We just completed options expiration week, and triple expiration at that (options, index futures, and commodities).

On item that I try to point out every options expiration week is the importance of options unraveling, which typically occurs mid-week, most commonly on Wednesday. What is unraveling? It’s the point where the big players close out their options positions that are in the money as time is running out. This has big implications for moves in the market, and it therefore often causes the biggest move of the week.

The key to making money off of this phenomenon is to understand what it is, then to know when to expect it, then to identify when it is occurring, and then to take advantage of it by increasing your odds.

The secret to unraveling is the following: when it happens, the market picks a direction sometime after the first hour of play, heads that way on volume, and never really reverses. In other words, if you see unraveling happen, you know what direction to stick with all day long.

So, that’s what it is.

When do we expect it? Usually mid-week, most commonly Wednesday, of expiration week, after the first hour. So, that’s when I watch for it.

How do we know we get it? A move will start, and VOLUME WILL REMAIN HIGHER THAN NORMAL midday.

What do we do once we spot it? Have great confidence in sticking with that direction into the close.

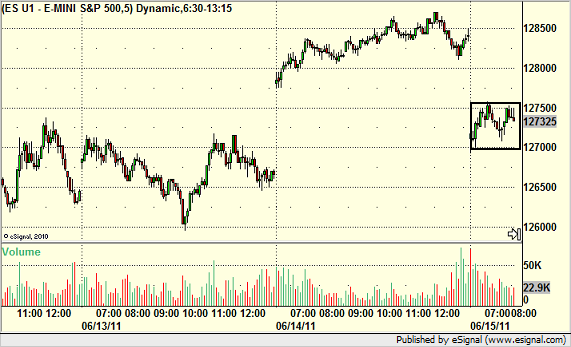

Here’s Wednesday with the first hour boxed off on the broad market futures after a gap down:

So from this point, if we’re going to get unraveling, we should see a move begin to occur and volume stay up. Do we get it? Here’s the shot after another 30 minutes:

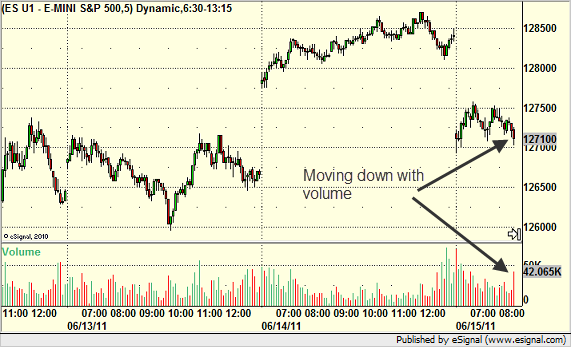

Note that we are breaking lows at a time of day where things are usually slowing down, and volume is up. But, that could be just one bar of volume, does the volume hold? Let’s jump a little further ahead and compare the volume midday to what we saw the prior two days:

Yes, indeed, volume is staying up as the market is selling off.

So, we expected it on Wednesday, now we have it, what do we do with it?

Well, the unraveling move is down. Most other days recently, we have seen a return to the midpoint of the session after lunch on light volume. I wouldn’t expect to get that move now. I would focus on any rally failing and looking for shorts.

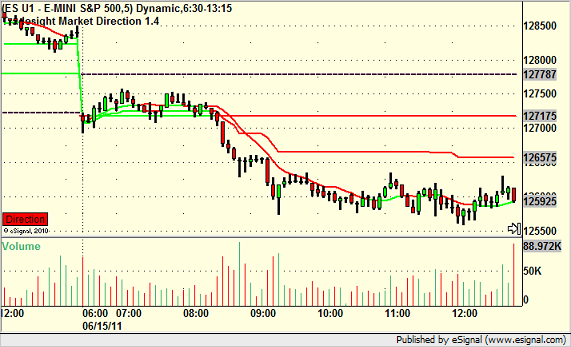

So as we come back from lunch, the market starts to tick up. I told subscribers that I didn’t think we’d get back up to the midpoint with the rally:

And, in fact, we did not. Everything failed as expected:

What does that do for me? It keeps me looking for short entries throughout the second half of the day with little concern that that is the correct direction. I focused on AMZN:

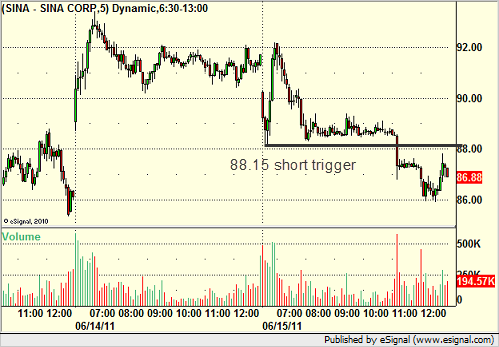

And SINA:

Both of which worked great.

Sometimes, trading is that easy, and you need to focus on those easy moments. Unraveling only happens once a month (and sometimes, it really doesn’t happen at all in any convincing fashion). Still, when it happens, we expect, identify, and then act with confidence.