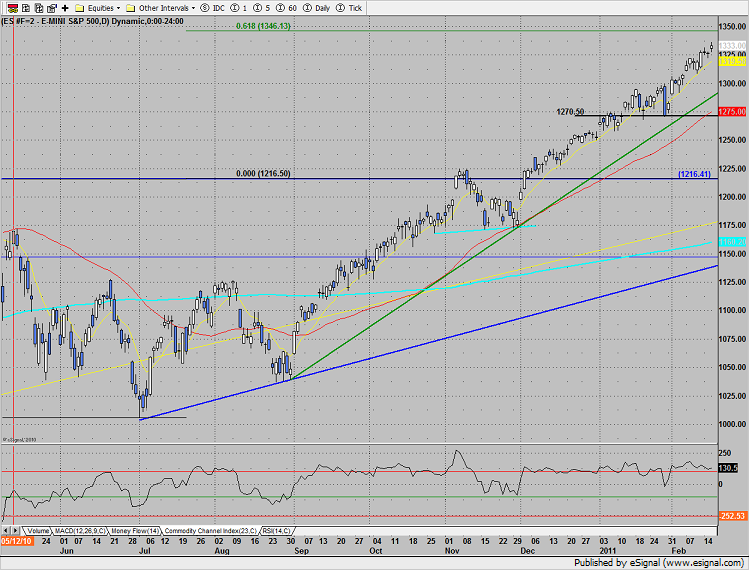

The SP added 6 handles to the advance, making a new high. A measured move target has been added to the chart by applying Fibonacci extensions from the July low to the 1216.50 breakout. 1346 is the first level.

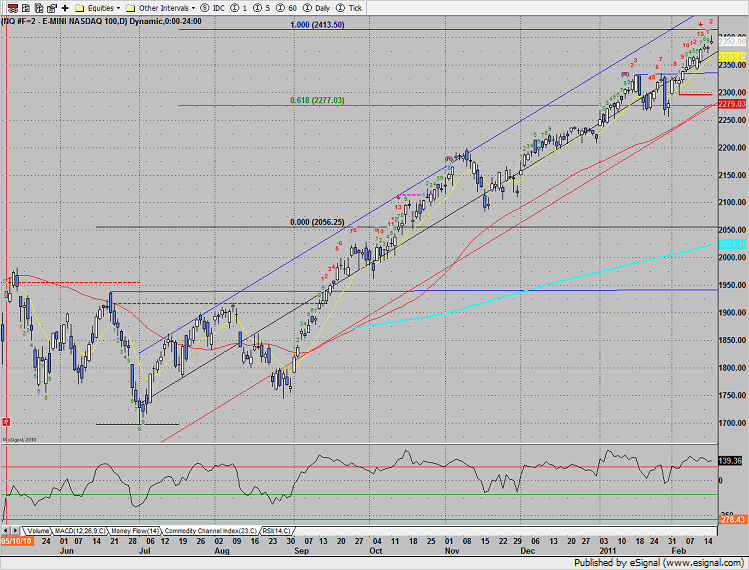

Naz was higher by 10 but settled near the low of the day. The Seeker exhaustion signal is still active and the 100% measured move target is just overhead.

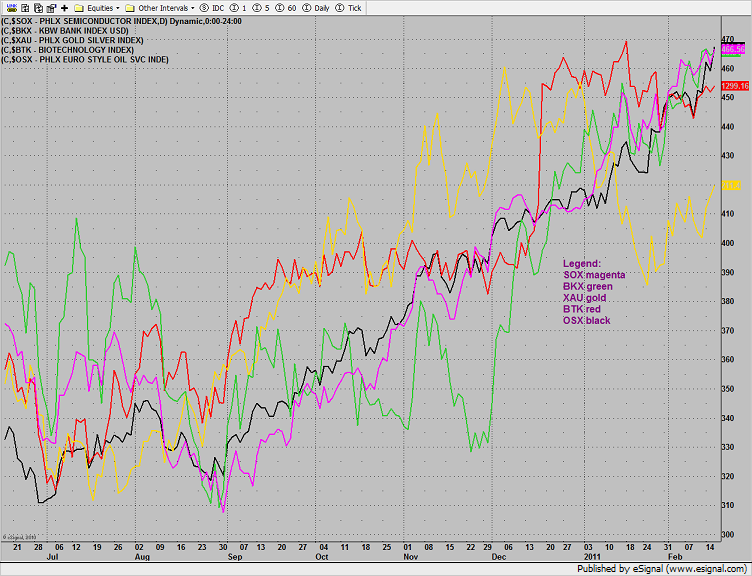

Multi sector daily chart:

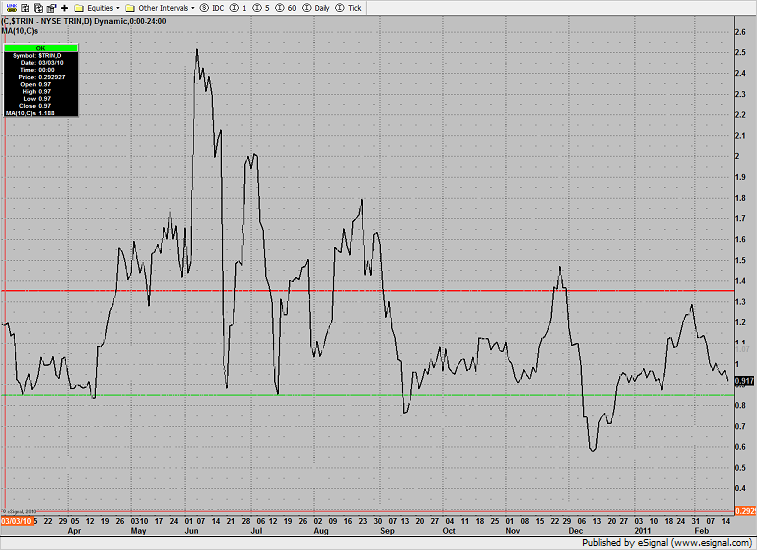

The 10-day Trin is getting close to the 0.85 overbought threshold.

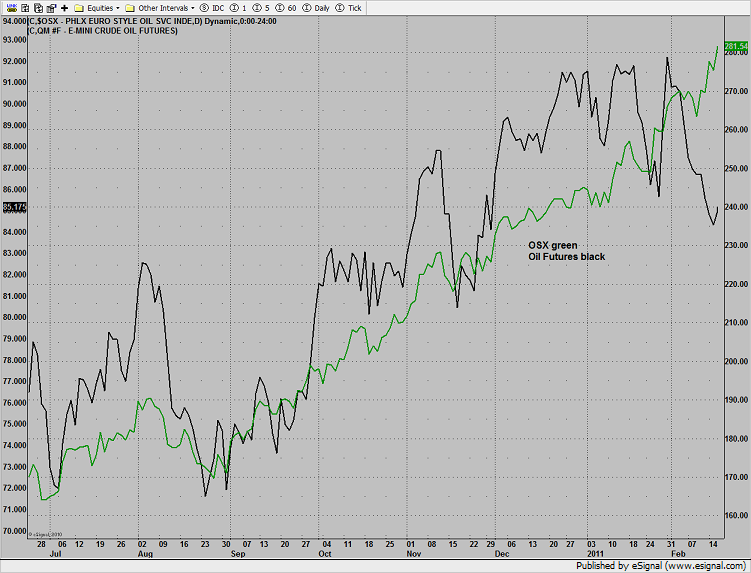

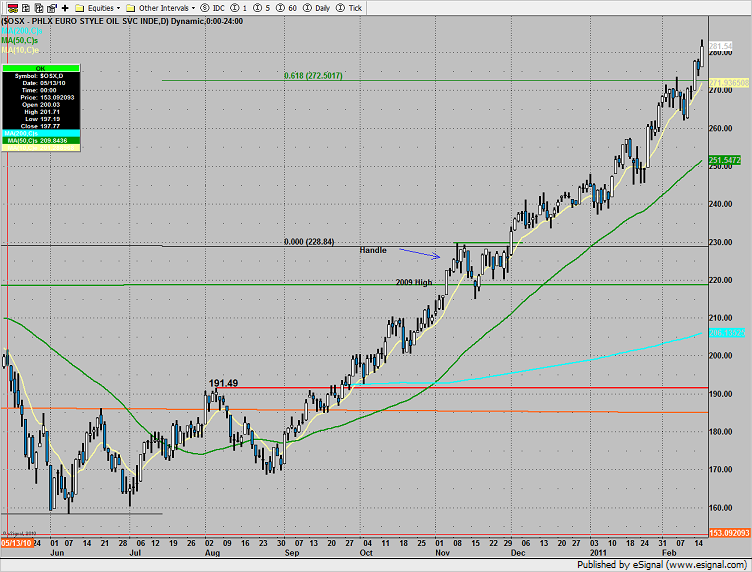

The OSX was top gun up more than 2%. Keep in mind that the pattern has the look a completed 4 bar trend termination formation but the first day of the pattern, 3 days ago, was not an up day which technically disqualifies the signal.

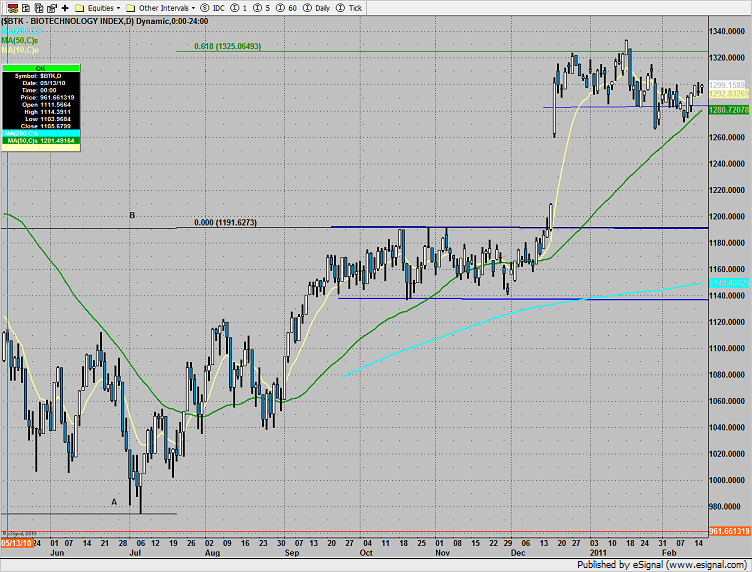

The SOX outperformed Naz and closed right at the 62% fib.

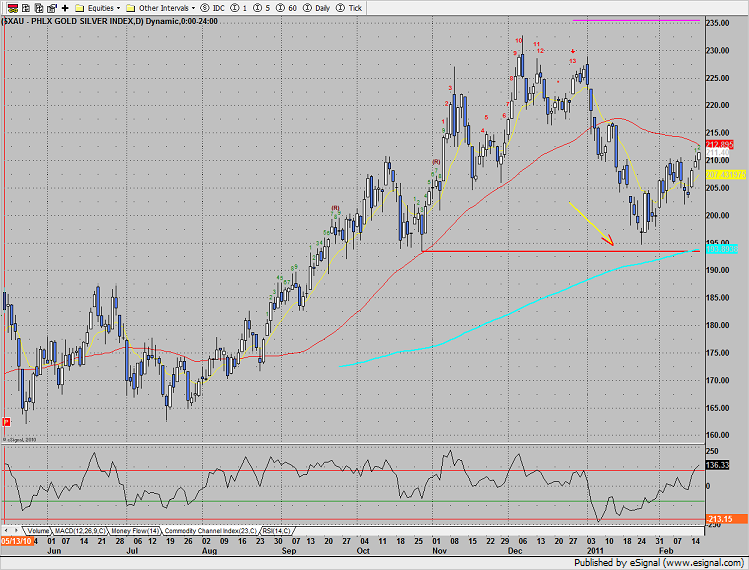

The XAU closed at the high of the bounce and is very close to the 50dma target.

The BTK remains boxed up:

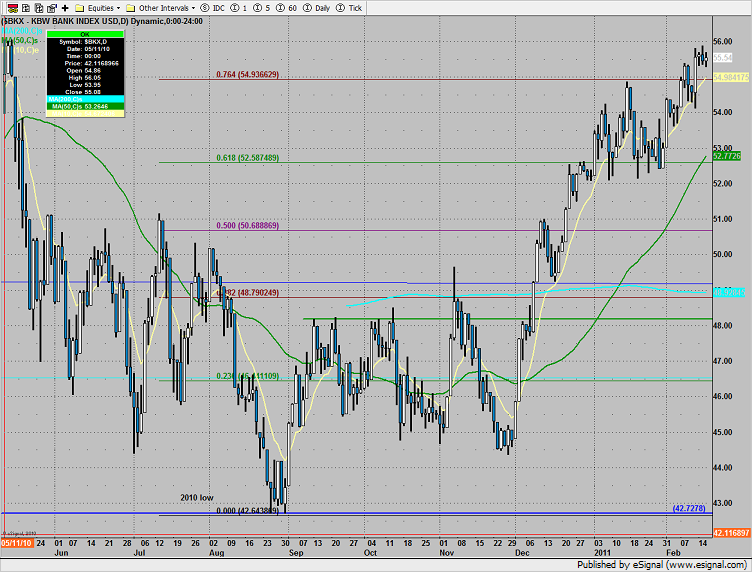

The BKX was the last laggard, still in the very tight 3 day range.

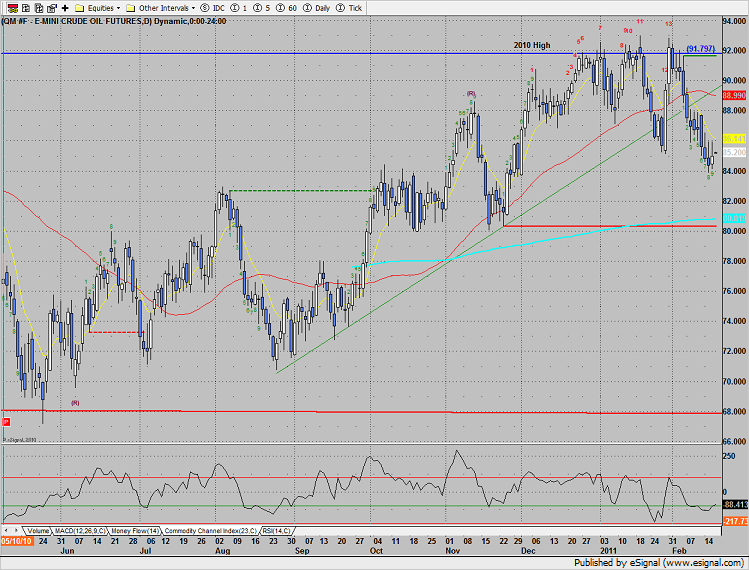

Oil completed the minimum 9 days down for a Seeker buy setup.

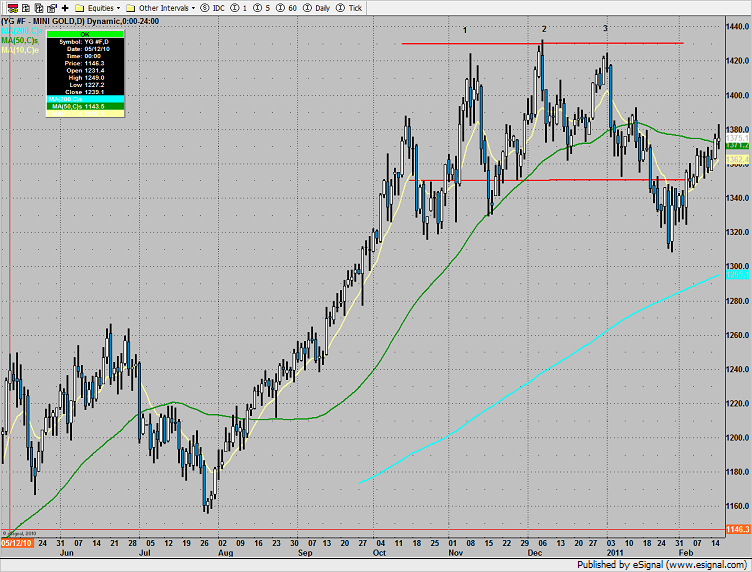

Gold is back at the 1375 level:

The crude vs. OSX spread remains very wide, stay on guard for a convergence move.