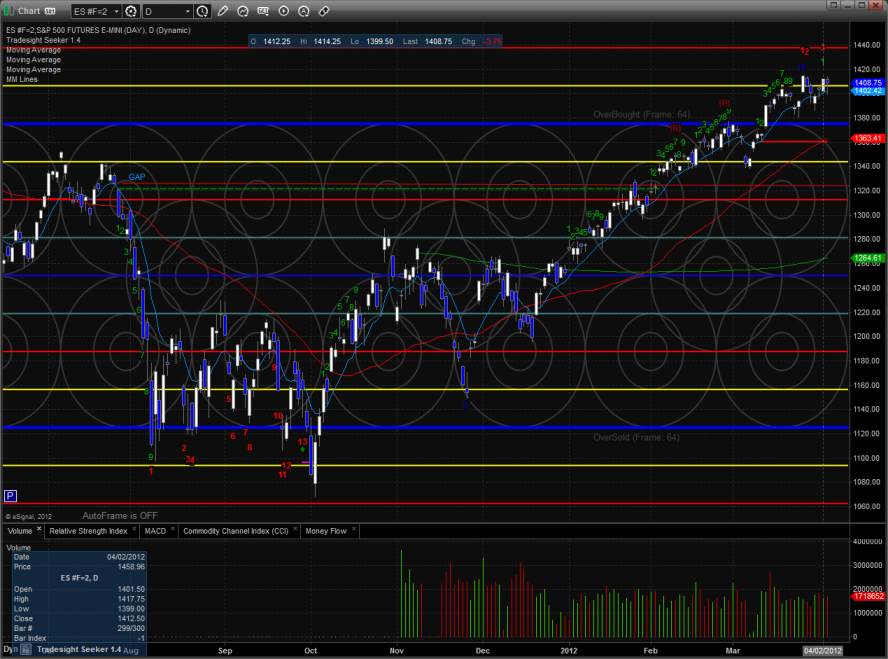

The ES was lower on the day by 3 handles but was contained by the previous day’s range which means there was no new technical development until price breaks the two day range.

The NQ futures were relatively strong all day gaining 2 points lead by the strength in AAPL. However, even though the futures were higher on the day, internally the market was weak with a net 1k issues lower on the day. Poor internals and bad breadth are often signs of an impending change in trend.

Multi sector daily chart:

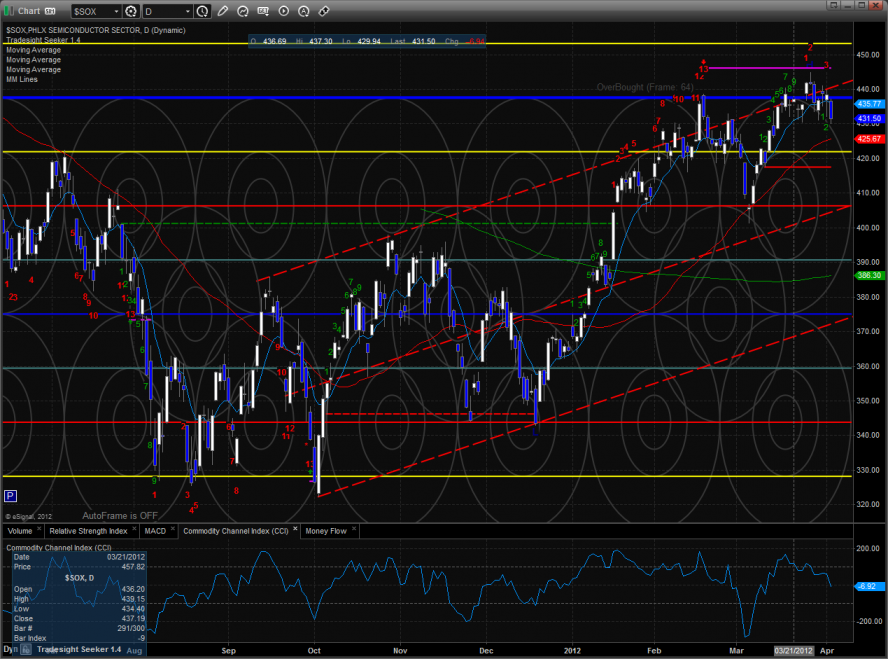

The SOX/NDX cross is very close to a breakdown. A leg down would have very bearish implications for the overall NDX.

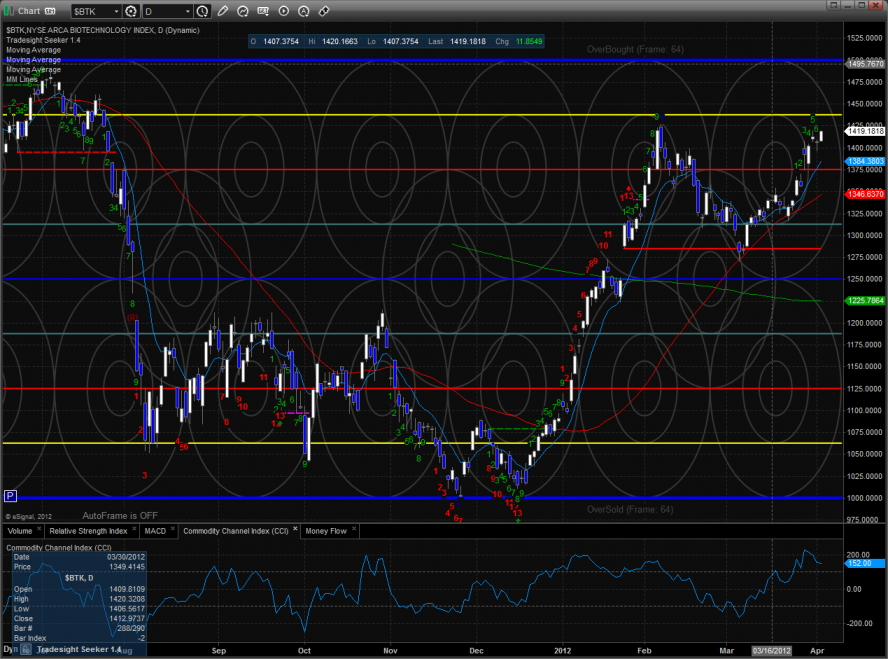

The BTK was the top gun on the day but did not make a new high on the move.

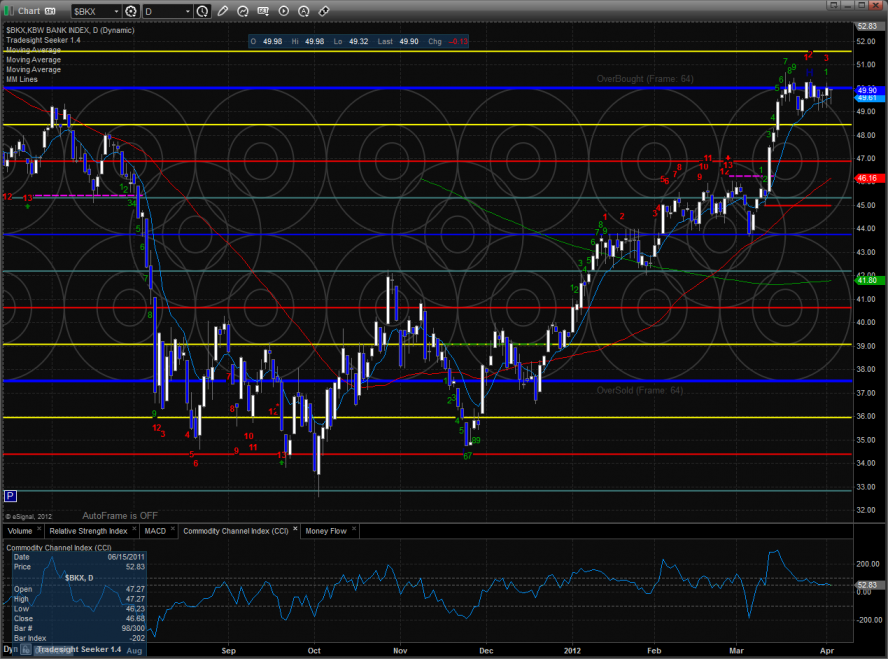

The BKX was little changed and remains boxed up at the 8/8 level.

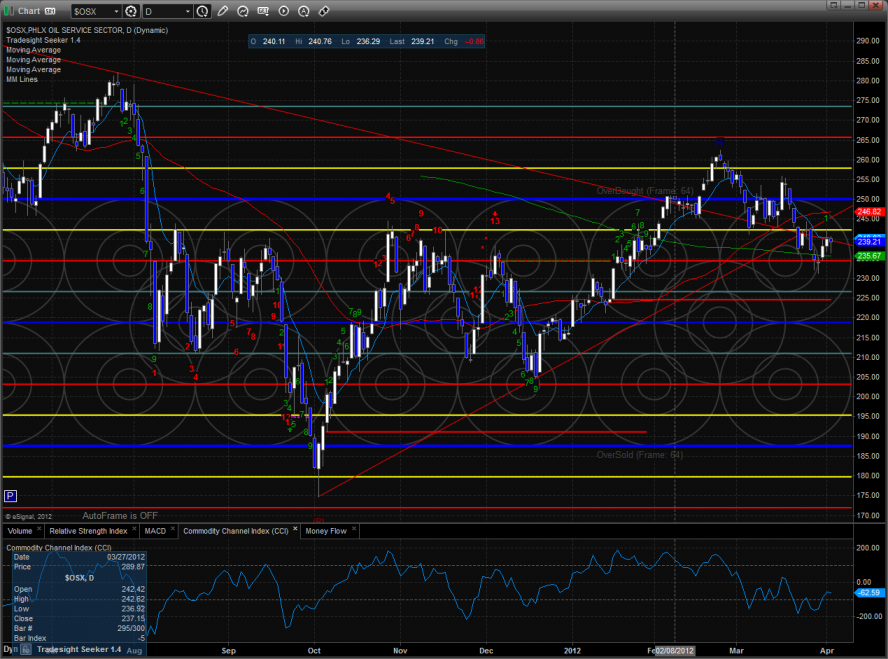

The OSX is trapped between the 50 and 200dmas, when price resolves this area it should move nicely.

The SOX was the weakest NDX sector on the day and the relative weakness must stop here. The Seeker sell signal is still acive.

The XAU was by far the weakest sector on the day and the bottom fishers were frustrated by the chart making a new low on the move.

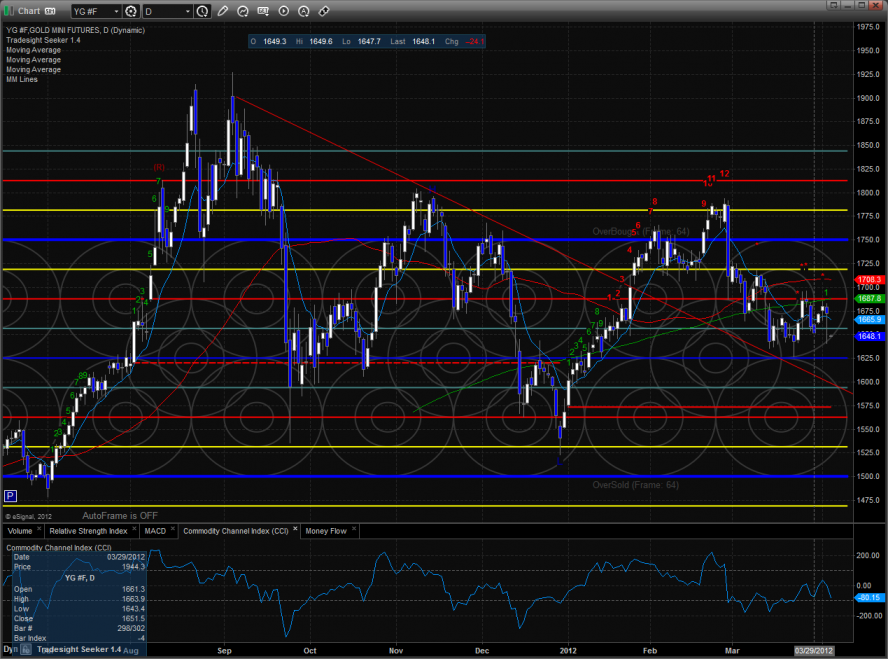

Gold waterfalled lower after the release of the FOMC minutes and didn’t recover.

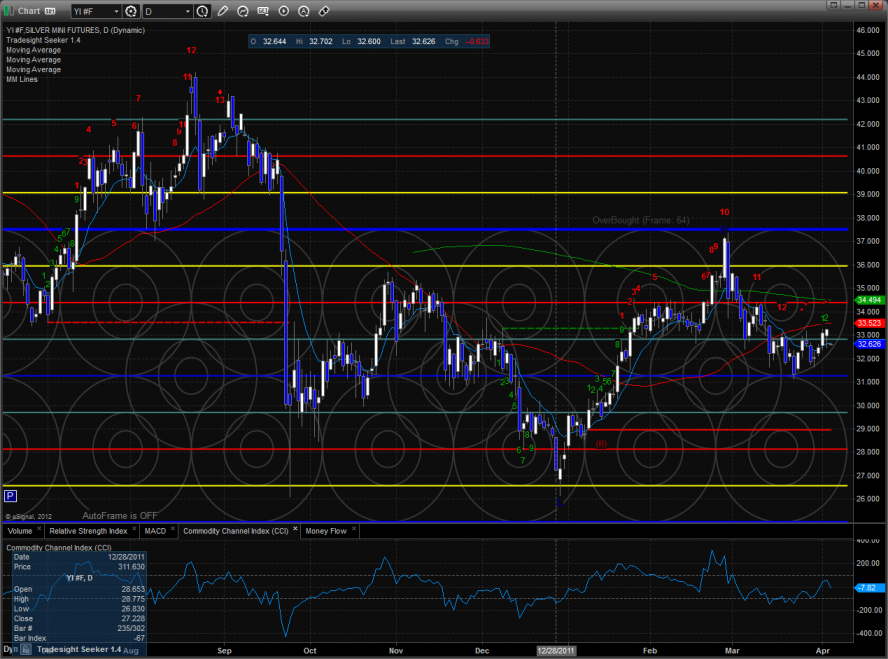

Silver:

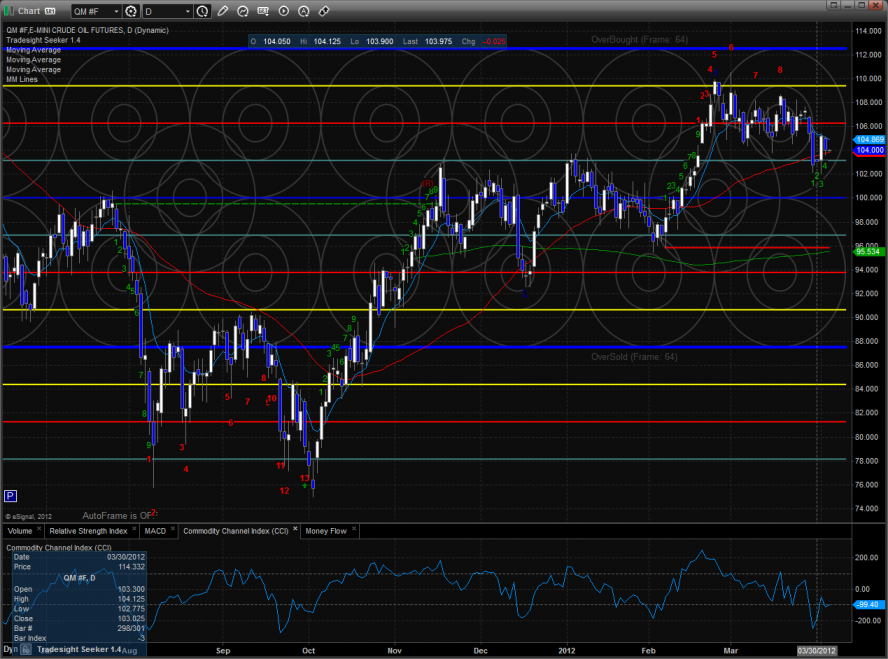

Oil: