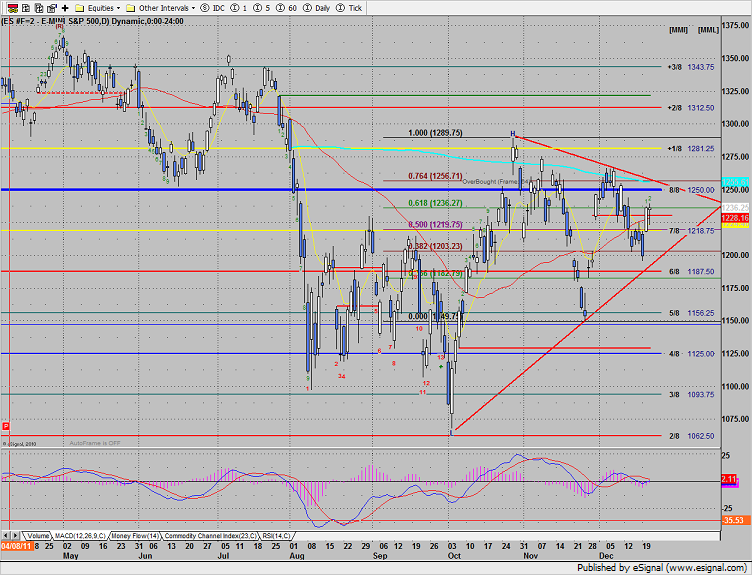

The ES was a wild ride, ultimately squeaking out a fractional gain. Note the large triangle that price is tracing out. Key overhead remains at 1250 where the 8/8 level sits.

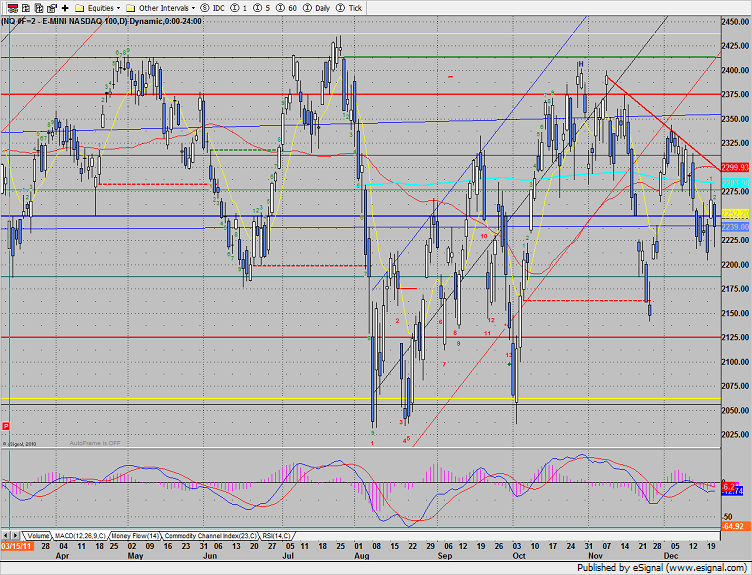

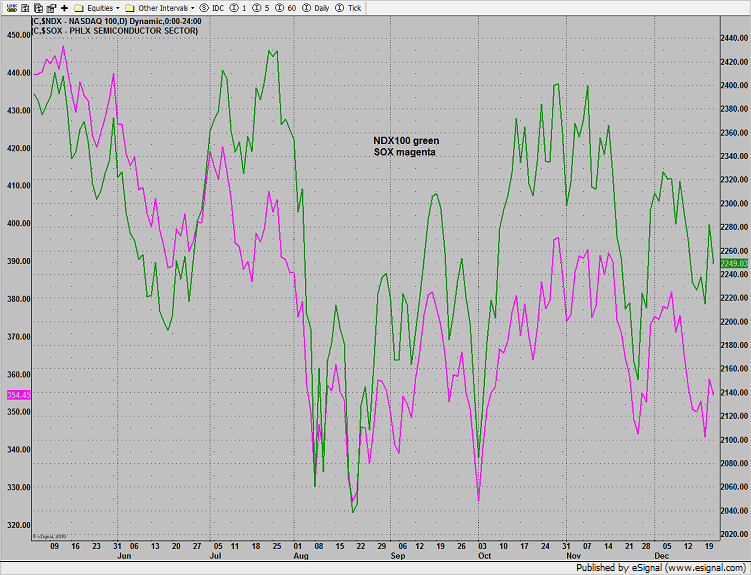

NQ futures got hit very hard and didn’t recover nearly as well as the broad market side. Price remains below the active DTL.

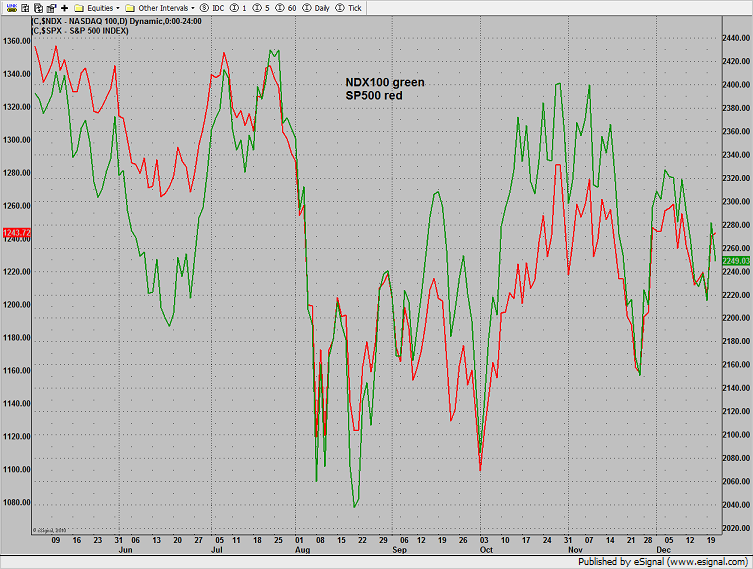

The performance divergence between the SPX and NDX is very important because the NASDAQ stocks usually lead the broad market SPX. Be sure to reevaluate this relationship next week after the dust settles.

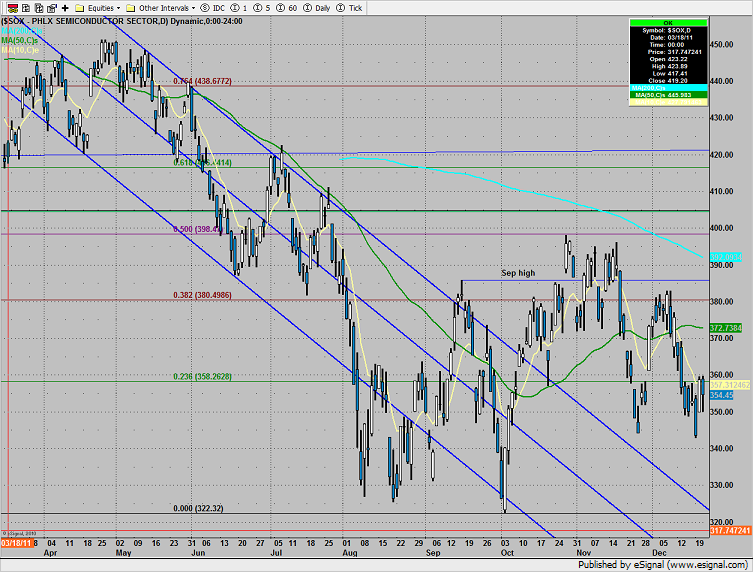

The SOX is also lagging the NDX which is usually an overall bearish condition.

The BKX was top gun on the day, unencumbered by weakness in tech. Keep a close eye on the upper DTL in the triangle pattern.

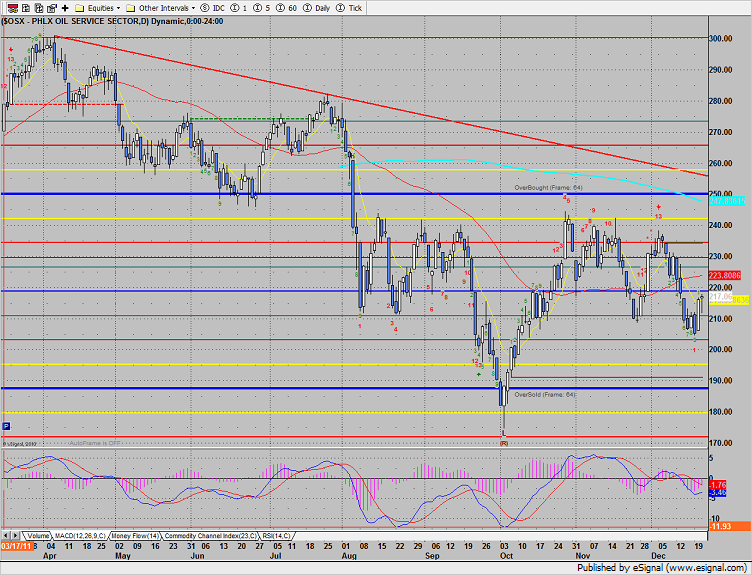

The OSX was higher and held above the midpoint of yesterday’s range which is a short term sign of strength. Use the 50dma for the near-term bounce target off the Seeker 9 bar run.

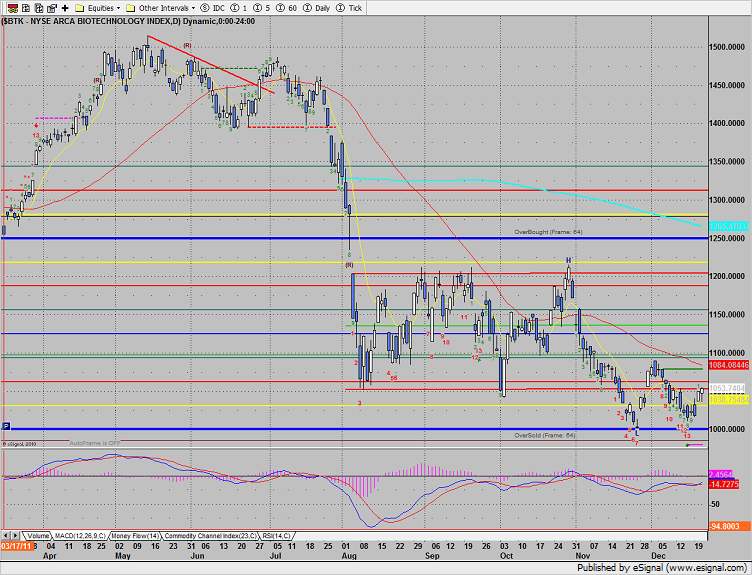

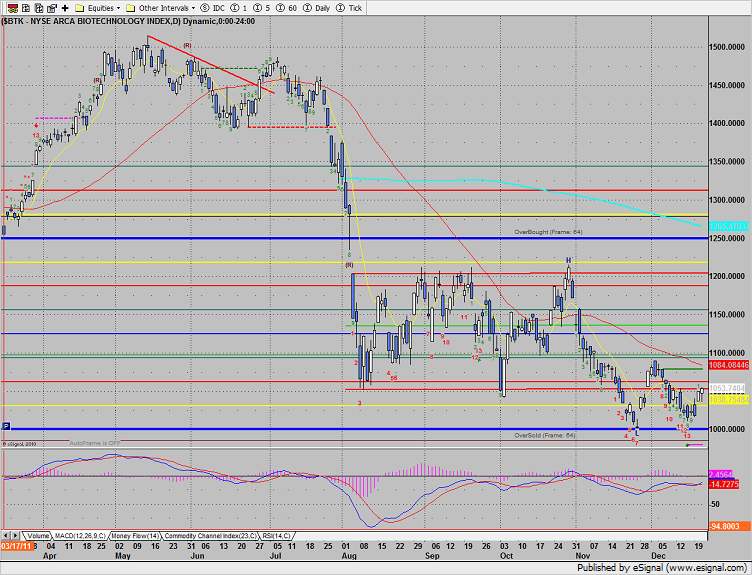

The BTK should be monitored for long opportunities off the Seeker 13 buy signal. Use the active static trend line for an initial price objective.

The SOX tested yesterday’s low and held. The pattern is still very sloppy.

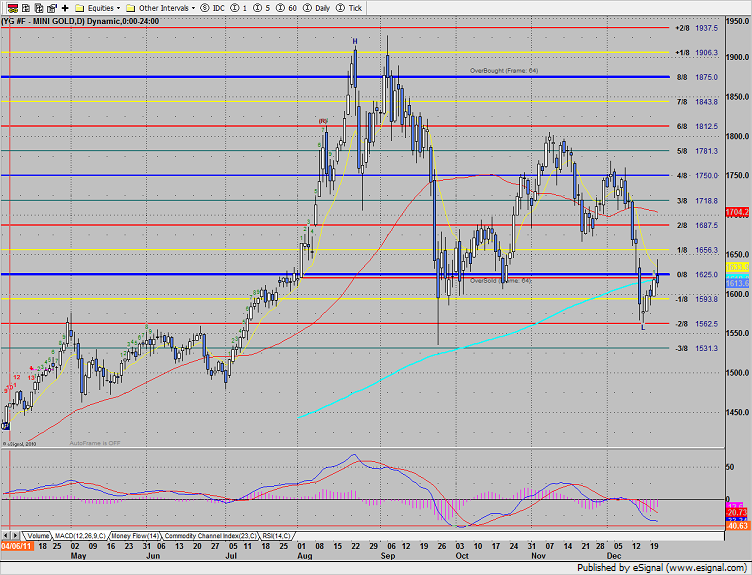

Gold tried higher price but was rejected settling below the 0/8 Gann level and 200dma.

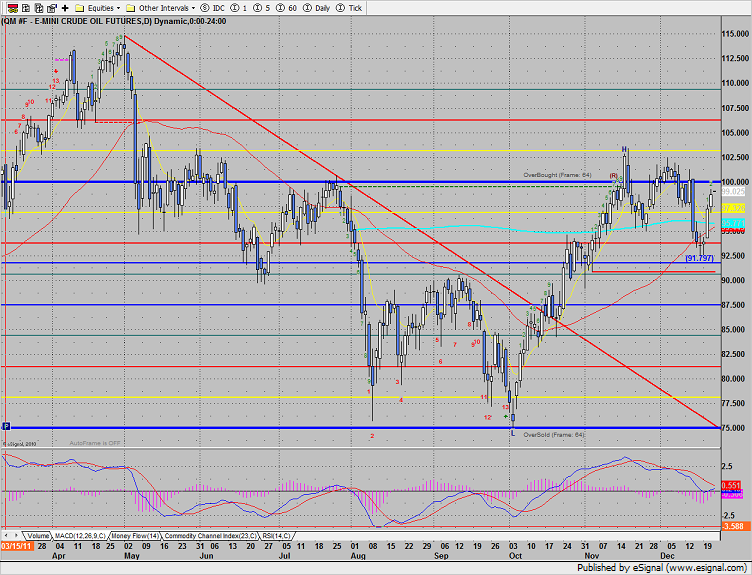

Oil has kept its relative strength. Watch the 8/8 Gann level very closely for a breakout/resistance level.