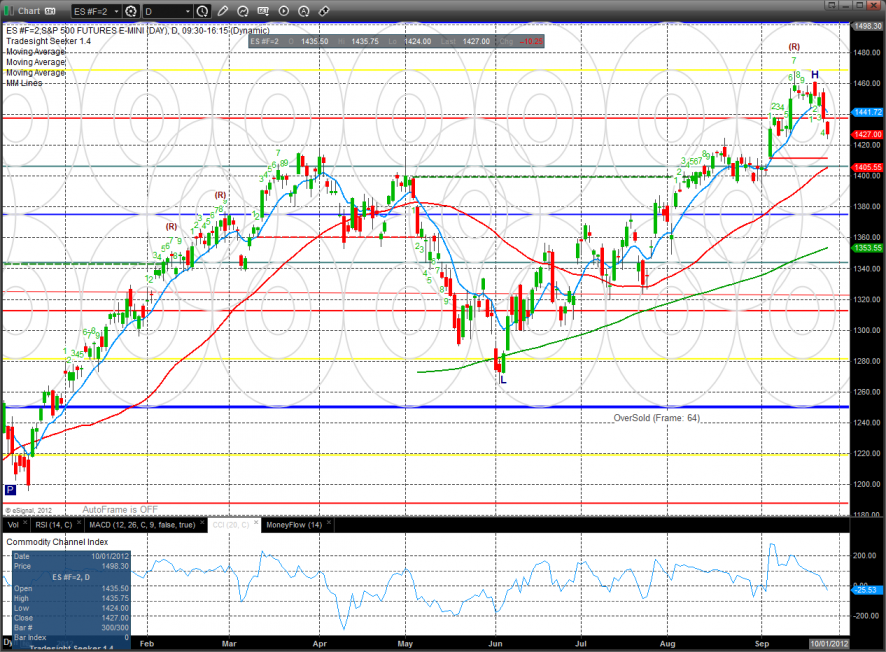

The ES expanded the downside and lost 10 handles on the day. Keep the static trend line in mind for a trade to target on the initial decline.

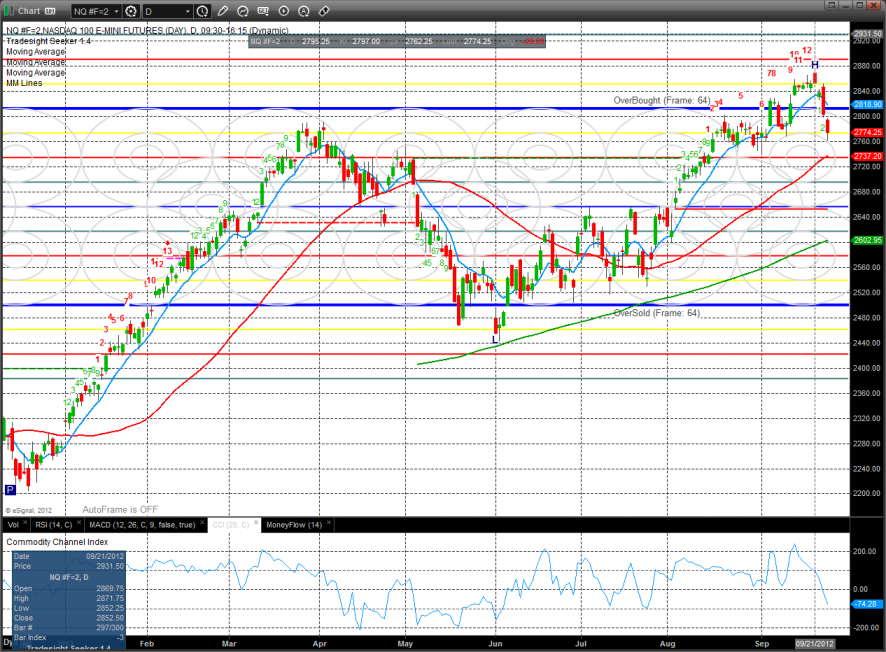

The NQ futures were weaker than the broad market losing 29. Price is below the Q1 breakout and looks poised to tag the 50dma.

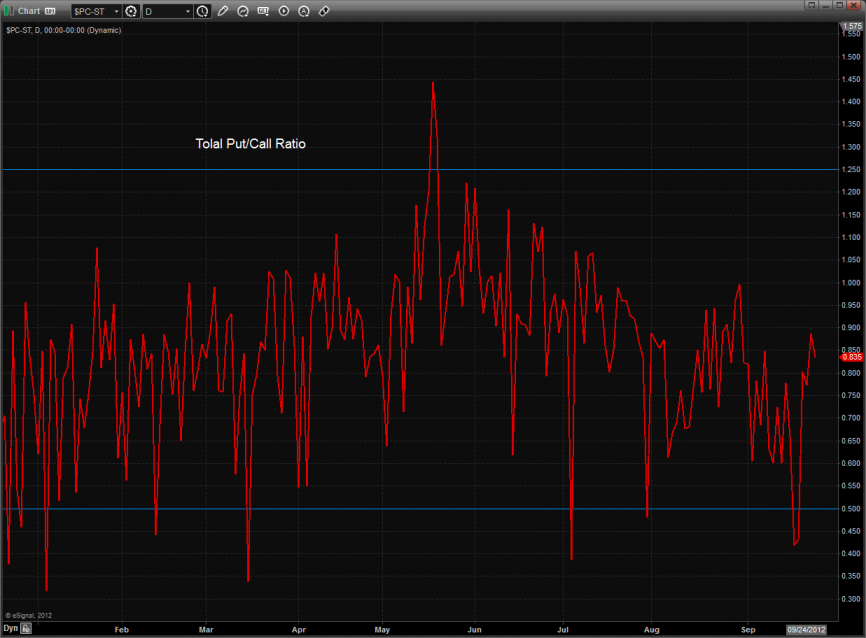

Total put/call ratio:

10-day Trin is on the rise but not yet oversold.

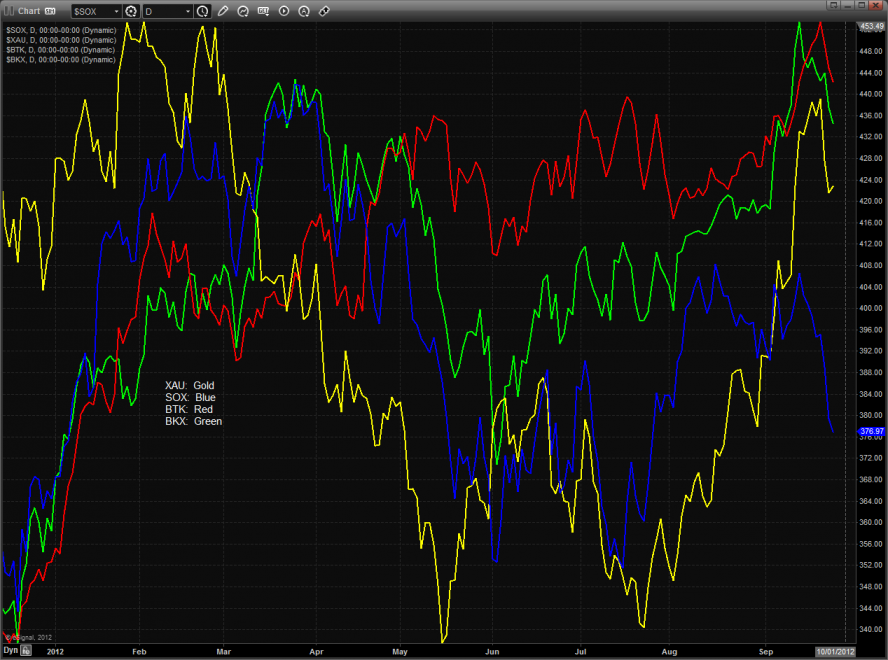

Multi sector daily chart:

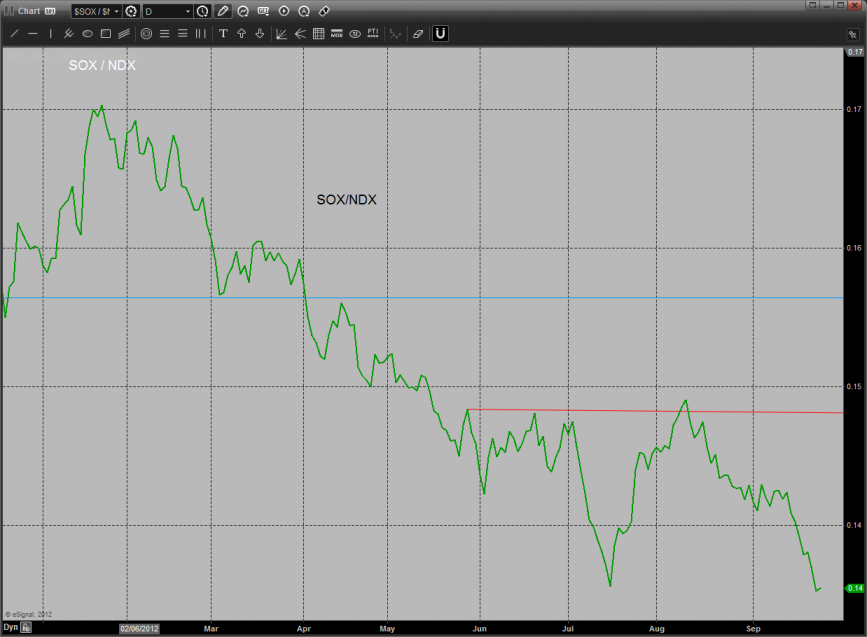

The SOX/NDX is hovering at the prior low. If this breaks and makes a new leg down then the NDX is in big trouble.

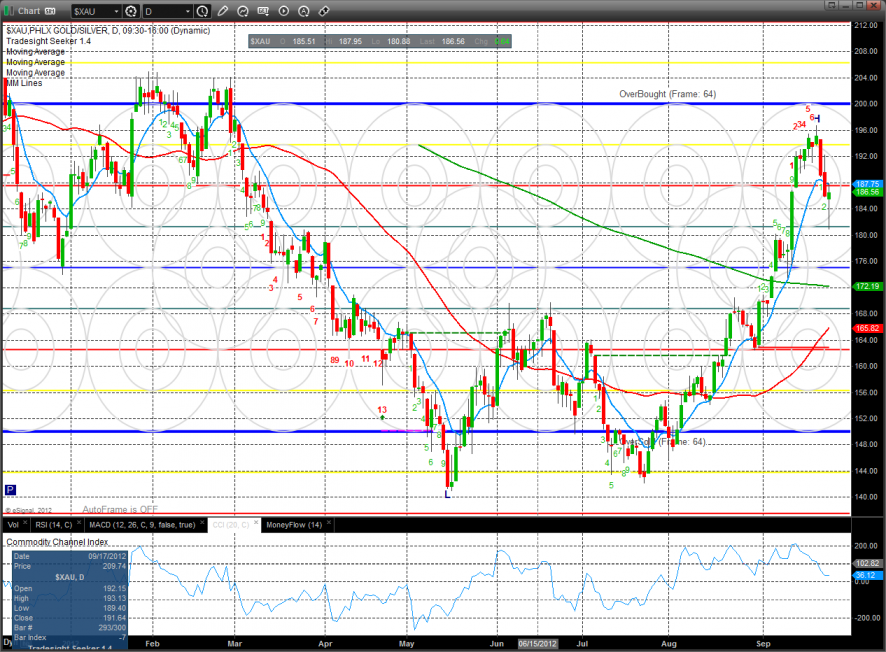

The defensive XAU was the top gun on the day and the only major sector up on the day. A reclamation of the 10ema could begin the tracing out of a handle in the oval pattern.

The SOX was actually slightly stronger than the NDX which is why out ratio chart above didn’t break to a new low yet. 4/8 is key near-term support.

The BKX traded in line with the market. Note the gap just above candle 1 of the most recent Seeker setup count.

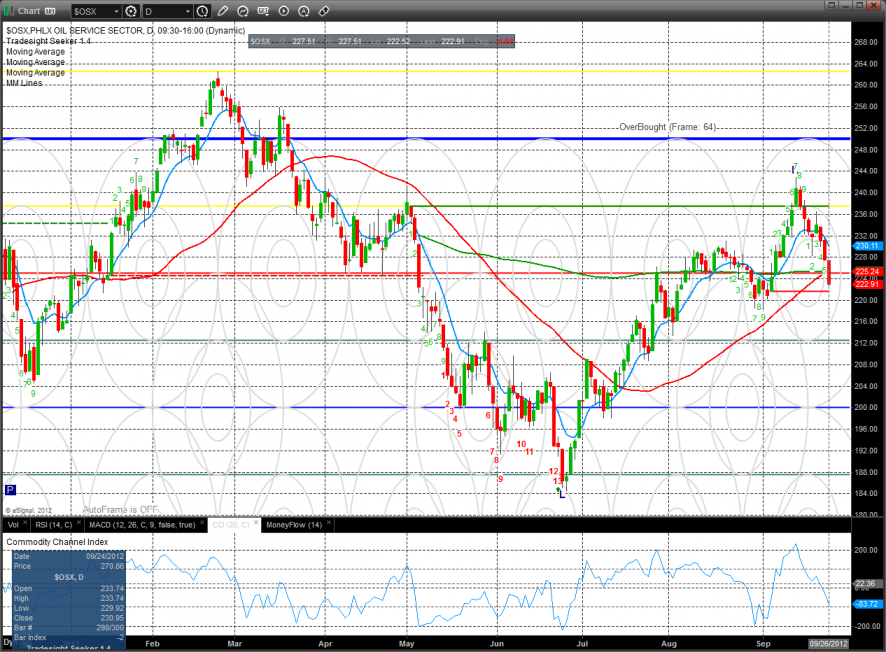

The OSX was the last laggard on the day and is very close to key support at the static trend line. Note that this candle breaks it below all of the moving averages.

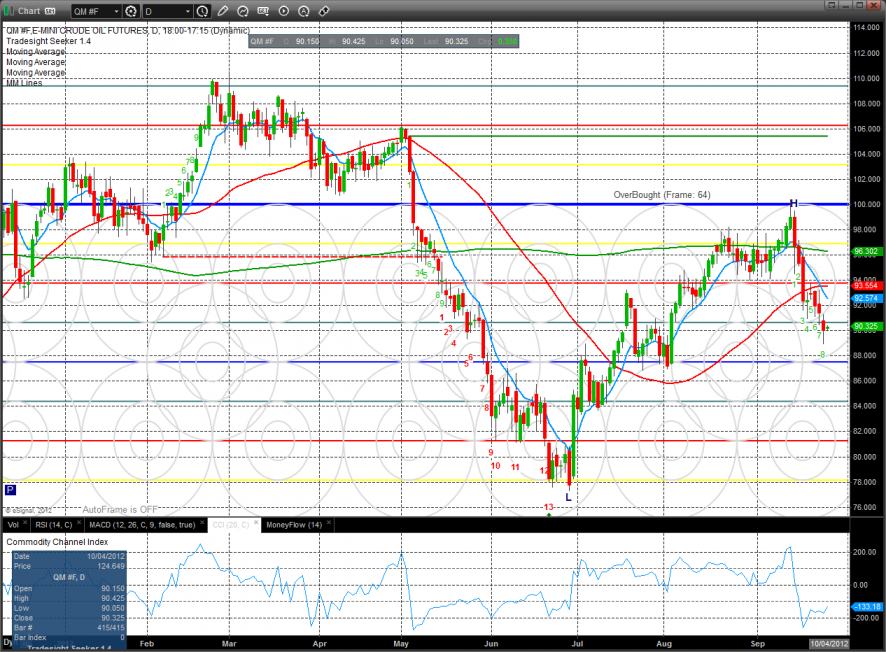

Oil:

Gold:

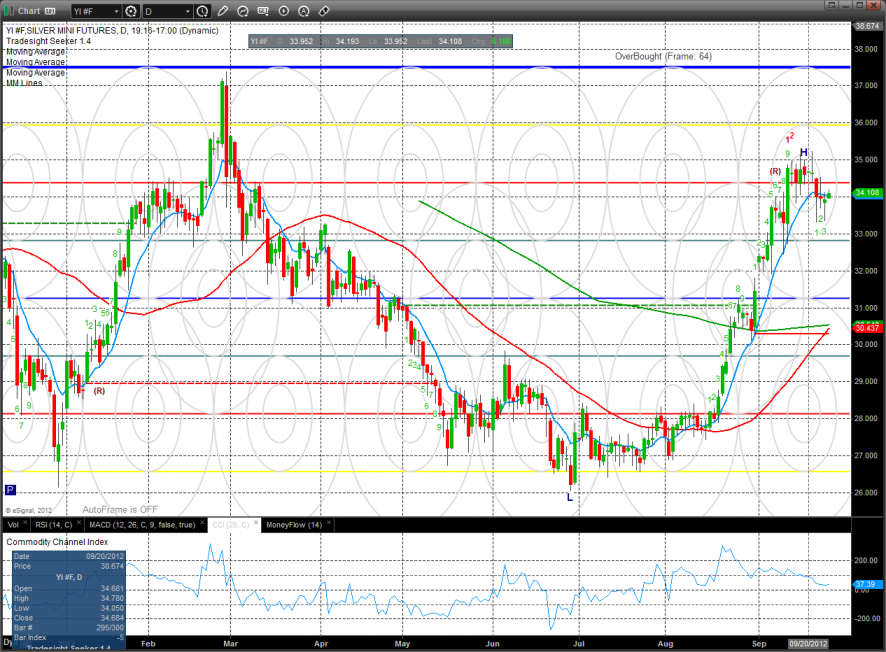

Silver:

TLT: