Worst day of the year for futures trading. Market gapped down and tried to go up for a second, then went down. In the process, both the ES and NQ Opening Range plays swept both directions. An additional call on the NQ didn’t work as it triggered on news (shouldn’t take them on news), and then Mark had an ES winner. See those sections below. Markets closed right where they opened (again) on 1.75 billion NASDAQ shares.

Net ticks: -55.5 ticks.

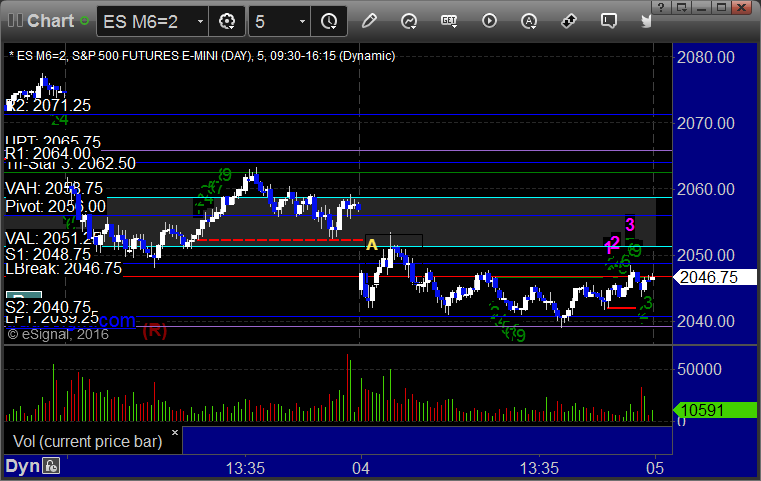

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn’t work, triggered short at B, missed first target by a tick under the rules, and stopped:

NQ Opening Range Play triggered long at A and didn’t work, triggered short at B and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark’s called triggered long at A at 2051.50, hit first target for 6 ticks, stopped second half under entry:

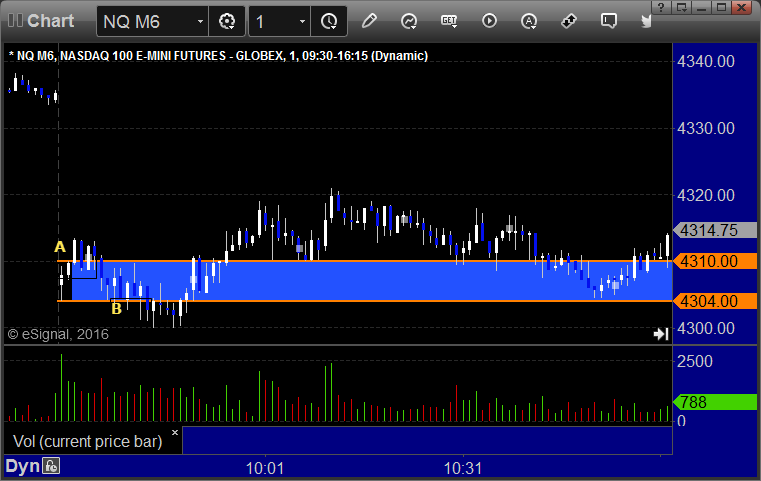

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4316.75 and stopped. I did not re-enter, although that would have worked: