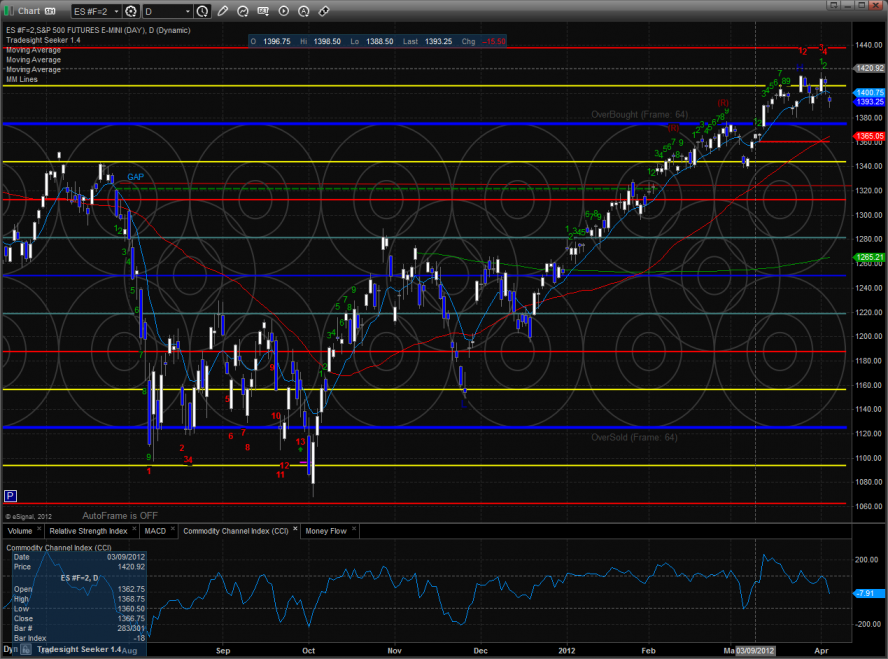

The ES gapped down below the lower pressure threshold and could not recover. Price lost 15 on the day and settled below the 10ema.

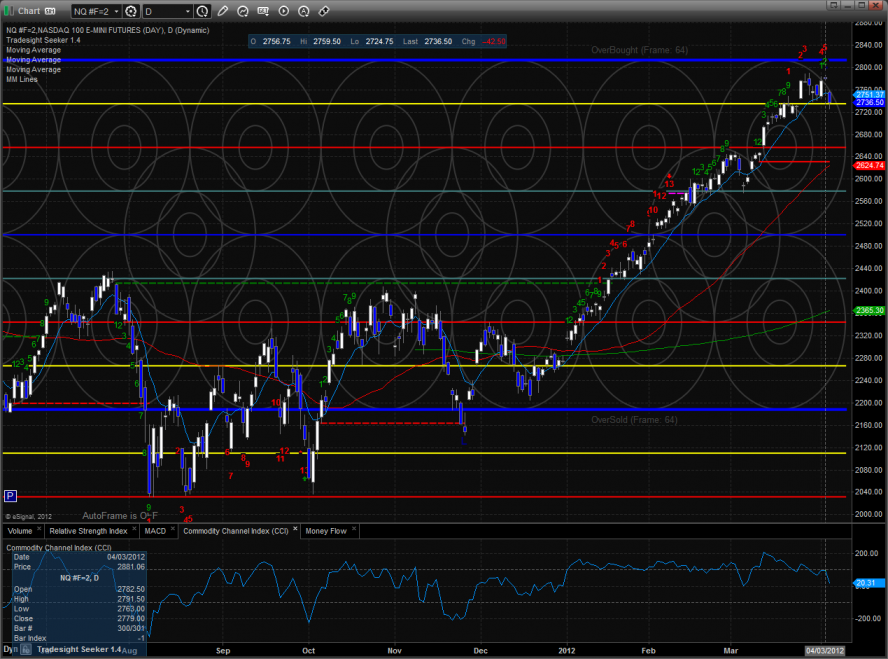

The NQ futures broke below the recent range and decisively settled below the trend defining 10ema. A follow through day would turn the chart short-term negative.

Multi sector daily chart:

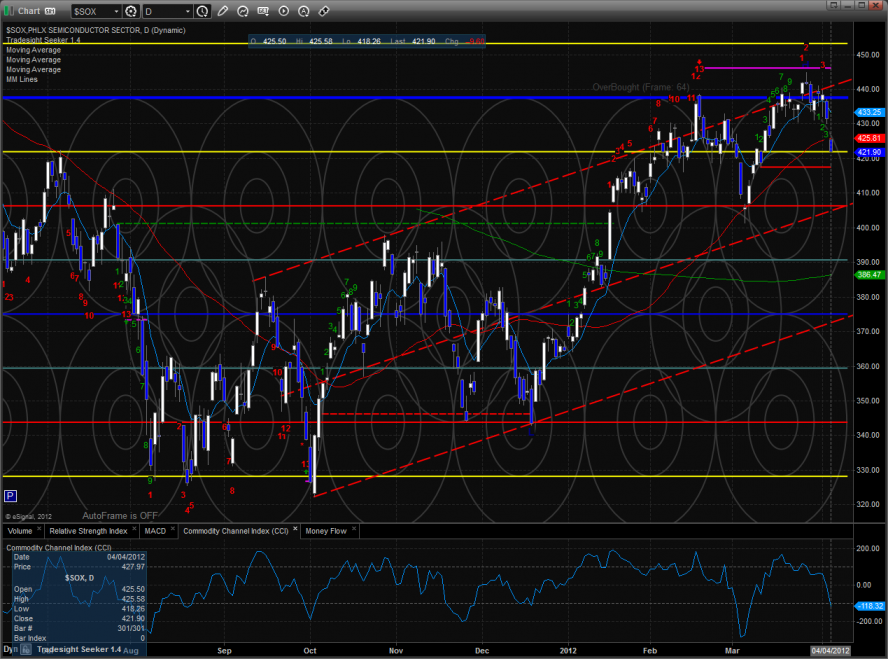

The SOX/NDX cross bearishly made a new low on the move which has negative implications for the overall NDX.

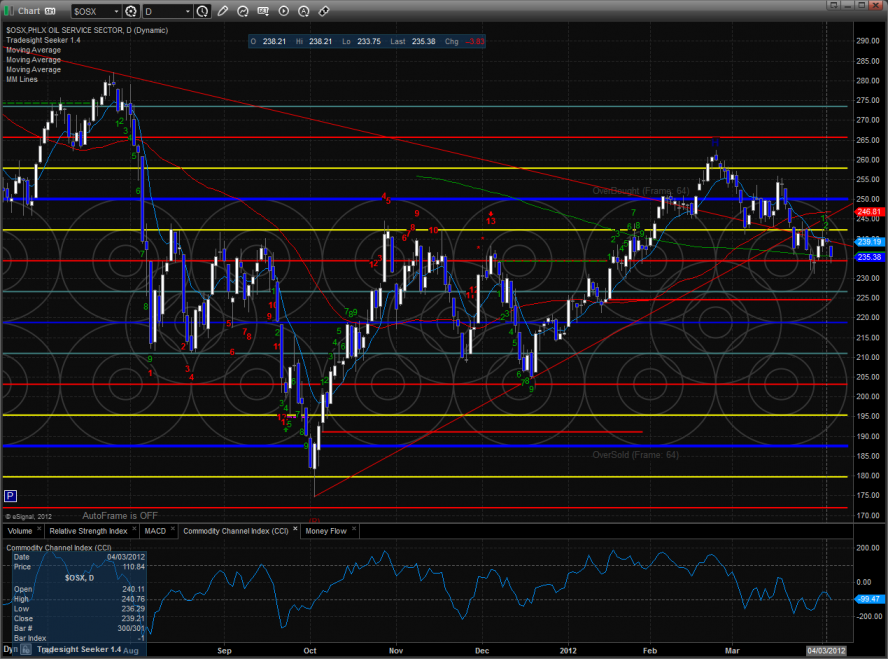

The OSX was the best performing sector on the day managing to hover above the real breakdown level below the March lows.

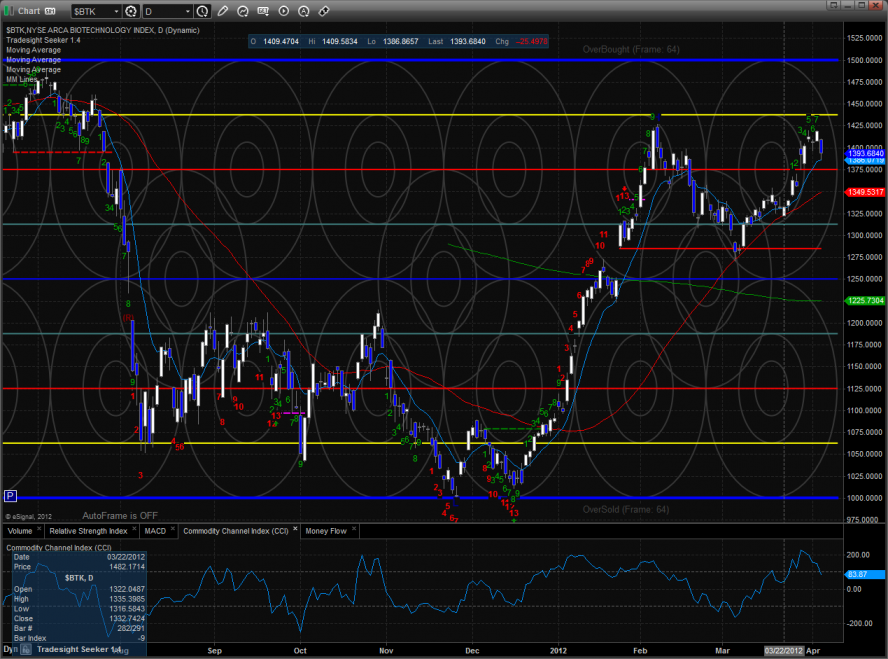

The BTK still has the potential for a nasty double top.

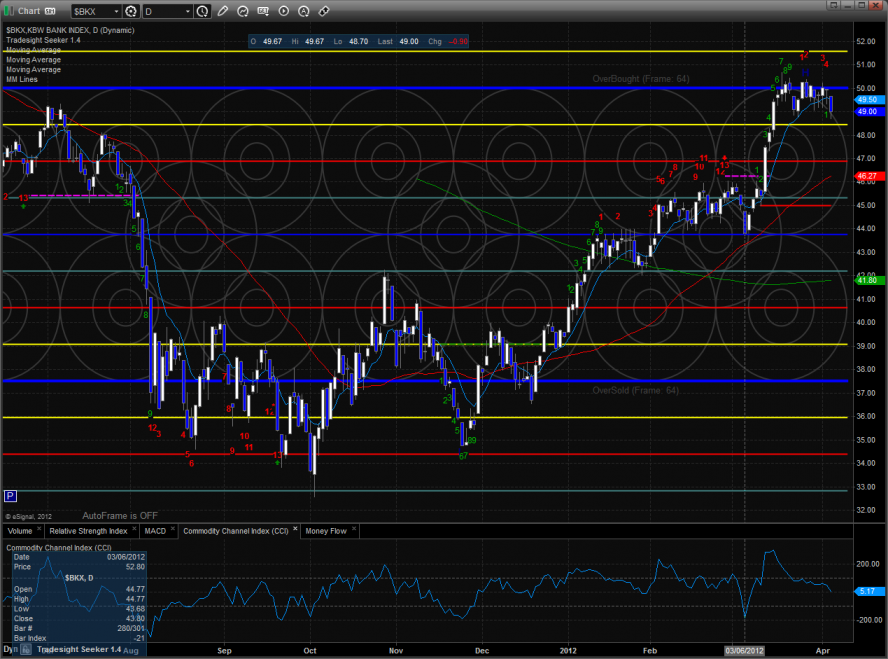

The BKX tested but did not break the recent range lows. A break under the range low would be very bearish and kick in some profit taking momentum.

The SOX is picking up downside momentum and is now below the 10ema and 50sma. The next important target is the active static trend line.

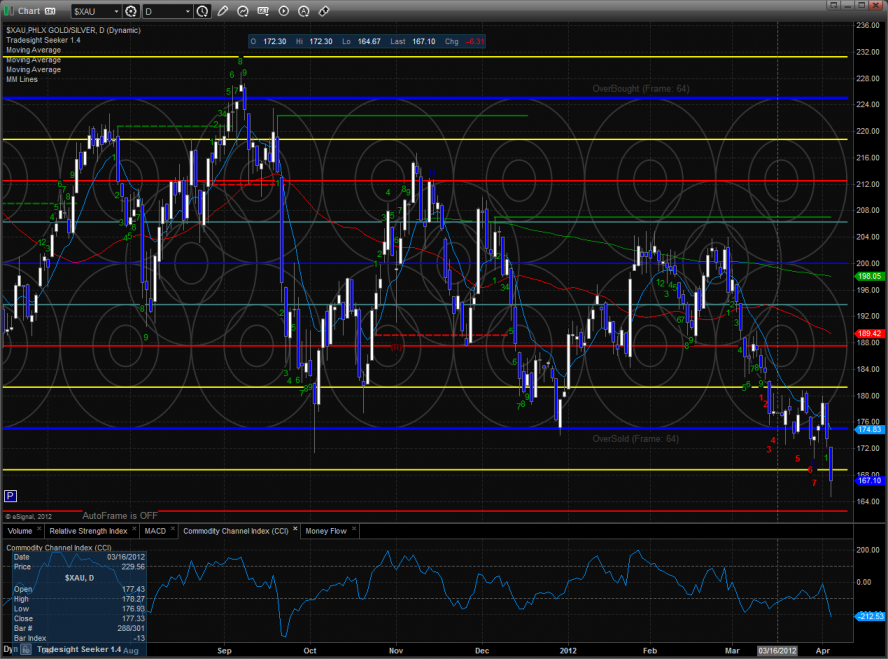

The XAU was no defensive stronghold for the bulls and made a new low on the move. The chart is in the oversold area closing below the -1/8 Murrey math level.

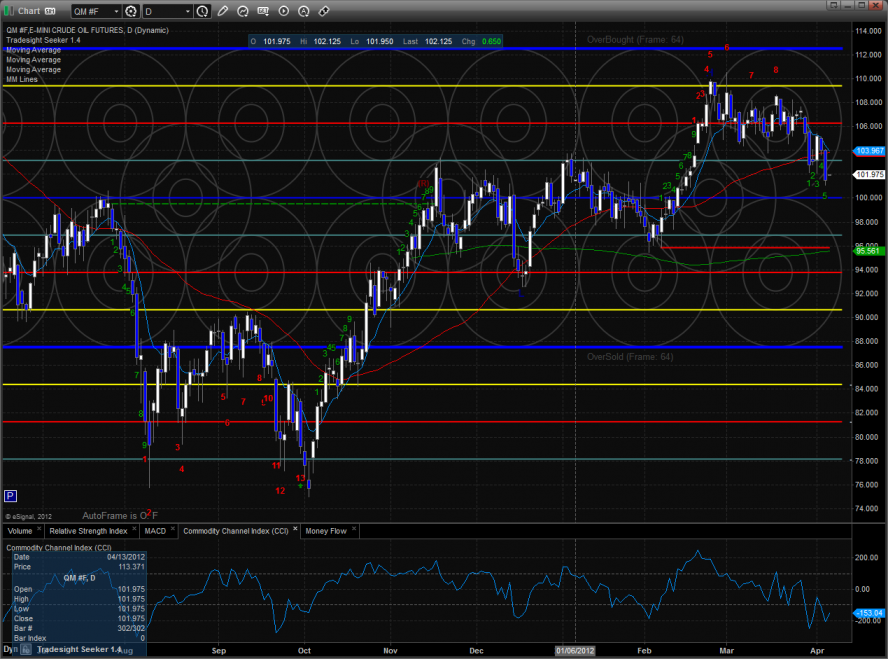

Oil:

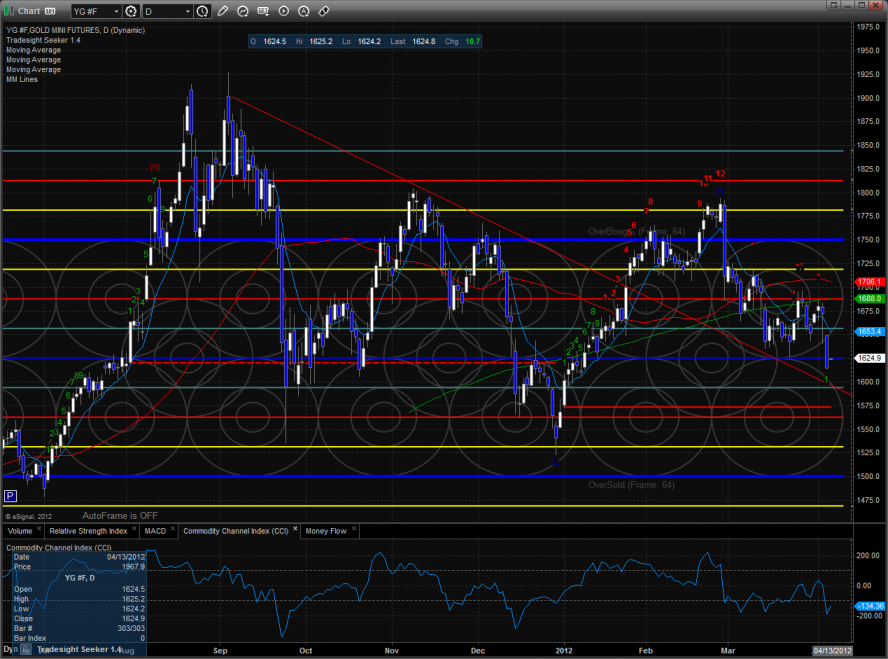

Gold:

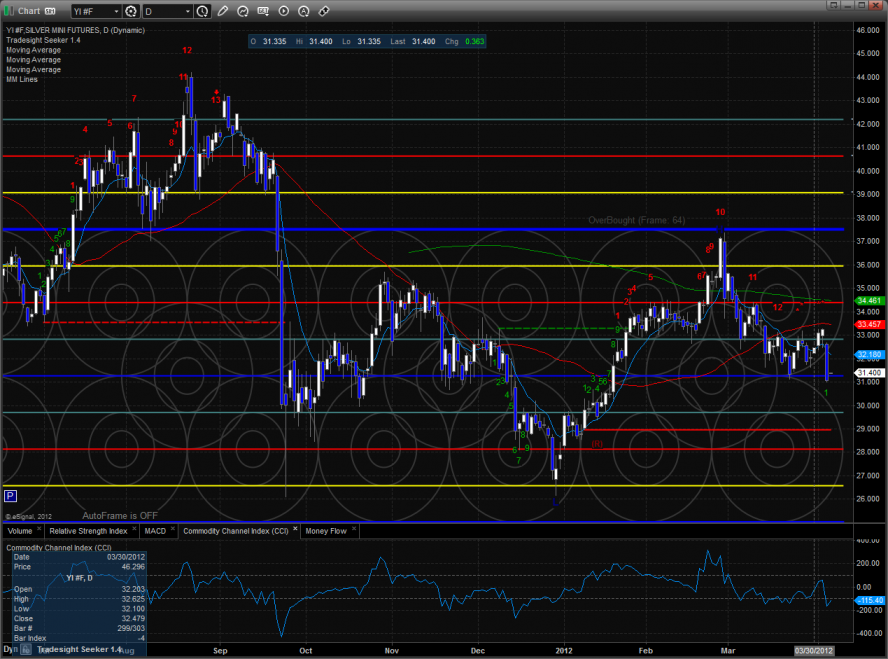

Silver: