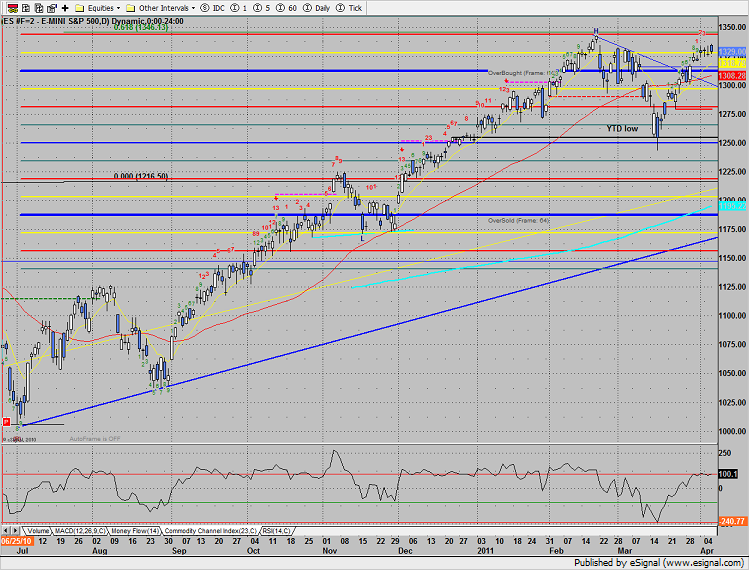

The SP tested the waters above the recent range but was rejected and settled below the open but up 2 handles on the day. The same technical condition persists in that only a close outside of the recent range will define a directional bias.

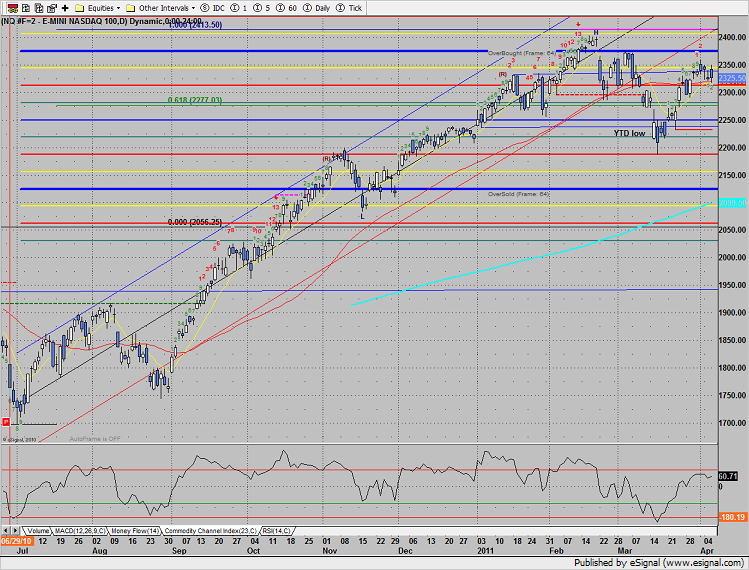

Naz was also higher on the day by 2 handles. Price remains just above the key 10 and 50dmas.

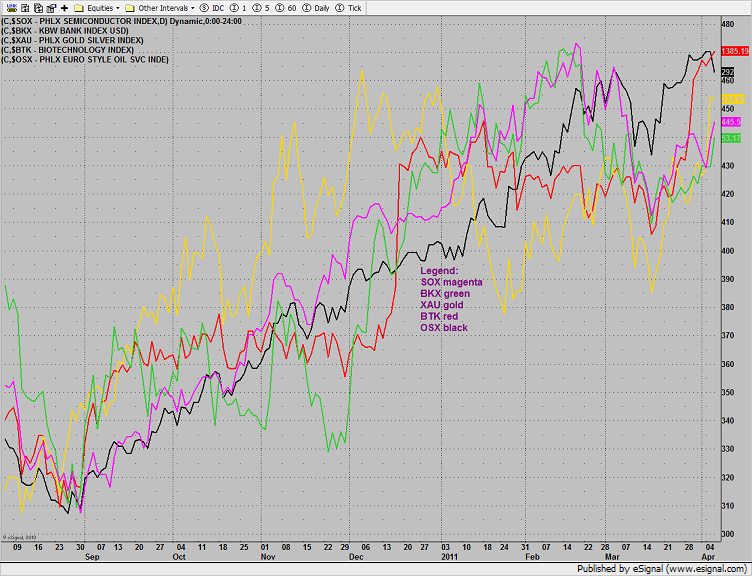

Multi sector daily chart:

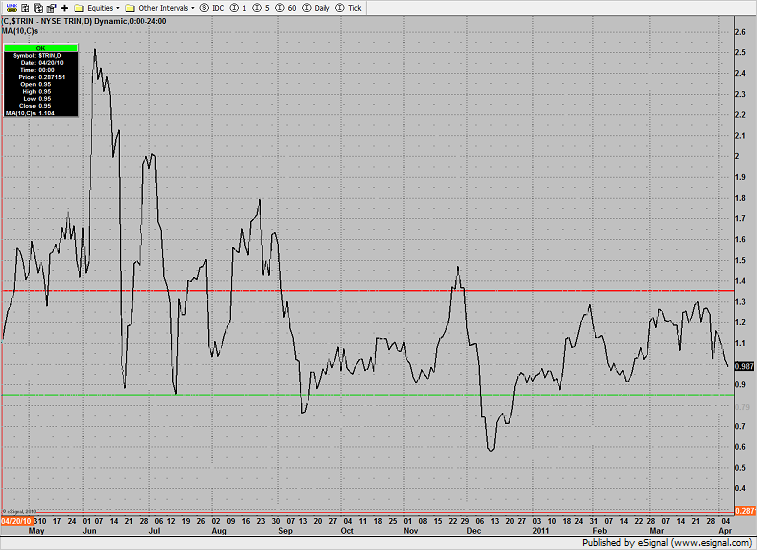

The 10-day Trin broke below the 1.00 baseline, neither overbought nor oversold.

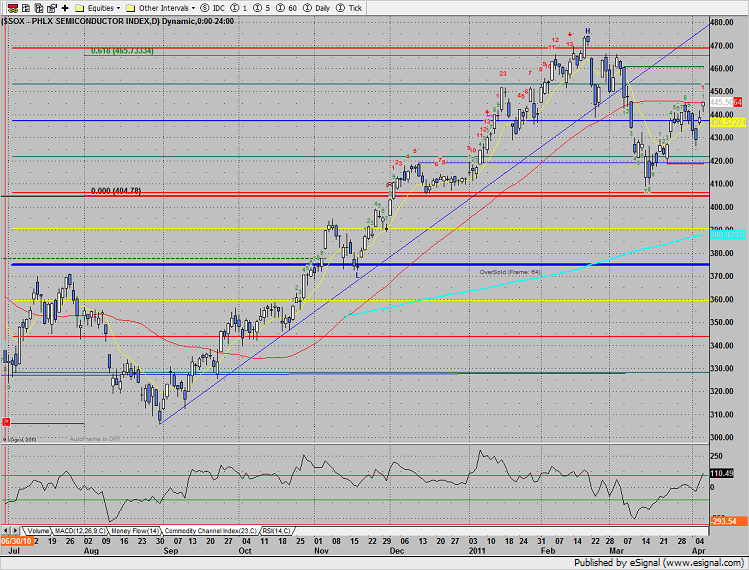

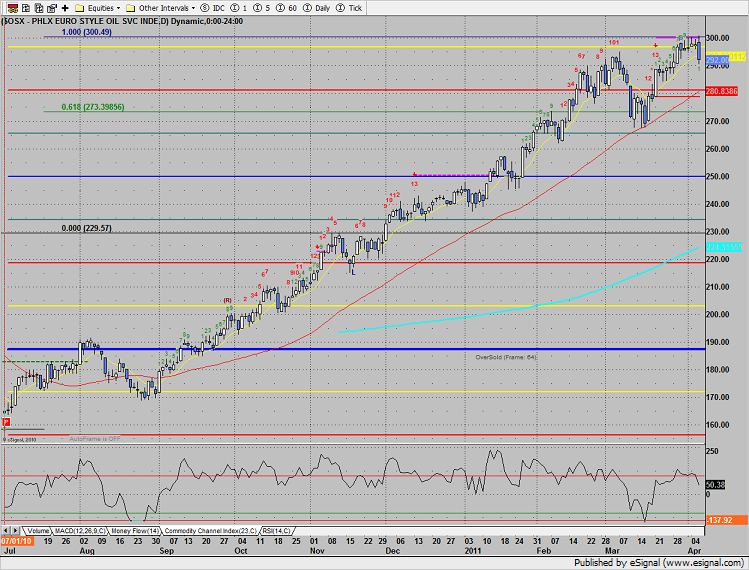

The SOX was top gun, closing at a new high on the move and challenging the 50dma. Note that today’s candle was a price flip and the setup phase now stands at one.

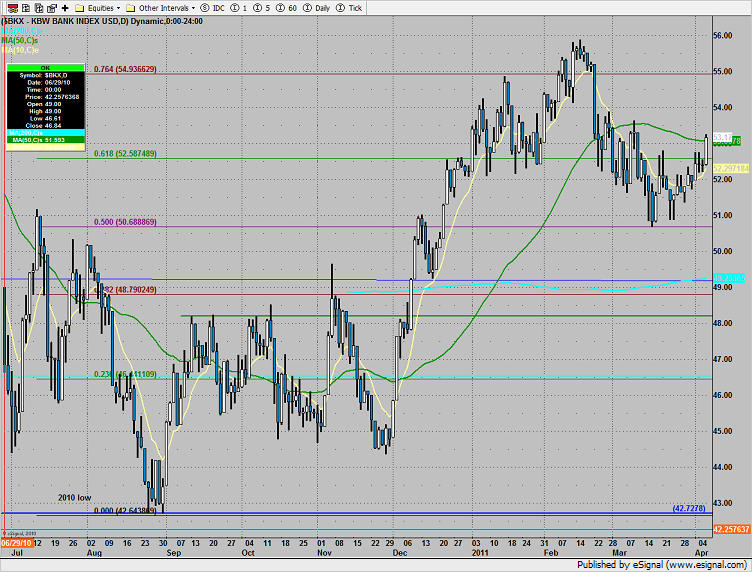

The BKX posted a similar day, breaking above the 50dma.

The BKX closed at a new high on the move and is still well shy of the 100% measured move target.

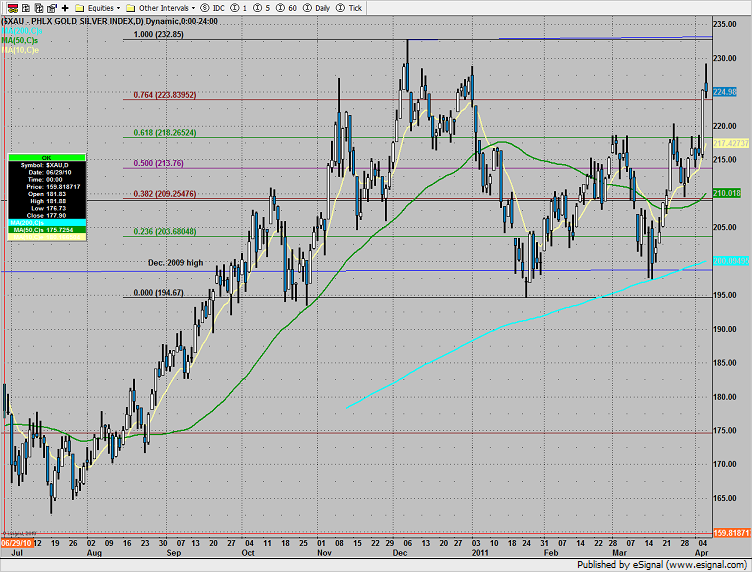

The XAU tried for higher prices but didn’t have much to show at the close. This was the dreaded measuring day that we were prepared for following yesterday’s range expansion candle. Thursday is a higher probability upside day, especially if price gaps lower over night.

The OSX was the last laggard, decisively breaking below the recent tight trading range. The Seeker exhaustion signal is still active.

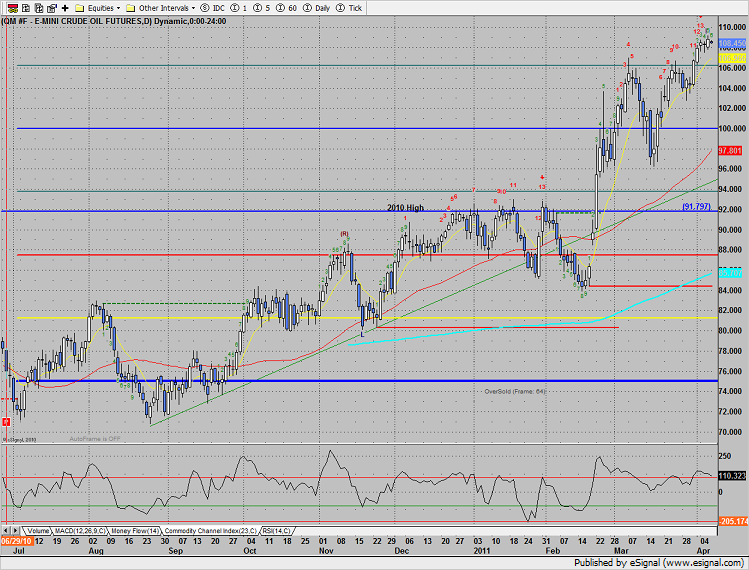

Oil:

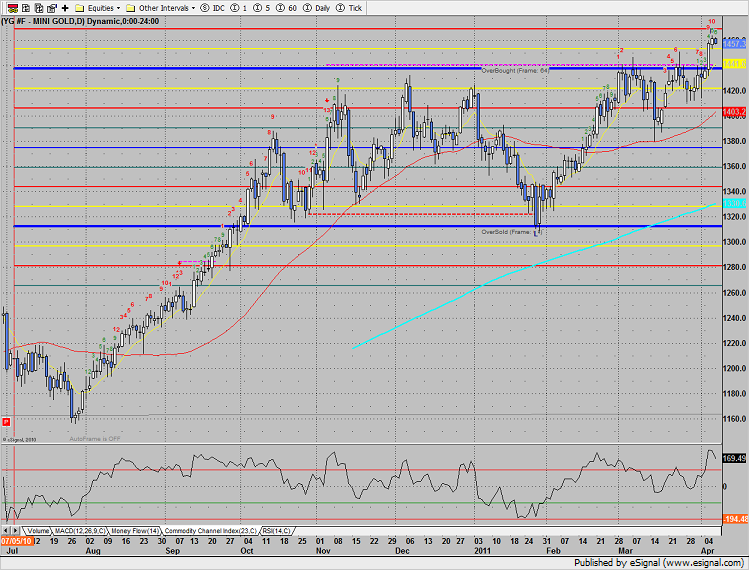

Gold: