See ES and NQ’s below to close out the month. NASDAQ volume was strong at 1.8 billion shares, but the futures trading continues to be choppy, and we had one trigger on news. The one thing that did work yet again is that the Comber called the high of the day on the ES midday. See below.

Net ticks: -21 ticks.

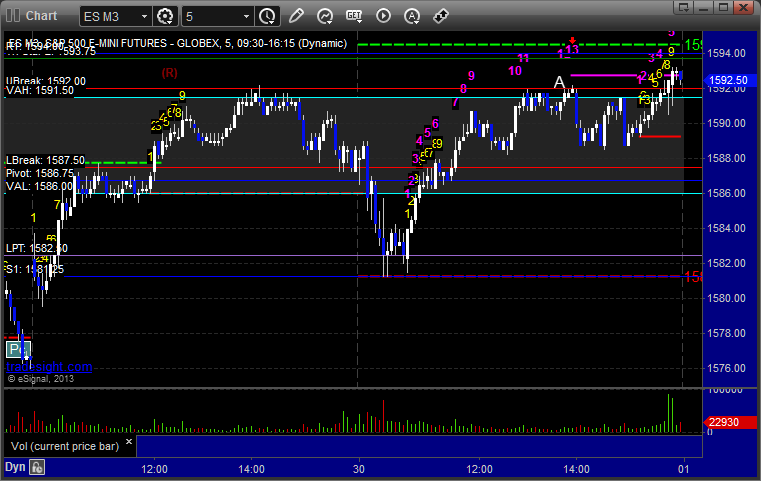

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

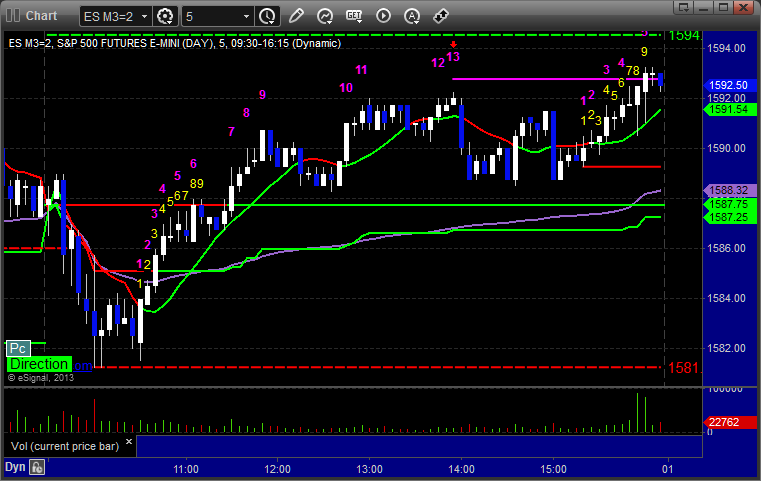

ES:

Note the Comber 13 was the top out point midday.

Mark’s long triggered over lunch right at the 13 and stopped for 7 ticks:

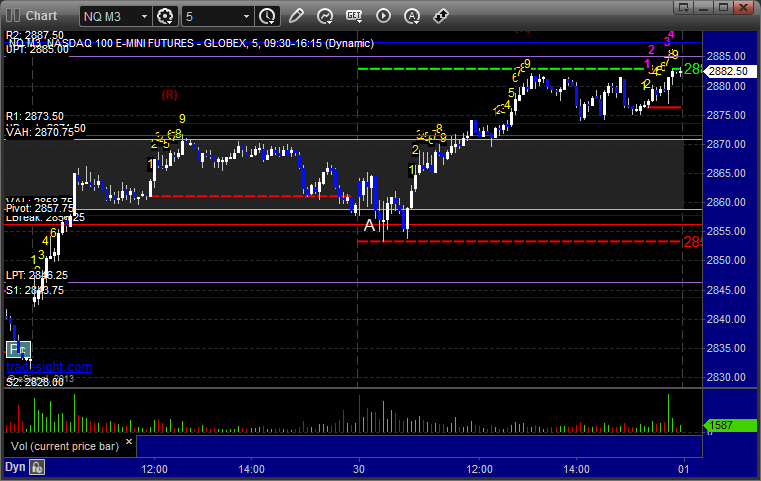

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Meanwhile, my short ended up triggering right before the Consumer Confidence number at A at 2856.00 and stopped on the news (you want to take less size or pass in the minutes before a big news item). Despite the fact that the number beat by a lot, the trade triggered again a few minutes later, came within a 1/4 point of the first target, and stopped. This is the 5th time this month that the NQ, which we use half points as ticks on, has come within a quarter point of the target. Unreal: