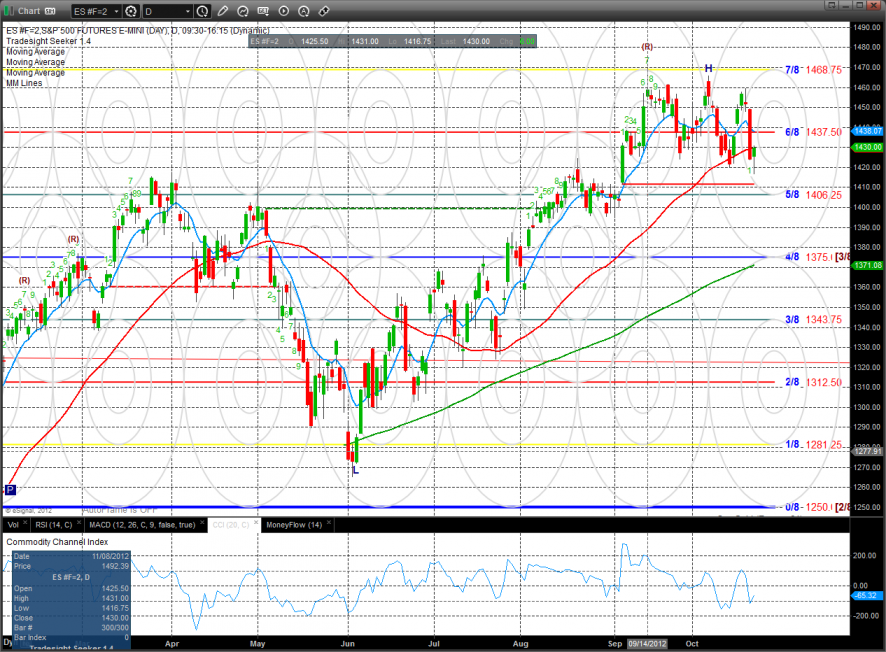

The ES was higher by 6 on the day after a strong afternoon rally. While the end of the day may have “felt good” to the bulls, it is still below the midpoint of Friday’s break which remains a technical negative and keeps the bears in charge. 1435 is key overhead and the active static trend line is near-term support.

The NQ futures were twice as strong as the ES but still leave the bears in charge. The combination of the static trend line and 4/8 level are near-term support and the 2706 is the key resistance level. The MACD is negative but in no way oversold.

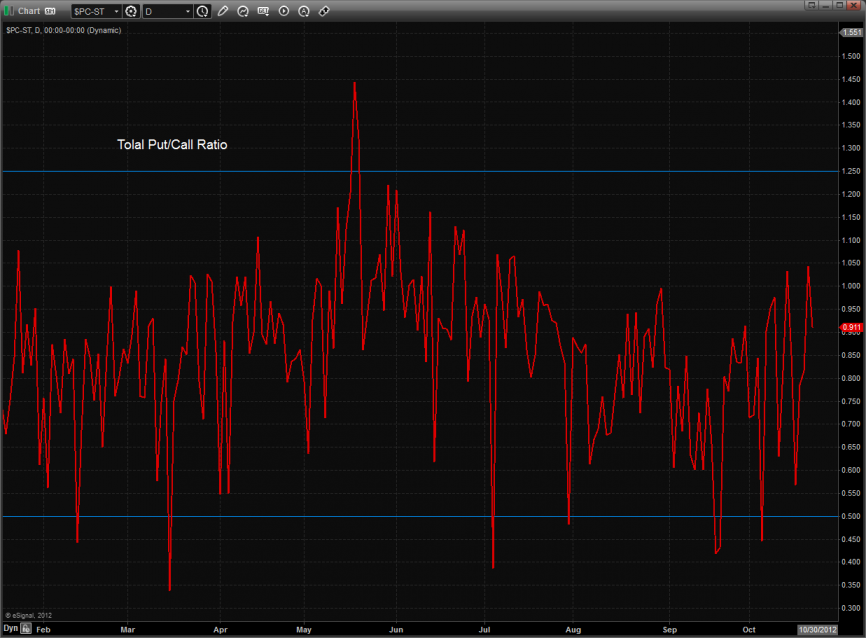

The total put/call ratio remains neutral:

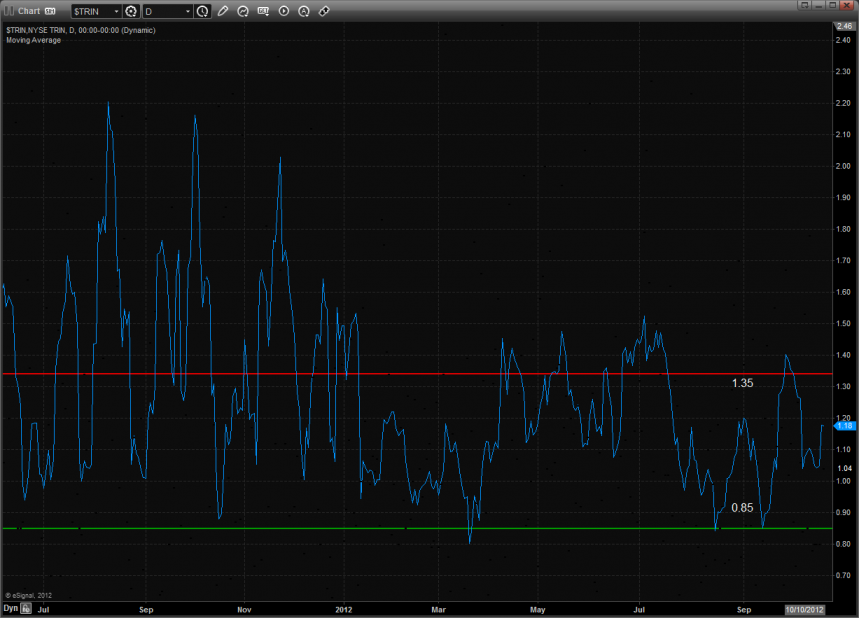

The 10-day Trin is also neutral being neither overbought nor oversold.

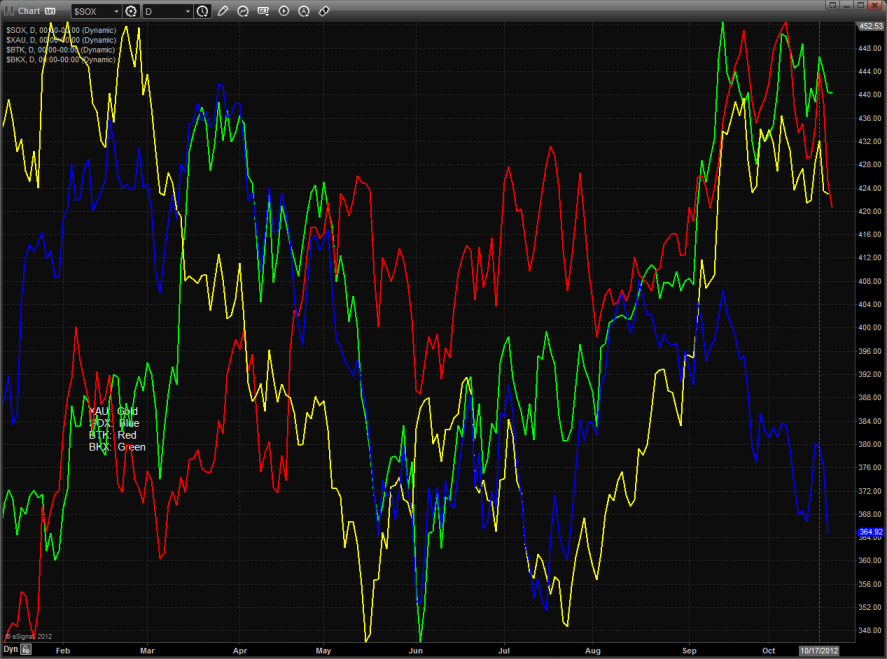

Multi sector daily chart:

The NDX has broken decisively below the support line indicating weakness in the Naz stocks which will likely be an anchor on the overall broad market.

The HWI hardware index posted an inside day and could be trying for a double bottom.

The defensive XAU put in a strong showing and could be building a handle below the 8/8 level.

The SOX was about flat on the day but remains below all of the key moving averages.

The BKX is winding up in a triangle and poised to breakout because it’s getting closer to the apex of the pattern.

The OSX was weaker than the broad market and has key overhead at the static trendline.

The BTK was the last laggard on the day and is in a confirmed short-term down trend. Note that the MACD has crossed below the zero line.

Oil followed through the 50dma:

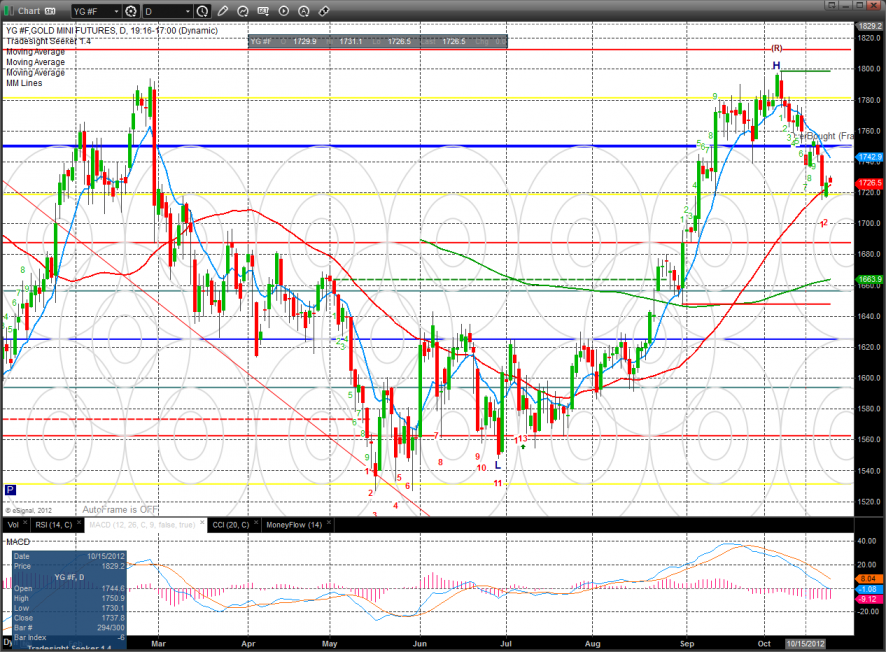

Gold:

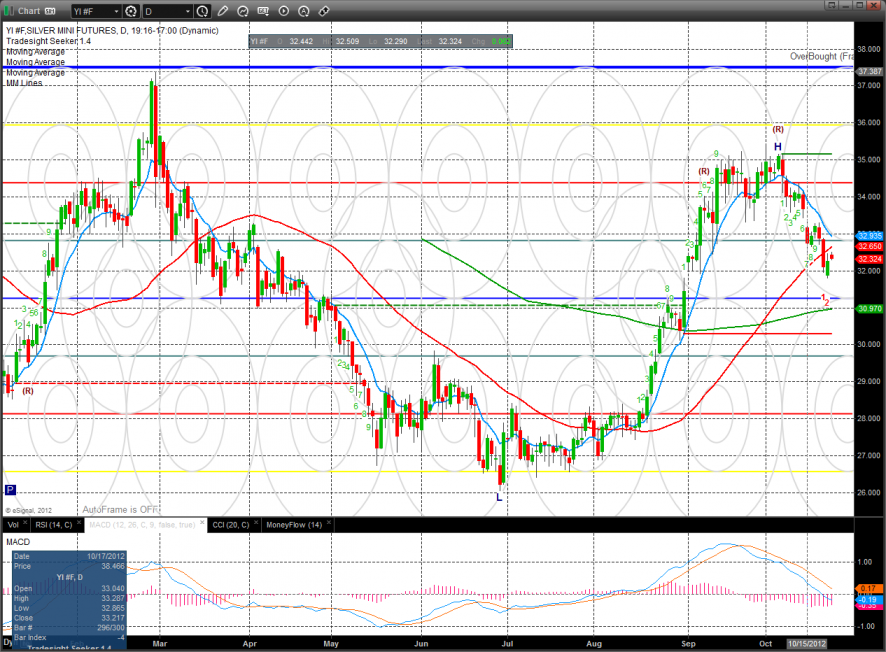

Silver: