The markets gapped up unevenly, with the ES up a couple and the NQ up a ton based on AAPL. We ended up with a pretty clean move lower to fill the gaps and caught several nice winners between the Opening and Institutional Range plays (see that section below) and the official NQ call (see that section below). The Fed announcement caused an initial spike up and then a reversal to the downside. NASDAQ volume closed at 1.8 billion shares, which is pretty good but not what you’d expect when you realize AAPL was way above its average.

Net ticks: +16.5 ticks.

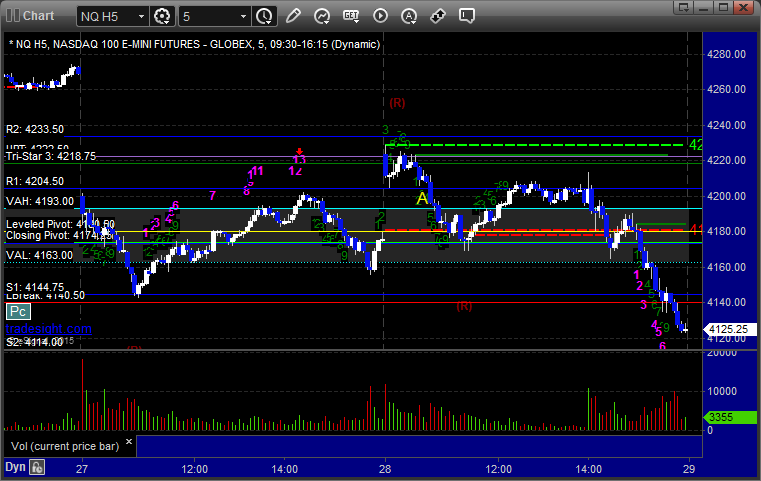

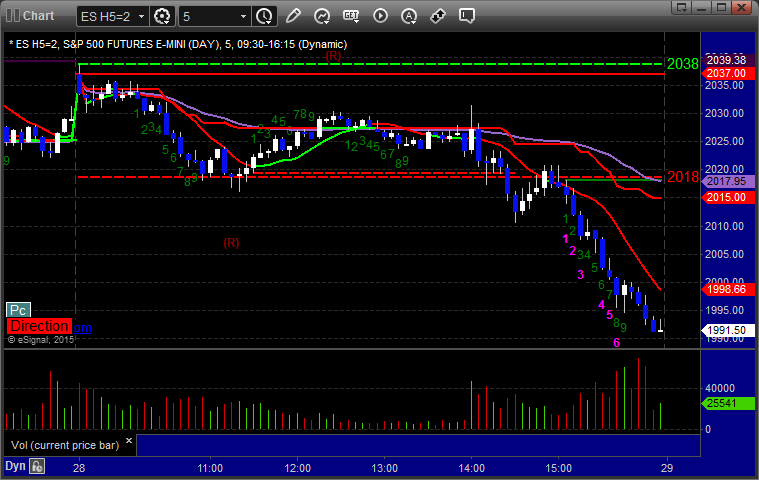

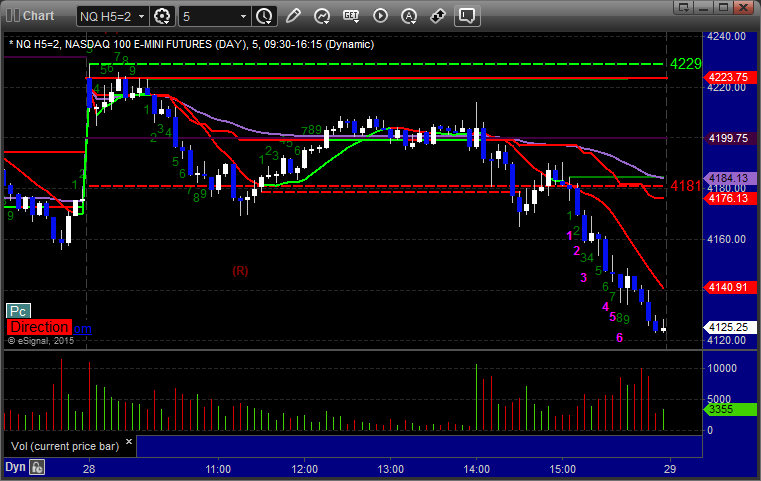

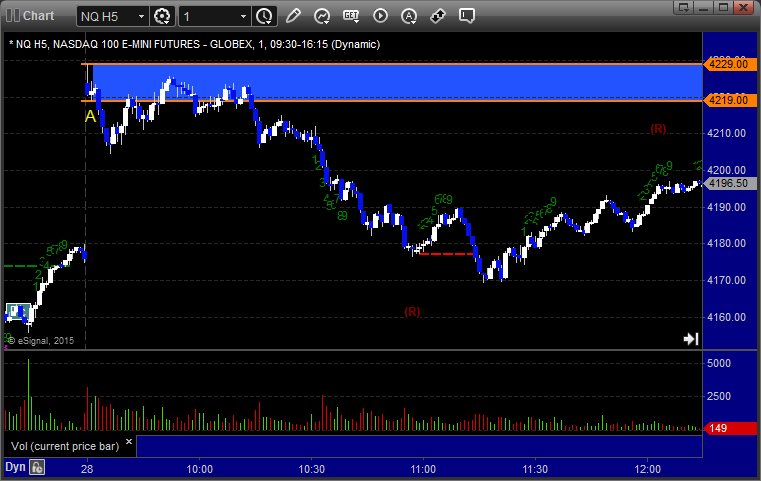

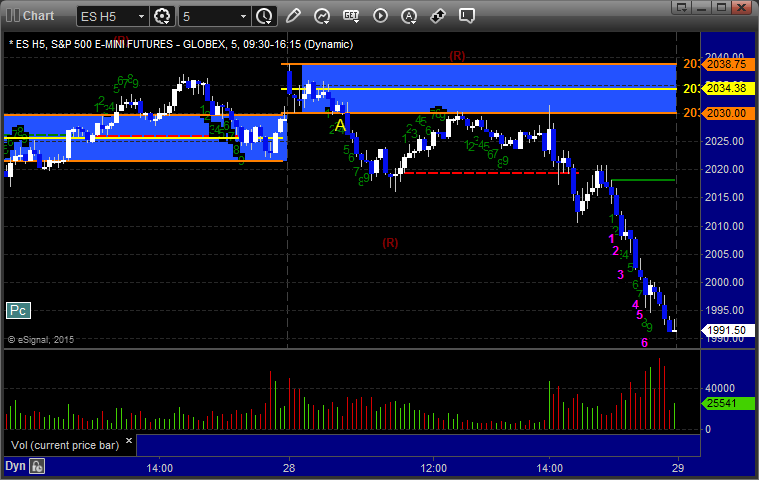

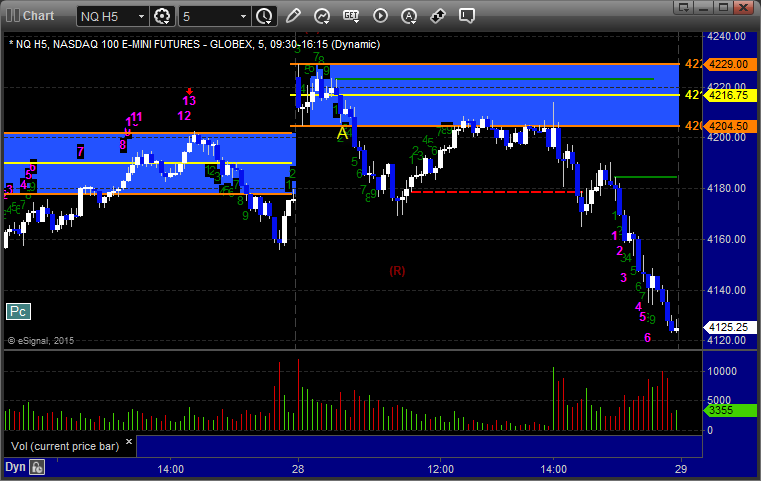

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

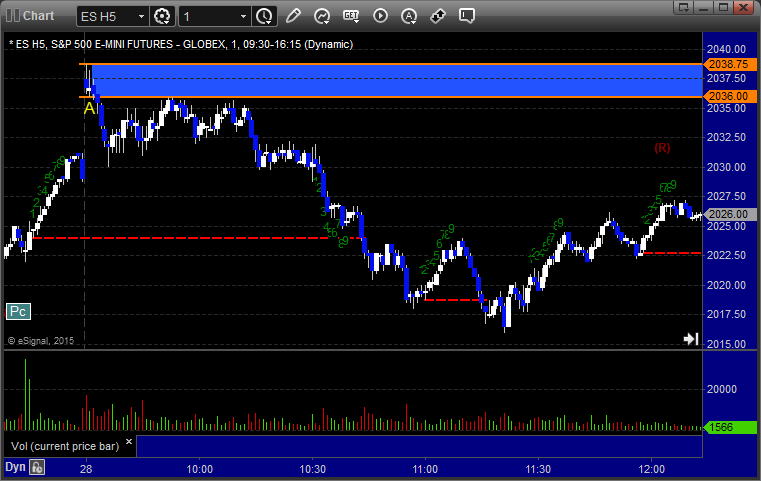

ES Opening Range Play worked, triggered and A and no issues:

NQ Opening Range Play worked, triggered at A, hit an easy partial, and that was it:

ES Tradesight Institutional Range Play worked great, triggered short at A:

NQ Tradesight Institutional Range Play worked, triggered short at B:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4204.00, hit first target for 6 ticks, lowered stop a couple of times and stopped final piece at 4190.50 for 27 ticks: