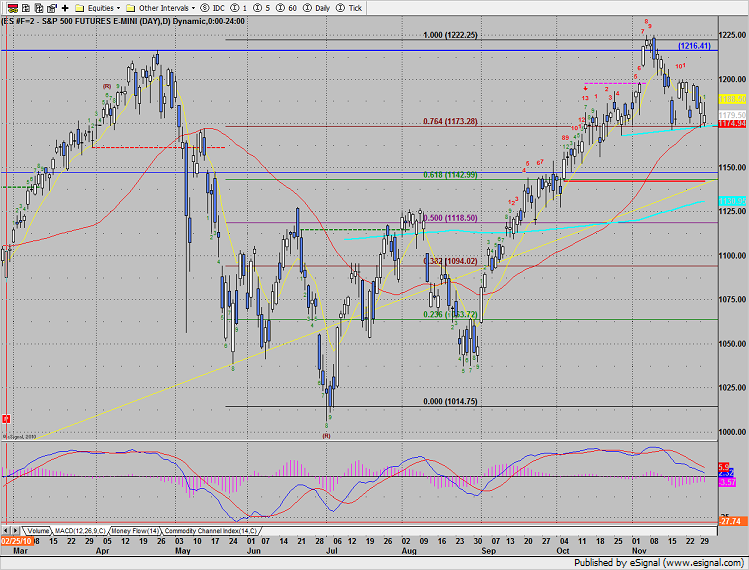

Tuesday was a typical month end mess. Gap down, then recover and the ultimately lots of white noise and nothing much to show for it. The market is bending but not yet breaking. The daily candle was both a downside CPS and also a camouflage buy signal which means that neither side has full control. The 50dma remains the key nearby technical level. Note the key neckline (aqua) that has been added to the chart.

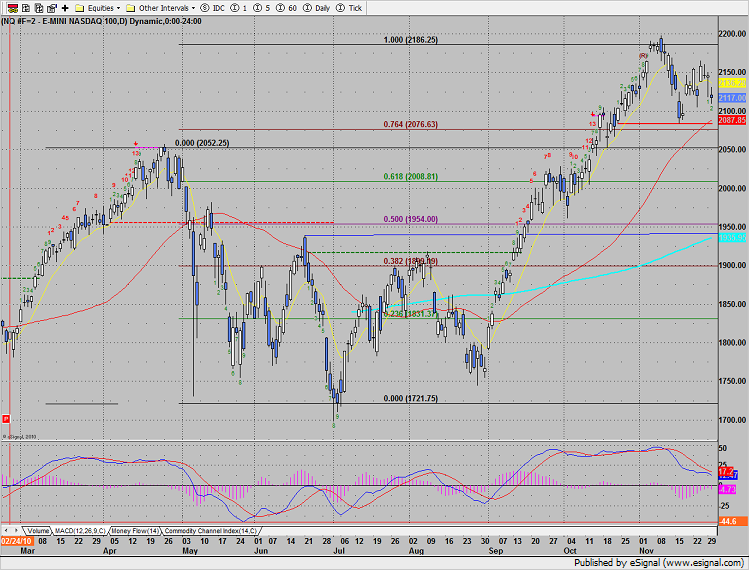

Naz was much weaker than the broad market losing 28 on the day. Key support remains at the static trend line and 50dma.

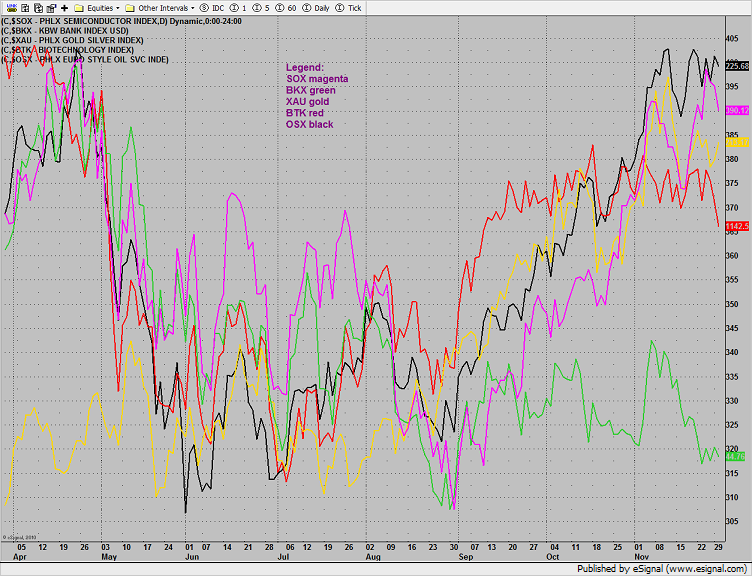

Multi sector daily chart:

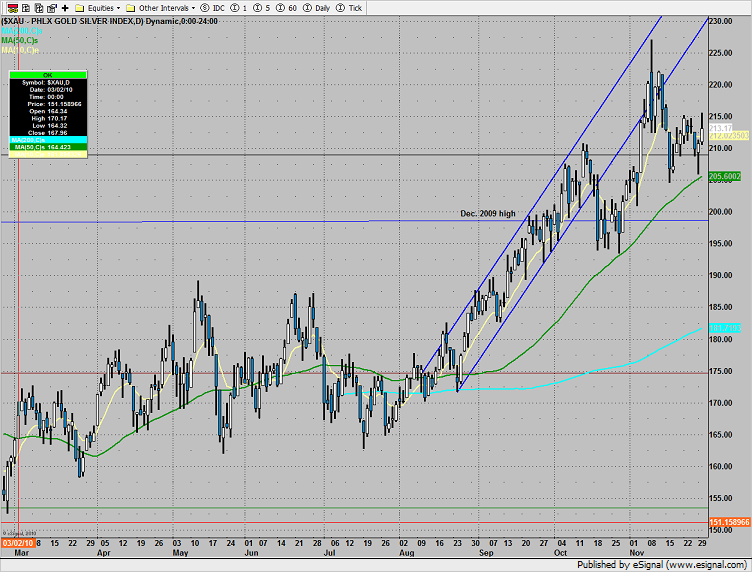

The XAU was the only sector green on the day, up 1%:

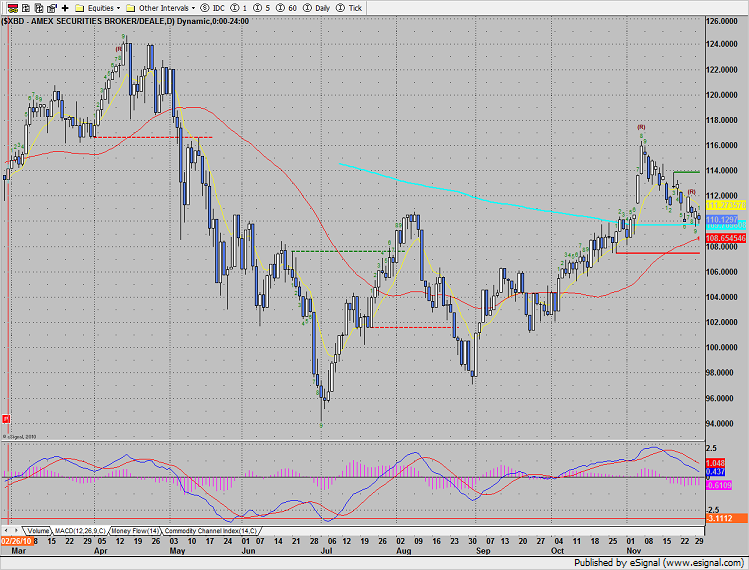

The XBD broker-dealer index is 9 days down and finding support at the 200dma. Look to this sector for upside continuation opportunities if the market starts higher again.

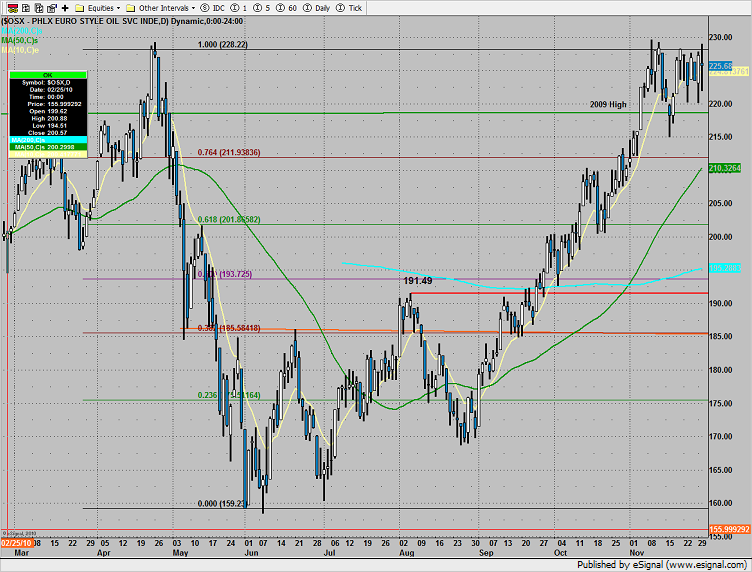

The OSX continues with the handle like price action.

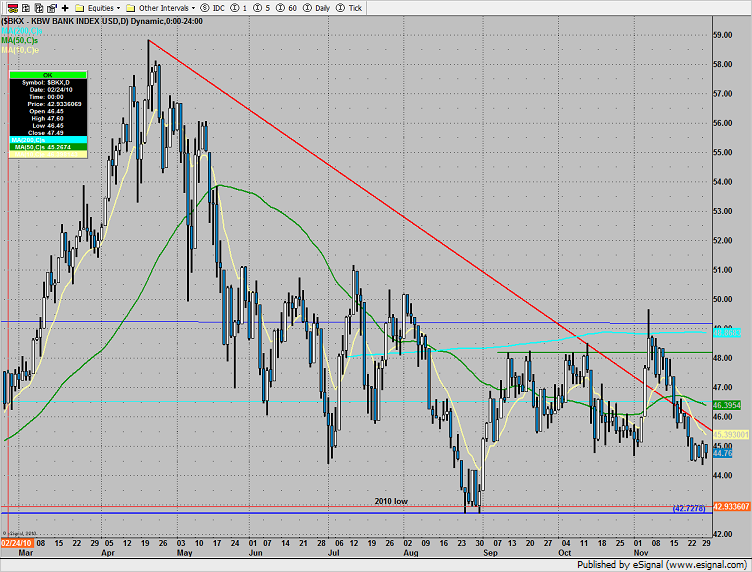

The BKX remains in the recent range, nothing new until this area is exited.

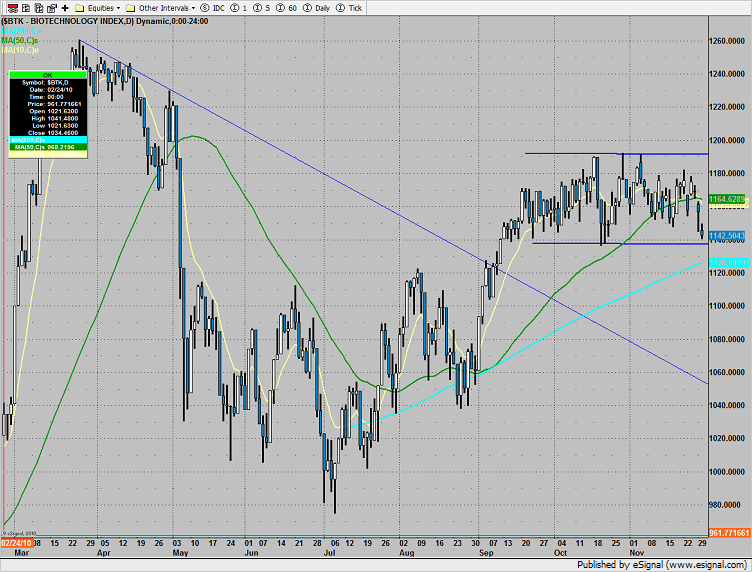

The BTK is leaking and close to the low of the recent range.

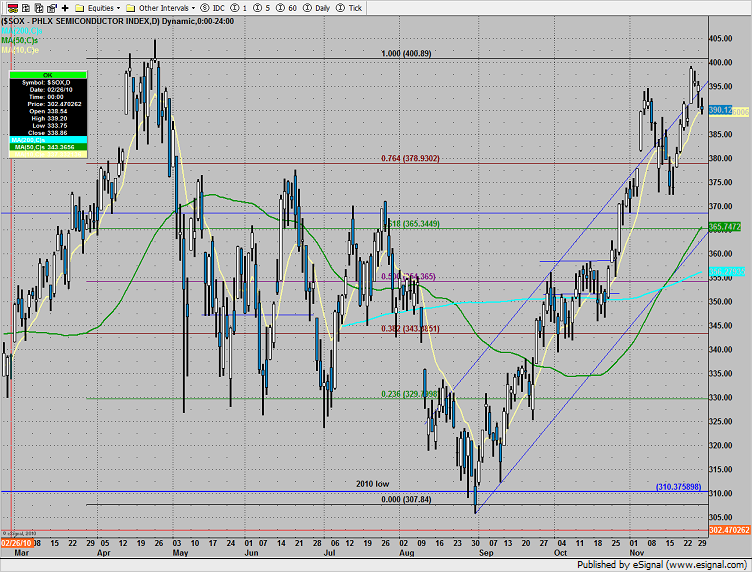

The SOX is finding support at the 10ema. The April highs remain the level to take.

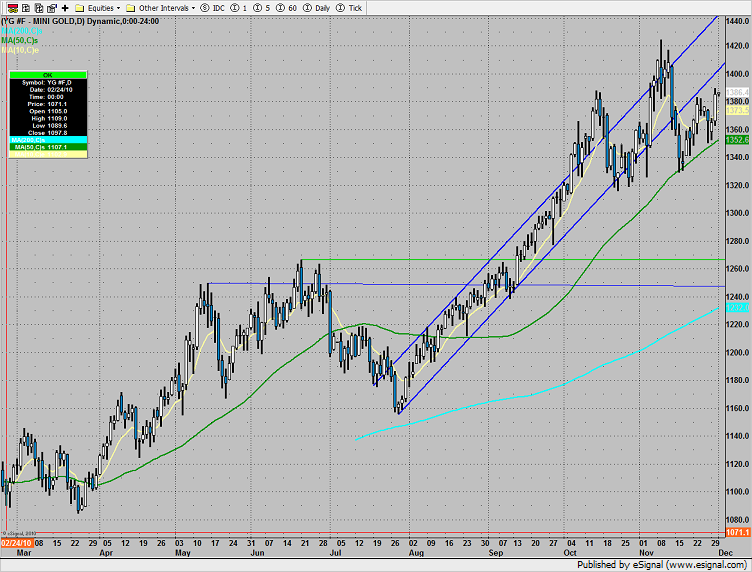

Gold was higher on the day by about $20 which is the high of the left shoulder.

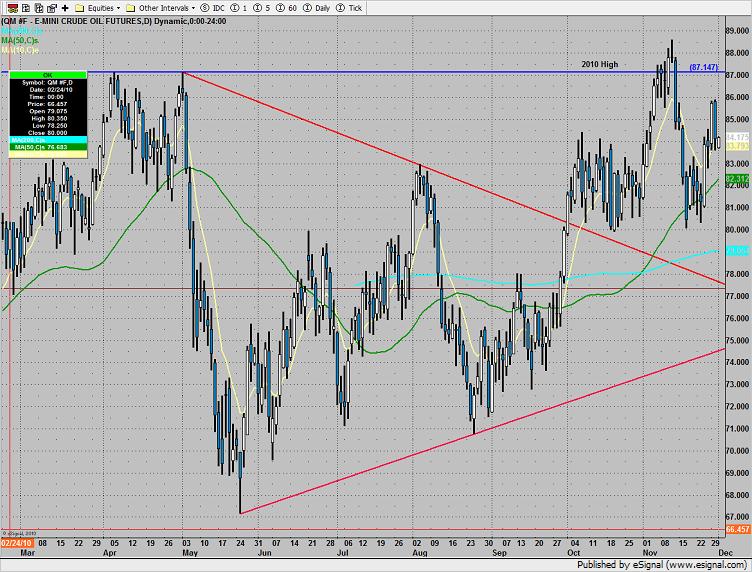

Oil diverged from the OSX and was much lower on the day. Keep in mind that at this stage in the cycle, the underlying stocks should lead crude futures not the other way around.