With the US Dollar Index now approaching the levels of April 2009, putting us at or near a 12-month high, it’s time to get a feel for what may lie in store for the Dollar Index in the months to come. We came into the year predicted that the US Dollar would ultimately have a positive 2010, although we stated that our prediction wasn’t meant to suggest that a sharp run-up would be what would happen. Less than five months into the year, we’ve definitely seen a sharp run-up. At the start of January, we predicted that the Dollar would hit the 82.00 level in 2010. We got there in March and were still there two weeks ago. Now we’re at 86.00.

For those that are familiar with MoB (Make or Break) lines in e-Signal, you know that these lines use chart analysis to project potential time and price targets for a symbol. One point of confusion on these levels is that some people assume that the fact that a MoB level exists, the symbol must get there or the MoB was wrong. That’s not actually the case. You can get MoB levels both below and above the market if you draw them off the most recent pivot low and high. That doesn’t mean both will hit. You’re basically getting a target scenario IF things keep moving in that direction.

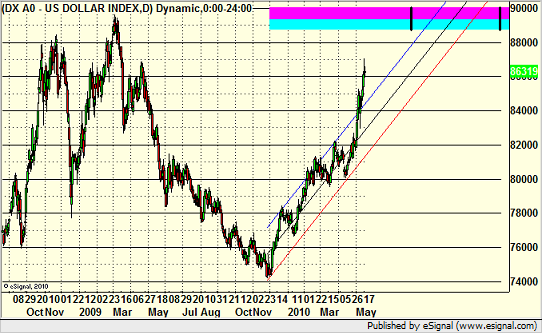

But the power of the MoB is not just that it gives you a price target. It gives you a TIME target as well. In the chart below, which shows about 18 months of US Dollar daily data, the MoB blue and pink line is drawn from the high around 87.00 in April of 2009:

First of all, the thickness of the line suggests that this is a bit stronger of a target than a lot of the MoB lines that we see. Second, note that even drawing that line back a year ago, the line doesn’t start until almost the end of 2009. Also, note the two black vertical lines, which show us the most likely point in time for the level to be hit.

What we found so interesting about this chart is that the regression channel lines off of the lows from last year, which so clearly channeled this move up until we broke out more sharply the last two weeks, also push the US Dollar Index into the MoB during the key time target.

Now that you have a broad cup, a two or three month handle of consolidation would put us back into the regression channel and poised for the final move up.

You can follow us on Twitter for more details by clicking here, or take a free or full trial to our various trade calling and education services here.