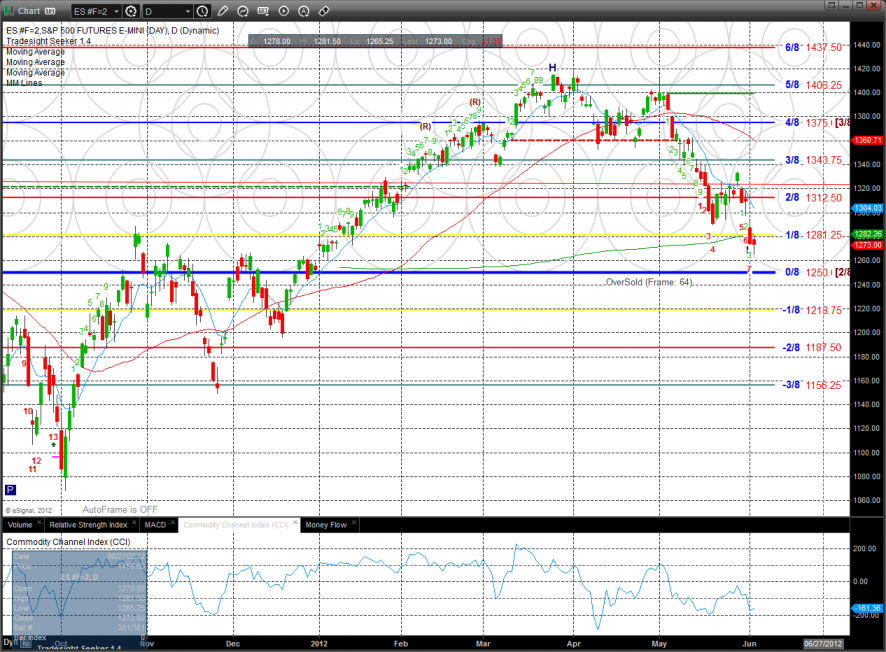

The ES wandered around on the day, expanded the range and settled lower on the day by one handle. This is the second close in a row below the 200dma. Note the important level of support just below at the 0/8 level.

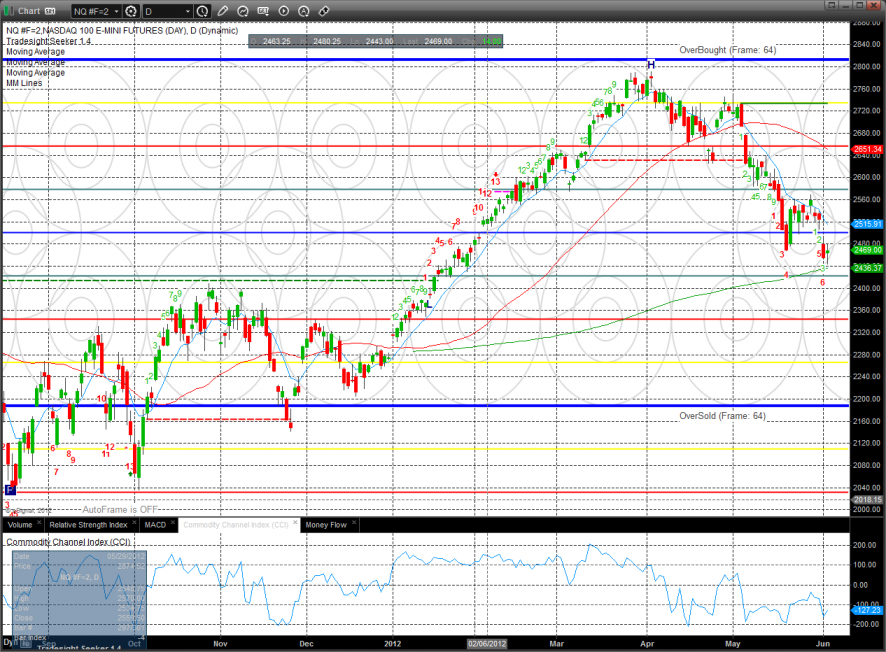

The NQ futures closed right in the middle of Friday’s real body and remain relatively strong vs. the SP side because the 200dma is still below. The 200dma is very key support and will likely be gamed once traded.

10-day Trin remains neutral but climbing.

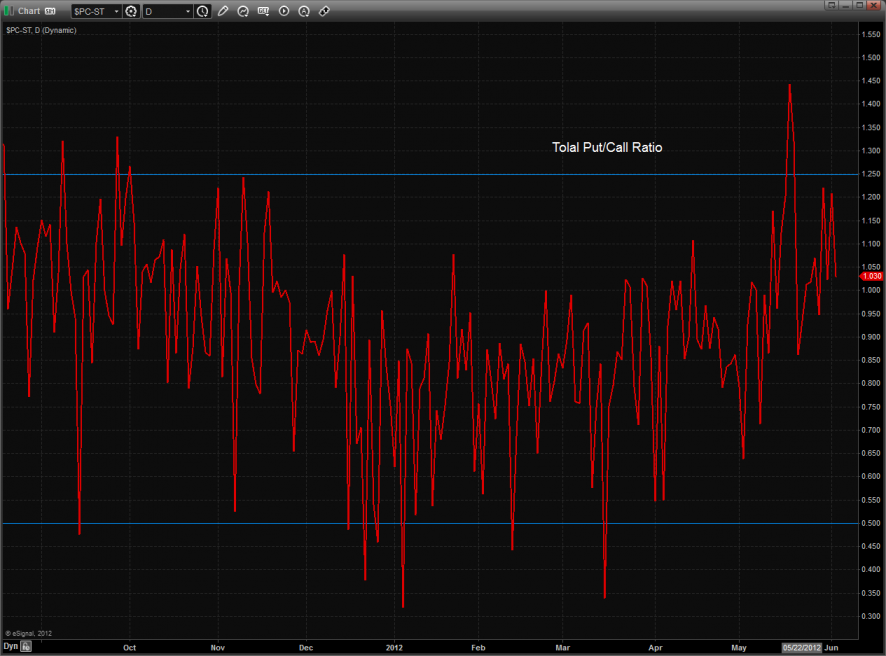

Total put/call ratio:

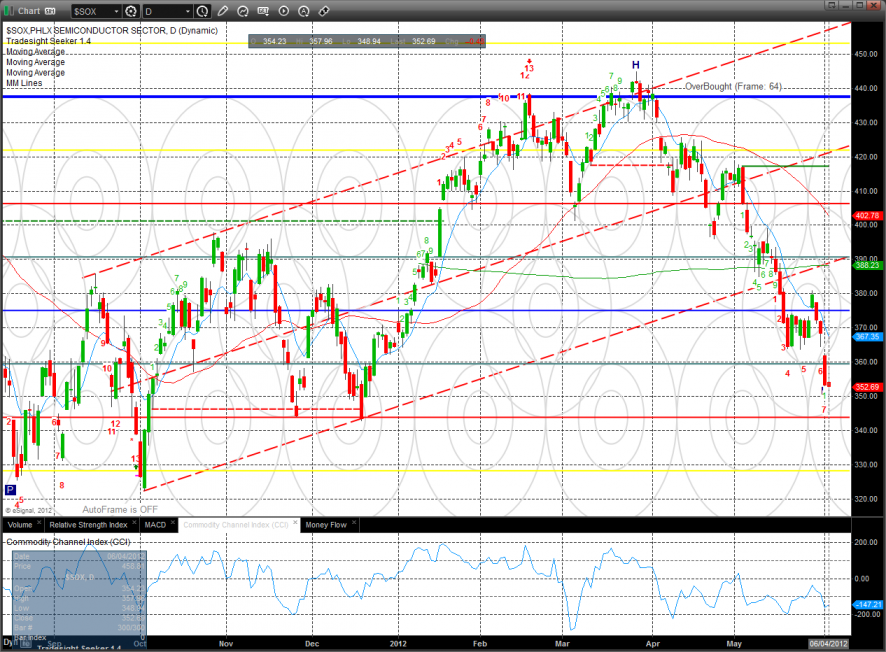

Multi sector daily chart:

The defensive XAU was the top gun. Note that the static trend line is a very big level and taking it will turn the chart to intermediate term positive.

The SOX was the strongest Naz sector and is now 8 days down on the Seeker count.

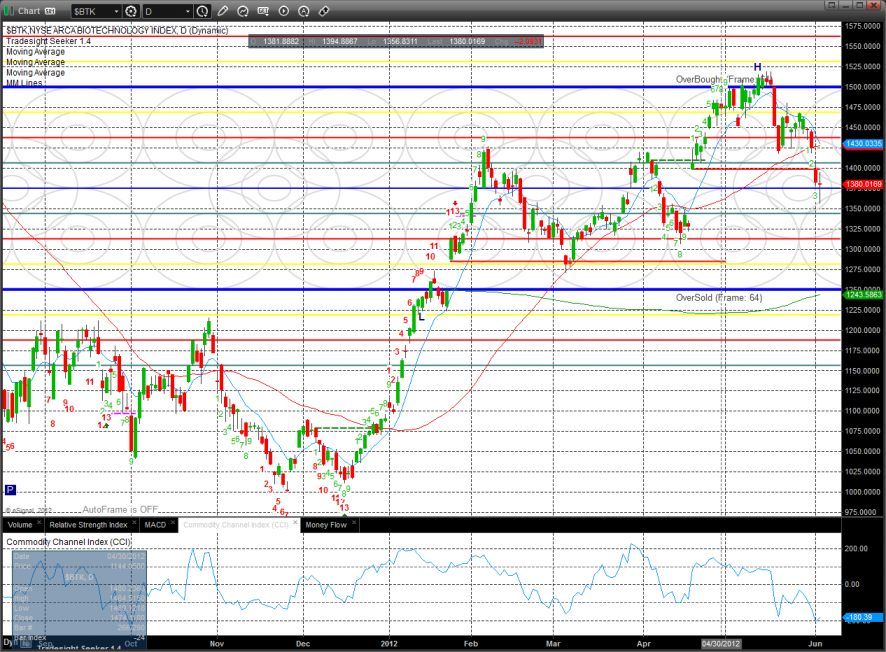

The BTK was unchanged.

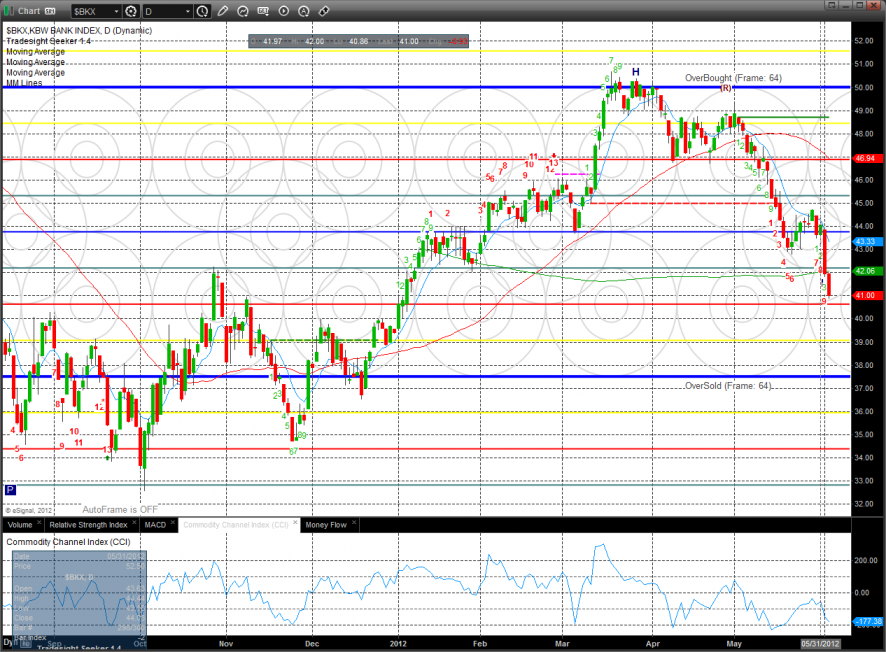

The BKX was the weakest major sector on the day and decisively broke below the 200dma. This chart looks bad but us already 10 days down in the seeker count.

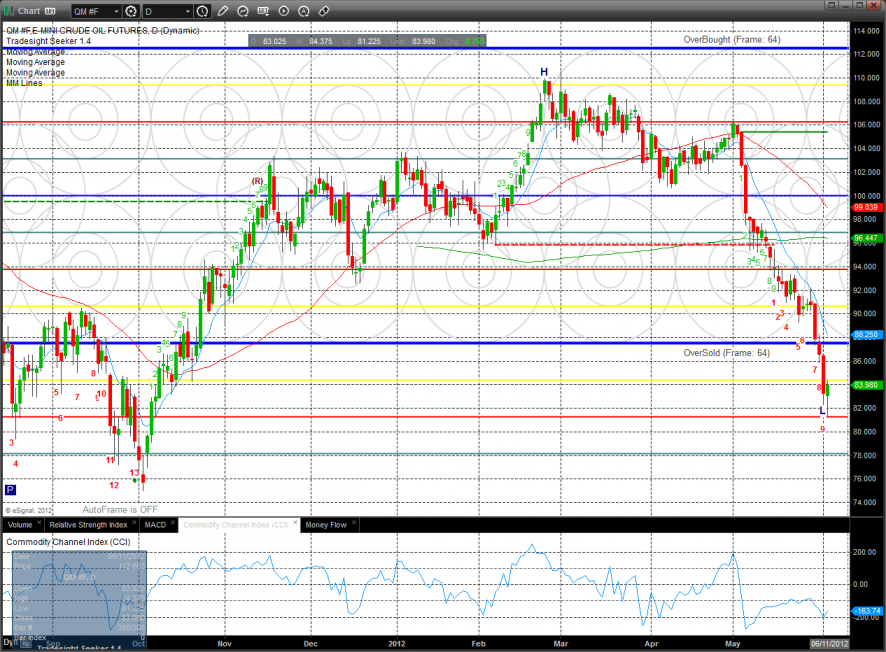

Oil

Gold:

Silver: