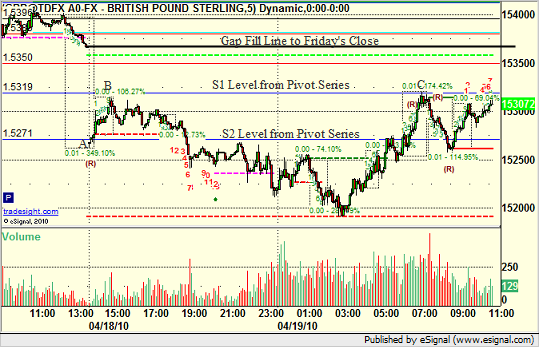

We saw some unique action that has led to an interesting setup in the GBPUSD to start the week. Sunday, the markets gapped in favor of the US Dollar on the open. This caused the GBPUSD to gap down between the S1 and S2 levels of the Pivot series. Gaps in Forex can only occur on Sundays, and this created an unusual starting place for the GBPUSD. As you can see from this chart, the initial impulse move after the gap was between S2 and S1 (points A and B on the chart):

The pair later broke under S2, giving us a short entry that led to a profitable overnight trade. However, this morning, the GBPUSD has moved back between the S1 and S2 levels, and in fact, it hit S1 exactly at C.

This has created an intriguing base, almost a cup and handle, against the S1 level with a gap to fill way above. Gap fills occur 80% of the time on the same day that the gap is created, but they fill about 95% of the time within a week. Although the session is mostly over and volume has drifted off, we will be watching this area once the new Levels are created after 5 pm EST and looking for an entry into the gap over this prior S1 level. The gap fill itself would be the target.

It is very unusual to get such a setup in Forex, although we see them daily in stocks and futures.