The ES posted a wide ranging day where price settled glued to the key 1312.50 level. Keep in mind that the active static trend line just overhead. Monday was the first day of the new options cycle and there is a two day fed meeting beginning on Tuesday so while there was little overall price bias expect one to develop by midweek.

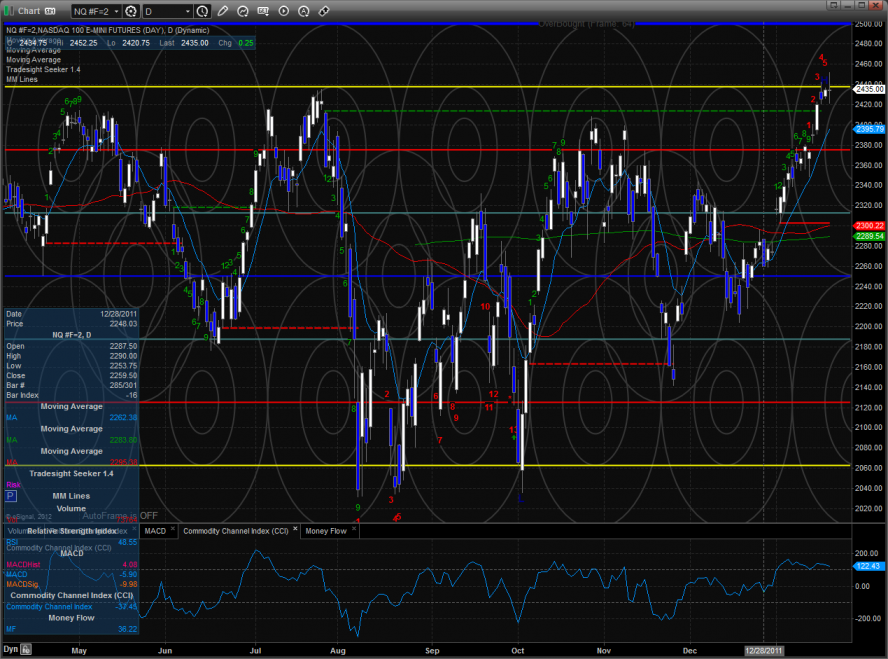

The NQ futures made a new high on the move but left a wide range doji on the chart. Price has not been able to do much with the break over the July highs.

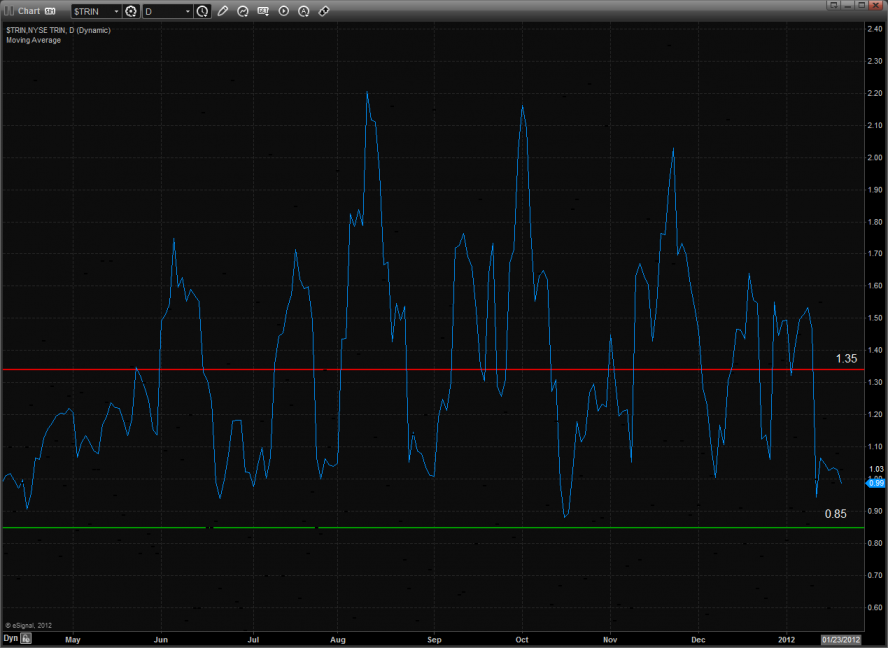

The 10-day Trin still has not yet recorded an overbought reading of 0.85 or lower.

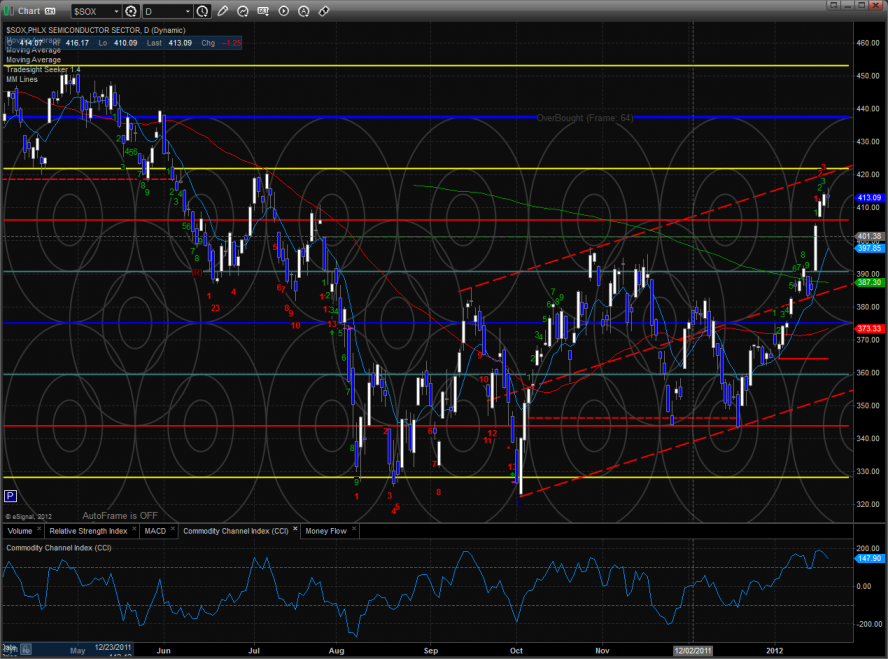

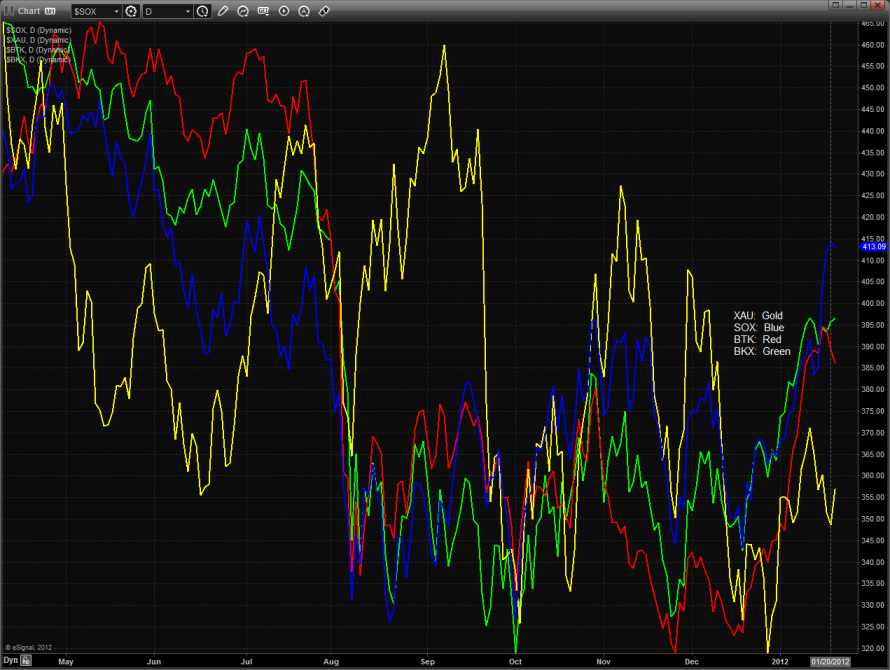

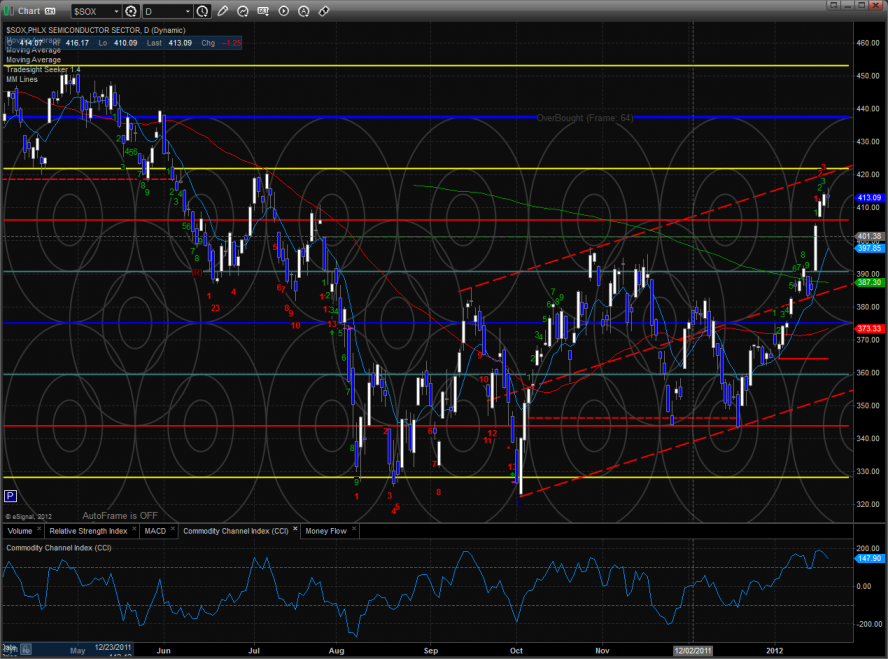

The multi sector daily chart shows the good relative strength of the SOX.

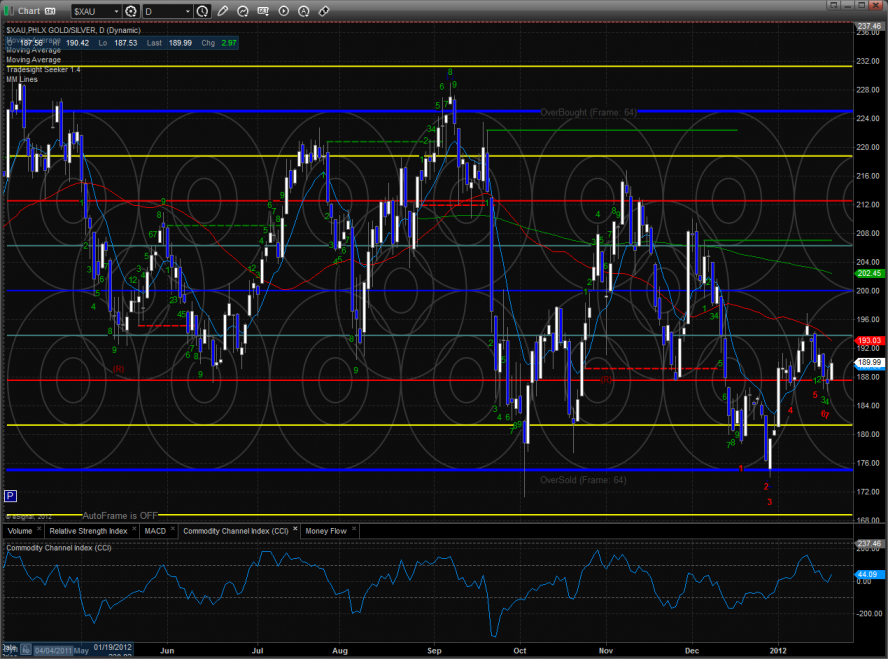

The XAU was the top performer of the day reclaiming the 10ema.

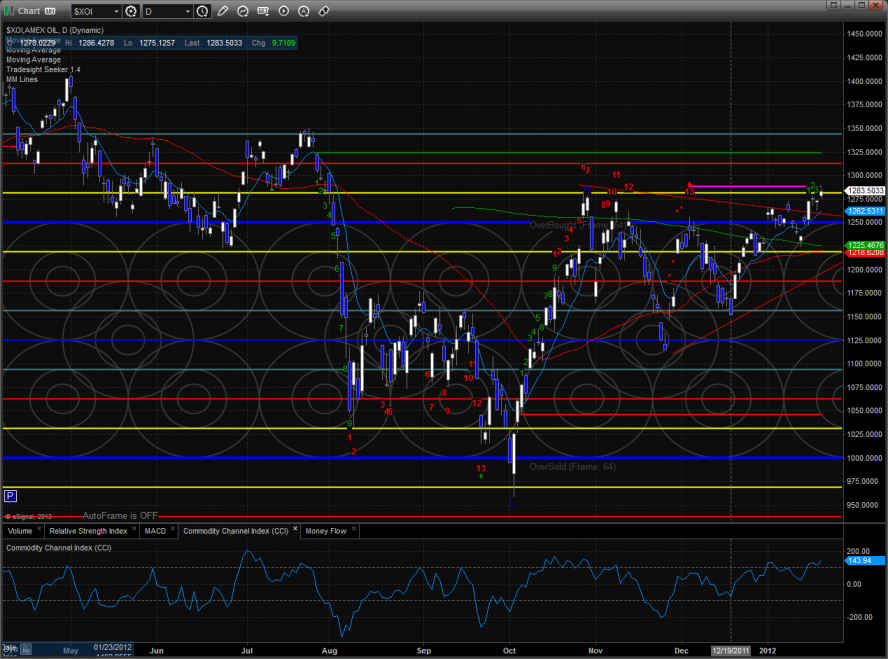

The XOI was much stronger than the broad market with good relative strength in the gas stocks. Keep a close eye on the risk level of the active Seeker sell signal.

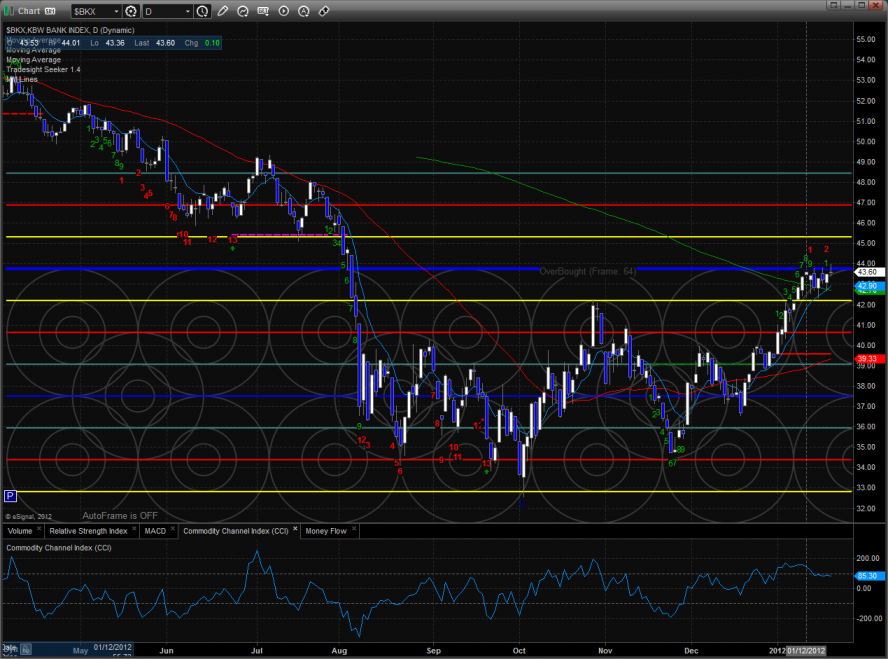

The BKX remains boxed up and below the 8/8 level.

The SOX settled within the prior day’s real candle body. Higher prices, near the upper trend channel, were recorded but rejected. Note there is a good deal of room between the close and the 10ema for a large pullback.

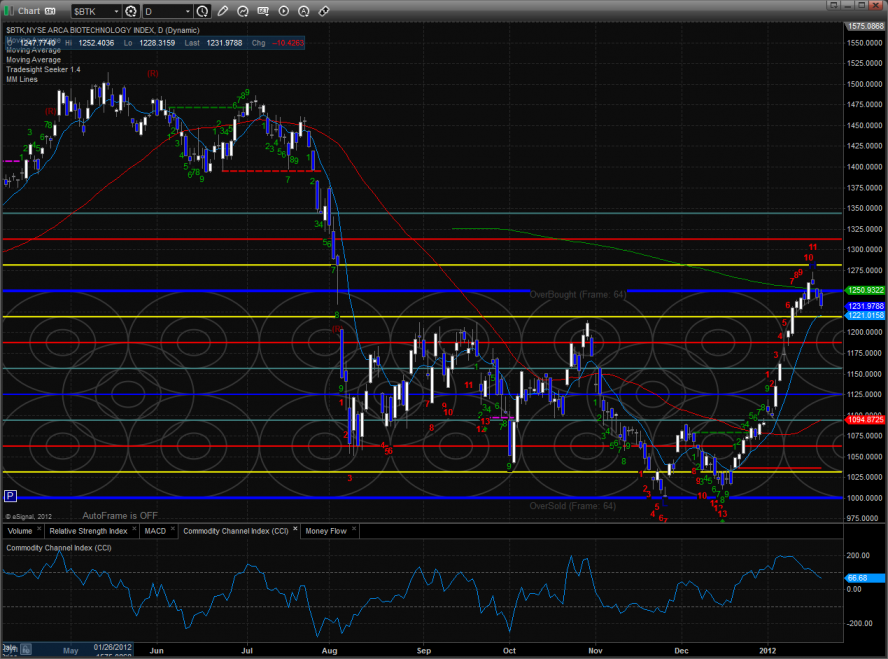

The BTK was one of the worst laggards. The Seeker count remains 11 days up.

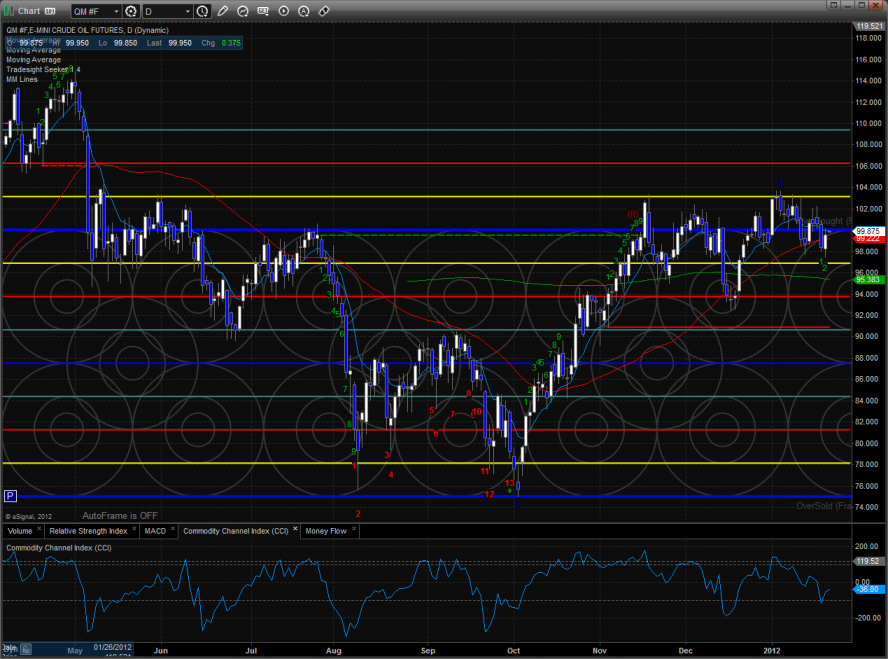

Oil:

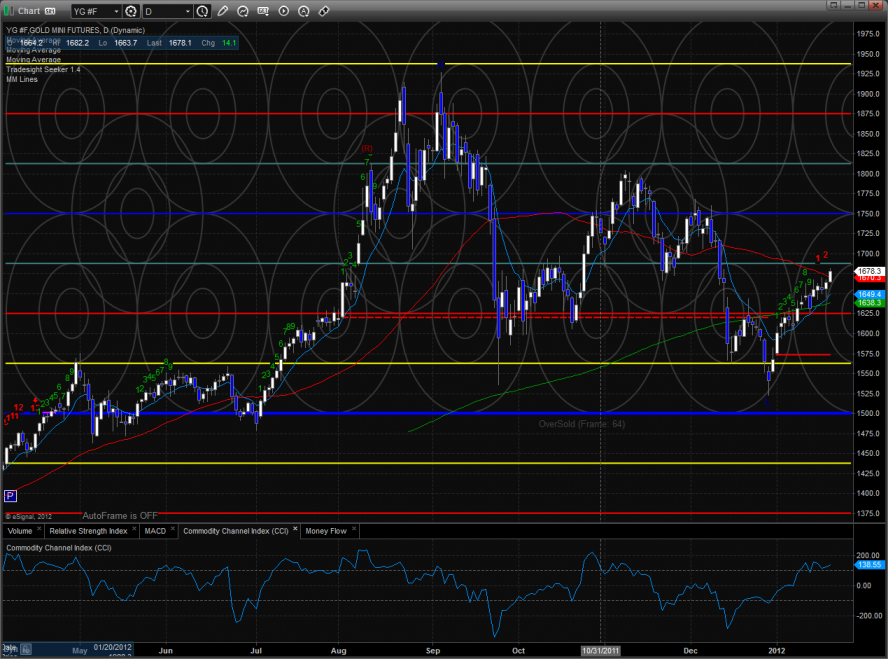

Gold: