Well, we did not get the options unraveling move that we were looking for. Instead, the markets opened flat, didn’t do much initially, spiked up on the news 30 minutes in, and then started to roll after an hour (when options unraveling should start), but then reversed higher and held the level that they were at before the Fed comments the prior session. NASDAQ volume was only 1.7 billion shares. Looks like we’re where we need to be for triple expiration Friday. See ES section below.

Net ticks: -7 ticks.

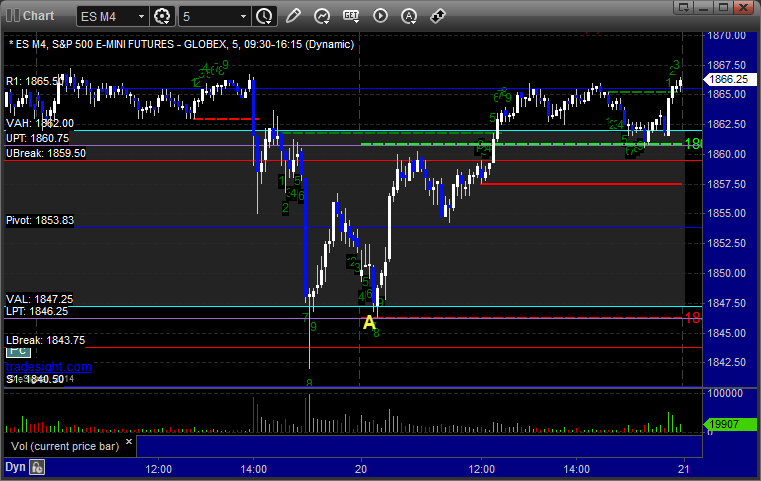

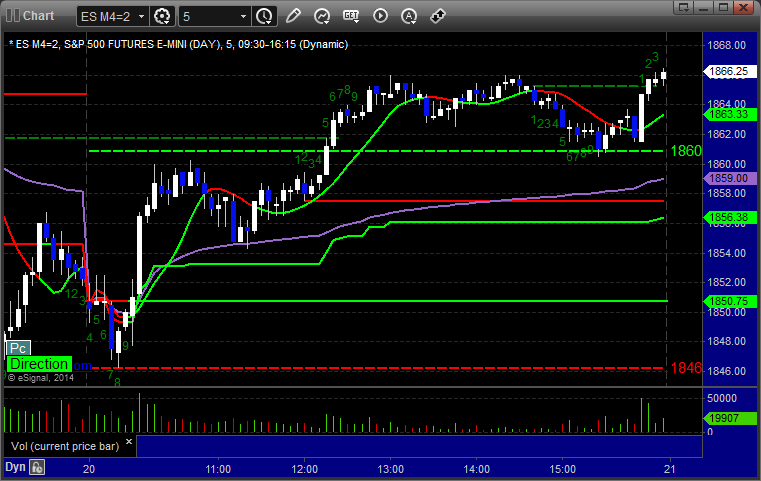

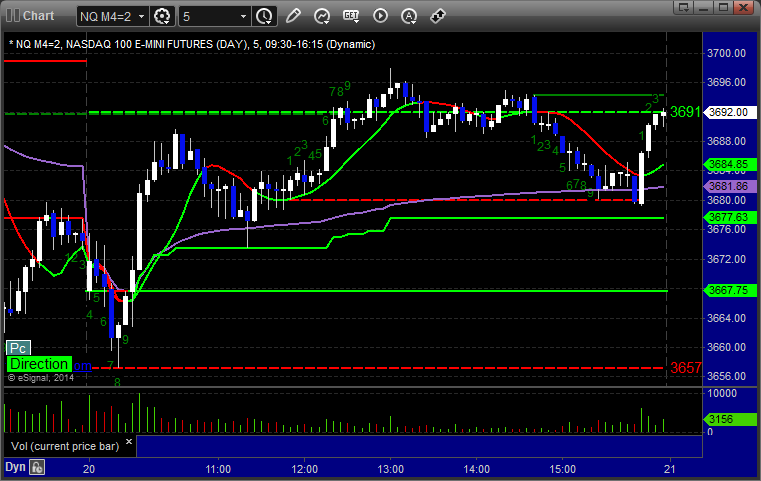

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES:

Mark’s call triggered short at 1846.75 at A and stopped. I cancelled his long call because we were heading into lunch and it looked like direction was rolling for unraveling, but that call would have worked: