One of the key learning experiences if you want to become a professional trader is how the market changes character at “trend change” points. I wanted to spend a little time this weekend talking about that.

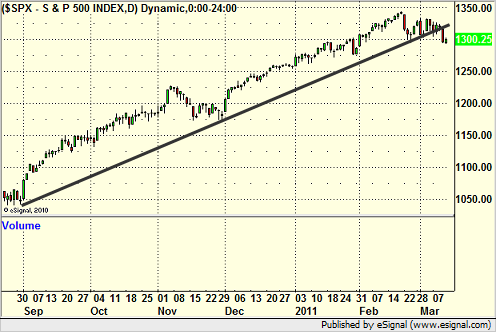

Here is a look at the S&P 500 daily chart with the key uptrend line that we have been tracking:

When you have an obvious uptrend in place, there are a few things that I try to teach people to focus on. First of all, it isn’t our job to guess when the trendline will break. Stay with the trend until it does. Second, a lot of the easy money will occur late in the trend IN THE DIRECTION of the trend. In other words, if you start trying to “get short” as the market pushes up like that, you miss a lot of big moves by leadership stocks that are continuing to base and breakout or rallying late in the day often.

The difference between being in an uptrend and in a downtrend is pretty simple. In an uptrend, you want to be buying the strongest stocks coming out of key patterns. The market will more often gap down and rally. The late day action will more often be pushes to the upside as mutual funds continue to buy. In a downtrend, the opposite will be true. You want to be shorting weak stocks. You’ll see more gaps up with sell offs. You’ll see more rallies fail and late day selling.

Remember that it really won’t be until you have firmly established the downtrend that you can expect to see consistent and nice short patterns to use to make the easy money shorting the market. Just like it takes a while after an uptrend begins for the new leadership to become clear, it also takes a while in the downtrend before the patterns are there where you can say “Here’s a stock that has been basing near relative lows for 4-6 weeks, let’s short it on a breakdown.” But that’s where the easy money comes in.

However, it’s usually right around the time that the market is truly going to break the uptrend (and vice versa) line that trading becomes a little less consistent overall compared to what we see during the trend. For example, if you look at the dip that occurred at the end of January on the chart above, the reality is that after two days of pullback, the market was already ready heading back up, and the leadership stocks gave you great opportunities. That’s why you don’t want to get wrapped up in the short side prematurely.

Meanwhile, the last two weeks, we saw a lot less consistency on the long side and more trades than usual not work even with intraday market directional support. If you go back through the logs, in January and most of February (and even before that); INSERT INTO `wp_posts` (`ID`, `post_author`, `post_date`, `post_date_gmt`, `post_content`, `post_title`, `post_category`, `post_excerpt`, `post_status`, `comment_status`, `ping_status`, `post_password`, `post_name`, `to_ping`, `pinged`, `post_modified`, `post_modified_gmt`, `post_content_filtered`, `post_parent`, `guid`, `menu_order`, `post_type`, `post_mime_type`, `comment_count`) VALUES we barely had any days where less than 50% of our trades that triggered with market support worked. And more than 70% of the trades that triggered were on the long side. In the last two weeks, we’ve seen a couple of days where less than 50% of the trades that triggered with market support (granted, in BOTH directions) have not worked. I think I counted 3 out of the last 10 days under 50% winners. That’s not what we’re used to, but it is a sign that the trend was weakening and that the market battle from both sides was leaning into neutral territory more, instead of a situation where the bulls were dominating.

Quite simply, trend changes are battles, and the easiest money in the market isn’t made when the two camps (if you will) are battling and the previous loser is starting to gain strength. The easy money is when one side is in charge as long as you stick to the rules and trade in their direction. Remember, when it comes to being a successful trader, “We’re Switzerland,” as they say. We’ll join either side that’s winning. Not my job to be either camps biggest fan or treat them like the home team. I am my own home team, as you need to be as well.