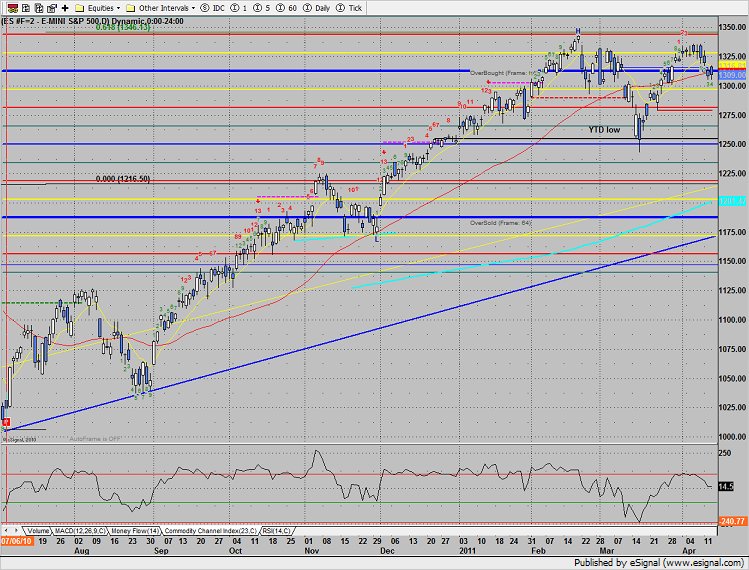

The SP treaded water, closing unchanged, and showing no sign of option unraveling. The 1317 overhead gap was filled, but otherwise there were no new technical features. Higher prices traded, but at the end of the day the chart recorded another distribution day.

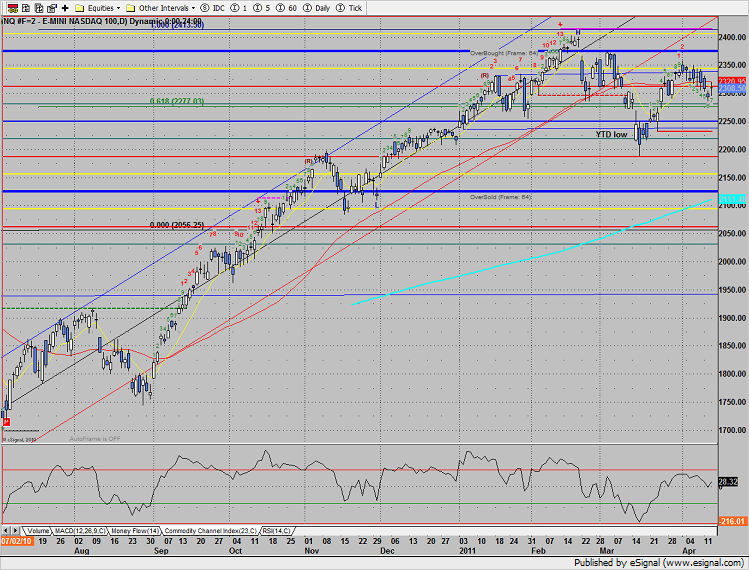

Naz was higher by a full 15 handles which made the Naz relatively strong vs. the SP. Since Naz tends to lead the SP, this difference, or “bifurcation” as it is known, can be a tell that a change in bias is forthcoming. One day does not make a trend but if this follows through and the condition persists, then the long side will be more profitable.

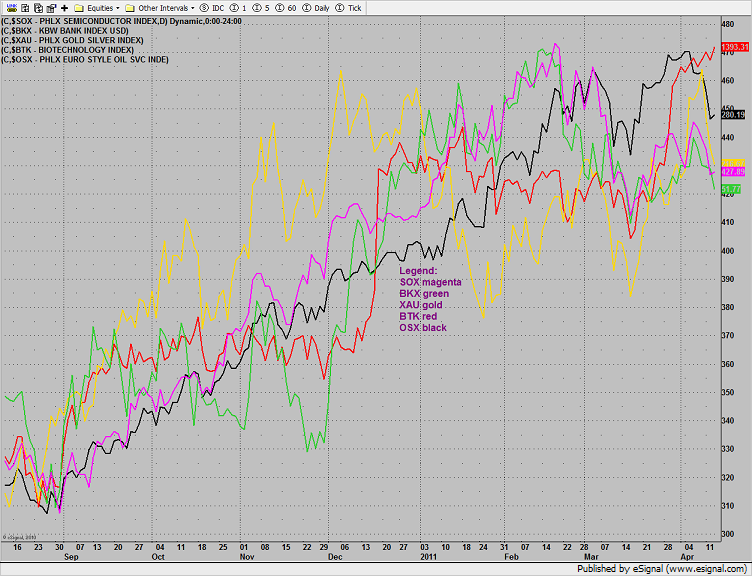

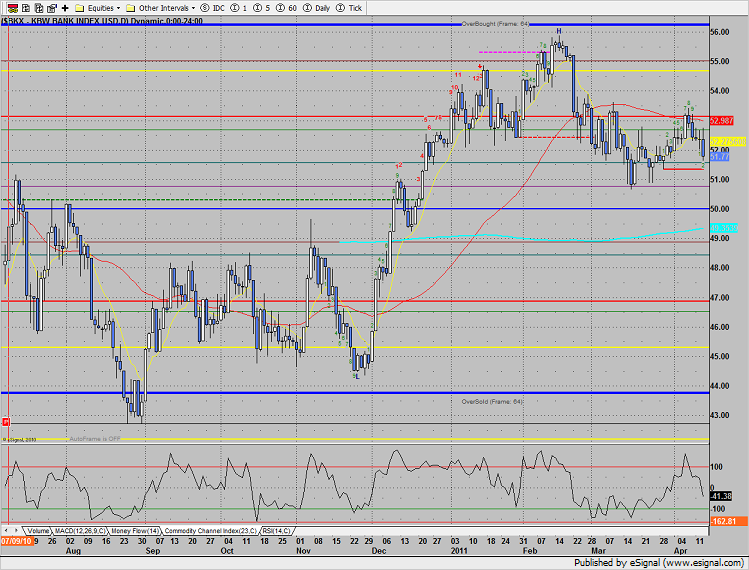

Multi sector daily chart shows the poor performance of the financials:

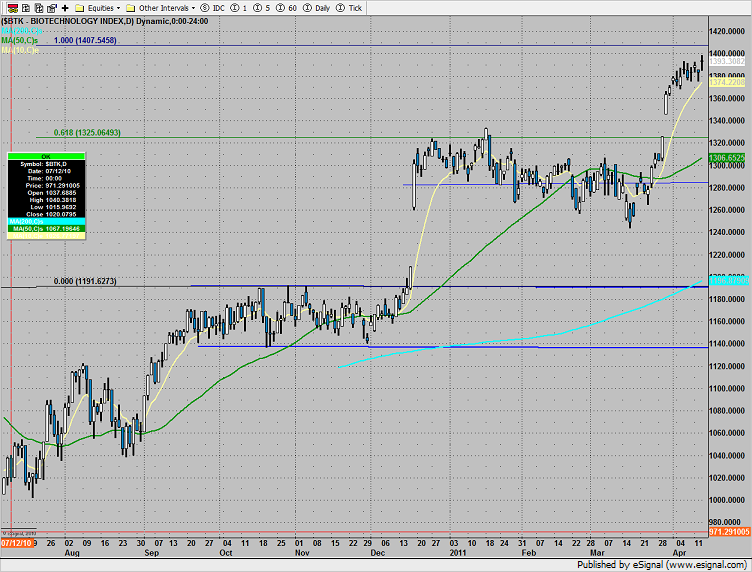

The BTK was top gun, closing at a new high and just shy of the measured move target. Keep looking to this sector for long continuation/breakout trades.

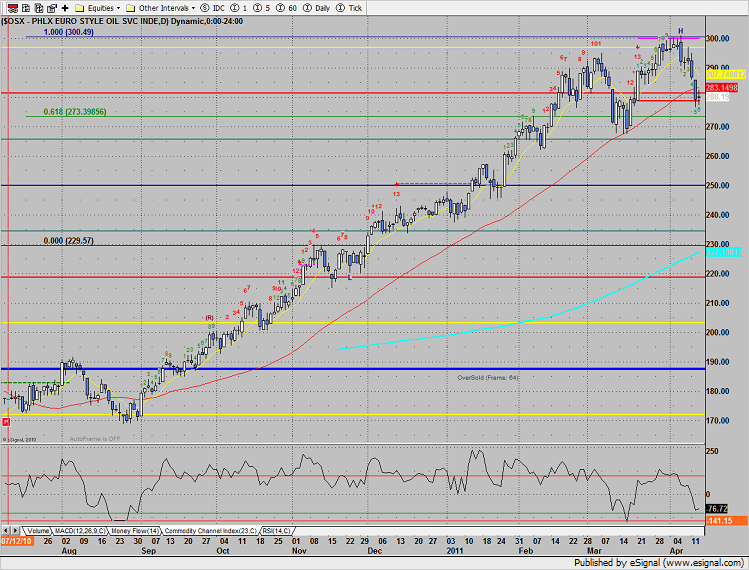

The OSX posted an inside day, using the static trend line as support. Be sure to alarm the high/low form Tuesday which will breakout the mini-pattern.

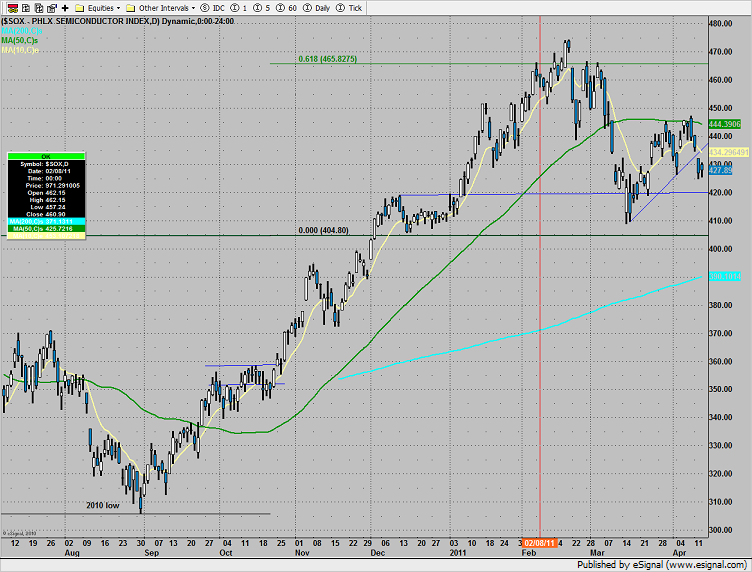

The SOX was slightly higher on the day but greatly underperformed the Naz. Wednesday’s candle was inside the prior day.

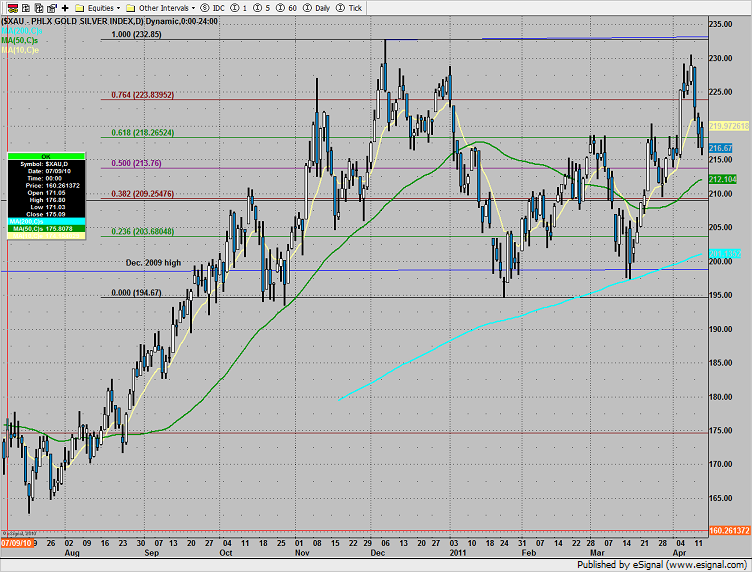

The XAU was weaker than the broad market and is closing in on key support at the 50% fib retracement. A close and follow through below the 50% line would validate the double top on the chart.

Following JPM’s earnings, the BKX was the last laggard on the day. The Seeker buy setup is only 2 days down and within striking distance of the static trend line. A break of the STL this early in the setup phase would be very bearish.

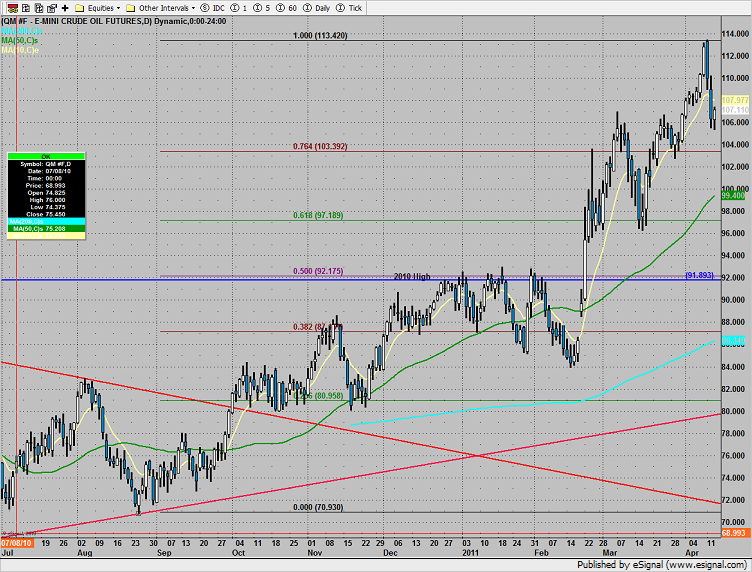

Oil was higher by about a dollar, perhaps working off the velocity and large range of the previous candles. A break below Wednesday’s low is an excellent short opportunity.

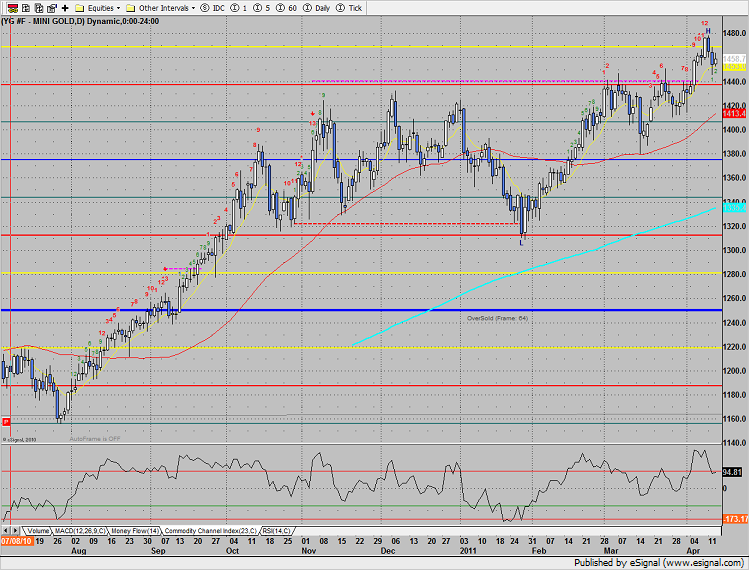

Gold was slightly higher on the day, trading inside yesterday’s range. Key support at 1440.