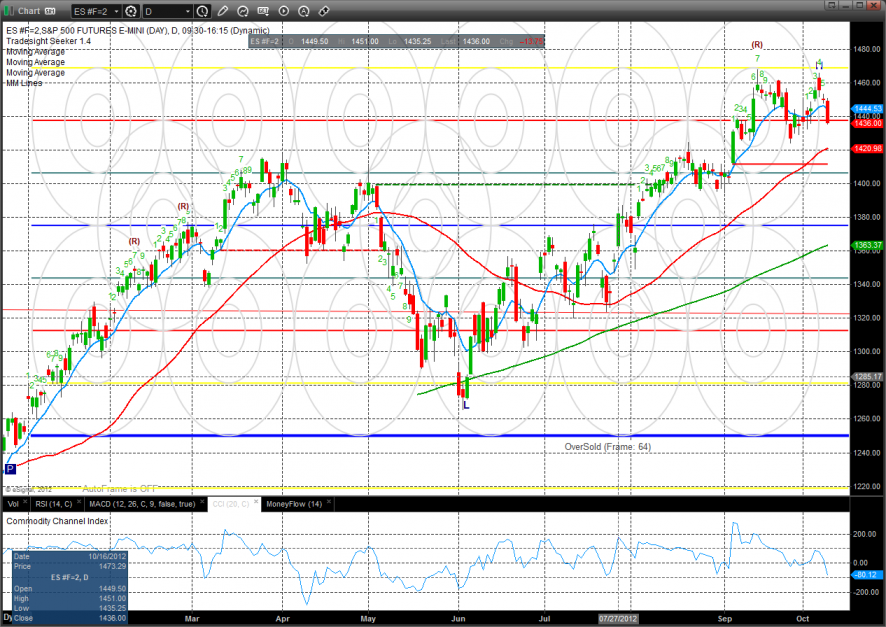

The ES lost 14 on the day, closing decisively back below the 10ema. The double top potential is there but cannot be called so until the September lows are undercut. Note that he September lows will have critical support from the rising 50dma if traded.

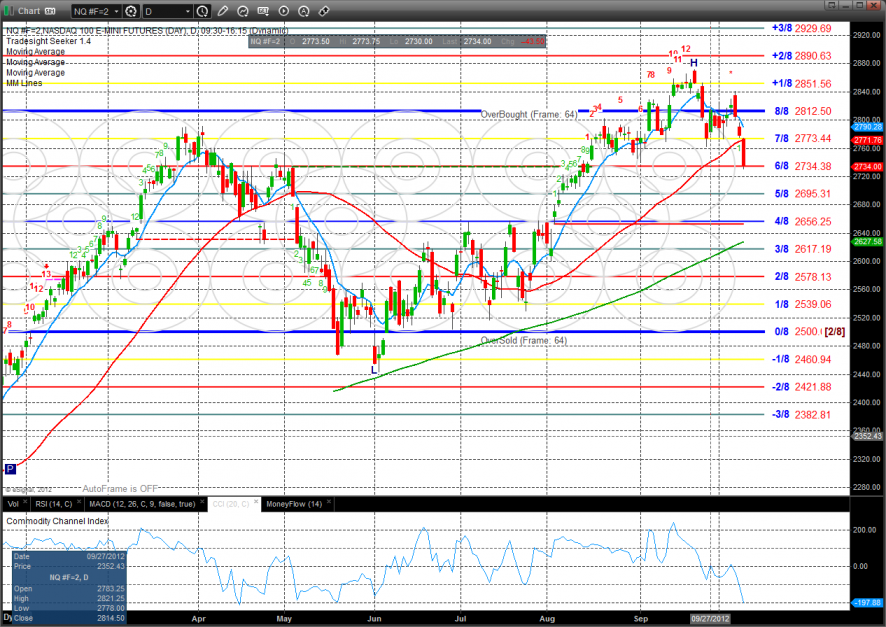

The NQ was relatively weak vs. the SP by losing a full 43 handles. The pattern is now below the 10ema and 50sma. The CCI is just above the oversold threshold of -200.

10-day Trin:

Multi sector daily chart:

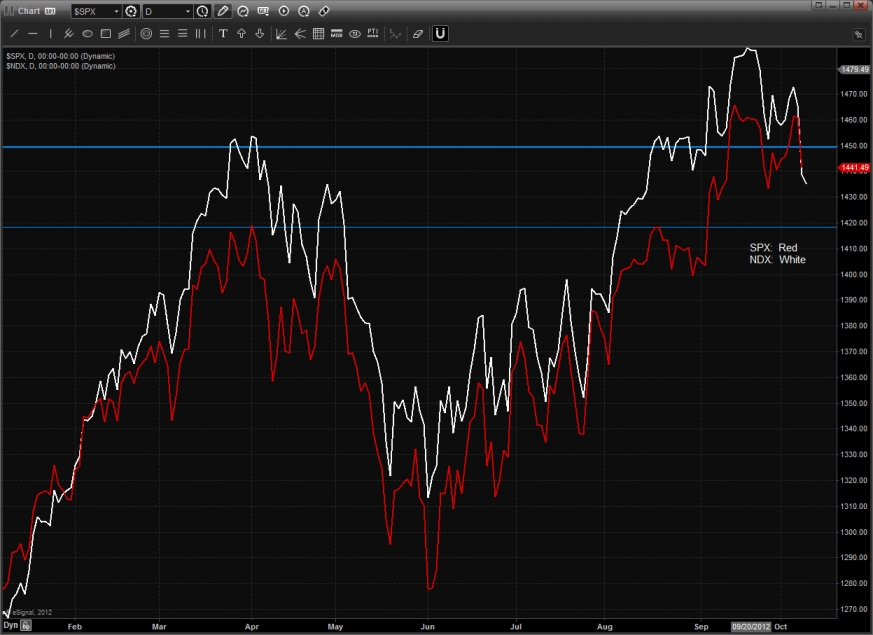

Note the relative weakness in the NDX which is always bearish.

The OSX was the only major sector that was higher on the day though price remains bearishly below all of the major moving averages.

The BKX continues to have potential for a double top but the pattern is still positive with price above the 10ema.

The SOX gapped to close at a multi month low. Next support is the Murrey math 3/8 level.

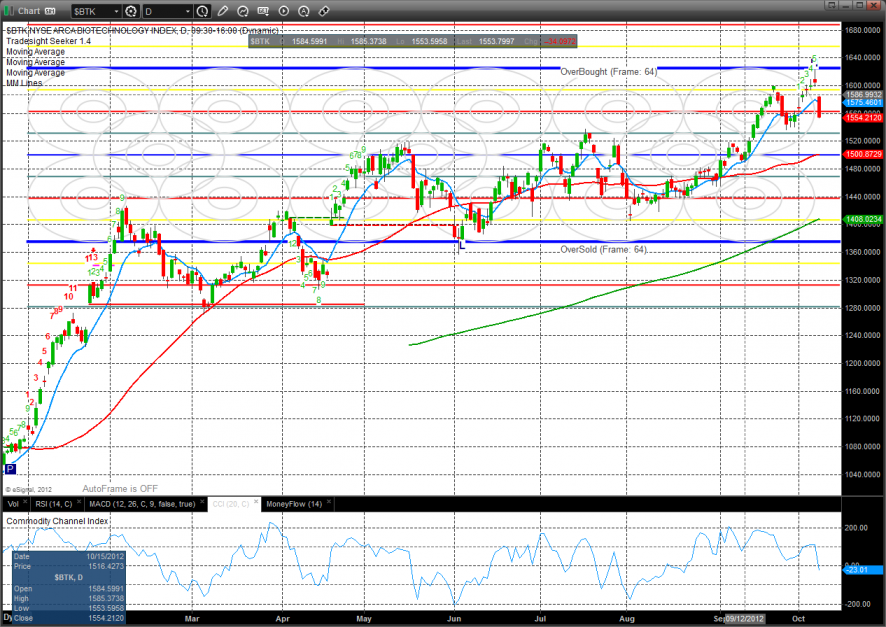

The BTK got slammed, closing weaker than the Naz and broad market. Key support and a break level is the July high.

The computer hardware index was the weakest sector on the day. The recent weakness in HPQ and AAPL are pulling heavily on this index. Note the open gap that is in the sights of the bears to close. The next level to watch after that will be the 0/8 level.

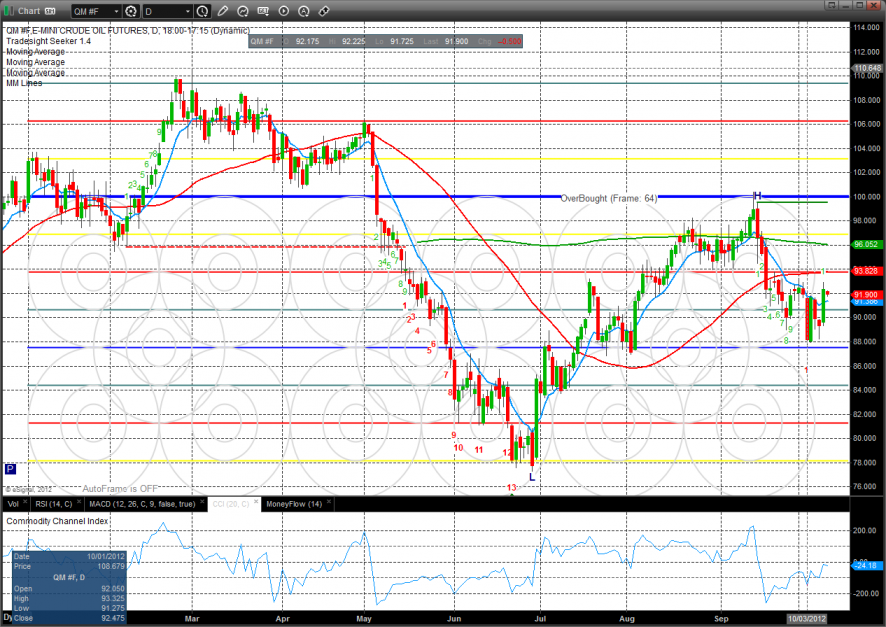

Oil:

Gold:

Silver: