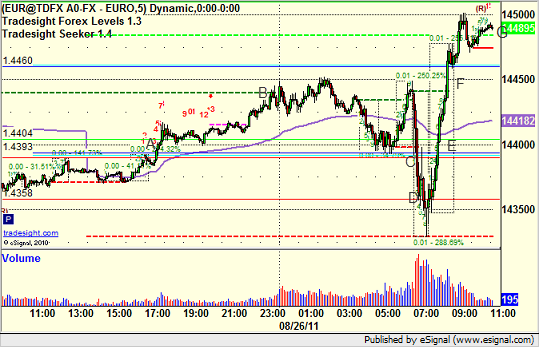

A LOT of triggers for the session, all in the EURUSD, and more than usual (four total). As expected, the long play, which was set up nicer worked better. See below and also check out the USDJPY review for the Value Area play there that was so wide open.

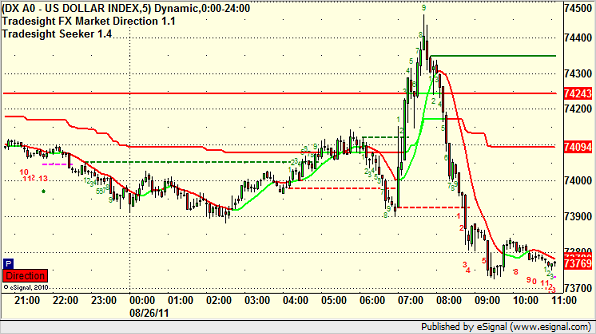

As usual on the Sunday report, we will take a look at the action from Thursday night/Friday, then look at the daily charts heading into the new week, and then look at the US Dollar Index, this week with a bit of an extended discussion.

Here’s the Index intraday with our market directional lines:

Calls resume Sunday. We have a full week next week, which is often considered the “end of summer” week heading into Labor Day. Should be light especially at the end of the week and then we will see when things pick up again after Labor Day.

EURUSD:

Crazy stuff. Triggered long at A, hit first target at B, raised stop under entry, stopped at C. Bernanke’s comments got the market moving in “news” fashion and it triggered short at D, just barely, and stopped immediately, then went again right after on the short side, went a little farther but not enough, and stopped. Triggered long at E again, hit first target at F, closed final at G to end the week:

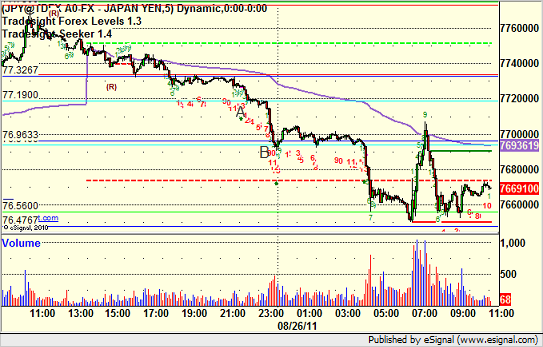

USDJPY:

Nice Value Area from A to B: