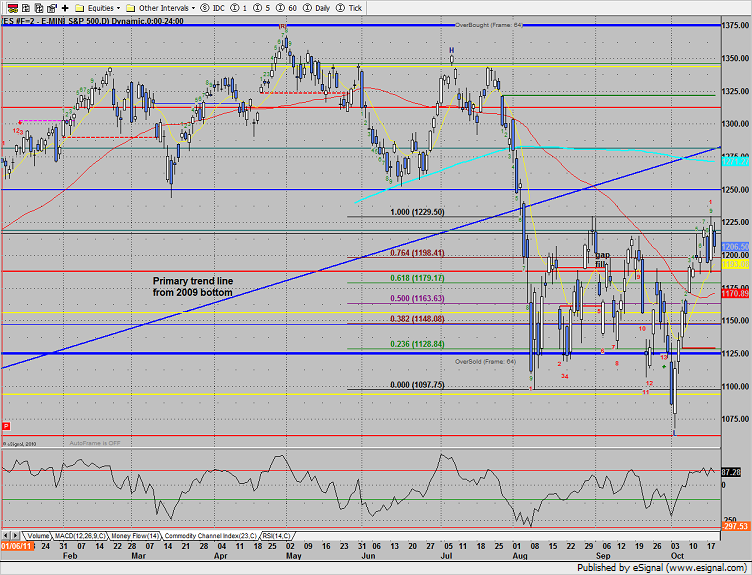

The ES lost 17 on the day held in check by the 9th bar up in the Seeker. While the advance at least temporarily halted, Wednesday’s range was contained within the prior day’s range making for an inside day. The resolution of candle 9 will be the important factor going forward. An immediate break back above it would be a very good sign of strength while a break below keeps price contained within the same frustrating trading range

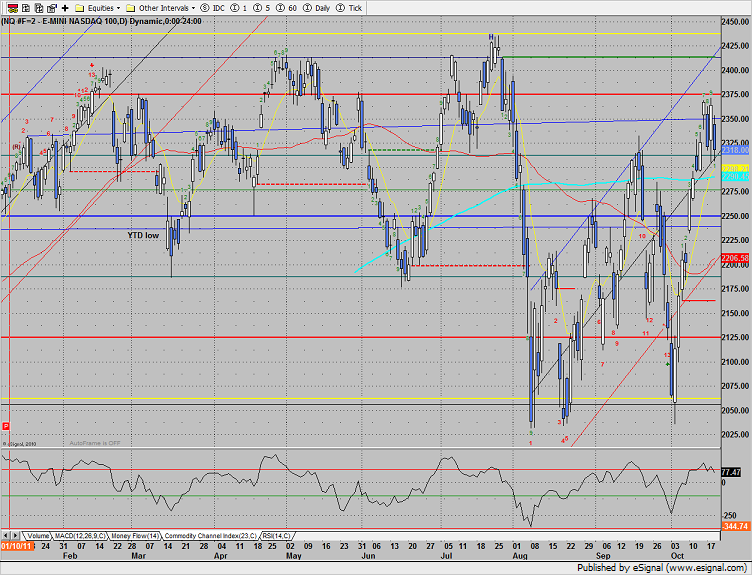

The NQ futures just barely recorded an inside day and showed relative weakness vs. the ES. The trend remains positive as long as price remains above the midpoint of the trend channel.

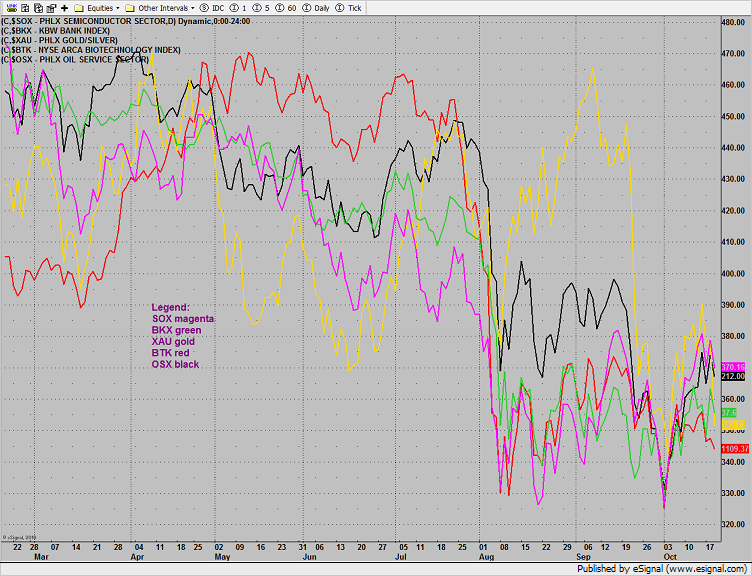

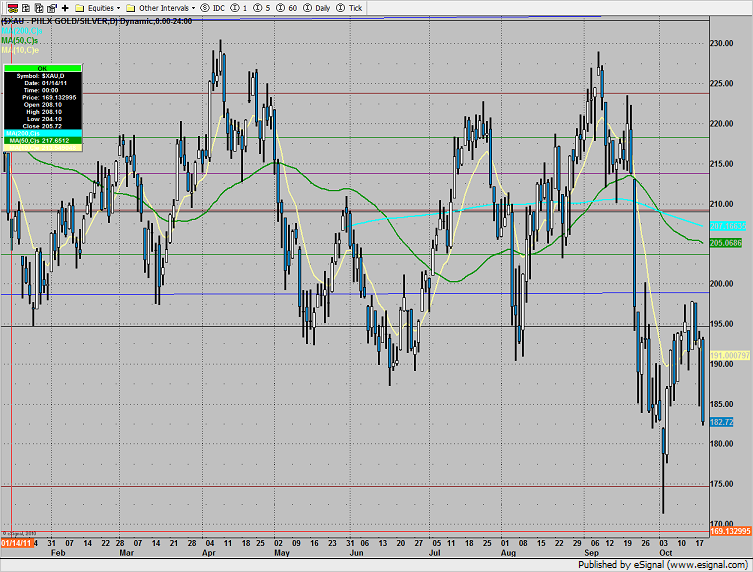

Multi sector daily chart:

The Dow/gold ratio remains in a downtrend and will not reverse until the 8 level is exceeded.

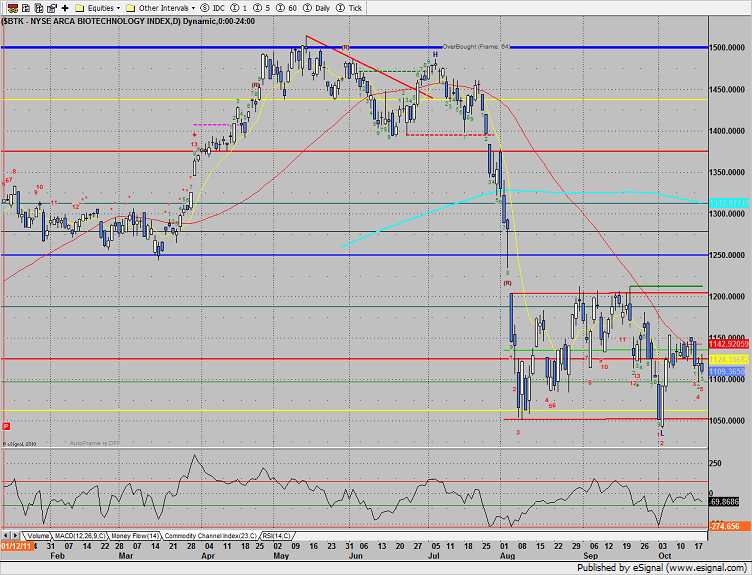

The BTK was top gun and unimpressive at midrange.

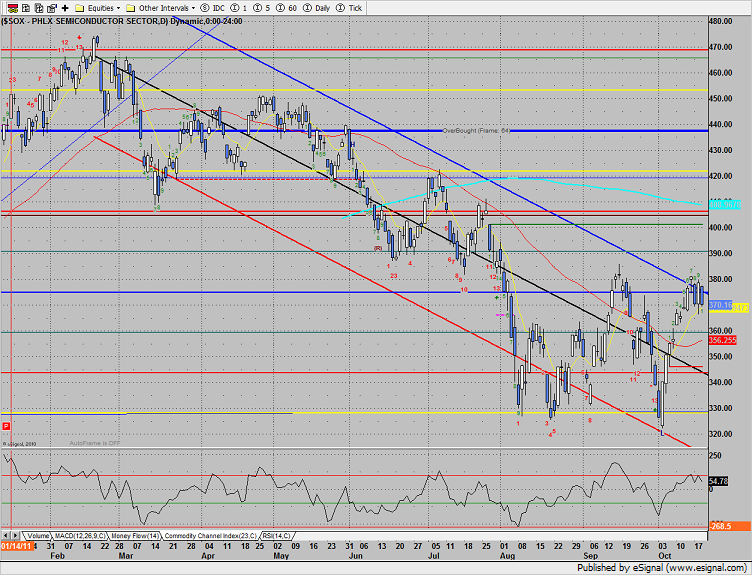

The SOX posted an inside day;

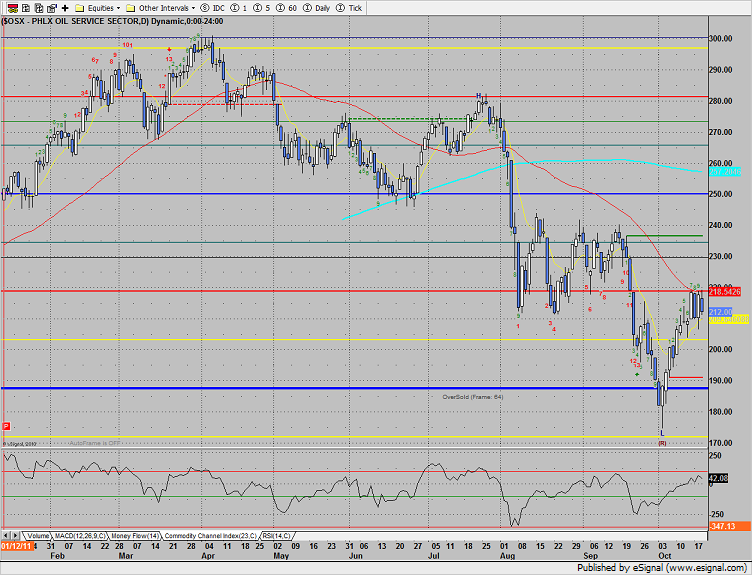

The OSX also posted an inside day and is winding up with energy.

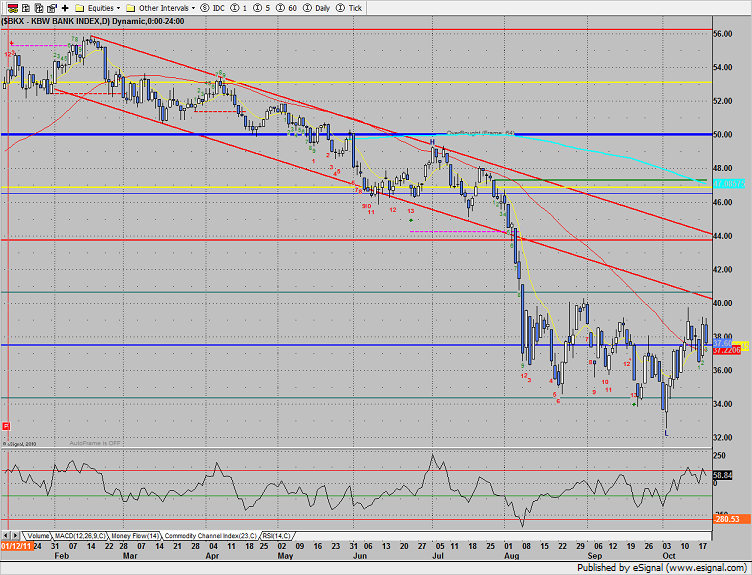

The BKX is still under the 40 breakout level.

The XAU collapsed 5%and recorded the second lowest close of the move. A break lower would be positive for stocks just like a reversal in the dow/gold ratio. This is a classic move that would telegraph that investors are raising their risk tolerance and favoring equities over hard assets.

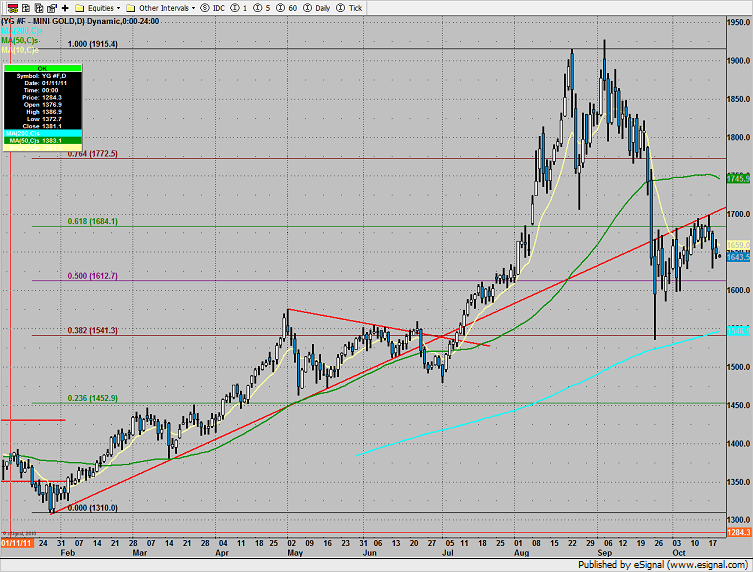

Gold was slightly lower on the day:

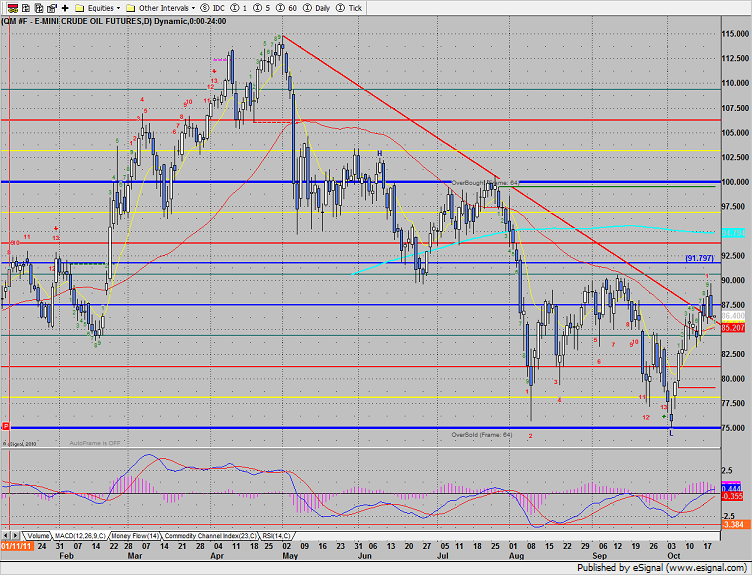

Oil was lower on the day but is still holding over the DTL. A failed break would be very bearish but the chart and is still positive with the MACD above the zero line.