The markets gapped up a little and drifted down but didn’t quite fill the gap, then cupped out and ran a little at the close.

Net ticks: +4.5 ticks.

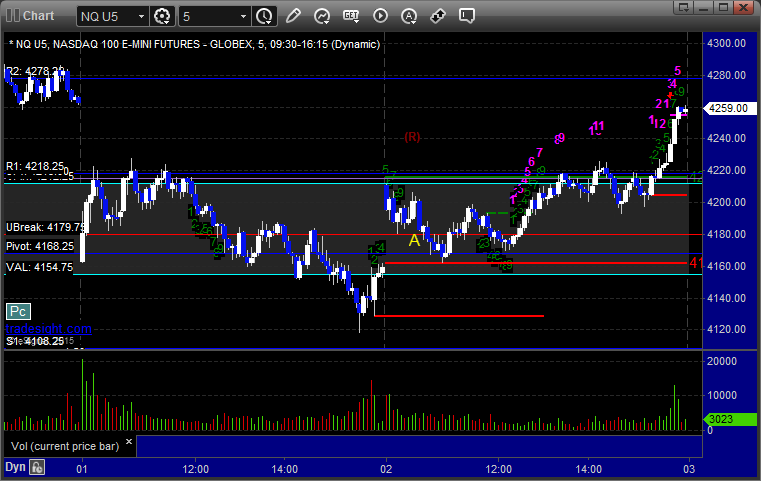

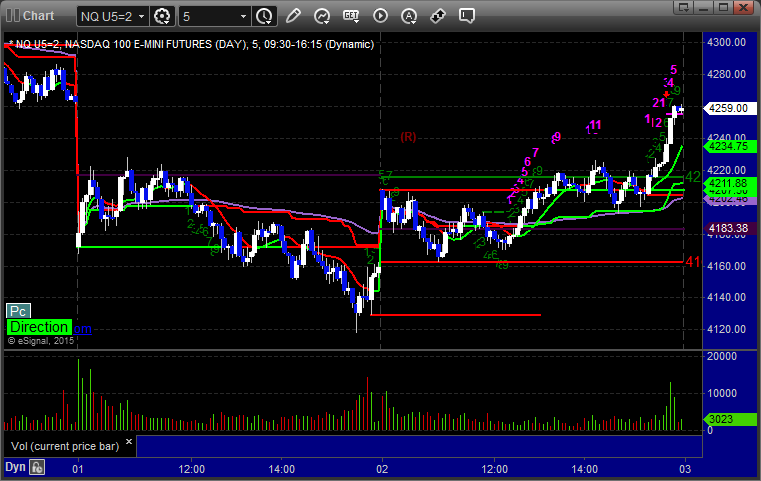

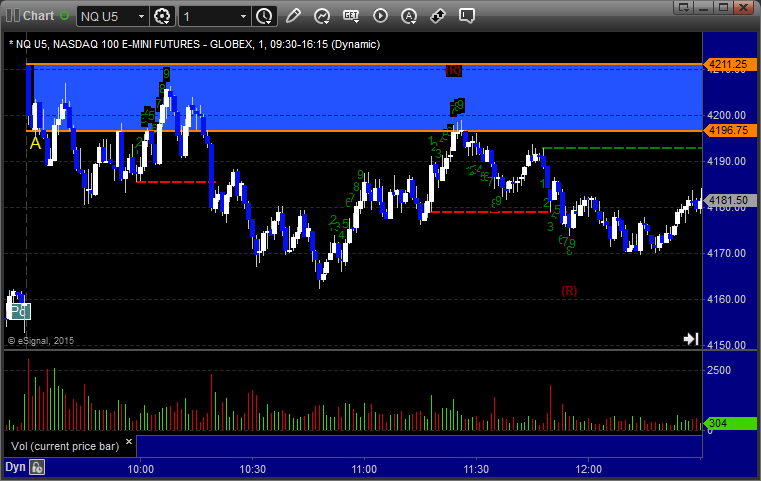

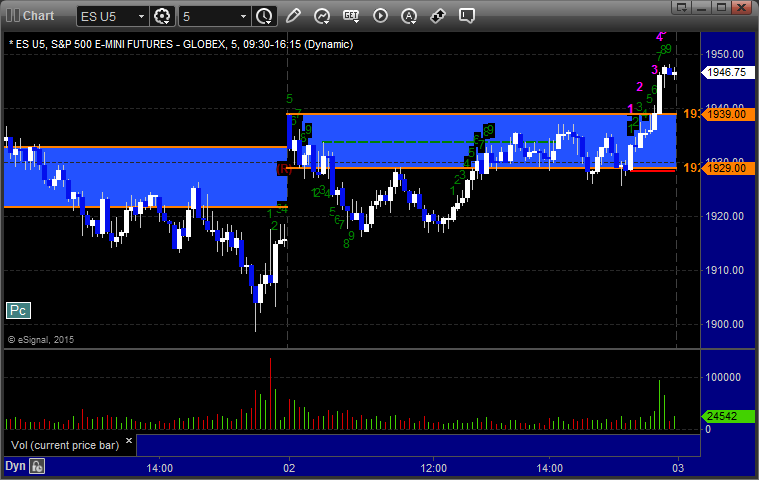

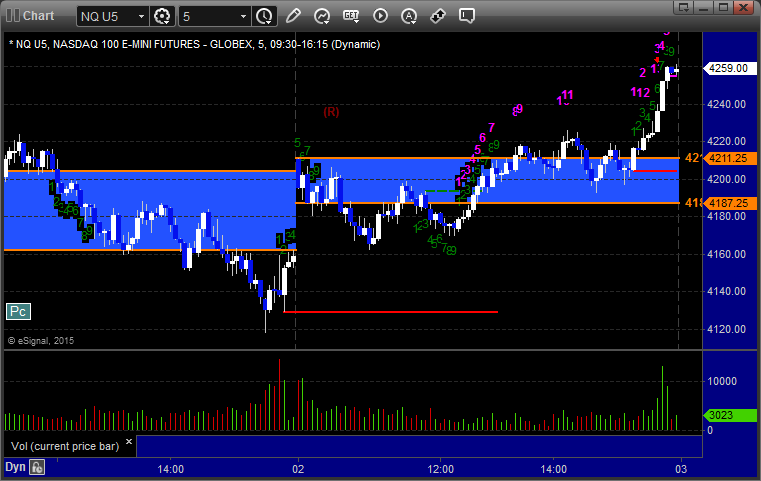

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1937.50, stopped initially on a sweep, triggered again, hit first target for 6 ticks, closed second half at 1940.50 for 12 ticks for end of day:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A 4179.50, hit first target for 6 ticks, stopped second half over the entry: