The markets opened flat and while volume was a little better (NASDAQ volume 1.7 billion at the close), it was still a very limited environment for earnings season. We did get an options unraveling move after the first hour to the downside, and that implied a close near the lows of the day, which we got. Mixed results on the Opening Range Plays, but I warned about the short side triggers in the room. See that and the ES and NQ sections below.

Net ticks: -11.5 ticks.

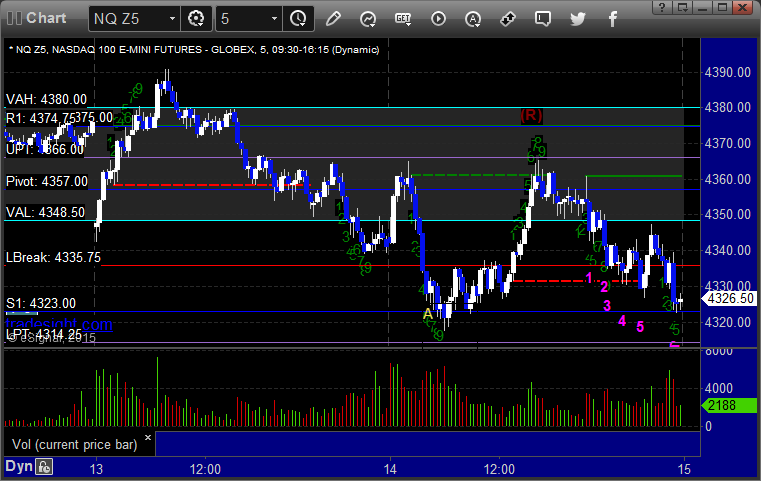

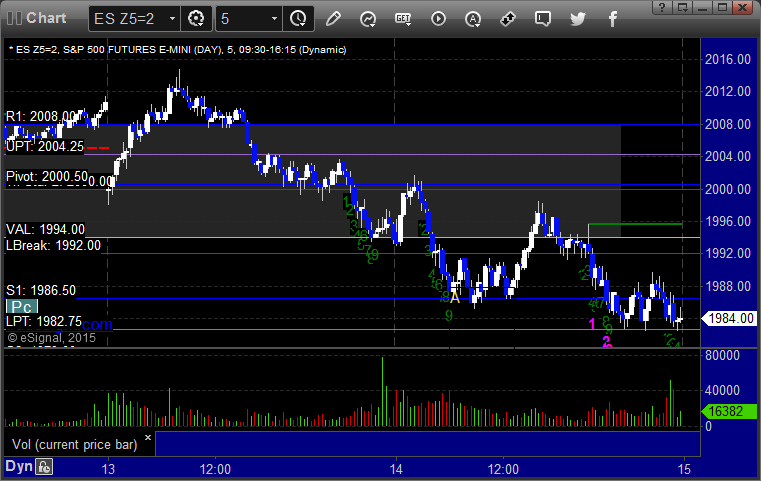

As usual, let’s start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today’s session:

ES and NQ Opening and Institutional Range Plays:

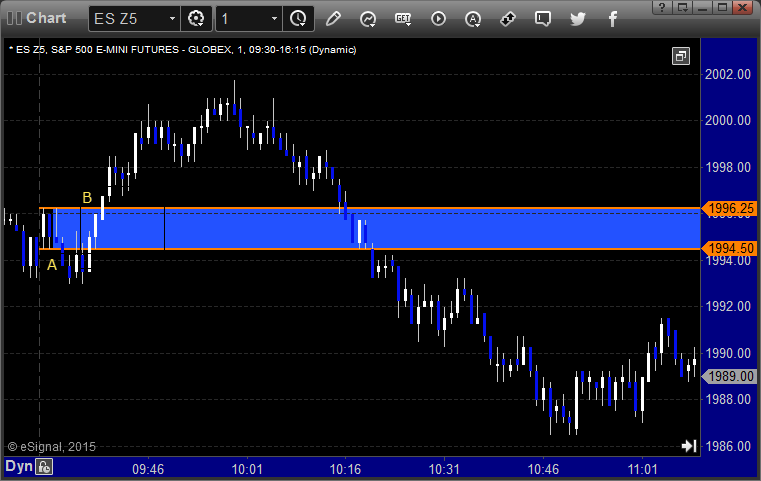

ES Opening Range Play triggered short at A and only filled the gap, which was the concern I stated in the room, but then triggered long at B and worked great:

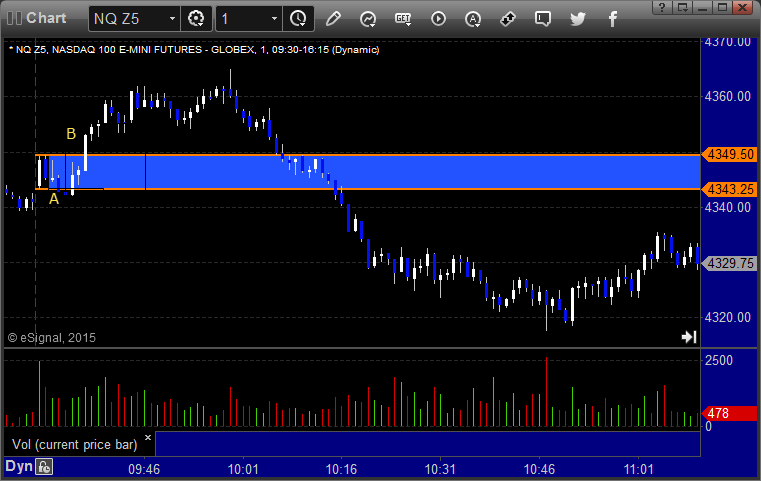

NQ Opening Range Play triggered short at A and only filled the gap, which was the concern I stated in the room, but then triggered long at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

This triggered short at A at 1986.25 and stopped. I did not take it again:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark’s call triggered short at 4322.50 at A and stopped. He put it back in and it triggered, hit first target, stopped second half over entry: