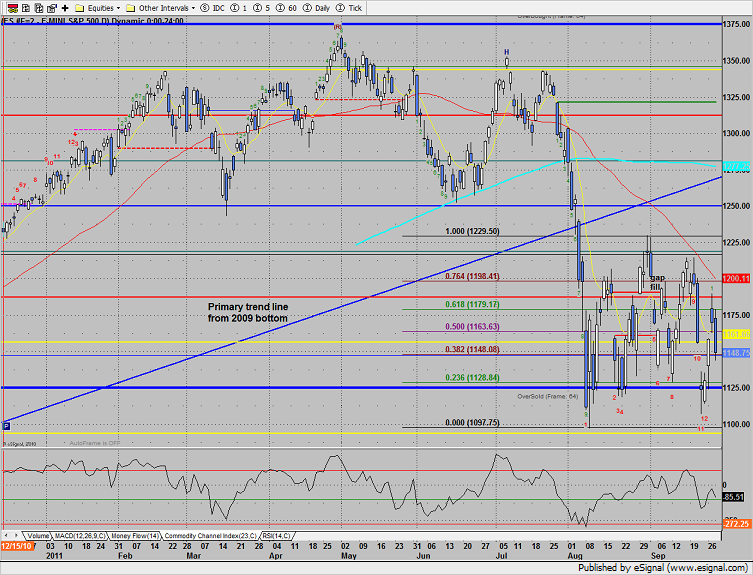

The SP posted a very weak day losing 20 handles. Price settled below the midpoint of the trading range and the CCI could be on its way to confirming a lower high.

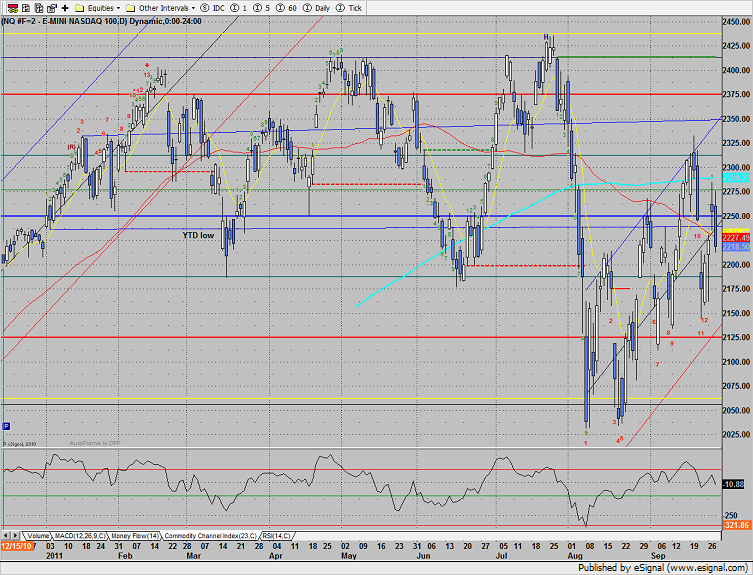

The NQ tanked by 35 handles and closed below the midpoint of the regression channel. Bearish activity to be sure but not yet a change in trend. The CCI is very close to breaking and qualifying a lower high. A technical lower high is defined as a lower high followed by 2 lower lows. This technique weeds out pauses in a healthy trend.

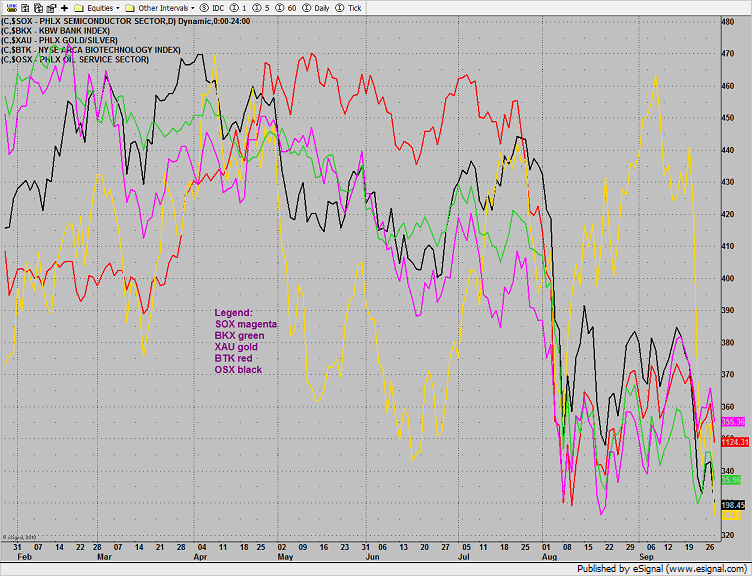

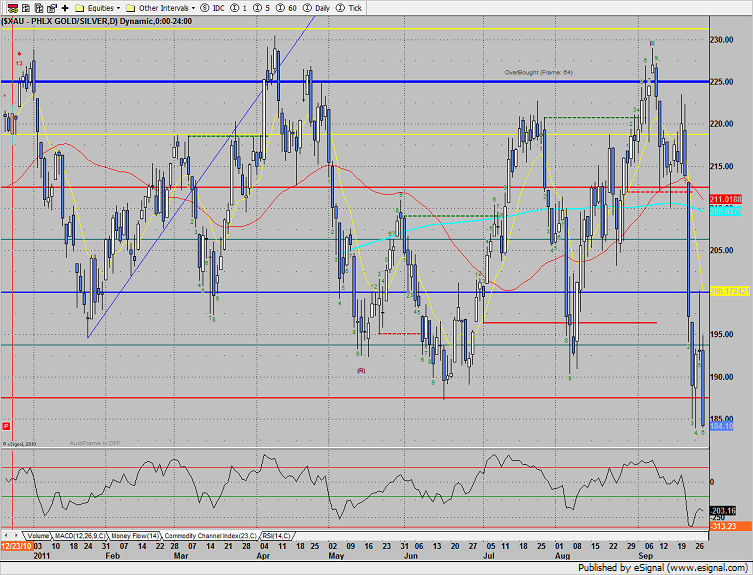

Multi sector daily chart shows the rapid reversal of the XAU moving from relative strength to relative weakness.

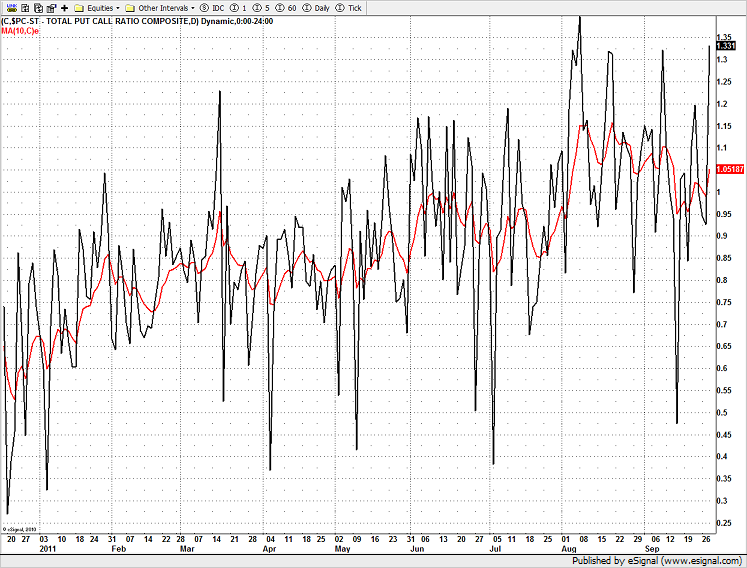

The put/call ratio recorded a climatic reading of 1.33 which implies that enough protection has been acquired short-term to allow for upside in equity prices.

Intermarket charts:

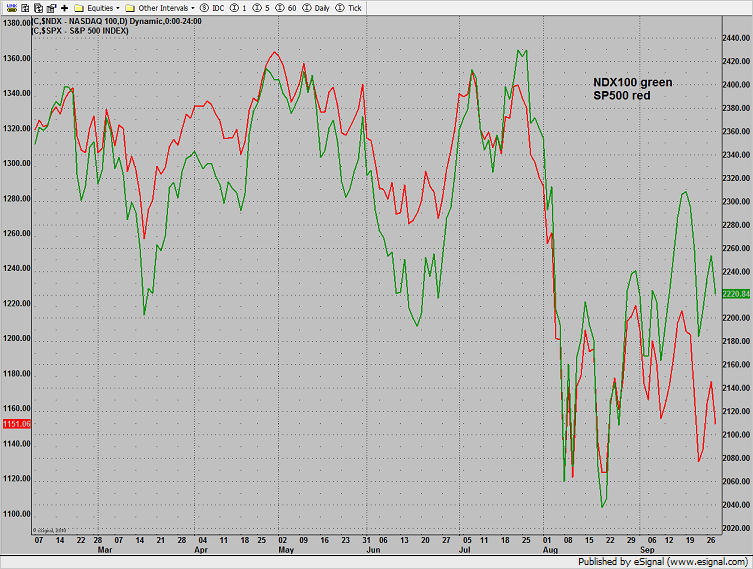

The NDX continues to bullishly lead the SPX:

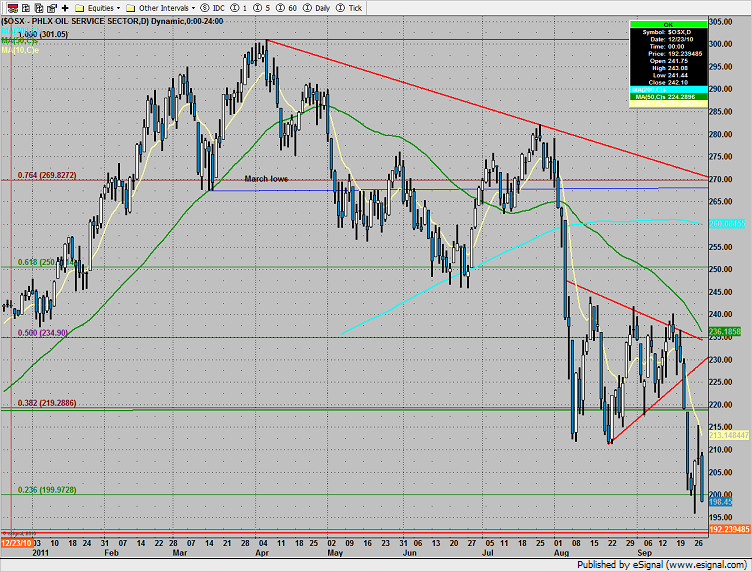

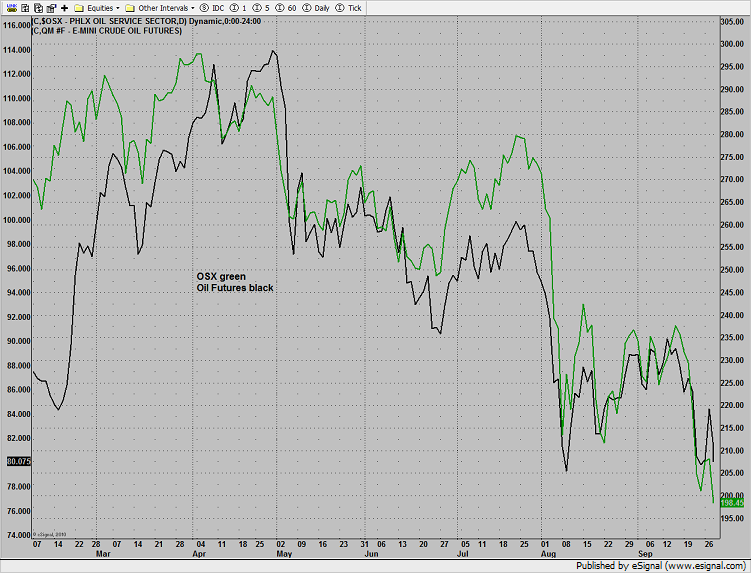

The OSX is trailing oil futures on a relative performance basis which is bearish for oil.

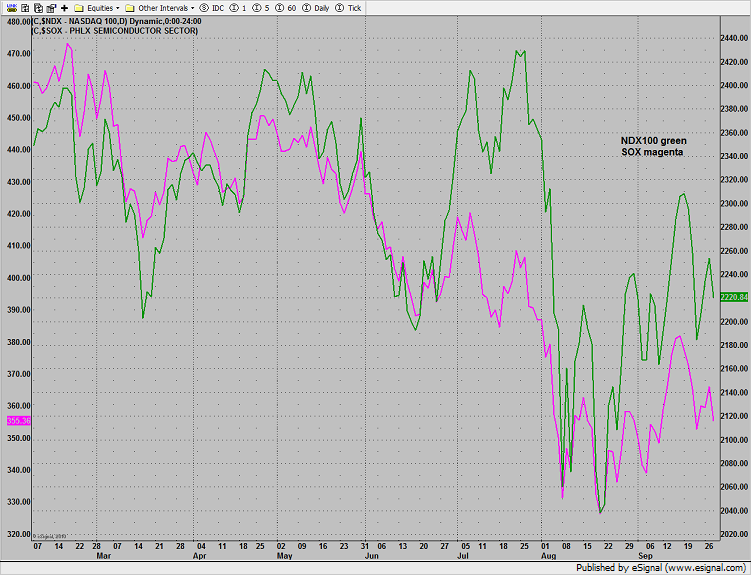

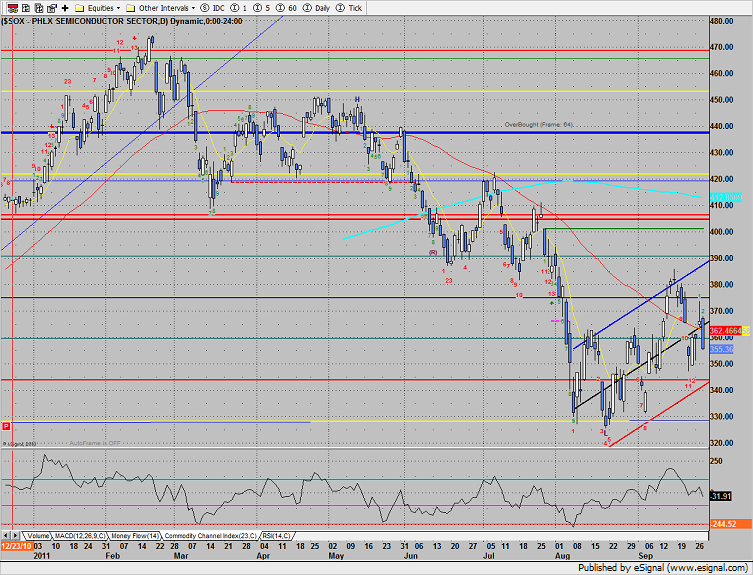

The SOX is bearishly lagging the NDX100. This is a classic bearish divergence.

The XAU is badly lagging gold futures which is negative for gold.

The SOX was the least bad major sector down 3% on the day. Note that using the Seeker countdown qualifier, price will have to drop to 339 to record the buy signal.

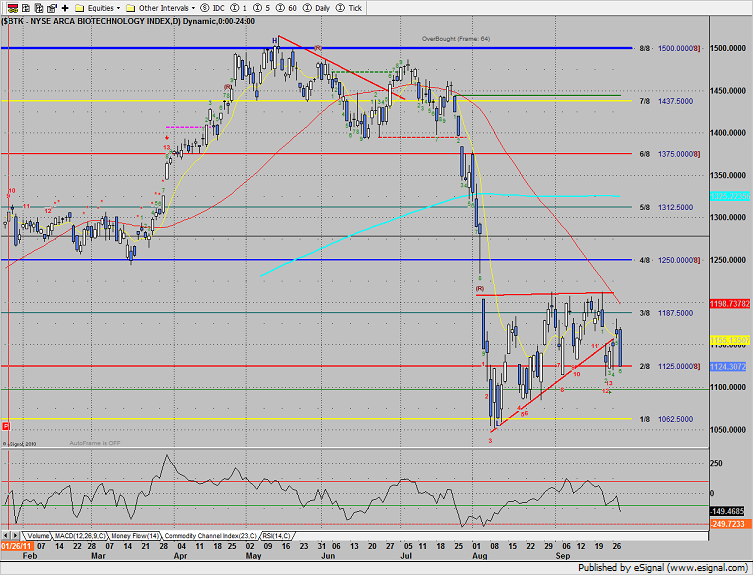

The BTK underperformed the Naz and settled right at the 2/8 Gann level. Note that this was the lowest close of the month

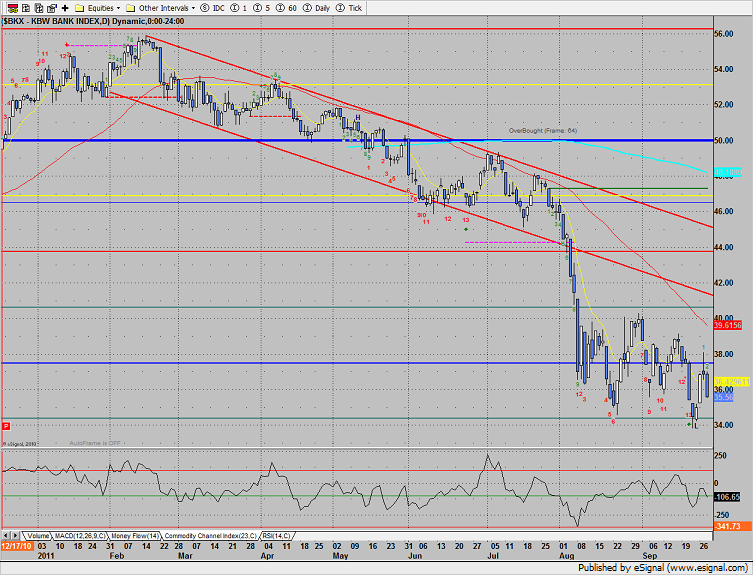

The BKX was lower by 3.5% and remains trapped in the same range.

The XAU matched the YTD low and recorded a new low close.

The OSX was last laggard on the day. This is a new low close on the move but not quite a new absolute low.