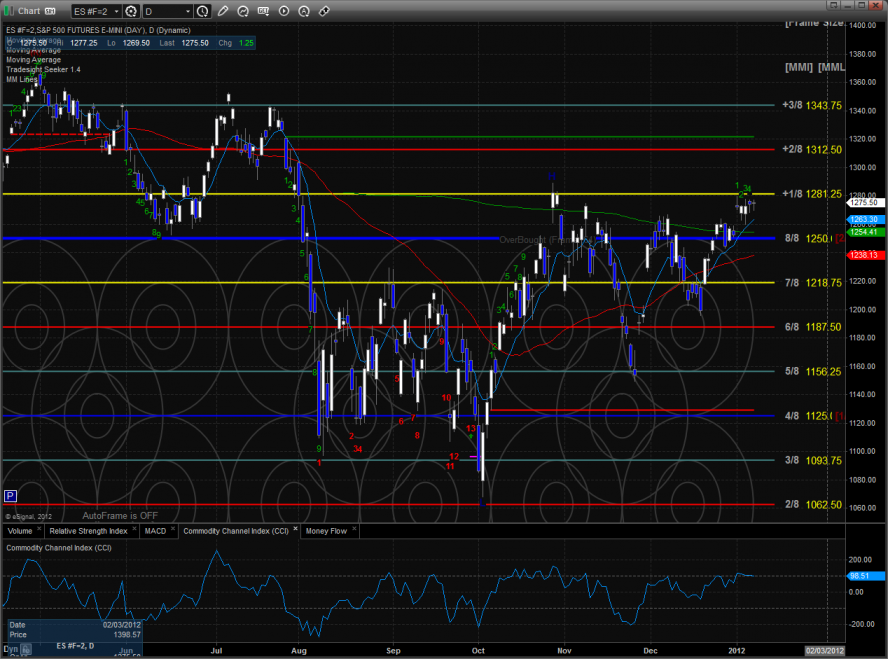

The ES did nothing on the day, trading inside Friday’s range. Price has done almost nothing since gapping up after the holiday.

The NQ futures were weaker than the broad market losing 5 handles on the day. Price did record a new high on the move intraday and has left an indecisive distribution candle on the chart.

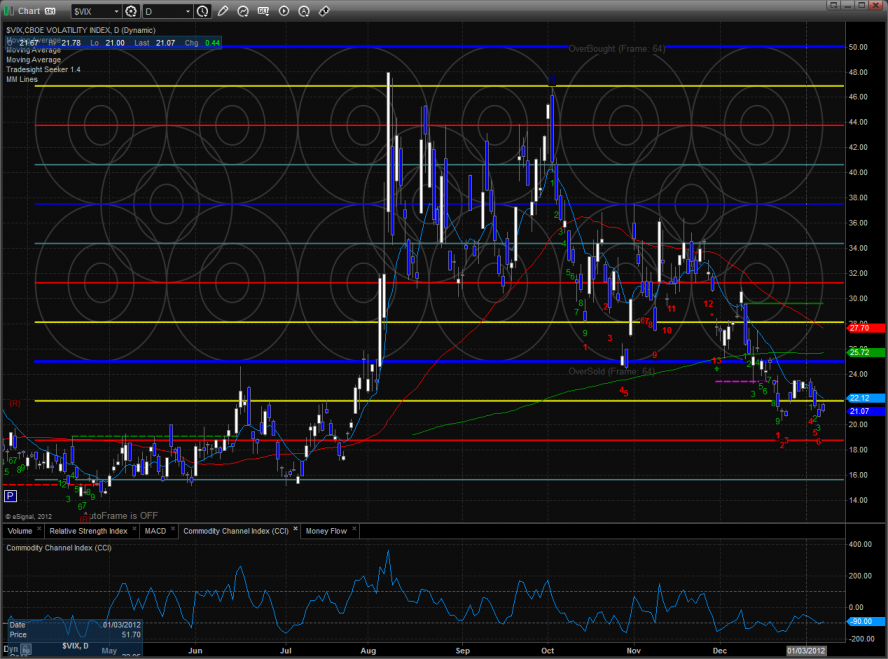

The Vix recorded an up day which could be a precursor on some selling pressure to come.

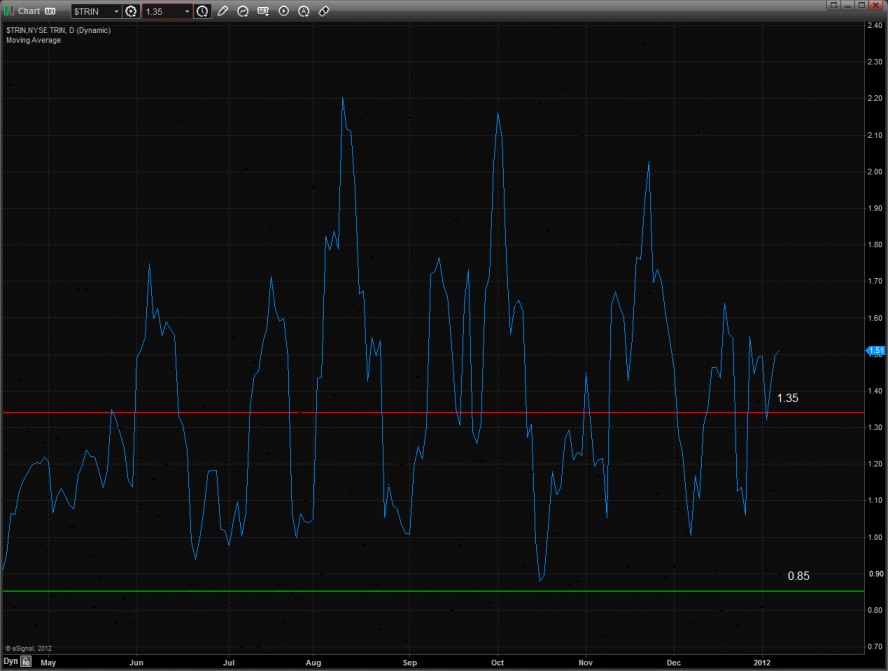

The 10-day NYSE Trin remains overbought reading above 1.35:

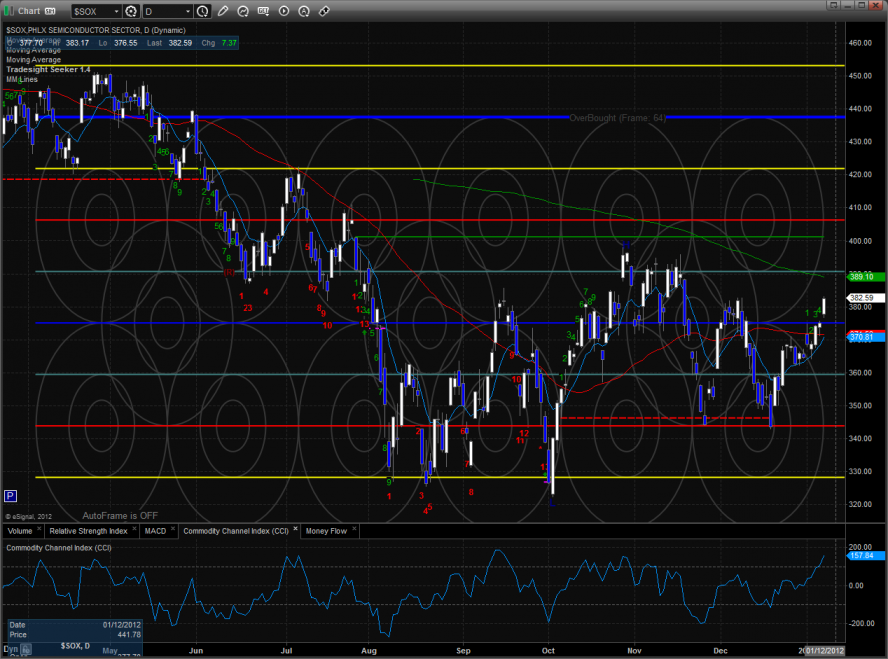

The SOX was the top sector on the day up almost 2%. The next level that comes into play will be the 200dma.

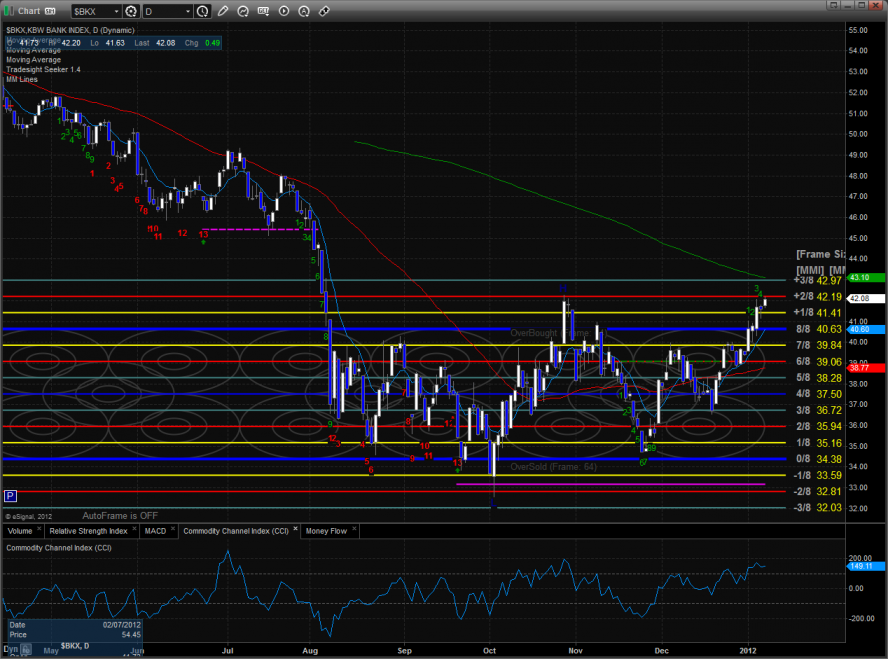

The BKX was also stronger than the market, making a new high close on the move. The index closed just below the +2/8 Gann level. If this level is exceeded on a closing basis it will bullishly force a frame shift. Next overhead is the declining 200dma.

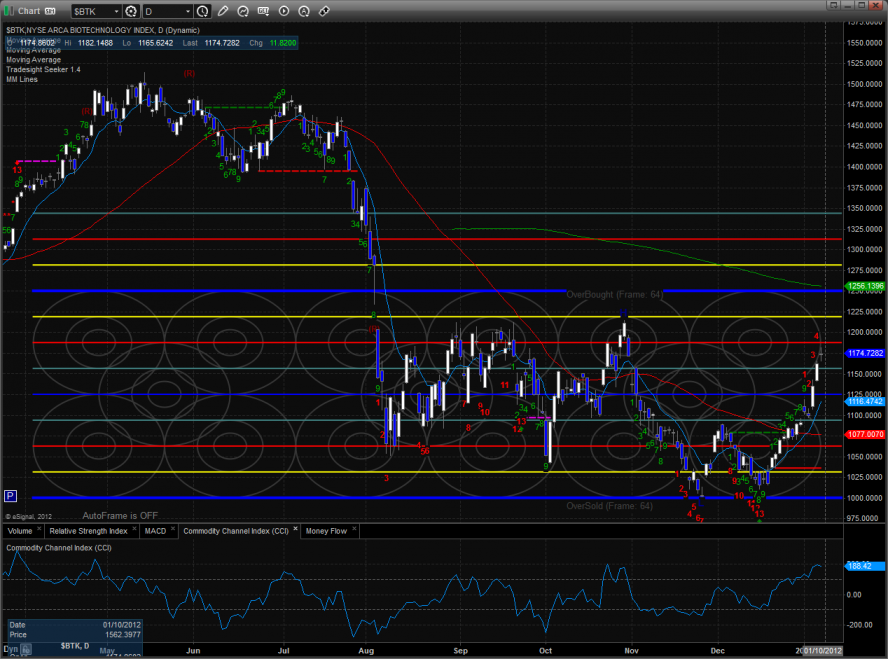

The BTK was also relatively strong but closed at the open. The pattern is now 5 days up in the Seeker which leaves more upside room.

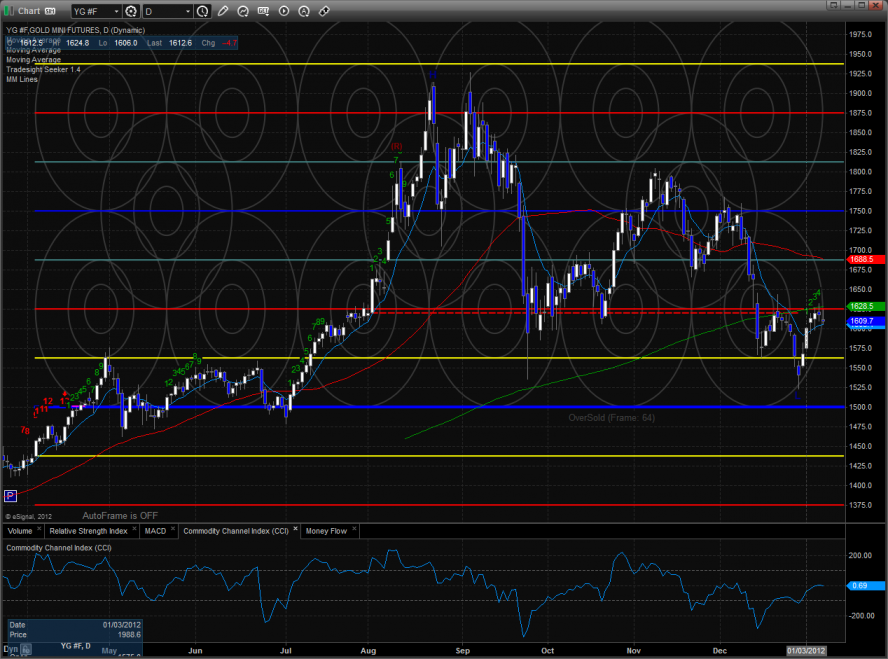

The XAU remains a source of funds for the higher beta rotation (i.e. gold money flowing into SOX and BTK).

Gold was lower on the day:

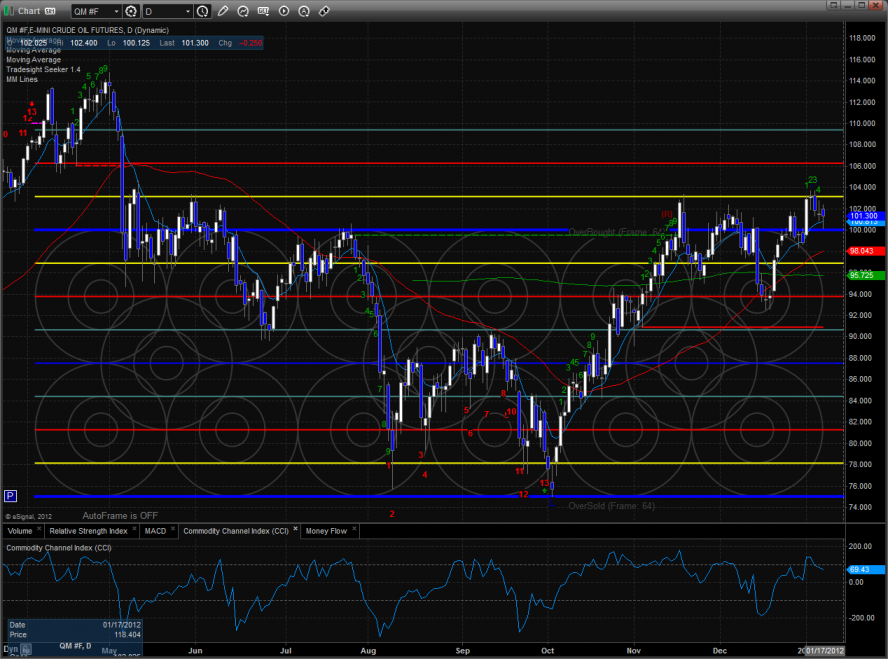

Oil was lower on the day but held the key $100 level. Price remains bullishly above all major moving averages.