Two stop outs (ES and NQ) and a small winner (NQ) on a narrow day in the markets. See both sections below.

Net ticks: -7.5 ticks.

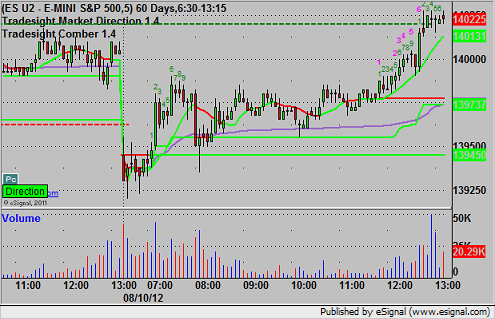

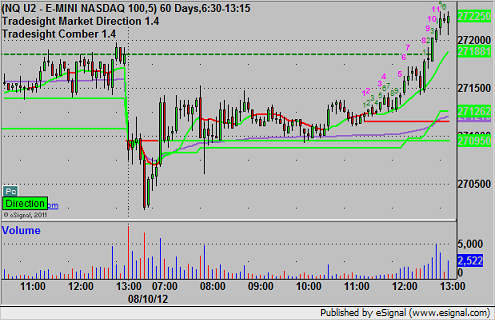

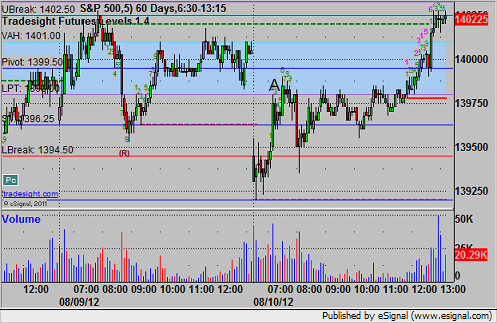

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Triggered long into the Value Area after perfectly setting the Value Area…entry was 1398.25 at A and stopped for 7 ticks, but not a re-entry candidate because it spent time above the entry:

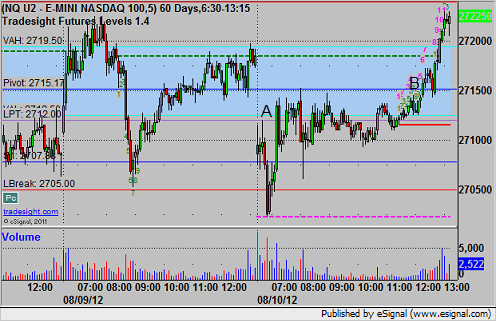

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A 2713.00 and stopped for 7 ticks, also not a re-entry candidate. Separate trade triggered long at B and hit first target for 6 ticks and closed the last piece around that level for end of session (2719.00 final exit):