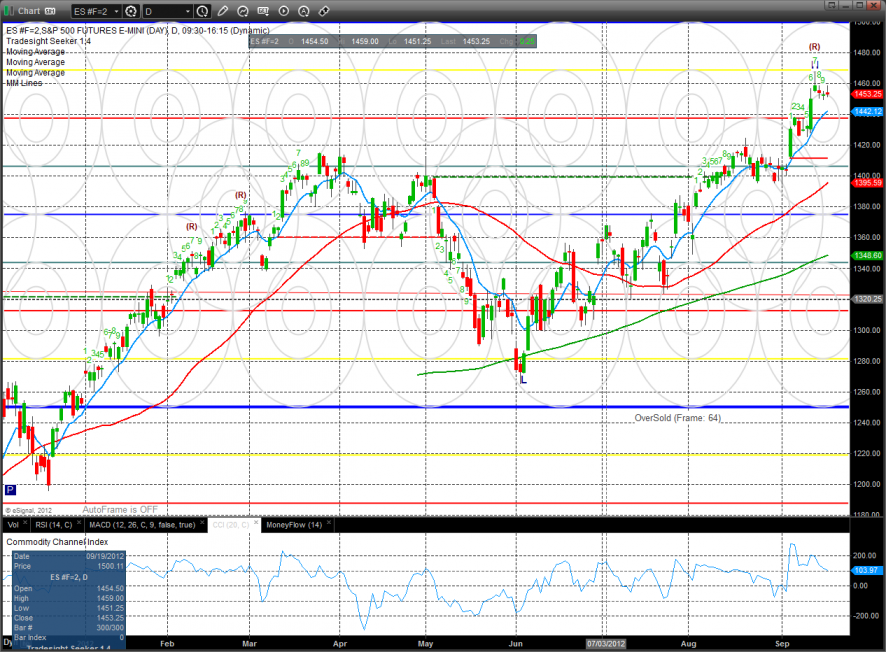

The ES was unchanged on the day and we saw no evidence of options unraveling. Be ready for a bias to develop tomorrow after 60mins into the session.

The NQ futures are also in the waiting room for expiration. Note that the Seeker pattern is now 12 days up.

10-day Trin:

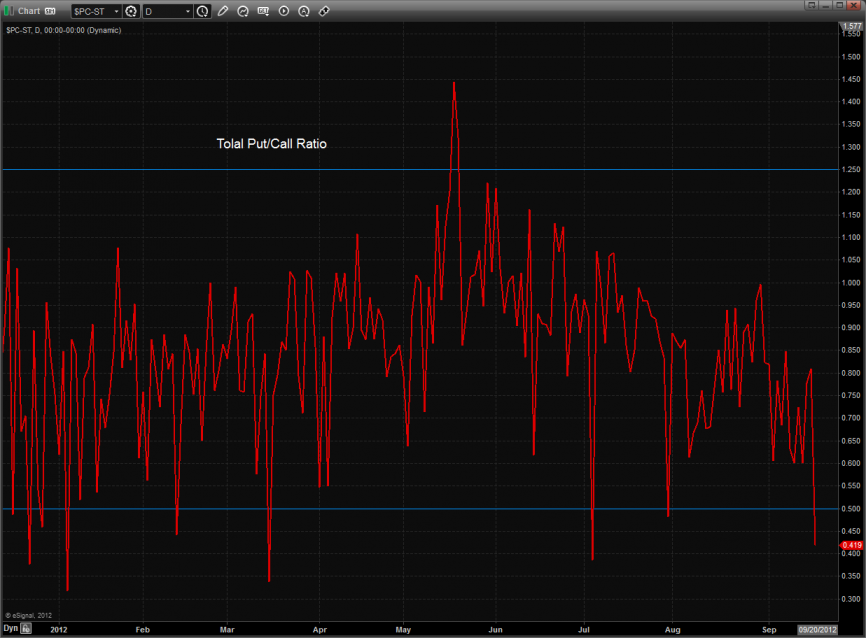

The total put/call ratio has recorded a climatic reading and is overbought:

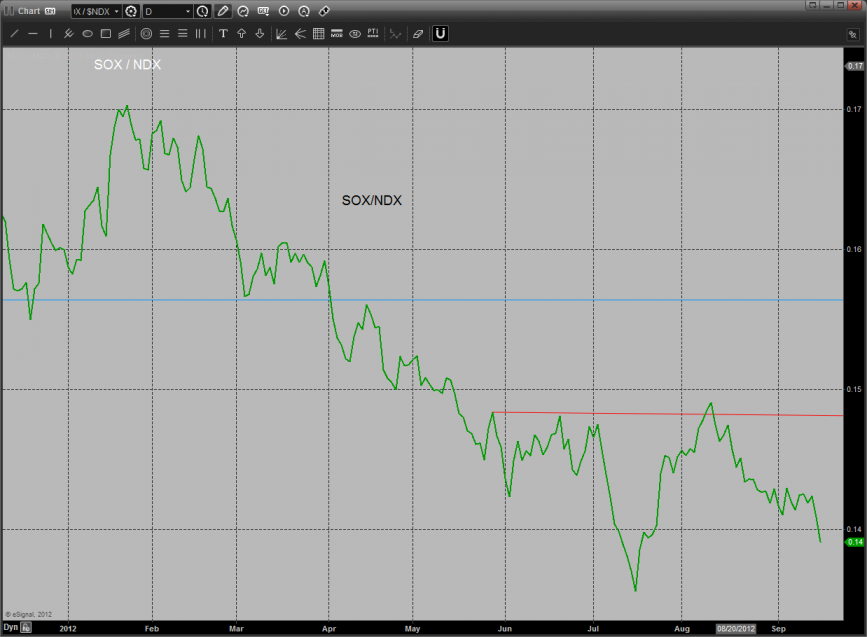

The SOX/NDX cross still looks terrible and is real cause for concern to the NDX longs.

The SPX/TLT took a big hit in favor of bond safety over equity exposure.

The XAU made a new high on the move clearing the 7/8 level. 8/8 is next and also the area of the prior highs.

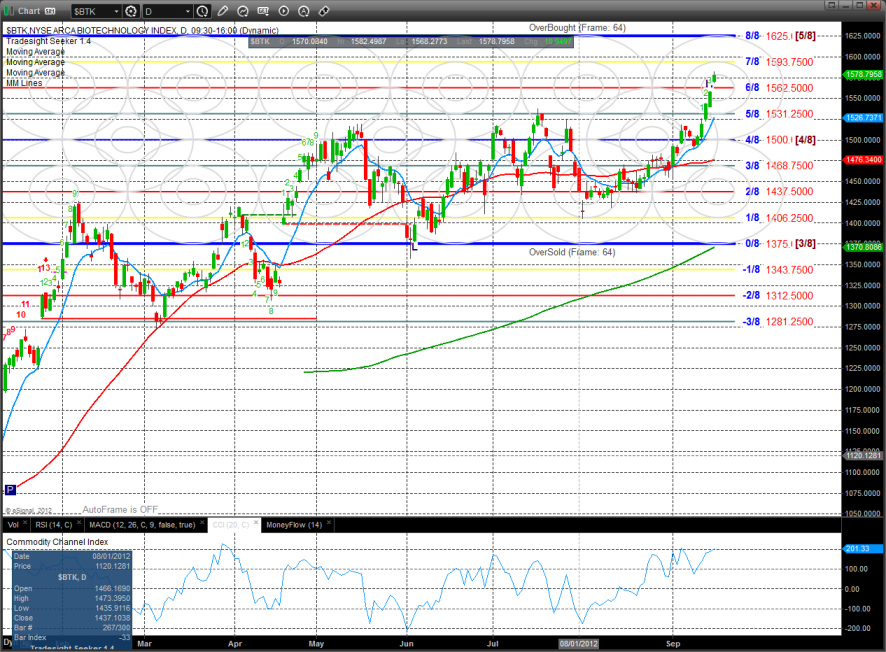

The BTK extended the run and is driving towards the next overhead at 1593.

The BKX was a little higher on the day and should find support at the 8/8 level on the retest. If that area fails to hold it will be a false breakout and real trouble for the pattern.

The OSX gapped lower and settled right at the 10ema. If we get a settlement below the 10ema the trend will turn short-term negative.

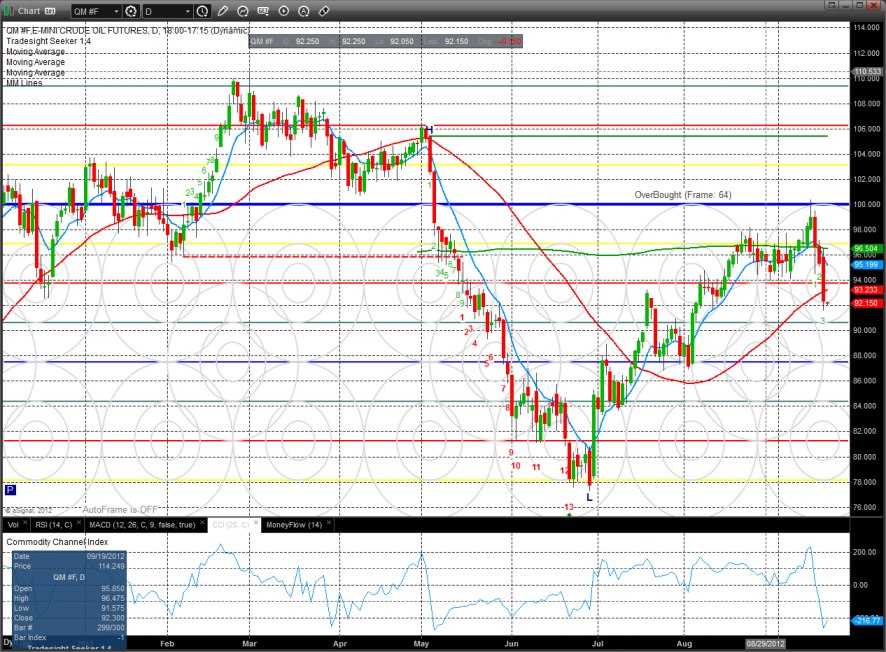

Oil broke hard and settled below all of the major moving averages. The 4/8 level could be a reasonable target.

Gold:

Silver: