The ES lost 15 on the day but managed to post a camouflage buy signal by settling above the open. Price remains in the upward regression channel. The camouflage signal implies that the ES will take out Monday’s high before the low.

The NQ was lower by 34 on the day but like the SP side settled with a camo buy signal with the same implications.

Interestingly the 10-day Trin worked lower on the day but still has oversold energy in it.

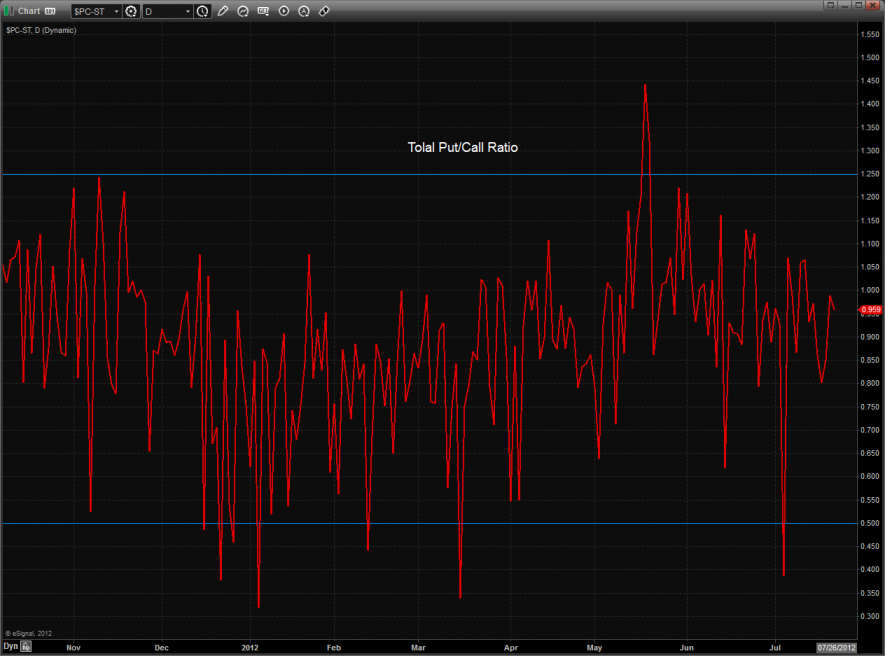

The total put/call ratio is neutral.

Multi sector daily chart:

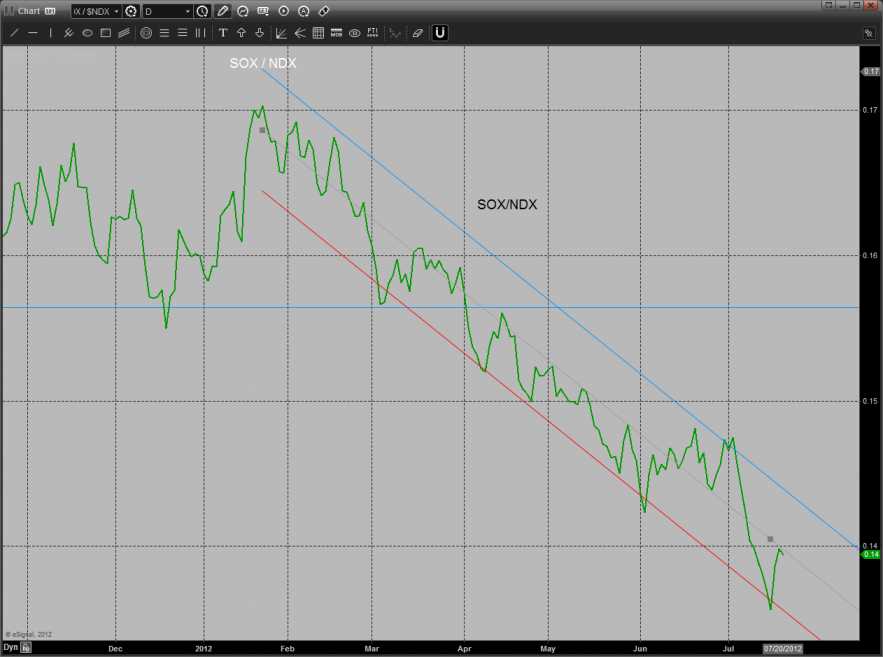

The Sox/Ndx cross has bounced off the lower regression channel and has more room to nit the top and is back to the midpoint of the range. Keep a close eye on a break back above the midpoint which would be the first step for a real reversal.

The weekly Dow/gold cross is very slowly making progress. The ultimate breakout remains the upper regression channel.

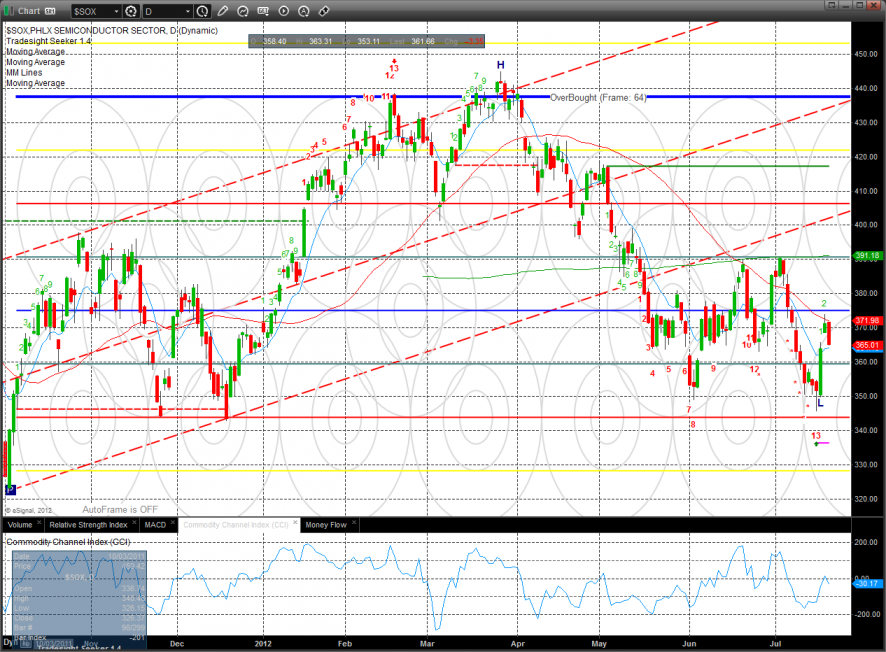

The SOX filled the dirty gap and still has an active Seeker exhaustion in place.

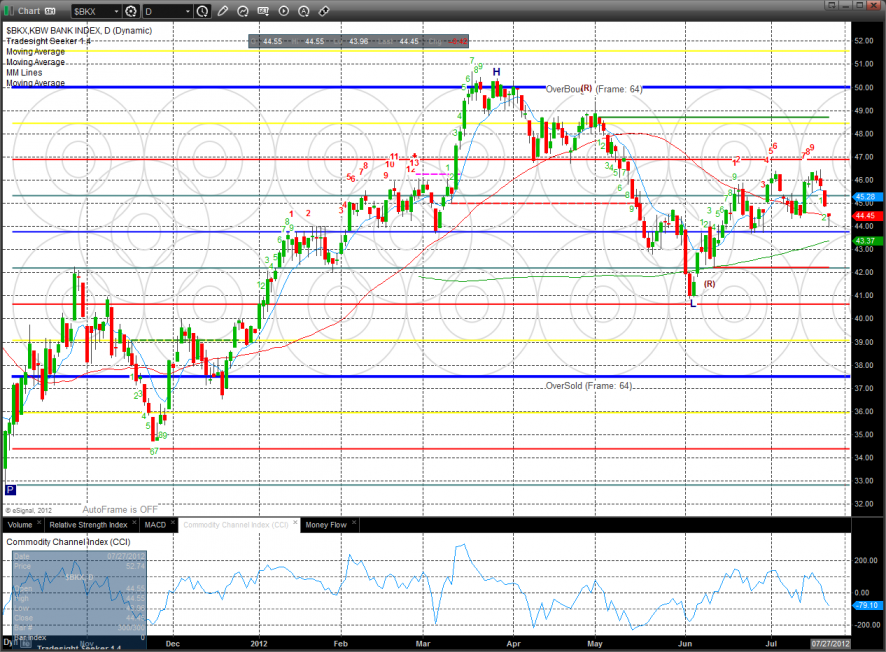

The BKX closed right at the 50dma.

The BTK is retreating the overbought 9/8 level. Expect support at the 50dma.

The XAU was the last laggard on the day but did not make a new low on the move. The CCI suggests that the reduced selling pressure could produce a double bottom. Stay tuned.

The TLT put in what could be a very important range high camouflage sell signal. Keep in mind the Seeker sell signal is still active.

Oil:

Gold:

Silver: