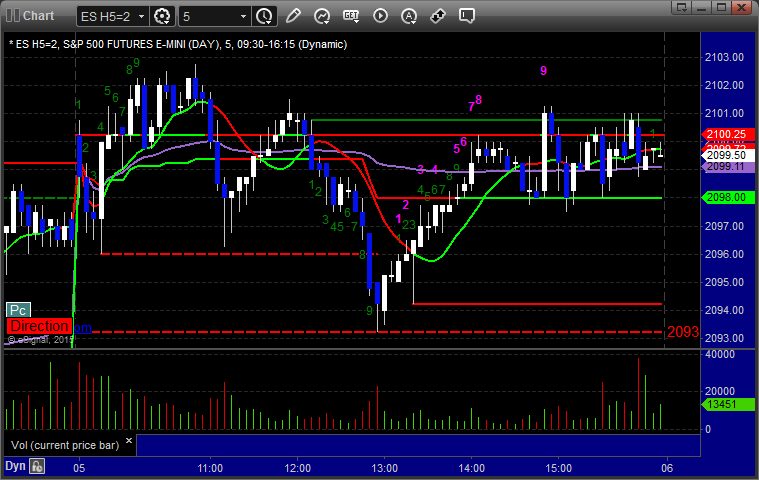

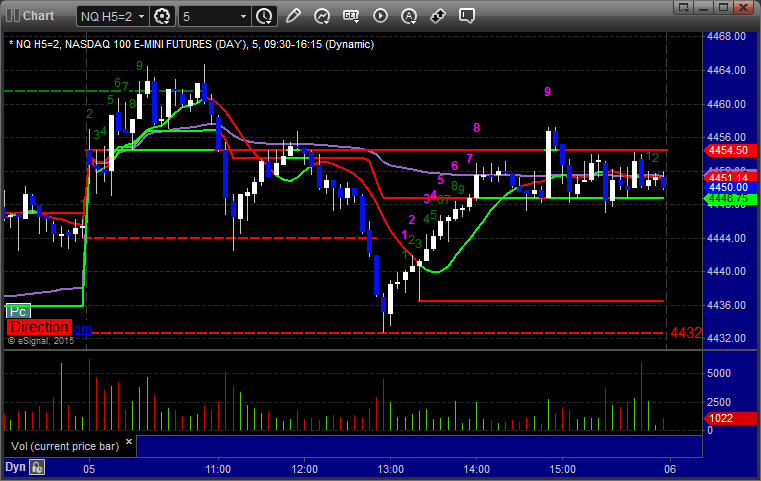

Futures Calls Recap for 3/9/15

I'm on the road this week. The markets opened flat and drifted. The NASDAQ side was a little weaker for most of the session and swung on the AAPL watch announcement. In the end, NASDAQ volume was only 1.5 billion shares, so a slow start to the week post-time change.

Net ticks: +0 ticks.

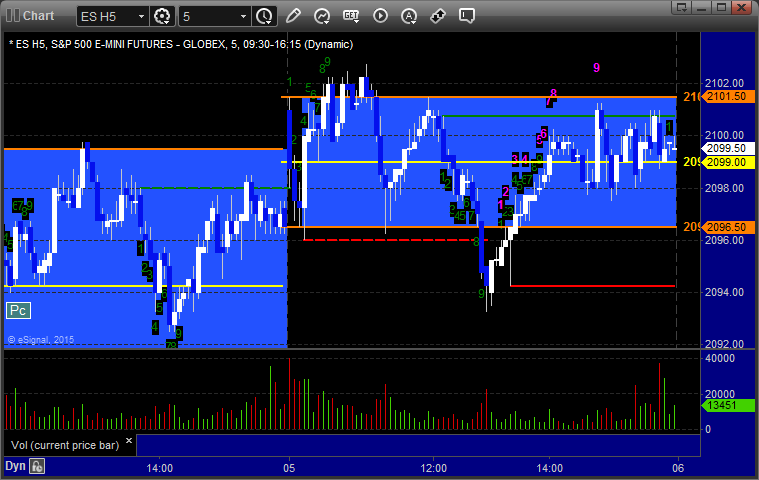

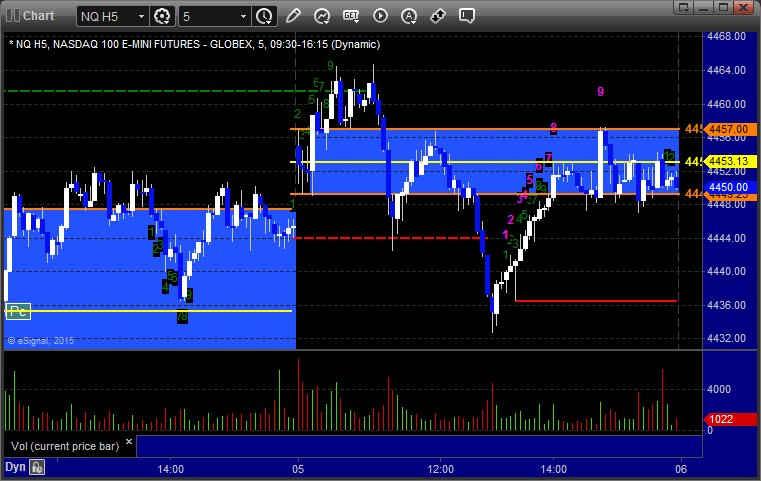

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B and didn't work:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

ES:

The setup was long over UBreak and it worked great (red line):

Forex Calls Recap for 3/9/15

Not a very exciting session to start the week, but we squeezed out a winner. It isn't unusual to have a slow start after part of the world went on a time change.

Here's a look at the US Dollar Index intraday with our market directional lines:

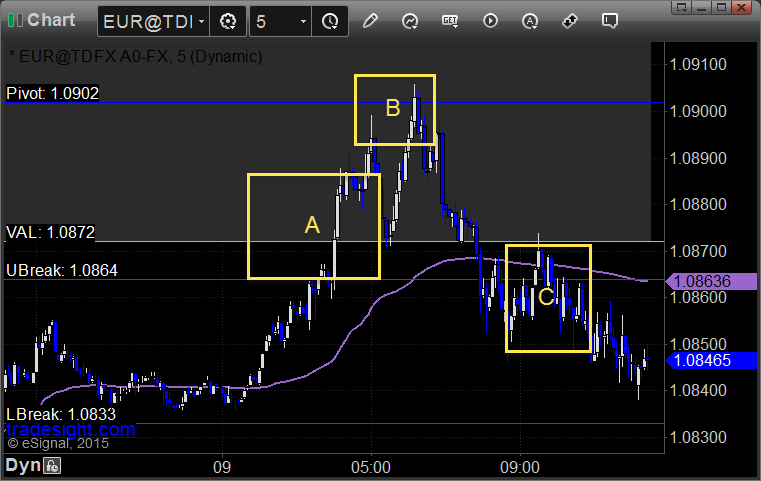

EURUSD:

Triggered long at A, hit first target at B, stopped second half in the morning at C:

Stock Picks Recap for 3/6/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's SPY triggered long (ETF, so no market support needed) and didn't work ultimately:

His BIDU triggered long (with market support) and worked enough for a partial:

Mark's C triggered long (with market support) and didn't work:

Rich's YY triggered long (with market support) and worked enough for a partial:

TSLA triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

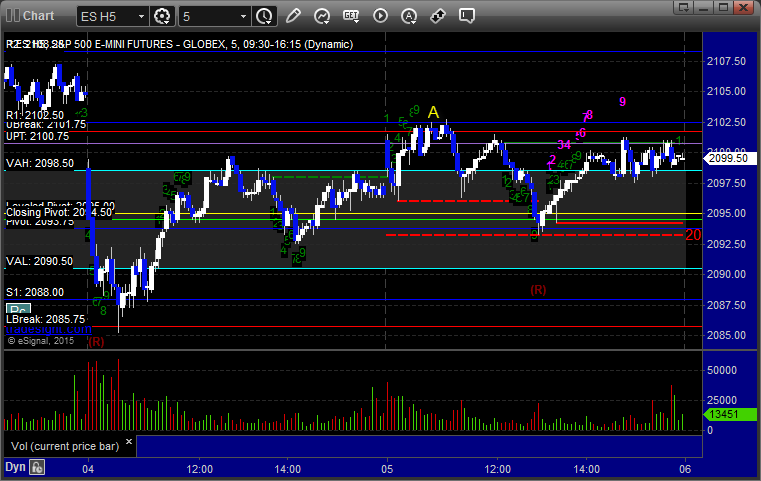

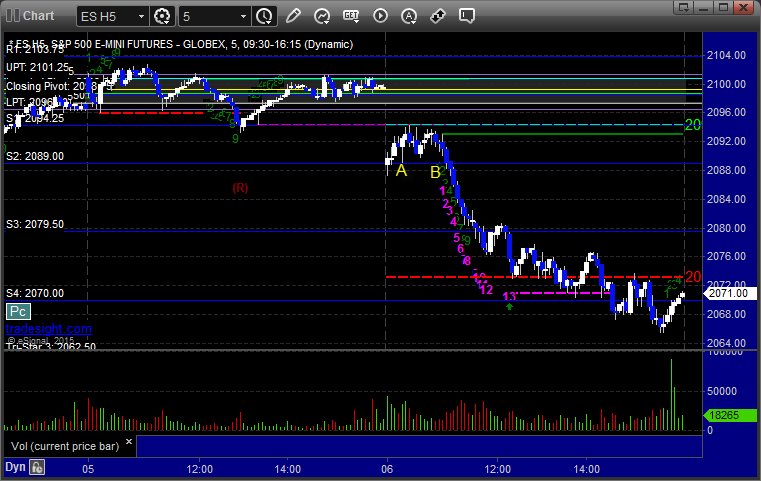

Futures Calls Recap for 3/6/15

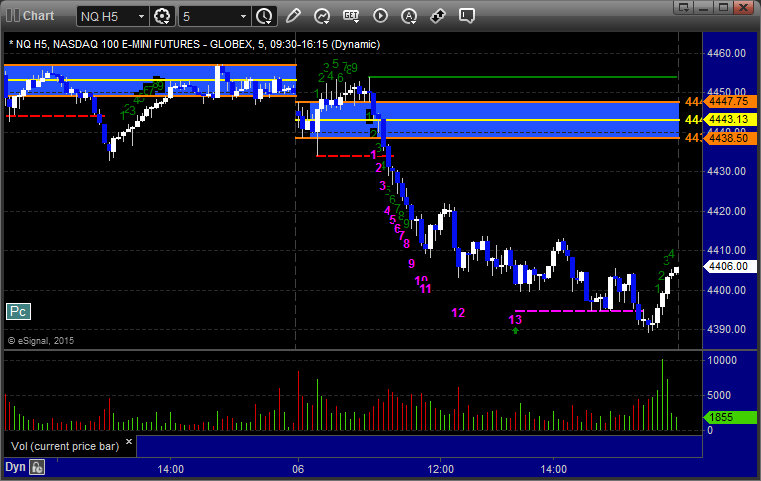

Another nice day in the futures calls. The Opening Range plays gave us some success, and then we set two key levels and broke one way on the ES that led to a nice winner. See those sections below. NASDAQ volume closed at 1.8 billion shares again and the markets headed lower.

Net ticks: +20 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial but I didn't take it because I was in the ES long already:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

The S2 level set at A, posted a short under it that triggered at B, hit first target for 6 ticks, lowered the stop several times and stopped the final piece for 34 ticks in the money:

Forex Calls Recap for 3/6/15

We stopped out of the second half of the prior day's GBPUSD short over the entry, but we had a nice new trade for 150 pips in the same pair. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Note the GBPCHF signal and also that the US Dollar is close to a Seeker reversal.

GBPUSD:

Triggered short at A, hit first target at B, lowered the stop a couple of times and closed final piece at C for end of week:

Stock Picks Recap for 3/5/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PTX triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

SYMC triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

His MBLY triggered long (with market support) and didn't work:

Mark's GILD triggered long (with market support) and didn't work:

MYGN triggered long (with market support) and worked enough for a partial:

Rich's GLD triggered short (ETF, so no market support needed) and didn't work:

His BIIB triggered long (with market support over lunch) and didn't work:

In total, that's 7 trades triggering with market support, 2 of them worked, 5 did not. Worst win ratio in months, although we had the volume warning early.

Futures Calls Recap for 3/5/15

A much slower session than the last few days as volume dropped off quite a bit early, even though it ended up closing at 1.8 billion NASDAQ shares in the end. The markets filled their gaps early and stuck to the VWAP/midpoint area after.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and didn't work:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

A nice setup against the R1 level triggered long at A and failed, we did not re-enter because of the volume problem: