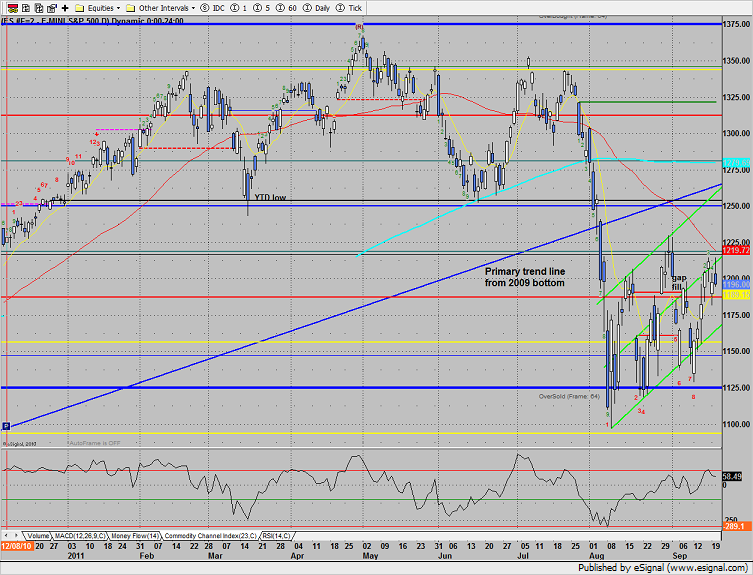

The SP put in a distribution day where it gapped up but closed on the low of the day. Note that price almost tested the declining the 50dma.

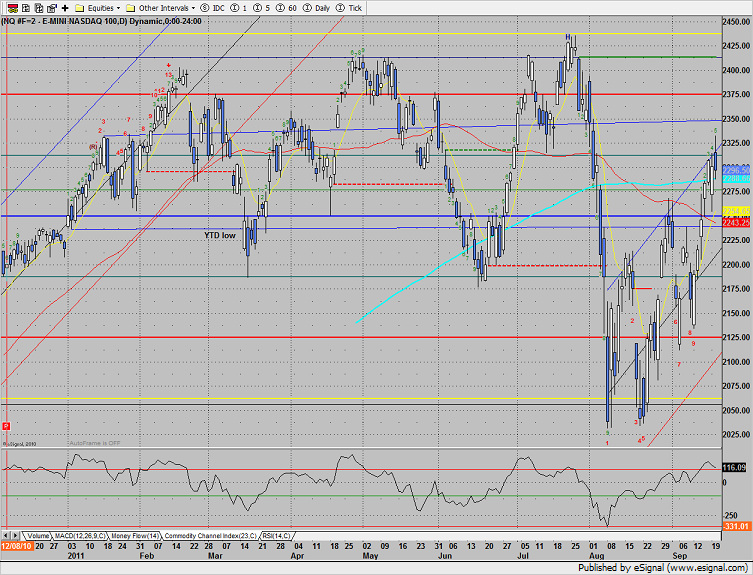

Naz was lower by 4 on the day and put in an ugly range high distribution candle. Price traded above the upper channel but was completely rejected. A held trade under Tuesday’s low should be respected and traders then should start to overweight the short side.

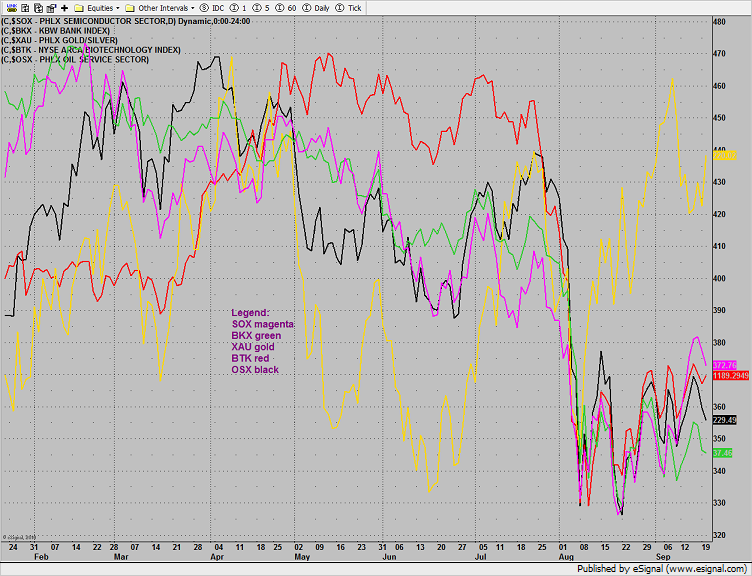

Multi sector daily chart:

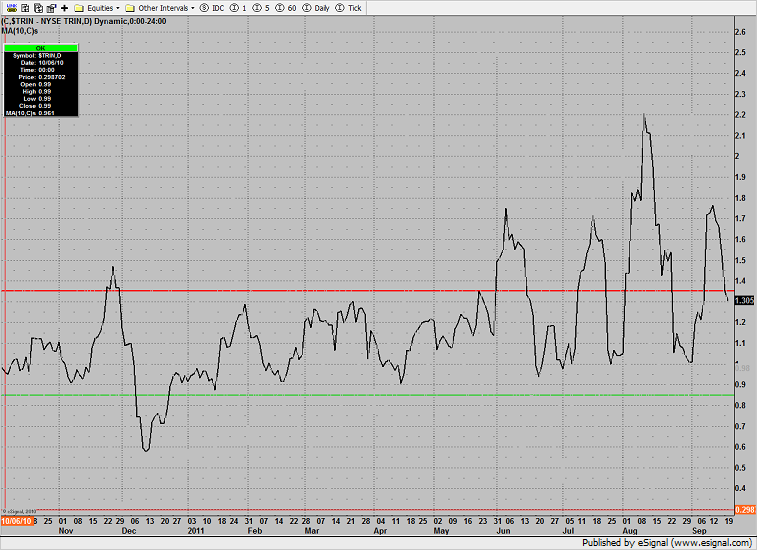

The 10-day Trin has just broken back into the neutral area after spending a week above the oversold threshold.

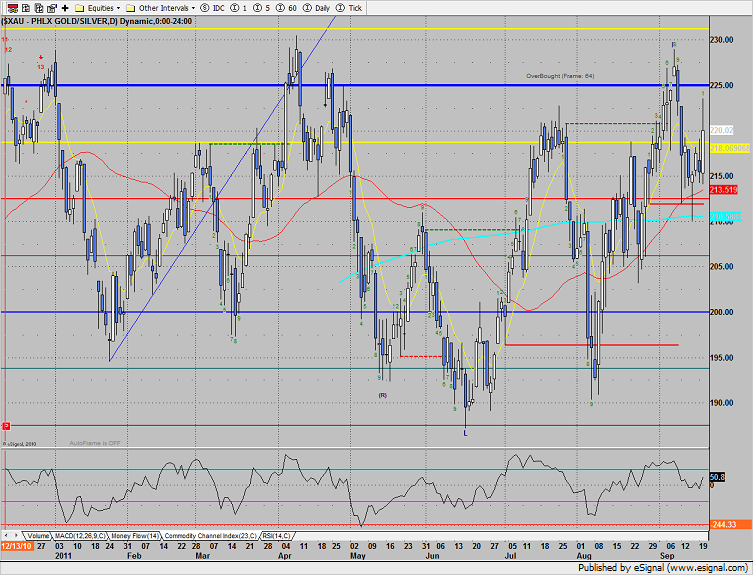

The defensive XAU was the top gun on the day up more than 2%.

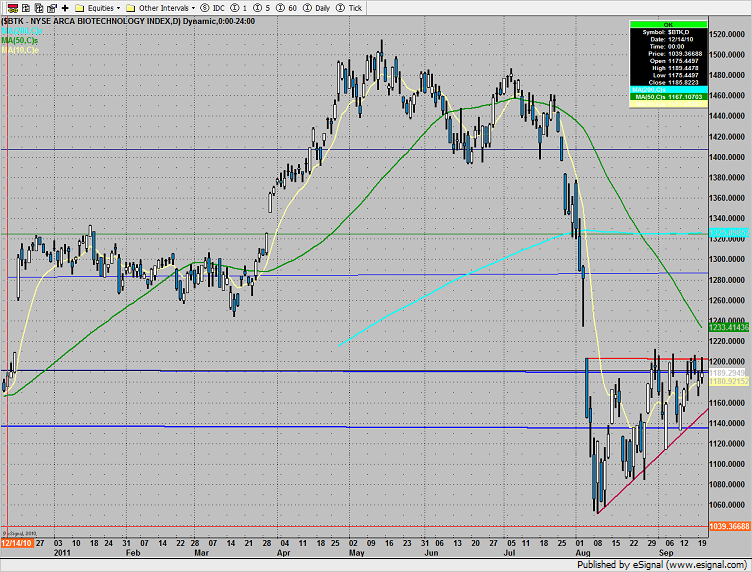

The BTK was the only major Naz sector higher on the day. The pattern is getting very close to its apex.

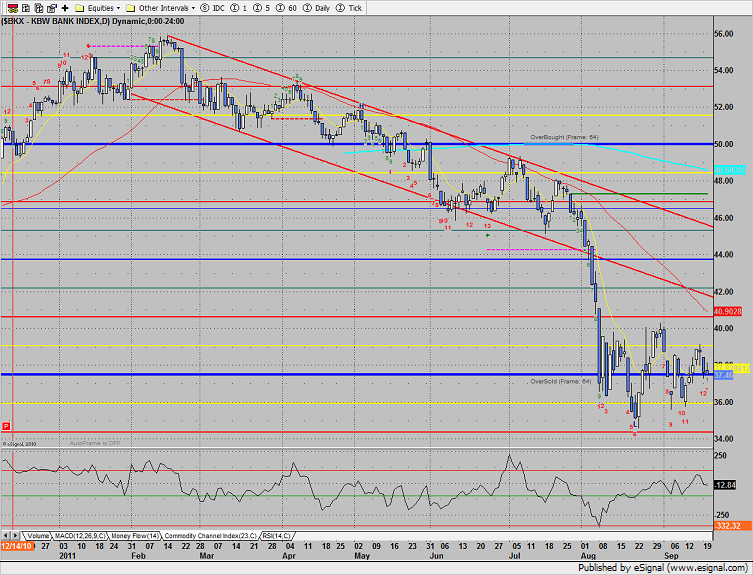

The BKX is still potentially one candle away from a Seeker exhaustion buy.

The OSX continues to muddle in the same pattern. The oil service stocks were weaker than the broad market.

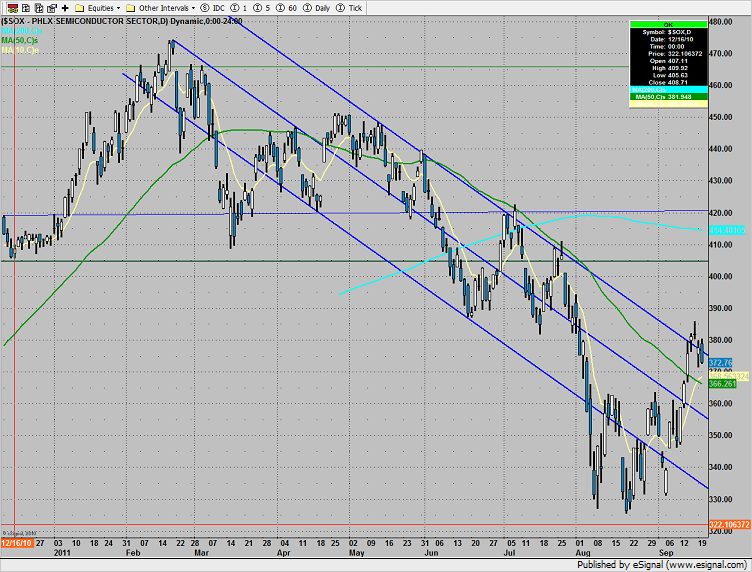

The SOX was weaker than the Naz and is still finding resistance at the upper channel. The 360 area would be a very likely retracement target.

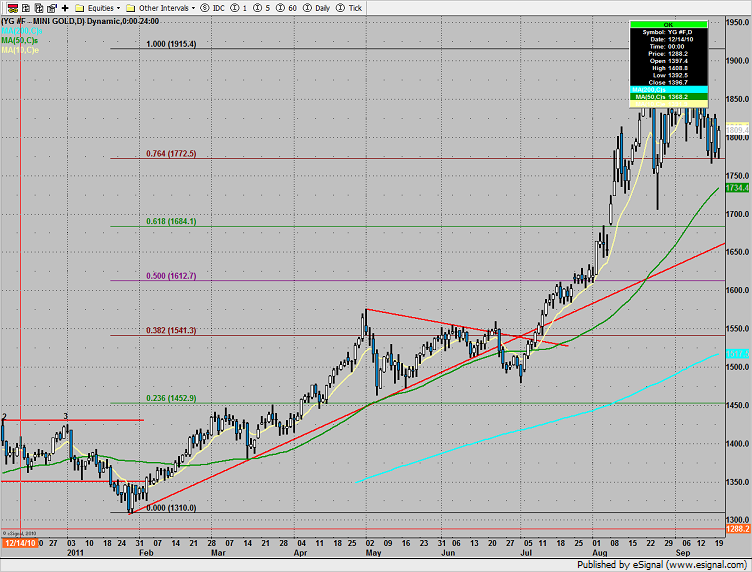

Gold was higher but basically inside the prior day’s range.

Oil traded inside and could be just resting for a bigger move later in the week. Wednesday is the weekly government inventory data.