A big day in the markets, but the prior day was better for our futures trading. We gapped down huge and ultimately went lower on 2.5 billion NASDAQ shares.

Net ticks: -30 ticks.

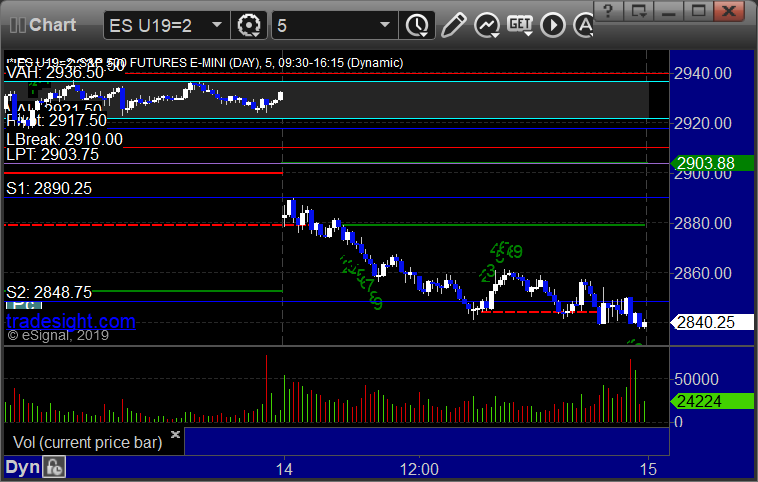

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

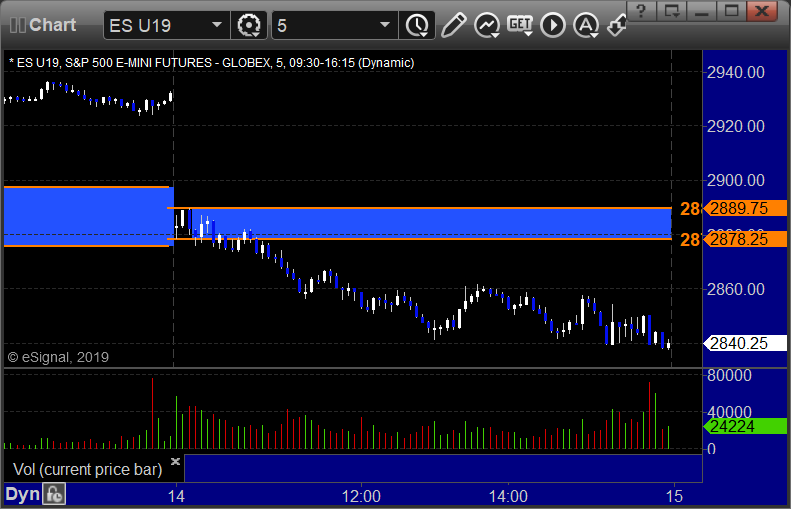

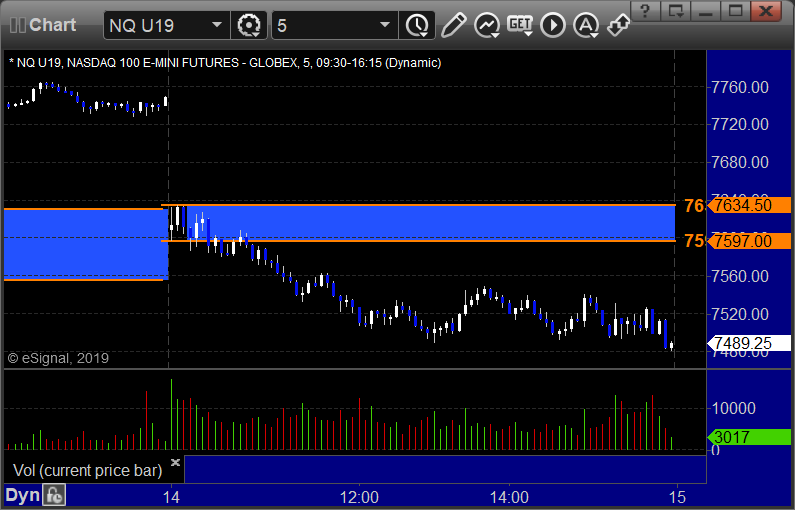

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play, lot of ways you could have treated this, but because the ES OR was so wide, the normal rules are triggered long at A and stopped under the midpoint, triggered short at B and stopped over the midpoint. If you traded them for the full OR then you made money instead:

NQ Opening Range Play triggered long at A and stopped and short at B and stopped, but way too much risk on both under the rules to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: